March 17, 2024

Avenira Limited (ASX: AEV) (“Avenira” or “the Company”) advises that it has completed a placement of approximately 137 million new fully paid ordinary shares at an issue price of A$0.008 per share, raising approximately A$1 million (before costs) (“Placement”).

Placement Details

137,125,000 fully paid ordinary shares will be issued under the Company’s existing Listing Rule 7.1A placement capacity at an issue price of A$0.008 per share to raise approximately A$1million, before costs.

Proceeds from the Placement will be used to replace working capital that was utilised to repay the outstanding secured convertible loan of A$3.7 million (including capitalised interest) from Au Xingao Investment Pty Limited that matured on 8 March 2024. Avenira is currently in discussions with several parties in relation to new note funding.

Commenting on the Placement, Avenira Chairman and Chief Executive Officer, Brett Clark stated:

“We are pleased that we have completed this small placement, with funds to be used for our ongoing working capital requirements. We are looking forward to providing shareholders with further progress on our projects in the coming weeks.”

Petra Capital Pty Ltd acted as Sole Lead Manager and Bookrunner to the Placement.

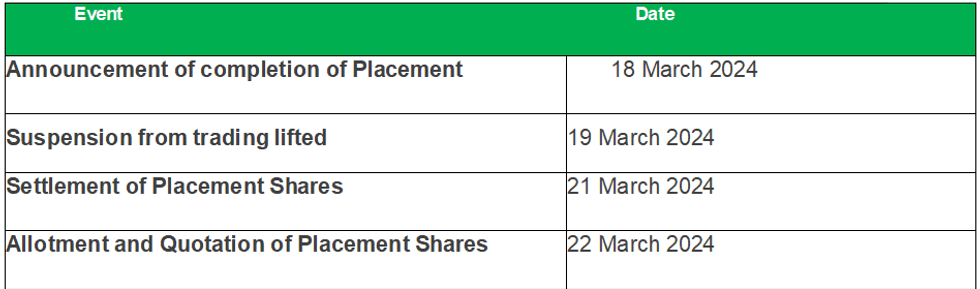

An indicative timetable for the Placement is set out below. The timetable remains subject to change at the Company’s discretion, subject to compliance with applicable laws and listing rules.

Indicative Timetable

This announcement was authorised for release by the Chairman.

Click here for the full ASX Release

This article includes content from Avenira Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AEV:AU

The Conversation (0)

17 June 2025

Wonarah Mine Management Plan Approved by the NT Government

Avenira Limited (AEV:AU) has announced Wonarah Mine Management Plan Approved by the NT GovernmentDownload the PDF here. Keep Reading...

30 April 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Avenira Limited (AEV:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

09 March 2025

Investment from Sichuan Hebang Biotechnology

Avenira Limited (AEV:AU) has announced Investment from Sichuan Hebang BiotechnologyDownload the PDF here. Keep Reading...

11 February 2025

Termination of Aleees License and Technology Agreement

Avenira Limited (AEV:AU) has announced Termination of Aleees License and Technology AgreementDownload the PDF here. Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00