Key Highlights

- Central Zone Mineralisation Extended: Diamond drilling at the Cape Ray Project intersected 1.85 g/t over 13.5 metres including 4.79 g/t over 0.85 metres from 340.5 metres, extending mineralisation down plunge of Z04 at Central Zone, with the deposit remaining open in multiple directions.

- Completed Comprehensive Mapping and Till Geochemical Sampling at Cape Ray West: Completed the Company's largest surface program in the project's history, with 91 rock and1,082 till samples collected; assay results pending.

- Preliminary Electromagnetic Survey Results: Identified several discrete anomalies at Cape Ray with magnetic signatures consistent with the Central Zone deposits.

- Mineral Resource Growth: Targeting a material growth in mineral resources based on results from recent drilling and from the systematic exploration program.

- Strong Treasury Position: AuMEGA remains well funded with C$9.2 million in cash1, fully supporting one of the largest and most systematic exploration campaigns in Company history.

AuMEGA Metals Ltd (ASX: AAM) (TSXV: AUM) (OTCQB: AUMMF) ("AuMEGA" or "the Company") is pleased to provide an update on its fully funded 2025 exploration program. This update highlights new drill results from the Cape Ray Project ("Cape Ray") and the Company's most comprehensive field initiatives to date on the Cape Ray Shear Zone ("CRSZ") in Newfoundland and Labrador ("Newfoundland"), Canada.

The 2025 program represents one of the most extensive and technically integrated exploration efforts in AuMEGA's history. It combines the largest surficial geochemical campaign ever undertaken on the CRSZ with systematic mapping, project-wide geophysics, and targeted drilling — all designed to advance the Company's commanding district-scale land package along one of Atlantic Canada's most prospective gold belts.

AuMEGA Metal's Managing Director and CEO, Sam Pazuki commented

"Our 2025 exploration campaign is the most comprehensive program ever undertaken by the Company and is building a strong foundation for future discovery success. At Cape Ray, we have extended the mineralisation down plunge of Z04 at Central Zone with a highly encouraging intercept of 1.85 g/t gold over 13.5 metres. The Central Zone deposits form the largest component of the Company's mineral resource, comprise a series of high-grade open pits with gold mineralisation remaining open along strike and down plunge. Our extensive geological review completed over the last three years leads us to believe we have considerable scope for resource growth in this area which requires a dedicated work program to update our mineral resources and identify further extensional target opportunities.

In parallel, we have completed the Company's largest-ever mapping and till geochemical program at Cape Ray West, with final results expected shortly. When integrated with the high-quality geophysics data we have been collecting, we are highly confident we will be able to generate new drill targets across this project.

Our Cape Ray regional activities will continue in conjunction with extensive, systematic exploration work at other targets along the CRSZ including Bunker Hill and at Hermitage. We are building a pipeline of opportunities through our district-scale land package, along strike from the multi-million-ounce Valentine Project, which is expected to produce first gold imminently. With the recent transactions in Newfoundland including the acquisition of Calibre Mining by Equinox Gold, and Maritime Resources by New Found Gold, it is clear that major gold companies are recognising this jurisdiction as a major gold mining district."

Cape Ray Project - Brownfields Activity

The Cape Ray Project currently hosts 420 koz of gold in indicated resources and 141 koz in inferred resources, based on a gold price of $1,750 per ounce2. In late May 2025, the Company commenced an initial phase of diamond drilling aimed at testing extensions of existing mineral resources and newly identified grassroots drill targets.

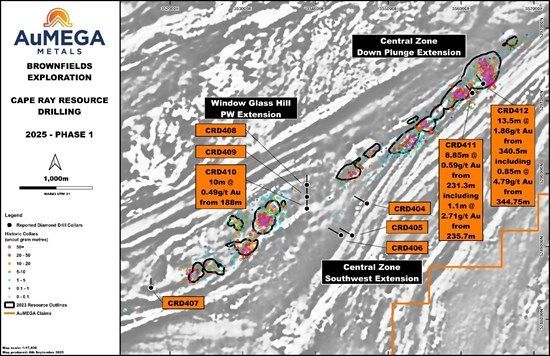

The Company completed nine diamond drill holes totalling 2,559.7 metres across a 5.3 kilometre stretch spanning the deposits at Central Zone and Window Glass Hill (see Figure 1). The majority of the holes were designed to test conceptual targets significantly away from current resource boundaries, with some areas ranging from 0.6 kilometres to 0.8 kilometres from known mineralisation3.

Figure 1: Cape Ray 2025 Drill Program - Phase One

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10713/265653_b14d3779e4aba8c2_002full.jpg

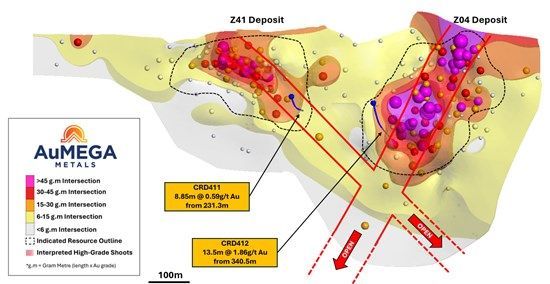

Of most significance is drill hole CRD412 which intersected 1.85 g/t gold over 13.5 metres including 4.79 g/t over 0.85 metres from 340.5 metres, extending mineralisation down plunge of the Z04 deposit at Central Zone (see Figure 2). CRD412 was targeting an area approximately 80 metres across strike and consisting of 160 metres of plunge extent where historical drilling has not adequately tested the extent of the Z04 deposit. Further review of the intercept indicates the deposit remains open up plunge towards Z41 deposit to the northwest.

This significant intercept demonstrates that low-cost, resource growth potential remains at Cape Ray. These results combined with last year's significant drill intercepts at Central Zone4 demonstrate that the deposits are still open both along strike, and up and down plunge.

The Company also recognises that there is a material silver component in its Cape Ray deposits which was not included in the last Mineral Resource update and will undertake additional work with an aim to provide an initial silver mineral resource estimate to accompany the existing gold inventory.

Figure 2: Long Section of the Z04 and Z41 deposits displaying the interpreted gold mineralisation extended down plunge. The long section plane is orientated 50 degrees towards the southeast, looking towards the northwest.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10713/265653_b14d3779e4aba8c2_003full.jpg

The other holes drilled in the recent program recorded important stratigraphic and structural information which will be incorporated into a full-field geological model to be used for targeting. No significant gold assays were recorded in these holes.

Final multi-element assays, including silver results, for the spring and summer drill program at Cape Ray remain pending.

Cape Ray Project - Greenfields Activity

AuMEGA is also advancing multiple complementary exploration streams. In May 2025, a project-wide electromagnetic ("EM") survey was completed. Preliminary data demonstrate several discrete EM anomalies interpreted to represent zones of high conductivity (possible areas of sulphide and/or graphitic sedimentary rocks) coincident with magnetic signatures that are consistent with known deposits at Central Zone. Final processing of the EM survey is underway, with results expected to be reported in the near term.

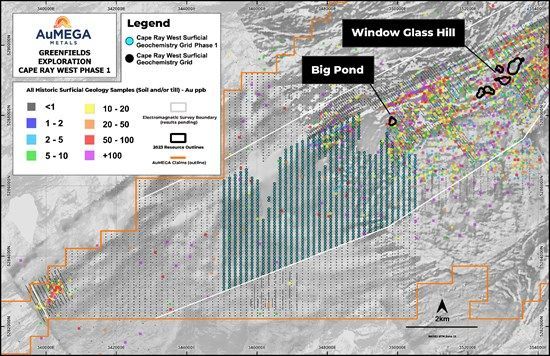

In July, the Company also executed its largest-ever till geochemical and mapping program at Cape Ray West. In total, 1,082 till samples and 91 rock samples were collected across 16 kilometre², providing unprecedented coverage of this underexplored area. Historical datasets confirm strong correlations between till anomalies and known deposits (see Figure 3), making this program particularly significant. Pending assay results will be integrated with EM and airborne magnetic data to create a layered targeting model, supporting the next round of drilling.

Figure 3: Cape Ray West Till and Rock Sampling Program

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10713/265653_b14d3779e4aba8c2_004full.jpg

Based on this work, AuMEGA is planning further exploration activities designed to expand the mineral resource base at Cape Ray.

Current Field Work

At Bunker Hill, AuMEGA has launched its most extensive surface geochemical program to date, designed to systematically define and refine drill targets across what is considered one of the most prospective and underexplored parts of the CRSZ5. In early August, the Company commenced an expansive till geochemical sampling and mapping campaign covering nearly the entire Bunker Hill Project. This initiative represents a step-change in scale and detail, with over 4,400 samples planned across an area of ~75 kilometre². This program is currently 50% complete and results from this program will refine drill targets.

At Hermitage, AuMEGA is preparing for the largest surface exploration campaign ever undertaken on the project. This upcoming effort follows a series of encouraging results from previous surficial sampling and the completion of a high-resolution airborne magnetic survey in late 20246. These earlier programs confirmed the presence of several high-grade gold anomalies along the project's central corridor, highlighting Hermitage as a priority growth opportunity within the portfolio.

Looking Ahead

With fieldwork well underway and multiple large datasets pending, AuMEGA anticipates a steady cadence of news flow throughout the remainder of 2025. Key upcoming milestones include:

Final multi-element assay results from Cape Ray drilling.

Processed results from the Cape Ray EM survey.

Assay results from the Cape Ray till geochemical program.

Assay results from the Bunker Hill till geochemical program.

Launch of the Hermitage surface program.

Commencement of additional drilling at Cape Ray and Bunker Hill.

Resource expansion initiatives at Cape Ray

All future activities will be based on results.

This announcement has been authorised for release by the Company's Board of Directors.

To learn more about the Company, please visit www.aumegametals.com, or contact:

Sam Pazuki, Managing Director & CEO

Canada Phone: +1 780 665 4925

Australia Phone: +61 8 6117 0478

Email: info@aumegametals.com

About the Company

AuMEGA Metals Ltd (ASX: AAM) (TSXV: AUM) (OTCQB: AUMMF) is utilising best-in-class exploration to explore on its district scale land package that spans 110 kilometers along the Cape Ray Shear Zone, a significant under-explored geological feature recognised as Newfoundland, Canada's largest identified gold structure. This zone currently hosts Equinox Gold's Valentine Gold Project, a multi-million-ounce deposit which is the region's largest gold project, along with AuMEGA's expanding Mineral Resource.

The Company is supported by a diverse shareholder registry of prominent global institutional investors, and strategic investment from B2Gold Corp, a significant, intermediate gold producer.

Additionally, AuMEGA holds a 27-kilometre stretch of the highly prospective Hermitage Flexure and has also secured an Option Agreement for the Blue Cove Copper Project in southeastern Newfoundland, which exhibits strong potential for copper and other base metals.

AuMEGA's Cape Ray Shear Zone hosts several dozen high potential targets along with its existing defined gold Mineral Resource of 6.1 million tonnes grading an average of 2.25 g/t, totaling 450,000 ounces of Indicated Resources, and 3.4 million tonnes grading an average of 1.44 g/t, totaling 160,000 ounces in Inferred Resources7.

AuMEGA acknowledges the financial support of the Junior Exploration Assistance Program, Department of Industry, Energy and Technology, Provincial Government of Newfoundland and Labrador, Canada.

Reference to Previous Announcements

In relation to this news release, all data used to assess targets have been previously disclosed by the Company and referenced in previous JORC Table 1 releases. Please see announcements dated: 30 May 2023, 30 May 2025, 11 September 2024, 26 May 2025, 22 January 2025, 25 November 2024, 22 March 2023

In relation to the Mineral Resource estimate announced on 30 May 2023, the Company confirms that all material assumptions and technical parameters underpinning the estimates in that announcement continue to apply and have not materially changed. The Company confirms that the form and context in which the Competent Person's findings are presented have not been materially modified from the original market announcement.

Competent Person's Statements

Drilling and Analytical Procedures

Diamond drilling operations generally uses NQ sized core, with HQ sized core being utilised only in highly fractured ground to ensure maximum recovery and drill stability. All diamond drill core in competent ground is orientated using a REFLEX ACT III core orientation tool with the bottom-of-hole line marked. Downhole surveys for all NQ and HQ diamond drill holes are recorded using either a REFLEX EZ-TRAC survey or an OMNIx™42 gyro. The orientation of the holes is decided based on the Company's geological interpretation, down hole lengths are reported as true width is not known due to the Greenfields nature of drilling.

All diamond drill holes are logged in entirety by onsite geologists before being selected for sampling. For diamond drilling, samples typically range from 0.2 - 1.2 metres in length respecting the geological or mineralisation contacts present. The drill core is cut longitudinally following a pre-marked cutting line. A consistent hemisphere of the core is sent for analytical purposes whilst the other remains as a reference sample of the interval. Pre-numbered alpha-numeric sample bags holding the individual samples are sealed and placed into bulk-bags which is distributed to the laboratory for analysis.

AuMEGA Metals used ALS Laboratories in Moncton, New Brunswick for the analysis of diamond drill core. All samples are dried to 60°C, crushed to 70% passing 2mm, riffle split to 250 grams and pulverized to 85% passing 75µm. Gold is analyzed by fire assay with an ICP-AES finish. Select samples are also analyzed by a 48 element 4-acid digestion with ICP-MS. Samples are securely stored at the Company's facilities until they are shipped either by a trusted 3rd party shipper or company personnel to the lab. ALS is an ISO accredited laboratory and is independent from the Company.

All sampling was carried out under AuMEGA's sampling guidelines which adheres to industry best practice. All QA/QC data is reviewed by the Database Manager, Exploration Manager and/or Competent Person to ensure quality of assays; batches containing multiple Certified Reference Material (CRM) that report outside of two standard deviations from expected values are re-assayed. Any batches containing individual CRM's greater than three standard deviations from expected values are also re-assayed.

The Company does not recognise any factors from the drilling, drill recovery, sample condition or sampling protocols that may affect the accuracy of the results or cause bias.

Geophysics

AuMEGA contracted Axiom Exploration Group Ltd. in conjunction with RPM Aerial Services and Breton Air to fly a TDEM survey using Axiom's proprietary 30Hz XciteTM TDEM system which collected both time domain electromagnetic and magnetic data simultaneously. Flight lines were spaced 100 m apart at an azimuth of 330° over a total area of 59.5 km2. Results are being processed and will be released in an upcoming release.

Qualified Person

The scientific and technical information in this press release was reviewed and approved by Shamus Duff, P. Geo., Project Geologist. Mr. Duff is a Qualified Person as defined under National Instrument 43-101 and a Professional Geologist registered with Professional Engineers and Geoscientists of Newfoundland and Labrador (PEGNL). Mr. Duff consents to the publication of this press release and certifies that the information is provided fairly and accurately represents the scientific and technical information disclosed within it.

Appendix 1 - Drill Hole Collars and Intercepts

Table 1: DRILL COLLAR INFORMATION

| DIAMOND DRILL COLLAR INFORMATION | ||||||||

| Hole ID | Prospect | UTM_E | UTM_N | RL (m) | Dip (o) | Azimuth (o) | Hole Depth (m) | Status |

| CRD404 | Southwest Extension | 354706 | 5289590 | 271 | -50 | 300 | 352 | See Table 2 |

| CRD405 | Southwest Extension | 354351 | 5289155 | 201 | -50 | 300 | 322 | NSR |

| CRD406 | Southwest Extension | 354510 | 5289146 | 230 | -50 | 300 | 250 | NSR |

| CRD407 | Window Glass Hill | 351741 | 5288443 | 307 | -50 | 360 | 199.7 | NSR |

| CRD408 | Window Glass Hill | 353878 | 5289854 | 289 | -50 | 360 | 250 | See Table 2 |

| CRD409 | Window Glass Hill | 353902 | 5289723 | 268 | -50 | 0 | 205 | See Table 2 |

| CRD410 | Window Glass Hill | 353881 | 5289521 | 251 | -50 | 0 | 232 | See Table 2 |

| CRD411 | Z41 | 356154 | 5291108 | 335 | -65 | 320 | 331 | See Table 2 |

| CRD412 | Z04 | 356304 | 5291236 | 335 | -67 | 322 | 418 | See Table 2 |

| NSR = No Significant Results. | All coordinates are displayed in NAD83, UTM Zone 21. |

Table 2: SIGNIFICANT DRILL HOLE INTERCEPTS TABLE: 0.2g/t Au & 0.5g/t Au cut-off*

| SIGNIFICANT DRILL HOLE INTERSECTIONS | ||||||||

| Hole ID | 0.2 g/t Au cut-off | 0.5 g/t Au cut-off | ||||||

| From (m) | Width (m) | Au (g/t) | From (m) | Width (m) | Au (g/t) | Comments | ||

| CRD404 | 221.8 | 1.2 | 0.64 | - | - | - | Including 0.4m at 1.22g/t Au from 221.8m | |

| 302 | 1 | 0.25 | - | - | - | |||

| CRD408 | 15 | 2 | 0.86 | 16 | 1 | 1.52 | ||

| 91 | 5 | 0.25 | 94 | 1 | 0.52 | |||

| 103 | 1 | 0.41 | - | - | - | |||

| 110 | 1 | 0.26 | - | - | - | |||

| 149 | 4 | 0.26 | - | - | - | |||

| CRD409 | 36 | 1 | 0.21 | - | - | - | ||

| 125 | 3 | 0.30 | - | - | - | |||

| 144 | 1 | 0.25 | - | - | - | |||

| 161 | 1 | 0.21 | - | - | - | |||

| CRD410 | 51.53 | 1.97 | 0.36 | |||||

| 106 | 4 | 0.56 | 106 | 1 | 1.98 | |||

| 188 | 10 | 0.49 | 188 | 1 | 3.18 | |||

| 211 | 1 | 0.25 | ||||||

| 222 | 1 | 0.21 | ||||||

| CRD411 | 196.65 | 1.85 | 1.21 | 196.65 | 0.85 | 2.33 | ||

| 224 | 6.3 | 0.56 | 225 | 5.3 | 0.63 | Including 1m at 1.74g/t Au from 225m & 0.75m at 1.95g/t Au from 229.55m | ||

| 231.3 | 8.85 | 0.59 | 232.3 | 4.5 | 0.87 | Including 1.1m at 2.71g/t Au from 235.7m | ||

| 248 | 1 | 0.29 | 239 | 1.15 | 0.75 | |||

| 251.25 | 1 | 0.32 | ||||||

| 264 | 1 | 0.27 | ||||||

| 269.5 | 1 | 0.97 | 269.5 | 1 | 0.97 | |||

| 301.78 | 2.62 | 0.26 | ||||||

| CRD412 | 238.3 | 9 | 0.78 | 238.3 | 8.7 | 0.80 | Including 0.7m at 4.34g/t Au from 238.3m | |

| 256 | 4 | 0.34 | 256 | 1 | 0.87 | |||

| 266 | 5 | 1.07 | 266 | 4 | 1.23 | Including 1m at 3.19g/t Au from 267m | ||

| 276 | 1 | 1.18 | 276 | 1 | 1.18 | |||

| 295.2 | 0.63 | 2.21 | 295.2 | 0.63 | 2.21 | |||

| 340.5 | 13.5 | 1.86 | 340.5 | 13.5 | 1.86 | Including 0.85m at 4.79g/t Au from 344.75m | ||

| 369 | 1 | 0.20 | ||||||

* All composites are reported with maximum 4 metres of internal waste material and reported with a 0.2g/t Au and 0.5g/t Au cut-off grade. Shorter, higher grade intervals not included in the 0.2g/t and 0.5g/t Au cut-offs are included in the comments.

1 As at 30 June 2025

2 News release dated 30 May 2023

3 News release dated 30 May 2025

4 News release dated 11 September 2024

5 News releases dated 26 May & 22 January 2025, 25 November 2024 & 22 March 2023

6 News release dated 4 February 2025

7 News release dated 30 May 2023

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/265653