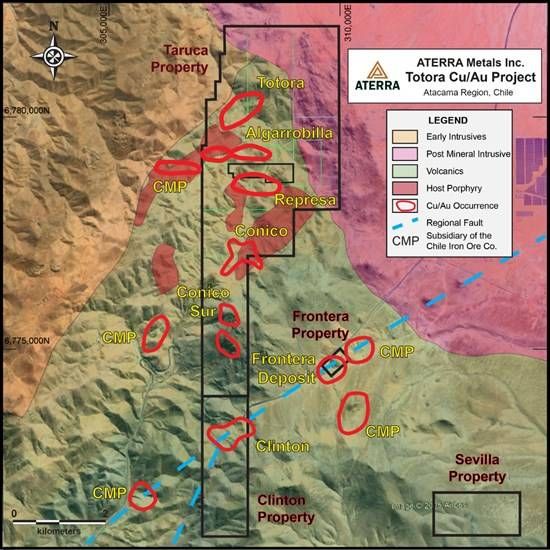

ATERRA Metals Inc. (CSE: ATC) (OTCQB: CSSCF) ("ATERRA") is pleased to announce that it has executed the option agreements for the Totora copper-gold porphyry properties (the "Totora Project") located 60 kilometres south of Vallenar in Chile's Region III (Figures 1 and 2). The Totora Project hosts multiple copper-gold porphyry systems, including the Frontera deposit and two advanced prospects, the Totora and Clinton porphyries.

"With the recent closing of our $2.78 million private placement, we have signed the three option agreements which underpin the Totora Project properties and are preparing to mobilize a field crew to start exploration activities immediately," noted Carl Hansen, CEO of ATERRA. "Our first task is to re-log key mineralized sections from the historical drill core, and prepare for geophysics over the key copper-gold porphyries, to assist in defining targets for a late first quarter drill program. The primary purpose of the Phase I drill program is to support the conversion of the historical Totora Project drill results into 43-101-compliant resource estimates."

Totora Project Historical Highlights

- Frontera deposit - historical resource / drill results:

- 16 Mt indicated grading 0.66% CuEq (0.38% Cu & 0.22 g/t Au) with

34 Mt inferred grading 0.64% CuEq (0.36% Cu & 0.22 g/t Au). - 478 m grading 0.72% CuEq (0.39% Cu & 0.26 g/t Au), hole FRP004D

- 16 Mt indicated grading 0.66% CuEq (0.38% Cu & 0.22 g/t Au) with

- Clinton historical drilling highlights include:

- 166 m grading 0.63% CuEq (0.23% Cu & 0.31 g/t Au), hole RCCL-01

- 276 m grading 0.61% CuEq (0.23% Cu & 0.30 g/t Au), hole DDHCL-06

- Totora historical drilling highlights include:

- 142 m grading 0.69% CuEq (0.47% Cu & 0.17 g/t Au), hole DDHTP-02

- 114 m grading 0.61% CuEq (0.23% Cu & 0.31 g/t Au), hole DDHTO-07

In addition to the Frontera, Taruca and Clinton properties, which collectively comprise the Totora Project, a fourth property, the 200-hectare Sevilla concession, has been added under the existing Clinton option agreement at no additional cost. Evidence of artisanal mining activities has been identified on the Sevilla property and numerous small-scale copper mines occur in the immediate area.

| Copper Equivalent Grade Calculation: Copper equivalent ("CuEq") grades were calculated using a copper price of $4.00 per pound and a gold price of $3,500 per ounce ($112.53 per gram). CuEq grades are calculated as follows: CuEq% = (((Au g/t grade * 112.53) / 4.00 / 2,204.6) * 100) + Cu grade. No recovery factors are used in this calculation. Metal prices are in US$. Historical Results: ATERRA has not undertaken any independent investigation of the historical results from the Totora Properties nor has it verified the underlying technical basis for the historical resources and drilling results, including assays, geology and hole orientation. The reader is cautioned against relying on the accuracy of the historical results presented; however, ATERRA considers all historical results to be relevant as those results will be used as a guide to plan future exploration programs: ATERRA considers the data to be reliable for these purposes. See the "Note:" associated with Table 1 for disclosure regarding the Frontera historical resource estimate. |

The numerous copper-gold porphyries in the Totora area are related to quartz diorite and dacitic intrusions associated with the Domeyko Intrusive Complex. The mineralized porphyry bodies intrude Jurassic sedimentary and volcanic rocks and are often closely associated with regional NE-SW fault structures.

For further information on the Totora Project properties and related option agreements, see ATERRA's press release dated November 20, 2025.

Figure 1 -Totora Project Properties (Frontera, Taruca, Clinton and Sevilla) and Known Cu/Au Occurrences

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7721/282419_7423ce2264a22932_001full.jpg

Frontera Cu/Au Deposit

The Frontera property hosts historic resources (Table 1) of 16 million indicated tonnes grading 0.66% copper equivalent ("CuEq") (0.38% copper and 0.22 grams per tonne ("g/t") gold) and 34 million inferred tonnes grading 0.64% CuEq (0.36% copper and 0.22 g/t gold). The resource estimate was prepared by Hot Chili Limited based on 16,175 metres of drilling completed in 2013. Hot Chili's option for the Frontera property expired in 2015. Copper prices during this period averaged less than US$3.00 per pound.

| Table 1 - Frontera Cu/Au Deposit - Historical Resource Estimate (March 2014) * | ||||||

| Classification | Tonnes | Cu | Au | CuEq | Contained Metal | |

| (millions) | (%) | (g/t) | (%) | Cu ('000 lbs) | Au (ounces) | |

| Indicated | 16 | 0.38 | 0.22 | 0.66 | 134,400 | 116,000 |

| Inferred | 34 | 0.36 | 0.22 | 0.64 | 275,500 | 239,000 |

| * See notes on Historical Results and Copper Equivalent Grade Calculation. Resource prepared by Hot Chili Limited under "Australasian Code for Reporting on Exploration Results, Mineral Resources and Ore Reserves" (The JORC Code, 2012 Edition) and published on March 11, 2014. The resource estimate is based on a cut-off grade of 0.25% Cu. | ||||||

The Frontera exploitation concessions cover 11 hectares hosting the entire historic resource. The mineralized porphyry extends onto concessions owned by Compañía Minera del Pacífico (CMP, a subsidiary of CAP S.A., the Chilean Iron Ore Company).

Clinton Cu/Au Porphyry

The Clinton copper-gold porphyry is hosted within an altered quartz diorite intruded along the regional Pajonales Fault. During 2018-2019, Sociedad Química y Minera de Chile S.A. ("SQM"), a major Chilean lithium producer, drilled 6,194 metres outlining a mineralized porphyry extending to depths of over 500 metres downhole. A summary of the drill highlights from the SQM program is presented in Table 2. No resource estimate has been prepared for the Clinton porphyry.

| Table 2 - Clinton Cu/Au Porphyry - Historical Drill Assay Highlights (SQM - 2018/19) | ||||||

| Drill Hole | From | To | Interval | CuEq | Cu | Au |

| (metres) | (%) | (%) | (g/t) | |||

| RCCL-01 | 202 | 368 | 166 | 0.63 | 0.23 | 0.31 |

| DDHCL-03 | 40 | 432 | 392 | 0.48 | 0.21 | 0.21 |

| DDHCL-04 | 570 | 693 | 124 | 0.55 | 0.21 | 0.27 |

| DDHCL-06 | 0 | 276 | 276 | 0.61 | 0.23 | 0.30 |

| DDHCL-07 | 14 | 132 | 118 | 0.37 | 0.17 | 0.16 |

| and | 156 | 240 | 84 | 0.62 | 0.28 | 0.27 |

| and | 256 | 508 | 252 | 0.53 | 0.22 | 0.24 |

| NOTE: See notes on Historical Results and on the calculation of Copper Equivalent Grade Calculation grades. CuEq grades were composited using a 0.25% cut-off grade and max. 4 metres of internal sub-0.25% CuEq "waste" material. Intervals represent downhole lengths and not true widths. | ||||||

Totora Cu/Au Porphyry

The Totora copper-gold porphyry has been the focus of a number of drill programs with approximately 10,140 metres completed (see Table 3 for Totora historical drill assay highlights). Drilling outlined a structurally controlled mineralized system traced along a strike length of 800 metres on surface and extending to depths of up to 500 metres downhole. No resource estimate has been completed for the Totora porphyry.

| Table 3 - Totora Cu/Au Porphyry - Historical Drill Assay Highlights | |||||||

| Drill Hole | From | To | Interval | CuEq | Cu | Au | Company |

| (metres) | (%) | (%) | (g/t) | ||||

| PAY-08 | 98 | 180 | 82 | 0.60 | 0.17 | 0.34 | Freeport |

| and | 200 | 228 | 28 | 0.48 | 0.33 | 0.12 | |

| DDHTO-02 | 214 | 356 | 142 | 0.69 | 0.47 | 0.17 | SQM |

| including | 214 | 286 | 72 | 0.97 | 0.64 | 0.26 | |

| DDH-TOT-09 | 62 | 154 | 92 | 0.49 | 0.27 | 0.18 | Minera Veinte Norte |

| and | 170 | 368 | 198 | 0.47 | 0.27 | 0.15 | |

| DDHTO-07 | 0 | 114 | 114 | 0.61 | 0.23 | 0.31 | SQM |

| and | 216 | 312 | 96 | 0.60 | 0.41 | 0.15 | |

| DH-TOT10 | 220 | 298 | 78 | 0.61 | 0.34 | 0.22 | SQM |

| and | 374 | 474 | 100 | 0.57 | 0.40 | 0.14 | |

| NOTE: See notes on Historical Results and on the calculation of Copper Equivalent Grade Calculation. CuEq grades were composited using a 0.25% cut-off grade and max. 4 metres of internal sub-0.25% CuEq material. Intervals represent downhole lengths and not true widths. | |||||||

Figure 2 - Location of the Totora Cu/Au Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7721/282419_7423ce2264a22932_002full.jpg

Algarrobilla Cu/Au Porphyry

Approximately 1 kilometre south of the Totora porphyry lies the Algarrobilla copper-gold porphyry. SQM drilled 3,140 metres during 2018-2019 and Freeport drilled 806 metres in 2014 (see Table 4 for drill assay highlights). Historical drilling outlined a 700-metre mineralized corridor. No resources are reported. Two bornite-bearing high-grade intervals were intersected at depth in drill hole DDHCL-13 including 8 metres grading 1.64% Cu and 0.39 g/t gold suggesting the potential for a higher-grade porphyry at depth. Drilling is wide-spaced with the nearest drill hole to DDHCL-13 located 300 metres to the northeast.

| Table 4 - Algarrobilla Cu/Au Porphyry - Historical Drill Assay Highlights | |||||||

| Drill Hole | From | To | Interval | CuEq | Cu | Au | Company |

| (metres) | (%) | (%) | (g/t) | ||||

| PAY-06 | 150 | 254 | 104 | 0.41 | 0.31 | 0.08 | Freeport |

| DDHCL-13 | 280 | 288 | 8 | 1.64 | 1.14 | 0.39 | SQM |

| DDHCL-16 | 84 | 170 | 86 | 0.55 | 0.33 | 0.11 | SQM |

| NOTE: See notes on Historical Results and on the calculation of Copper Equivalent Grade Calculation grades. CuEq grades were composited using a 0.25% cut-off grade and max. 4 metres of internal sub-0.25% CuEq material. Intervals represent downhole lengths and not true widths. | |||||||

NI 43-101 Disclosure

As defined by National Instrument 43-101 ("NI 43-101") of the Canadian Securities Administrators, the Qualified Person for ATERRA's exploration activities in Chile is Francisco Bravo, a resident of Santiago, Chile. Mr. Bravo is a Public Registered Person for Reserves and Resources N° 515, in Chile, and is registered in the Colegio de Geólogos de Chile under N° 725.

About ATERRA Metals Inc.

ATERRA is a mineral exploration company focused on exploration opportunities in Chile. ATERRA's team of successful exploration professionals are dedicated to the discovery of mineral deposits that can be progressed into economically viable development projects creating value for all stakeholders.

On behalf of ATERRA Metals Inc.,

Carl Hansen, CEO

Phone: 416-953-0258

For additional information, please contact us at: info@aterrametals.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains forward-looking statements, including predictions, projections and forecasts. Forward-looking statements include, but are not limited to: plans for the evaluation of exploration properties; the success of evaluation plans; the success of exploration activities; mine development prospects; and, potential for future metals production. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "planning", "expects" or "does not expect", "focus is to", "continues", "scheduled", "estimates", "forecasts", "objectives", "intends", "potential", "anticipates", "does not anticipate", or describes a "goal", or variation of such words and phrases or state that certain actions, events or results "may", "could", "would", "might", or "will" be taken, occur or be achieved.

Forward-looking statements involve known and unknown risks, future events, conditions, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, prediction, projection, forecast, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among others: the successful acquisition of exploration projects; changes in economic parameters and assumptions; all aspects related to the timing of exploration activities and receipt of exploration results; the interpretation and actual results of current exploration activities; the timing of availability of resource estimates, changes in project or exploration parameters as plans continue to be refined; the results of regulatory and permitting processes; future metals price; possible variations in grade or recovery rates; failure of equipment or processes to operate as anticipated; labour disputes and other risks of the mining industry; the results of economic and technical studies; delays in obtaining governmental approvals or financing or in the completion of exploration; as well as those factors disclosed in ATERRA's publicly filed documents.

Although ATERRA has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Neither the Canadian Securities Exchange nor its regulation services provider has reviewed or accepts responsibility for the adequacy or accuracy of the content of this news release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/282419