Investor Insight

Brazil’s expanding natural gas market, supported by an attractive and stable regulatory framework and fiscal regime, presents a unique opportunity for Alvopetro Energy to leverage its high-potential upstream and midstream assets. In early 2025, Alvopetro also announced a strategic entry into Western Canada focused on the prolific Mannville stack play fairway in Saskatchewan. With capital investment opportunities in Canada and Brazil, Alvopetro is on the pathway for long-term growth.

Overview

Alvopetro Energy (TSXV:ALV;OTCQX:ALVOF) is an independent energy company focused on unlocking onshore natural gas in Brazil while expanding its footprint into Canada. The company is recognized as Brazil’s first integrated onshore natural gas producer, having established a unique model that combines upstream production, midstream infrastructure and long-term sales agreements with stable pricing linked to Brent and Henry Hub benchmarks.

Since commencing production in 2020, Alvopetro has delivered strong operating results, sector-leading netbacks and consistent dividends. With a disciplined capital allocation strategy, approximately half of the cash flow from operations has been reinvested in organic growth, while the remainder has been returned to shareholders through dividends, debt reduction and share repurchases. This balance has underpinned exceptional shareholder returns, including a cumulative 1,495 percent total shareholder return since 2018.

Alvopetro’s growth is anchored by two pillars: its high-margin natural gas business in the Recôncavo Basin of Bahia, Brazil, and its newly established Western Canadian heavy oil platform. Together, these assets provide a diversified base of production and reserves, supporting near-term growth and long-term value creation.

Headquartered in Calgary, Canada, and operating in Salvador, Brazil, Alvopetro is led by a proven management team with extensive international oil and gas experience. The company is committed not only to profitable growth but also to sustainable development, investing in local communities through education, entrepreneurship, cultural programs and biodiversity initiatives.

Company Highlights

- Alvopetro is a leading independent upstream and midstream gas operator in the state of Bahia, Brazil.

- The company’s growth strategy targets opportunities with the best combinations of geological prospectivity and fiscal regime. In Brazil, Alvopetro is focused on unlocking Brazil’s on-shore natural gas potential, building off the development of its Caburé and Murucututu natural gas fields strategic midstream infrastructure. In Canada, four wells have been drilled and are on production and Alvopetro has expanded its land base with potential for over 100 drilling locations.

- Over 95 percent of Alvopetro’s Brazil production is from natural gas and the company has a 2P reserve base of 9.1 million barrels of oil equivalent (MMboe) with a before-tax NPV10 of $327.8 million.

- The company generates highly attractive operating netbacks and profitability per unit of production, setting it apart from its Latin American and North American peers. The state of Bahia boasts a favorable fiscal regime with low royalties and Alvopetro’s projects are eligible for a 15 percent income tax rate.

Key Projects

Caburé

The company’s flagship Caburé asset has historically delivered the majority of the company’s production. The project is a joint development of a conventional natural gas discovery across four blocks, two held by Alvopetro and two by its partner.

Following the first redetermination in 2024, Alvopetro’s working interest in Cabure increased to 56.2 percent, entitling the company to a larger share of production. The unitized area includes eight producing wells and all necessary production facilities. Gross unit production capacity has increased by 33 percent to 21.2 million cubic feet per day (MMcfpd), and an ongoing development program includes five additional wells, four of which have already been drilled.

Murucututu Gas

Immediately north of Caburé, Murucututu is a 100 percent owned Alvopetro asset with significant growth potential. Independent reserves evaluators have assigned 2P reserves of 4.6 MMboe, with an additional 4.5 MMboe of risked best estimate contingent resources and 10.2 MMboe of risked best estimate prospective resources.

The company successfully completed the 183-A3 well in 2024 and drilled the 183-D4 well updip of the 183-A3 well in 2025, bringing the 183-D4 well online in August 2025, which achieved initial production of 953 barrels of oil equivalent per day (boepd). With field production facilities already in place, Alvopetro plans a multi-year development program targeting both the Gomo and Caruaçu formations, including at least six more development wells.

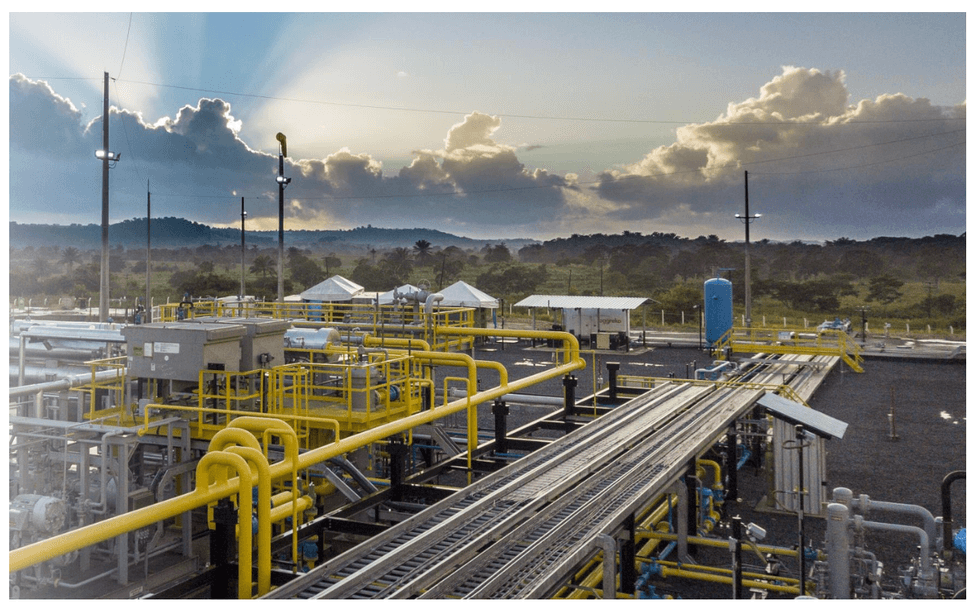

Midstream – Infrastructure and marketing

Alvopetro owns and operates all of the key infrastructure needed to process and deliver its natural gas. Production from Caburé and Murucututu is transported via Alvopetro’s 11-kilometre transfer pipeline to its UPGN gas processing facility, which has a capacity of more than 18 MMcfpd.

At the UPGN, condensate and water are removed, with condensate sold at a premium to Brent. Processed natural gas is delivered to the Bahiagás city gate, with onward transportation through a 15-kilometre distribution pipeline into Bahia’s Camacari industrial complex. Under the long-term gas sales agreement with Bahiagás, pricing is set quarterly based on Brent and Henry Hub benchmarks. An updated agreement, effective January 1, 2025, increased firm sales volumes by 33 percent, further securing Alvopetro’s cash flow stability.

Western Canadian Growth Platform

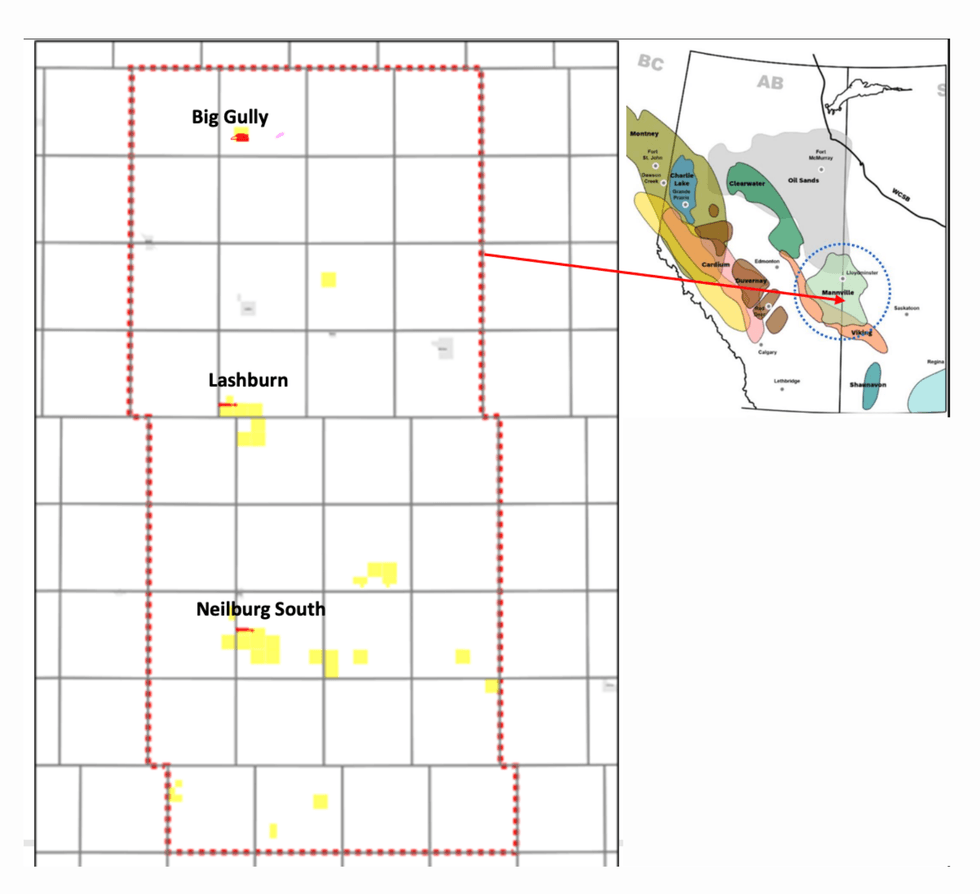

Beyond Brazil, Alvopetro has expanded its global footprint into North America with the establishment of a new heavy oil growth platform in Western Canada. The company holds a 50 percent working interest in 27.5 sections (8,890 net acres) of Mannville conventional heavy oil lands in Alberta and Saskatchewan, in partnership with an experienced operator, where we are deploying leading edge open hole multilateral drilling technology:

The diagram above depicts the evolution of drilling technology to develop a ¼ section of land. On the far left, traditional development would have required 32 vertical wells. Technology then advanced to horizontal wells, as depicted in the middle of the diagram with 4 separate wells. Today, multilateral drilling technology (as depicted on the far right) allows for just a single well with 6+ open-hole lateral legs developing the ¼ section of land. Alvopetro’s first 2 wells drilled in Saskatchewan each included 6 lateral legs. A total of 15 km of open-hole horizontal legs were drilled.

The Mannville stack is a multi-zone fairway with shallow depths, lower geological risk and attractive drilling economics. The first two earning wells were drilled with more than 15 km of open hole and brought into production in April 2025. Two additional wells were drilled in Big Gully in July 2025, with more than 19 km of open hole, with oil sales from the new wells are expected to commence in September 2025.

With the potential for more than 100 drilling locations, the Canadian platform provides Alvopetro with a complementary source of long-term production growth.

Management Team

Corey C. Ruttan – President, Chief Executive Officer and Director

Corey C. Ruttan is the president, chief executive officer and director of Alvopetro. He was the president and CEO of Petrominerales, from May 2010 until it was acquired by Pacific Rubiales Energy in November 2013. Prior to that, he was the vice-president of finance and chief financial officer of Petrominerales. From March 2000 to May 2010, Ruttan was the senior vice-president and chief financial officer of Petrobank Energy and Resources, and held increasingly senior positions with Petrobank since its inception in 2000. He also served as executive vice-president and chief financial officer of Lightstream Resources from October 2009 to May 2010; served as vice-president of Caribou Capital from June 1999 to March 2000; and manager financial reporting of Pacalta Resources from May 1997 to June 1999. He began his career at KPMG where he worked from September 1994 to May 1997. Ruttan obtained his Bachelor of Commerce degree majoring in accounting from the University of Calgary in 1994 and his chartered accountant designation in 1997.

Alison Howard – Chief Financial Officer

Alison Howard is a chartered accountant with over 20 years of experience in Canadian and international taxation, accounting and finance. Howard joined Petrominerales in July 2011 as a tax manager and was subsequently promoted to tax director. From May 2008 to July 2011, Howard was the tax manager at Petrobank Energy and Resources. Prior to that, Howard spent a number of years at Deloitte LLP in Calgary. She obtained her Bachelor of Commerce degree from the University of Saskatchewan in 1999.

Adrian Audet – VP, Asset Management

Adrian Audet joined Petrominerales in 2013 and has held increasingly senior roles with Alvopetro since its inception. Audet has spent extensive time in Bahia overseeing the operations, realizing extensive cost savings and improvements in efficiency. Previously, Audet held engineering roles with increasing responsibility in the oil and gas industry. Audet began his career in 2006 and completed his masters and undergraduate degrees in mechanical engineering at the University of Alberta. Audet is a professional engineer registered with APEGA and is a CFA charterholder.

Nanna Eliuk – Exploration Manager

Nanna Eliuk is a professional geophysicist (M.Sc.) with over 23 years of diversified petroleum exploration and development experience. She has expertise in conventional and unconventional plays in both carbonate and clastic reservoirs in different depositional and structural settings (including pre-salt) in various basins around the world. Prior to joining Alvopetro, Eliuk was the senior explorationist of Condor Petroleum (Kazakhstan) for two years, and prior thereto, she was the vice-president of geophysics and land for Waldron Energy. Eliuk started her career in 1997, holding progressively senior roles at Husky Energy for five years, and at Compton Petroleum for over six years. Her extensive experience includes geophysical evaluation and analysis for business development opportunities and new ventures in various international basins, along with regional mapping, play fairway analysis, petroleum system evaluation, prospect definition, and seismic attribute analysis. Eliuk holds a masters degree in geology and geophysics, and a BSc. in geology.

Darcy Reynolds – Western Canadian Business Unit Lead

Darcy Reynolds, P.Geo is the Western Canadian Business Unit Lead with over 20 years of subsurface and asset evaluation experience across Western Canada. For the past 12 years, Reynolds has focused on heavy oil development, including horizontal multilateral wells, enhanced oil recovery (waterflood, polymer, CO₂), and thermal SAGD projects. He has held senior leadership and technical roles at Rubellite Energy (senior geologist), Cenovus Energy (geoscience director), Husky Energy (geoscience director), and Talisman Energy (geology manager). Reynolds holds a B.Sc. in Geology from the University of Alberta and is a registered professional geoscientist with APEGA

Frederico Oliveira – Country Manager

Frederico Oliveira has held increasingly senior roles since 2008 and has expertise in regulations, contracts, partnerships, management and cost efficiency. He has held management roles in large private companies in Brazil, performing strategic planning, project implementation, process restructuring, efficiency and productivity improvements, and cost control. Oliveira obtained an MBA from the Federal University of Minas Gerais in 2004 and a Bachelor of Science degree in Mechanical Engineering from the Pontificia Universidade Catolica de Minas Gerais.