July 17, 2023

Consolidates Paradox Project area into One Contiguous Ground Holding & Provides Near-Term Resource Upgrade Potential

Anson Resources Limited (ASX: ASN, ASNOC, ASNOD) (Anson or the Company) is pleased to announce that it has entered into an agreement to purchase the strategically located Green Energy Lithium Project (the Project), from Legacy Lithium Corp (Legacy), in the Paradox Basin in south-eastern Utah, USA.

Highlights:

- Anson to purchase a lithium brine project from Legacy Lithium Corp. in the Paradox Basin,

- The proposed strategic acquisition will result in the Paradox Lithium Project becoming one contiguous mineralised block with an 8% increase in land area, to a total of 231.35 km2,

- 208 placer claims covering 16.85 km2 (4,160 acres) that abut the Paradox Project.

- Project hosts 18 historic oil and gas wells providing modelling data - 3 wells with recorded lithium values, planned to be used to upgrade a JORC Mineral Resource.

- NOI submitted to re-enter Cane Creek Fed 11-1,

- The Project purchase expected to increase the Exploration Target by 14%,

- Anson plans to upgrade the JORC Resource for the Paradox Lithium Project.

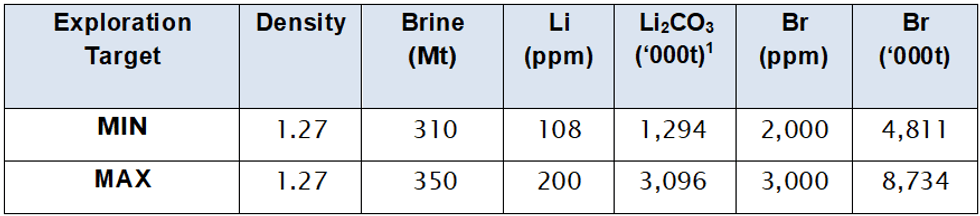

The increase in the project area is expected to result in an increase in the Exploration Target of 14%, see Table 1.

The Exploration Target figure is conceptual in nature as there has been insufficient exploration undertaken on the project to define a mineral resource for the Leadville. It is uncertain that future exploration will result in a mineral resource.

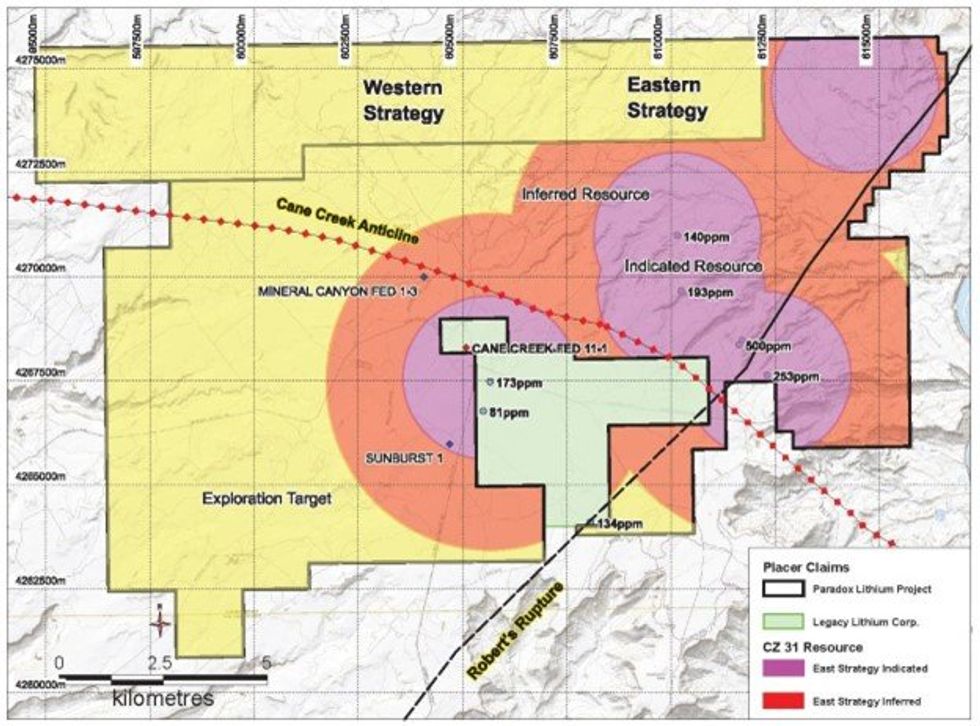

The Green Energy Lithium Project has strong potential to deliver an increase in the existing JORC Mineral Resource estimate at Paradox without the need for further drilling. The Project area contains 18 historic oil and gas wells – and three of these wells have recorded lithium values: 173ppm in Clastic Zone 31, 134ppm in Clastic 19 and 81ppm in the Mississippi Units.

The Project acquisition increases the Paradox Lithium Project land holding by 8% to a total of 231.35 km2. The Project comprises 208 placer claims over a total area of 16.85km2 and is strategically positioned immediately adjacent to Anson’s lead asset, the Paradox Lithium Project, (Figure 1). In addition, it should be noted that a Plan of Operation (POO) and an Application to Drill (APD) has been lodged with the Bureau of Land Management and the Utah Department of Oil, Gas and Minerals (UDOGM) respectively to re-enter the Cane Creek Fed 11-1 well by the previous owners of the Green Energy Lithium Project.

The data from the historic wells will contribute to a Mineral Resource upgrade at the consolidated Paradox Lithium Project and would be included in the development of the flow model Anson is currently preparing for the Paradox Lithium Project.

Acquisition Terms

Under the Agreement, Anson proposes to acquire all the placer claims that make up the Green Energy Lithium Project from Legacy Lithium Corp. for a consideration of USD1 million in cash and 15,060,981 Ordinary Shares in the Company (Consideration Shares). The transaction is subject to Legacy shareholder approval, in accordance the requirements of corporation laws and securities Laws applicable to Legacy, as determined by counsel to Legacy. There are no other material conditions precedent for the Agreement.

This article includes content from Anson Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ASN:AU

The Conversation (0)

08 June 2022

Anson Resources

Developing a Near-Term Clean Energy Project in Utah

Developing a Near-Term Clean Energy Project in Utah Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00