December 04, 2024

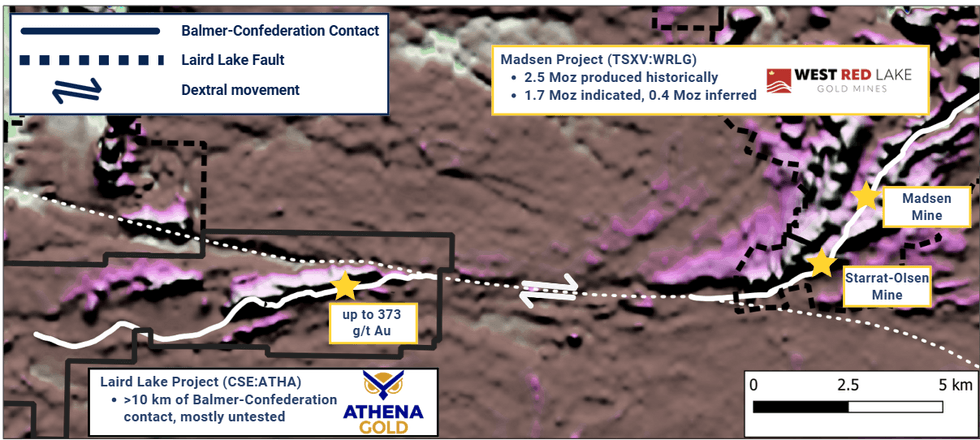

Athena Gold Corporation (CSE:ATHA)(OTCQB:AHNR) ("Athena" or the "Company") is pleased to report additional high-grade gold samples from its reconnaissance prospecting program at its newly-acquired Laird Lake project, located in Ontario's prolific Red Lake Gold District. The Laird Lake project, spanning 4,158 hectares and covering >10 km of Balmer-Confederation Assemblage contact, represents an underexplored portion of the Red Lake Gold District. The road-accessible project lies approximately 10 km west of West Red Lake Gold Mines' flagship Madsen mine and 34 km northwest of Kinross Gold's Great Bear project.

"Laird Lake continues to impress. Our sample returning 373 g/t Au represents the highest-grade grab sample ever taken at the project and, to our knowledge, is amongst the highest-grade surface grab samples publicly reported in the Red Lake Gold District. With more than 10 km of Balmer-Confederation contact to explore and high-grade, visible gold showings scattered throughout, we believe we might be on the cusp of the next major gold discovery in Red Lake," stated John Power, President & CEO of Athena Gold.

Highlights:

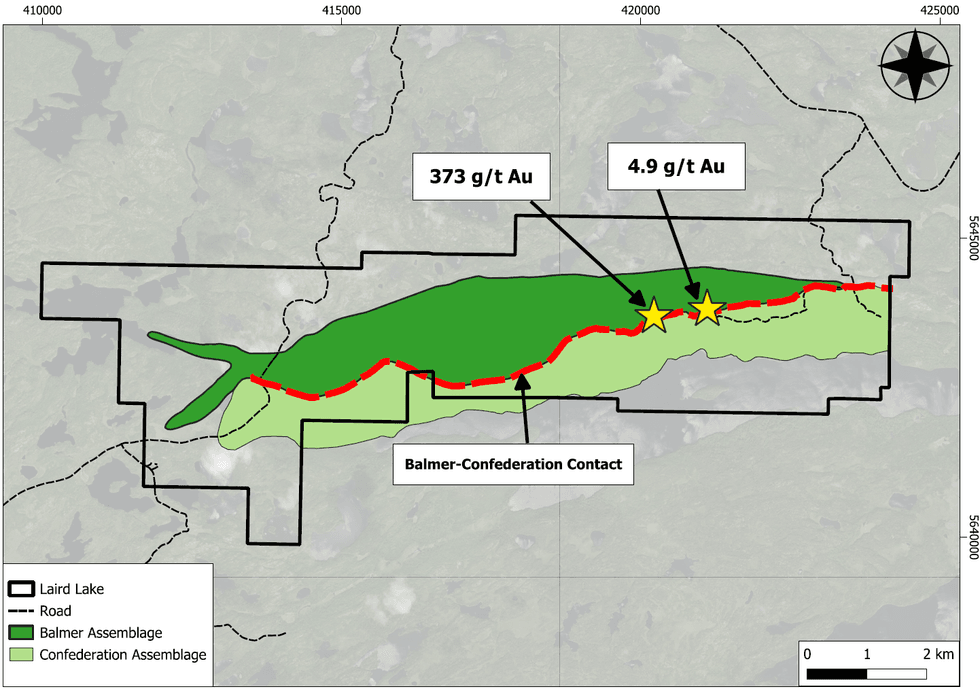

- Additional sampling of surface grab samples taken at the Laird Lake project in October 2024 confirmed mineralization over 2.2 km of strike length along the contact between the Balmer and Confederation Assemblages (Figure 1). Mineralization is open along strike to the east and west.

- The Balmer-Confederation contact is believed to be a significant structural control for gold mineralization in the Red Lake Gold District, with >90% of all gold ever mined in the camp occurring within approximately 300 m of this contact.

- Thehighest-grade sample to date returned 373 g/t Au and was collected from a smoky quartz vein with blebby pyrite, chalcopyrite, and visible gold. This sample represents the highest-grade gold sample ever recorded in Laird Lake's history.

- The recent reconnaissance prospecting program is expected to guide a property-wide geochemistry survey scheduled to commence in H1 2025. The results are anticipated to provide targets for Athena's initial drill program at Laird Lake.

- A recently completed MSc. thesis on the Laird Lake project suggested that Laird Lake represents the continuation of the same mineralized structure found at both the Madsen and Starratt-Olsen gold minesi now owned by West Red Lake Gold (2.5 Moz past-production, 1.7 Moz indicated, 0.4 Moz inferred)ii and was later displaced as far as 10 km west (Figure 2).

Geology:

Gold mineralization observed at Laird Lake occurs in discrete quartz veins hosted in volcanic rock, localized high-strain zones consisting of silicification and disseminated sulfides, and in more broad zones of strongly deformed banded iron formation up to 15 m wide characterized by gossan, fine-grained disseminated sulfides, and silicification. Gold-bearing zones exhibit a general east-west orientation and occur in both Balmer and Confederation Assemblage rocks.

Future Drill Testing:

Laird Lake has been subject to only minimal historical exploration work, mainly because the Balmer-Confederation contact was only mapped on Laird Lake in recent times as part of an MSc. research thesis. Athena's initial work programs are focused on understanding structural controls and potential splays off this contact that may host high-grade gold mineralization.. Athena plans to conduct a property-wide gold-in-till geochemistry program in Spring 2025. Historical, high-resolution airborne magnetic and electromagnetic surveys highlighted several prospective targets within the Balmer Assemblage that have yet to be tested and will be included in future drilling on the property, in addition to other targets generated from prospecting and geochemical programs.

About Our Laird Lake Project

The 4,158 ha Laird Lake property is situated 20 km to the southwest of the town of Red Lake, Ontario. Red Lake is a prolific gold mining town in Northwestern Ontario. Importantly, >90% of the gold has come from within 300 m of the contact between the Balmer and Confederation Assemblages. The Laird Lake property is considered underexplored for gold, relative to much of the surrounding Red Lake Greenstone Belt, despite possessing more than 10 km of strike length of the known gold-bearing contact between Balmer and Confederation Assemblage rocks. Also important is being near several major gold production and exploration sites in the region:

- 34km to the Great Bear project (Kinross - 2.7 Moz indicated, and 3.9 Moz inferred)iii;

- 11 km to the Madsen Mine (West Red Lake Gold - 1.7 Moz indicated, and 0.4 Moz inferred); and

- 28 km to the Red Lake Mine (Evolution Mining - 7.2 Moz indicated, and 4.5 Moz inferred)iv.

Limited exploration activity at Laird Lake has demonstrated that high-grade gold mineralization occurs in both Balmer and Confederation Assemblage rocks over several kilometers in proximity to the main Balmer-Confederation contact. The highest gold grades on the property show a strong correlation to high-strain zones characterized by the presence of silicification, disseminated sulfides, and gossan. The Laird Lake property is dominated by mafic to ultramafic metavolcanic rocks as well as lesser banded iron formation and felsic to intermediate metavolcanic rocks of the Balmer and Confederation Assemblages. Felsic to ultramafic intrusive units are also present throughout the property, most notably of which include the Killala-Baird Batholith to the north, and the Medicine Stone Lake Batholith to the south.

QA/QC

Analytical work for rock samples was completed by ALS Laboratories, and sample preparation and geochemical analyses were completed in Thunder Bay, Ontario. Samples were crushed before a 250-gram split was pulverized to better than 85%, passing 75 microns. Rock samples were analyzed for gold by fire assay using a 50-gram charge with an atomic absorption spectroscopy finish. If assay results exceed 10.0 g/t gold, the sample rejects are analyzed by 50-gram fire assay with a gravimetric finish. Sampling and analytical procedures are subject to a Quality Assurance and Quality Control program that includes duplicate samples and analytical standards.

Qualified Person

Technical information in this news release has been reviewed and approved by Benjamin Kuzmich, P.Geo., a geoscientist and qualified person for the purposes of National Instrument 43-101.

About Athena Gold Corporation

Athena is engaged in the business of mineral exploration and the acquisition of mineral property assets. Its objective is to locate and develop economic precious and base metal properties of merit and to conduct additional exploration drilling and studies on its projects across North America.

Athena's flagship Excelsior Springs Au-Ag project is located in the prolific Walker Lane Trend in Nevada. Excelsior Springs spans 1,675 ha and covers at least three historic mines along the Palmetto Mountain trend, where the Company is following up on a recent shallow oxide gold discovery, with drill results including 5.2 g/t Au over 33 m.

The Company's new Laird Lake project is situated in the Red Lake Gold District of Ontario, covering 4,158 hectares along more than 10 km of the Balmer-Confederation Assemblage contact, where recent surface sampling results returned up to 56.5 g/t Au. This underexplored area is road-accessible, located about 10 km west of the Madsen mine by West Red Lake Gold Mines and 34 km northwest of Kinross Gold's Great Bear project.

For further information about Athena Gold Corporation, please visit www.athenagoldcorp.com.

On Behalf of the Board of Directors

John C. Power

Chief Executive Officer and President

Email: johnpower@athenagoldcorp.com

Contact:

CHF Capital Markets

Cathy Hume, CEO

Phone: 416-868-1079 x 251

Email: cathy@chfir.com

Forward-Looking Statements

This press release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and US. Securities laws. All statements, other than statements of historical fact, included herein, including, without limitation, statements regarding future exploration plans, future results from exploration, and the anticipated business plans and timing of future activities of the Company, are forward looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove correct. Forward-looking statements are typically identified by words such as: "believes", "will", "expects", "anticipates", "intends", "estimates", ''plans", "may", "should", ''potential", "scheduled", or variations of such words and phrases and similar expressions, which, by their nature, refer to future events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this press release, the Company has applied several material assumptions, including without limitation, that there will be investor interest in future financings, market fundamentals will result in sustained precious metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future exploration and development of the Company's projects in a timely manner.

The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various risk factors as disclosed in the final long form prospectus of the Company dated August 31, 2021.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements in this press release or incorporated by reference herein, except as otherwise.

iGeology and Geochemistry of the Laird Lake Property and Associated Gold Mineralization - https://www.lakeheadu.ca/programs/departments/geology/about/msc-theses/summaries/node/47164

iiIndependent NI 43-101 Technical Report and Updated Mineral Resource Estimate - https://westredlakegold.com/wp-content/uploads/2024/04/26Apr24_-_PureGold_Mine_NI_43-101_Technical_Report_-_WRLG.pdf

iiiGreat Bear Gold Project Preliminary Economic Assessment - https://s2.q4cdn.com/496390694/files/doc_downloads/2024/09/Great_bear/Kinross-Great-Bear-PEA-TR-REVISED-FINAL-Sep-9-2024.pdf

ivEvolution Mining Mineral Resource and Ore Reserve Statement, December 2023 - https://evolutionmining.com.au/reservesresources/

ATHA:CC

The Conversation (0)

09 January 2025

Athena Gold

High-grade gold exploration in Ontario and Nevada

High-grade gold exploration in Ontario and Nevada Keep Reading...

2h

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

2h

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

5h

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00