/NOT FOR DISTRIBUTION TO US NEWSWIRE SERVICES OR FOR RELEASE, PUBLICATION, DISTRIBUTION OR DISSEMINATION DIRECTLY, OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES /

Arizona Metals Corp. (TSX: AMC) (OTCQX: AZMCF) (the " Company " or " Arizona Metals ") is pleased to announce that Pamela L. Saxton has agreed to join its board of directors (the " Board "), with her appointment to take effect on September 17, 2025 .

Ms. Saxton brings more than 35 years of senior leadership and board experience in the mining and natural resources sectors. She currently serves on the boards of Bunker Hill Mining Corporation and Rare Element Resources Ltd. and has previously served as a director of Aquila Resources Inc. and Pershing Gold Corporation. Her executive management experience includes serving as Executive Vice President and Chief Financial Officer of Thompson Creek Metals Company, CFO of NewWest Gold Corporation, and Vice President of Finance for Franco-Nevada's U.S. Operations. Trained as an accountant with Arthur Andersen & Company, Ms. Saxton has a proven record of financial governance, capital markets expertise, and value creation within the U.S. mining sector. She holds a B.Sc. in Accounting from the University of Colorado, Boulder , and is based in Denver, Colorado .

Ms. Saxton is being appointed to the Board to fill a vacancy created by the departure of three of the Company's independent directors. Michael Pilmer , Katherine Arnold , and Rosa Espinoza have each tendered their resignation from the Company's Board of Directors to be effective September 17, 2025 . Mr. Pilmer, Ms. Arnold and Ms. Espinoza were not re-elected by shareholders of the Corporation at the annual meeting of shareholders of the Company which concluded on June 26, 2025 (the " Shareholder Meeting "), however, as permitted by Canada Business Corporations Act, each graciously agreed to remain on the Board for a period following the Shareholder Meeting in order to facilitate an orderly transition and good corporate governance while the Company searched for and identified a qualified and suitable replacement director candidate. Arizona Metals wishes to thank Mr. Pilmer, Ms. Arnold, and Ms. Espinoza for their significant contributions and dedicated service to the Company.

Duncan Middlemiss , President and CEO of Arizona Metals commented: " On behalf of the Company and the Board, I am very pleased to welcome Pam Saxton as an independent director. Pam's extensive financial leadership and board experience in the mining sector will provide valuable insight and strengthen our governance as we advance our projects. I would also like to sincerely thank Mike, Katherine, and Rosa for their important contributions and commitment during their tenure with Arizona Metals ."

Drill Results

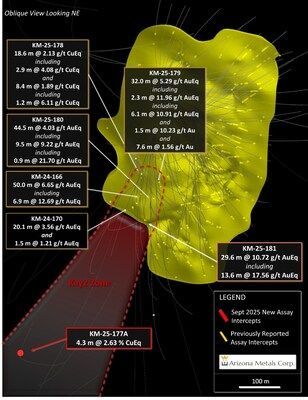

Arizona Metals is also pleased to announce assay results from one drill hole in the Kay2 Zone and four drill holes on the Kay North Extension at the Kay project in Arizona .

In the Kay2 Zone within the Kay Deposit, KM-25-177A intersected 4.3 m @ 2.6% CuEq (Table 1, Figure 1). This extends mineralization 280 m below the previous deepest drill intercept on the property (KM-24-173, 2.4 m @ 2.7% CuEq), and brings the total down-dip length of drilled mineralization on the project to approximately 1,350 m .

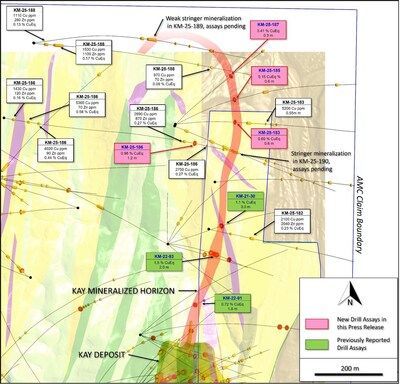

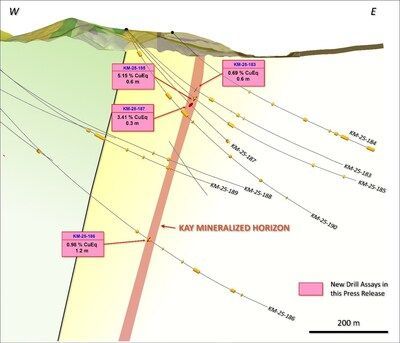

Drilling along the Kay North Extension target has extended drilled mineralization approximately 440 m to the north, demonstrating continuity of the Kay mineralized horizon in this direction (Table 1, Figure 2, Figure 3). Results from this drilling include 0.6 m @ 4.8% CuEq in KM-25-185 and 0.3 m @ 3.2% CuEq. Although narrow, these and other intercepts shown in Table 1 demonstrate a consistent horizon of mineralization stretching north from the Kay Deposit. Additional holes in this area intersected anomalous Cu, Zn, and Au along this same horizon and several other parallel horizons.

Duncan Middlemiss , President and CEO of the Company, comments: " We are excited that these new drill results demonstrate depth potential in the Kay Deposit as well as on-strike potential to the north. Both are encouraging for expansion of the Kay Deposit and for our exploration efforts on targets outside the currently known Kay Deposit."

Additionally, 5,000 m of reverse circulation drilling is planned at the Company's Sugarloaf Peak Gold Project (the "Sugarloaf Peak Project") in La Paz County, Arizona . Drilling and road contractors have been chosen for the project and road crews have been mobilized. The geology team is ready and drilling is expected to begin in mid-September.

As previously stated, the Company is executing on all of its previously-stated goals for 2025 and looks forward to continuing the development of the Company's strong assets.

Table 1. Results of Phase 3 Drill Program at the Kay Project, Yavapai County, Arizona announced in this news release.

| | | | | Analyzed Grade | Analyzed Metal | Metal Equivalent | ||||||||

| Hole ID | From | To m | Length | Cu | Au | Zn | Ag | Pb | CuEq | AuEq | ZnEq | CuEq | AuEq | ZnEq |

| KM-25-177A | 1393.2 | 1397.5 | 4.3 | 2.73 | 0.05 | 0.11 | 4.1 | 0.00 | 2.84 | 4.66 | 7.39 | 2.63 | 4.31 | 6.83 |

| KM-25-182 | no significant assays | | | | | | | | | | | | ||

| KM-25-183 | 232.6 | 233.5 | 0.9 | 0.57 | 0.10 | 0.02 | 6.0 | 0.01 | 0.69 | 1.13 | 1.80 | 0.62 | 1.01 | 1.61 |

| KM-25-184 | no significant assays | | | | | | | | | | | | ||

| KM-25-185 | 257.3 | 257.9 | 0.6 | 4.98 | 0.08 | 0.05 | 13.0 | 0.01 | 5.15 | 8.44 | 13.39 | 4.76 | 7.80 | 12.37 |

| KM-25-186 | 772.1 | 773.3 | 1.2 | 0.85 | 0.03 | 0.21 | 3.0 | 0.02 | 0.98 | 1.61 | 2.56 | 0.90 | 1.48 | 2.35 |

| KM-25-187 | 288.0 | 288.3 | 0.3 | 3.29 | 0.04 | 0.01 | 11.0 | 0.02 | 3.41 | 5.59 | 8.87 | 3.15 | 5.16 | 8.19 |

| KM-25-188 | no significant assays | | | | | | | | | | | | ||

| |

| The true width of mineralization is estimated to be 50% to 99% of reported core width, with an average of 76%. (2) Assumptions used in USD for the copper and gold metal equivalent calculations were metal prices of $4.63/lb Copper, $1937/oz Gold, $25.20/oz Silver, $1.78/lb Zinc, and $1.02/lb Pb. Metal Equivalent calculations used assumed metal recoveries, based on a preliminary review of historic data by SRK and ProcessIQ, were 93% for copper, 92% for zinc, 90% for lead, 72% silver, and 70% for gold. The following equation was used to calculate copper equivalence: CuEq = Copper (%) (93% rec.) + (Gold (g/t) x 0.61)(70% rec.) + (Silver (g/t) x 0.0079)(72% rec.) + (Zinc (%) x 0.3844)(92% rec.) + (Lead (%) x 0.2203)(90% rec.). The following equation was used to calculate gold equivalence: AuEq = Gold (g/t)(70% rec.) + (Copper (%) x 1.638)(93% rec.) + (Silver (g/t) x 0.01291)(72% rec.) + (Zinc (%) x 0.6299)(92% rec.) +(Lead (%) x 0.3609)(90% rec.). Analyzed metal equivalent calculations are reported for illustrative purposes only. The metal chosen for reporting on an equivalent basis is the one that contributes the most dollar value after accounting for assumed recoveries. |

About Arizona Metals Corp

Arizona Metals Corp owns 100% of the Kay Mine Project in Yavapai County , which is located on 1669 acres of patented and BLM mining claims and 193 acres of private land that are not subject to any royalties. The Kay Mine Project is a steeply dipping VMS deposit that has been defined from a depth of 60 m to at least 900 m . It is open for expansion on strike and at depth.

The Kay project contains a current mineral resource estimate (MRE) of 9.28 million tonnes grading 1.39 g/t Au, 27.6 g/t Ag, 0.97% Cu, 0.33% Pb, and 2.39% Zn in the Indicated category, and 0.86 million tonnes grading 1.06 g/t Au, 15.4 g/t Ag, 0.87% Cu, 0.20% Pb, and 1.68% Zn in the Inferred category, at a base-case cut-off grade of 1.00 % CuEq. Copper equivalent MRE grades are 9.28 million tonnes @ 3.18% CuEq in the Indicated category and 0.86 million tonnes @ 2.44% CuEq in the Inferred category.

The Company also owns 100% of the Sugarloaf Peak Project, in La Paz County, which is located on 4,400 acres of BLM claims. The Sugarloaf Peak Project is a heap-leach, open-pit target and has a historic estimate of "100 million tons containing 1.5 million ounces gold" at a grade of 0.5 g/t (Dausinger, N.E., 1983, Phase 1 Drill Program and Evaluation of Gold-Silver Potential, Sugarloaf Peak Project, Quartzsite, Arizona : Report for Westworld Inc.)

The historic estimate at the Sugarloaf Peak Project was reported by Westworld Resources in 1983. The historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

Qualified Person and Quality Assurance/Quality Control

All of Arizona Metals' drill sample assay results have been independently monitored through a quality assurance/quality control ("QA/QC") protocol which includes the insertion of blind standard reference materials and blanks at regular intervals. Logging and sampling were completed at Arizona Metals' core handling facilities located in Phoenix and Black Canyon City, Arizona . Drill core was diamond sawn on site and half drill-core samples were securely transported to ALS Laboratories' ("ALS") sample preparation facility in Tucson, Arizona . Sample pulps were sent to ALS's labs in Vancouver, Canada , and Reno, Nevada , for analysis.

Gold content was determined by fire assay of a 30-gram charge with ICP finish (ALS method

Au-AA23). Silver and 32 other elements were analyzed by ICP methods with four-acid digestion (ALS method ME-ICP61a). Over-limit samples for Au, Ag, Cu, and Zn were determined by ore-grade analyses Au-GRA21, Ag-OG62, Cu-OG62, and Zn-OG62, respectively.

ALS Laboratories is independent of Arizona Metals Corp. and its Vancouver and Reno facilities are ISO 17025 accredited. ALS also performed its own internal QA/QC procedures to assure the accuracy and integrity of results. Parameters for ALS' internal and Arizona Metals' external blind quality control samples were acceptable for the samples analyzed. Arizona Metals is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data referred to herein.

The qualified person who reviewed and approved the technical disclosure in this release is David Smith , CPG, a qualified person as defined in National Instrument43-101 – Standards of Disclosure for Mineral Projects . Mr. Smith supervised the preparation of the scientific and technical information that forms the basis for this news release and has reviewed and approved the disclosure herein. Mr. Smith is the Vice-President, Exploration of the Company. Mr. Smith supervised the drill program and verified the data disclosed, including sampling, analytical and QA/QC data, underlying the technical information in this news release, including reviewing the reports of ALS, methodologies, results, and all procedures undertaken for quality assurance and quality control in a manner consistent with industry practice, and all matters were consistent and accurate according to his professional judgement. There were no limitations on the verification process.

Cautionary Note Regarding Forward-Looking Statements

This press release contains statements that constitute "forward-looking information" (collectively, "forward-looking statements") within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as "expects", or "does not expect", "is expected", "anticipates" or "does not anticipate", "plans", "budget", "scheduled", "forecasts", "estimates", "believes" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements contained in this press release include, without limitation, statements regarding the appointment of a new independent director and the resignation of directors of the Company; statements regarding the expansion potential of the Kay Project, statements regarding drill results and future drilling of the Kay2 Zone, the main Kay deposit and expansion drilling targets on the Kay Project, statements regarding Kay2 Zone mineralization, statements regarding Kay2 Zone mineralization and the contribution of the Kay2 Zone mineralization to the mineral resource estimate for the Kay deposit, and the mineral resource estimate being completed in H1 2025 or at all, statements regarding drilling and other exploration activity on the Sugarloaf Peak Gold Project, statements regarding completion of a PEA in H2 2025 or at all, statements regarding execution of the Company's plans for 2025 and the achievement of targeted milestones.. In making the forward- looking statements contained in this press release, the Company has made certain assumptions. Although the Company believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: availability of the Company to stay well funded; delay or failure to receive required permits or regulatory approvals; and general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward- looking statements or otherwise.

Cautionary Note regarding Mineral Resource Estimates

Until mineral deposits are actually mined and processed, Mineral Resources must be considered as estimates only. Mineral Resource Estimates that are not Mineral Reserves have not demonstrated economic viability. The estimation of Mineral Resources is inherently uncertain, involves subjective judgement about many relevant factors and may be materially affected by, among other things, environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant risks, uncertainties, contingencies and other factors described in the Company's public disclosure available on SEDAR+ at www.sedarplus.ca . The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration. The accuracy of any Mineral Resource Estimates is a function of the quantity and quality of available data, and of the assumptions made and judgments used in engineering and geological interpretation, which may prove to be unreliable and depend, to a certain extent, upon the analysis of drilling results and statistical inferences that may ultimately prove to be inaccurate. Mineral Resource Estimates may have to be re-estimated based on, among other things: (i) fluctuations in mineral prices; (ii) results of drilling, and development; (iii) results of future test mining and other testing; (iv) metallurgical testing and other studies; (v) results of geological and structural modeling including block model design; (vi) proposed mining operations, including dilution; (vii) the evaluation of future mine plans subsequent to the date of any estimates; and (viii) the possible failure to receive required permits, licenses and other approvals. It cannot be assumed that all or any part of a "Inferred" or "Indicated" Mineral Resource Estimate will ever be upgraded to a higher category. The Mineral Resource Estimates disclosed in this news release were reported using Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards for Mineral Resources and Mineral Reserves (the " CIM Standards ") in accordance with National Instrument 43-101- Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators (" NI 43-101 ").

Cautionary Statements to U.S. Readers

This news release uses the terms "Mineral Resource", "Indicated Mineral Resource" and "Inferred Mineral Resource" as defined in the CIM Standards in accordance with NI 43-101. While these terms are recognized and required by the Canadian Securities Administrators in accordance with Canadian securities laws, they may not be recognized by the United States Securities and Exchange Commission. The "Mineral Resource" Estimates and related information in this news release may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations

THE TORONTO STOCK EXCHANGE HAS NEITHER REVIEWED NOR ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

SOURCE Arizona Metals Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2025/15/c7912.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/September2025/15/c7912.html