August 09, 2022

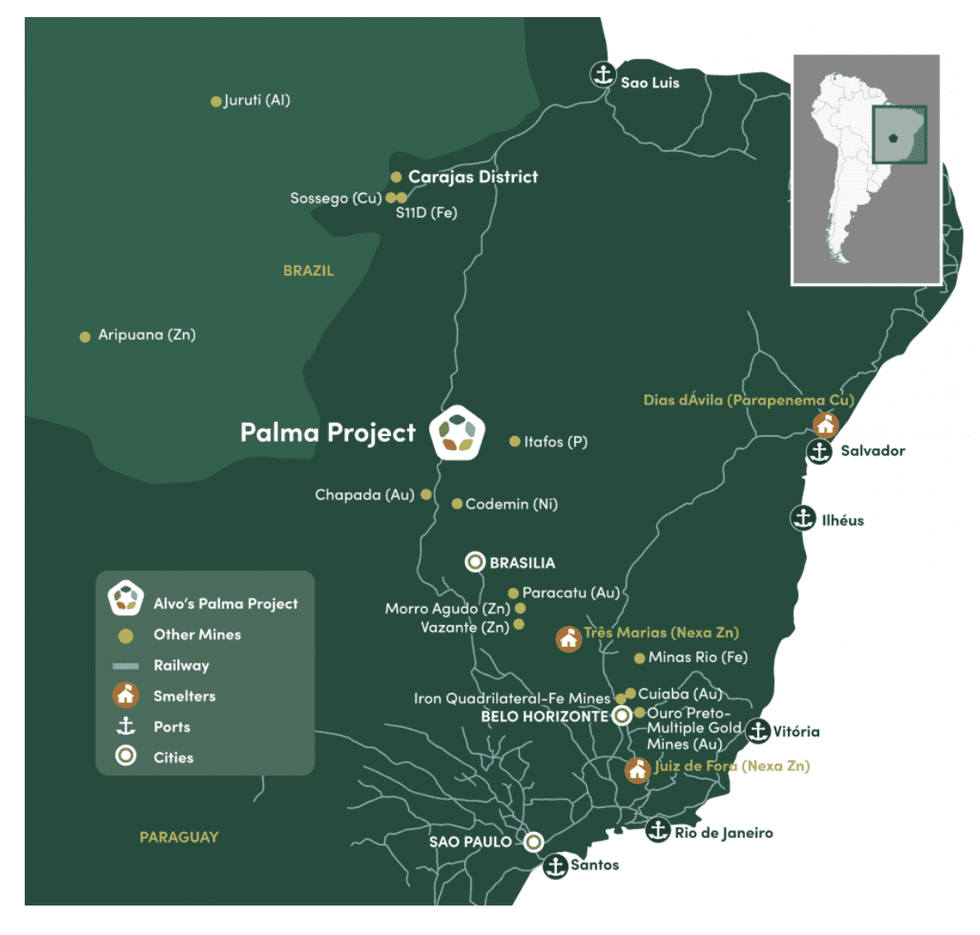

Alvo Minerals (ASX:ALV) focuses on a district-scale opportunity in an underexplored asset in Palmeiropolis region of central Brazil. The advanced-stage Palma project has produced exploration results that indicate high-grade copper-zinc deposits in a rich volcanogenic massive sulphide (VMS) zone. It has the right rocks to become a new VMS camp essential in global sources of copper, zinc, lead, silver and gold. The project is surrounded by active mines, including Lundin Mining’s Chapada copper-gold mine and Serra Verde’s REE project.

The Palma project was discovered in the 1970s, yet it has been idle for approximately 30 years. Once Alvo Minerals acquired the project, it became the first mining company to apply modern, systematic, and aggressive exploration techniques. A 2012 JORC inferred mineral resource estimate indicated 4.6 million tonnes at 1.0 percent copper, 3.9 percent zinc, 0.4 percent lead and 20 g/t silver. The company also recently released assays on the C3 deposit- with highlights including 7.0m @ 5.2 percent Cu, 8.0 percent Zn & 7.4m @ 2.2 percent Cu, and 23.1 percent Zn.

Company Highlights

- Alvo Minerals is an exploration and development company with a district-scale project in Tocantins and Goias states, central Brazil.

- Historic exploration programs have indicated high-grade copper-zinc deposits containing lead and silver. These results were confirmed in the 2012 JORC resource estimate that indicated 4.6 million tonnes of these metals.

- The Palma project has received minimal attention since its discovery, and Alvo Minerals is the first explorer to apply modern and systematic exploration techniques.

- Only the outcropping prospects in the Palma project have been drilled to date, leaving much of the VMS deposits unexplored.

- Palma is surrounded by active mines, including Lundin Mining’s Chapada copper-gold mine and Serra Verde’s REE project. There are also major Nickel, gold and phosphate operating mines within the district.

- The Palma project has robust infrastructure along with community and political support.

- An experienced management team leads the company with the right experience to fully capitalise on its promising district-scale opportunity.

This Alvo Minerals profile is part of a paid investor education campaign.*

Click here to connect with Alvo Minerals (ASX:ALV) to receive an Investor Presentation

ALV:AU

The Conversation (0)

08 August 2022

Alvo Minerals

District-Scale Copper-Zinc VMS Project in Brazil

District-Scale Copper-Zinc VMS Project in Brazil Keep Reading...

5h

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00