- WORLD EDITIONAustraliaNorth AmericaWorld

January 06, 2025

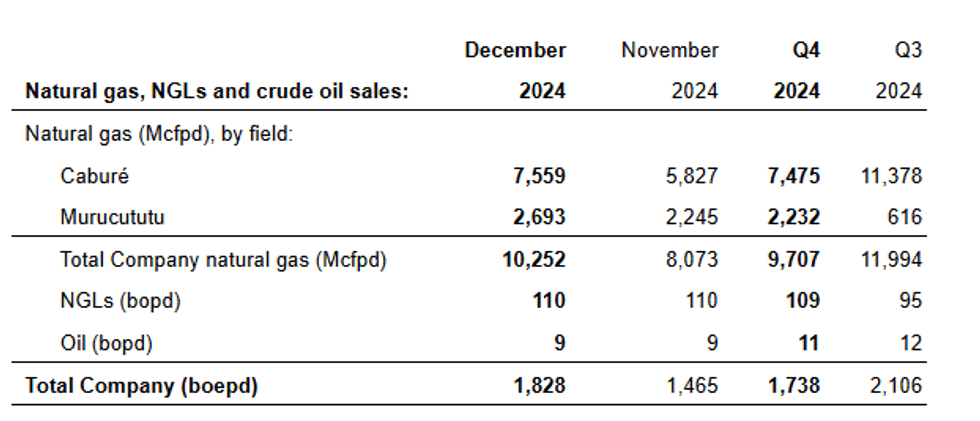

Alvopetro Energy Ltd. (TSXV: ALV) (OTCQX: ALVOF) announces December 2024 sales volumes of 1,828 boepd, including natural gas sales of 10.3 MMcfpd, associated natural gas liquids sales from condensate of 110 bopd and oil sales of 9 bopd, based on field estimates, bringing our average sales volumes to 1,738 boepd in the fourth quarter of 2024.

Sales volumes in the latter half of December were impacted by reduced demand from Bahiagás. As announced on December 17, 2024, our updated long-term gas sales agreement came into effect on January 1, 2025. Bahiagás nominations and deliveries for January have commenced at the new contracted daily firm volumes of 400 e3m3/d.

Corporate Presentation

Alvopetro's updated corporate presentation is available on our website at:

http://www.alvopetro.com/corporate-presentation.

Social Media

Follow Alvopetro on our social media channels at the following links:

Twitter - https://twitter.com/AlvopetroEnergy

Instagram - https://www.instagram.com/alvopetro/

LinkedIn - https://www.linkedin.com/company/alvopetro-energy-ltd

YouTube -https://www.youtube.com/channel/UCgDn_igrQgdlj-maR6fWB0w

Alvopetro Energy Ltd.'s vision is to become a leading independent upstream and midstream operator in Brazil. Our strategy is to unlock the on-shore natural gas potential in the state of Bahia in Brazil, building off the development of our Caburé and Murucututu natural gas assets and our strategic midstream infrastructure.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

All amounts contained in this new release are in United States dollars, unless otherwise stated and all tabular amounts are in thousands of United States dollars, except as otherwise noted.

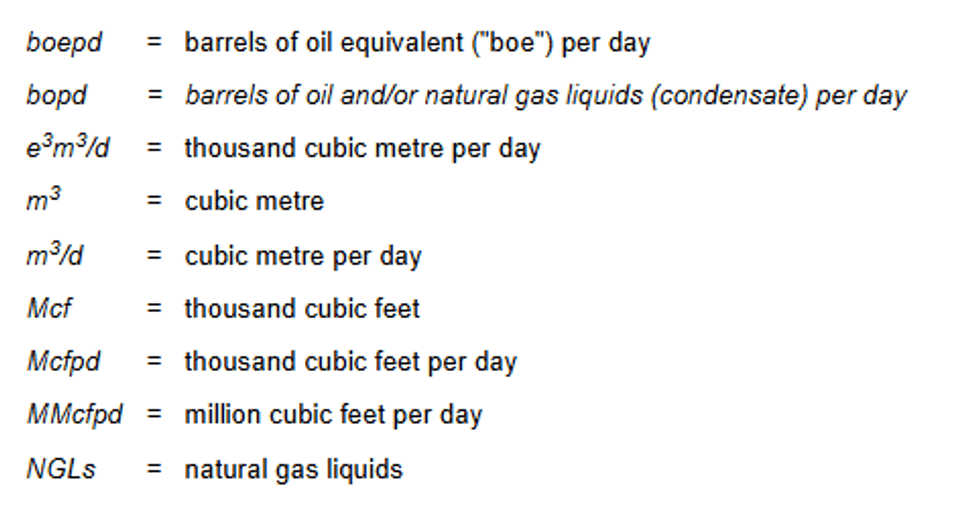

Abbreviations:

BOE Disclosure. The term barrels of oil equivalent ("boe") may be misleading, particularly if used in isolation. A boe conversion ratio of six thousand cubic feet per barrel (6Mcf/bbl) of natural gas to barrels of oil equivalence is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. All boe conversions in this news release are derived from converting gas to oil in the ratio mix of six thousand cubic feet of gas to one barrel of oil.

Contracted firm volumes. The 2025 contracted daily firm volumes of 400 e3m3/d (before any provisions for take or pay allowances) represents contracted volumes based on contract referenced natural gas heating value. Note that Alvopetro's reported natural gas sales volumes are prior to any adjustments for heating value of Alvopetro natural gas. Alvopetro's natural gas is approximately 7.8% higher than the contract reference heating value. Therefore, to satisfy the contractual firm deliveries Alvopetro would be required to deliver approximately 371e3m3/d (13.1MMcfpd).

Forward-Looking Statements and Cautionary Language. This news release contains "forward-looking information" within the meaning of applicable securities laws. The use of any of the words "will", "expect", "intend" and other similar words or expressions are intended to identify forward-looking information. Forward‐looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether or not such results will be achieved. A number of factors could cause actual results to vary significantly from the expectations discussed in the forward-looking statements. These forward-looking statements reflect current assumptions and expectations regarding future events. Accordingly, when relying on forward-looking statements to make decisions, Alvopetro cautions readers not to place undue reliance on these statements, as forward-looking statements involve significant risks and uncertainties. More particularly and without limitation, this news release contains forward-looking information concerning future production and sales volumes and expected sales under the Company's long-term gas sales agreement. Current and forecasted natural gas nominations are subject to change on a daily basis and such changes may be material. Forward-looking statements are necessarily based upon assumptions and judgments with respect to the future including, but not limited to, expectations and assumptions concerning forecasted demand for oil and natural gas, the success of future drilling, completion, testing, recompletion and development activities and the timing of such activities, the performance of producing wells and reservoirs, well development and operating performance, expectations regarding Alvopetro's working interest and the outcome of any redeterminations, the outcome of any disputes, the timing of regulatory licenses and approvals, equipment availability, environmental regulation, including regulation relating to hydraulic fracturing and stimulation, the ability to monetize hydrocarbons discovered, the outlook for commodity markets and ability to access capital markets, foreign exchange rates, general economic and business conditions, the impact of global pandemics, weather and access to drilling locations, the availability and cost of labour and services, the regulatory and legal environment and other risks associated with oil and gas operations. The reader is cautioned that assumptions used in the preparation of such information, although considered reasonable at the time of preparation, may prove to be incorrect. Actual results achieved during the forecast period will vary from the information provided herein as a result of numerous known and unknown risks and uncertainties and other factors. Although Alvopetro believes that the expectations and assumptions on which such forward-looking information is based are reasonable, undue reliance should not be placed on the forward-looking information because Alvopetro can give no assurance that it will prove to be correct. Readers are cautioned that the foregoing list of factors is not exhaustive. Additional information on factors that could affect the operations or financial results of Alvopetro are included in our annual information form which may be accessed on Alvopetro's SEDAR+ profile at www.sedarplus.ca. The forward-looking information contained in this news release is made as of the date hereof and Alvopetro undertakes no obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

www.alvopetro.com

TSX-V: ALV, OTCQX: ALVOF

ALV:CC

Sign up to get your FREE

Alvopetro Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 September 2025

Alvopetro Energy

Leading independent upstream and midstream gas developer in Brazil

Leading independent upstream and midstream gas developer in Brazil Keep Reading...

18 February

Half Yearly Report and Accounts

MEC Resources (MMR:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Half Yearly Report and Accounts

BPH Energy (BPH:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Alvopetro Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00