June 11, 2024

Resource growth adds confidence in future expansion and scale opportunities

Aura Energy Limited (ASX: AEE, AIM: AURA) (“Aura” or “the Company”) is pleased to provide an update on the Mineral Resource Estimate (“MRE”) for the Tiris Uranium Project (“Tiris” or the “Project”) in Mauritania.

KEY POINTS:

- Tiris’ global Mineral Resources increased by 55% to 91.3 Mlbs U3O8, up from 58.9Mlbs U3O81 (global Mineral Resources includes Tiris East and Oum Ferkik Project areas)

- The recent 15,262m drill program delivered a very large 28.9 Mlbs U3O8 increase in the Tiris East Uranium Project’s Mineral Resources, totalling 76.6 Mlbs U3O8, delivered at a discovery cost of only US$ 0.14 per lb U3O8

- Measured and Indicated Mineral Resources increased by 35% adding 10.3 Mlbs U3O8 providing further confidence to the Front End Engineering Design (“FEED”)2 production schedule

- Drilling results and the increase in Mineral Resources both demonstrate significant future resource growth potential at Tiris from ongoing exploration activities

- The major increase in the Tiris Mineral Resources:

- Reinforces Auras’ commitment to progress Tiris towards a development decision in late 2024 or early 2025;

- Offers significant potential to materially enhance the already excellent FEED economics of NPV8 US$ 388 M and IRR 36% after tax3,4, and

- Presents real opportunities to increase the Project’s future scale beyond the current 17-year mine life at 2 Mlbs pa U3O8 production

- Additional Mineral Resources were defined from extensions to known mineralisation and exhibit the same characteristics as the current shallow free digging mineralisation that has proven exceptional beneficiation characteristics

- Mine scheduling and optimisation including a review of the Ore Reserve Estimate will now be undertaken on the enhanced Mineral Resources

Aura Energy’s Managing Director and CEO Andrew Grove said:

"The resource growth at Tiris confirms our view that this is an important uranium province with the capacity for further growth upside.

The Board believes that the very significant increase in Mineral Resources resulting from the successful drilling campaign will have a materially positive impact on Tiris’ economics and has been delivered at a very low discovery cost of just US$ 0.14 per lb.

Mineralisation was identified not only from high strength radiometric anomalies, but from areas of low strength anomalies, significantly increasing the exploration potential of the area as these low-level anomalies have been ignored in past exploration.

More opportunities remain to expand the known mineralisation within the current granted tenements. In addition, the potential for future discoveries within the 13,000km2 of new tenement applications is significant as we have only just begun exploration over this district-scale opportunity.

The increased Mineral Resource inventory will further support the funding and development of the Tiris Uranium Project in the near future.”

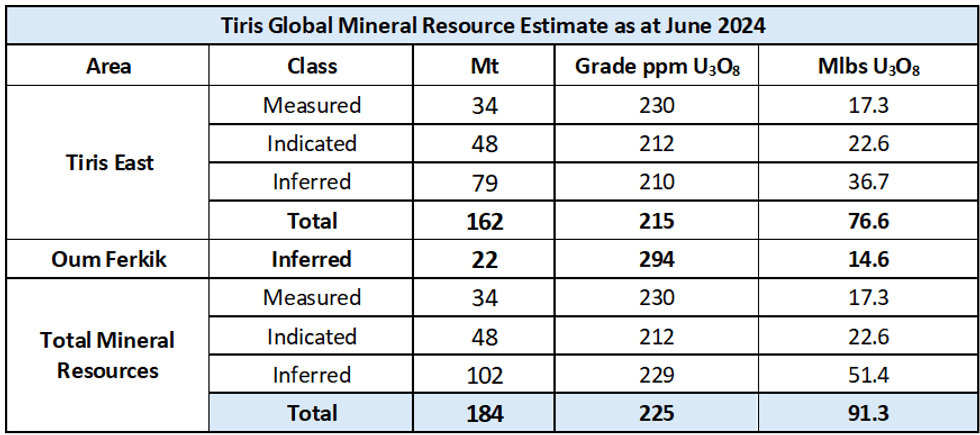

The drilling program undertaken in 2024 has delivered a major increase to the Project’s Global Mineral Resources totalling 184 Mt at 225ppm for 91.3 Mlbs U3O8 at a 100ppm cut-off grade. This is a 55% increase in the contained U3O8 from the previous MRE, reported in 2023, of 113Mt at 236ppm for 58.9Mlbs5 U3O8.

This drilling program was aimed at assessing additional resource potential at Tiris East and delivered a 10.3 Mlbs or 35% increase of Measured and Indicated (“M&I”) Resources, which stands at 83 Mt @ 219ppm for 39.9 Mlbs U3O8, and a 76% increase in total Inferred Resource, which stands at 102 Mt @ 229ppm for 51.4 Mlbs U3O8. The detail of the upgraded resource across the project areas and the previous resources are shown in Table 1.

In April 20246, Aura completed an air core (“AC”) drilling program of 2,995 holes for 15,262 metres, a 37% increase in the total number of holes available for resource calculations, to evaluate a previously announced exploration target of between 8 Mlbs and 32 Mlbs7. The Mineral Resource increase of

32.4 Mlbs U3O8 exceeded the upper end of the exploration target range, providing strong support to Aura’s exploration methodology, and is a strong indication to the mineralisation potential that may be available in regional leases that are currently under application8.

In addition to targeting extensions to known mineralisation, and testing previously un-drilled radiometric anomalies around Tiris East, the program considered several conceptual targets over low- level radiometric anomalies. Several of these conceptual targets returned very positive results, further increasing exploration potential of the area. This is a major change from previous exploration in the area.

Mineral Resource estimates were undertaken utilising Multiple Indicator Kriging (“MIK”) estimation methodology and recoverable Mineral Resources reported using a 10x10x1m Selective Mining Unit (“SMU”). The Competent Person for the 2024 Tiris Mineral Resource Estimates is Mr Arnold van der Heyden of H&S Consulting Pty Limited (“HSC”).

Click here for the full ASX Release

This article includes content from Aura Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AEE:AU

The Conversation (0)

02 June 2023

Aura Energy

Fast-tracking the Tiris Uranium Project to support a clean, decarbonized future

Fast-tracking the Tiris Uranium Project to support a clean, decarbonized future Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00