Altamira Gold Corp. (TSXV: ALTA,OTC:EQTRF) (FSE: T6UP) (OTCQB: EQTRF), ("Altamira" or the "Company") is pleased to announce that it has received an Environmental Installation License (Licença de Instalação, "LI") for trial mining with respect to permits 850.2242009 and 866.4642017 from the Pará State Secretariat of Environment, Climate and Sustainability (SEMASPA) for its Cajueiro Project, Pará State, Brazil.

Highlights:

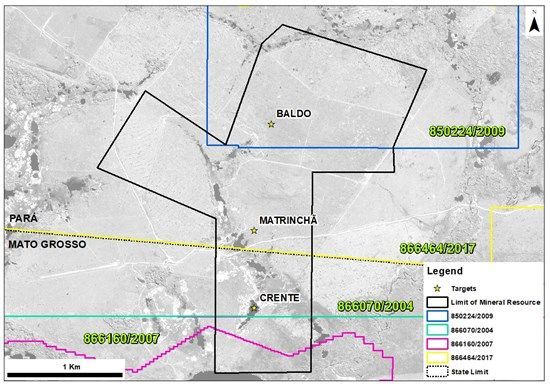

- The environmental process LI No 3651/2025 within permits 850.224/2009 and 866.464/2017, was published on September 22, 2025, and is valid for two years until September 22, 2027. This permit covers the northern part of the Central Resource Area (figures 2 and 3).

- This license permits the Company to construct a plant which would initially process up to 100,000 tonnes of material per year across two mineral rights. The Baldo and Matrincha targets, both located within the current mineral resource in the Central area, are potential sources of feed to a trial mining operation.

- Trial mining could potentially generate near-term cash flow, provide greater insight into the structural controls on gold mineralization, and help refine the understanding of the deposit through processing and reconciliation of mined material.

CEO Mike Bennett commented; "Receiving the Environmental Installation Permit for the Cajueiro Project is an important milestone for the Company. While no decision has been made to proceed with trial mining, the permit creates a pathway to such activities in the future. Trial mining could potentially provide near-term cash flow, generate valuable geological information, and improve our understanding of the gold mineralization at the Cajueiro Central deposit. We believe this could help identify additional gold-bearing structures and further demonstrate the long-term potential of the project."

CAJUEIRO PROJECT

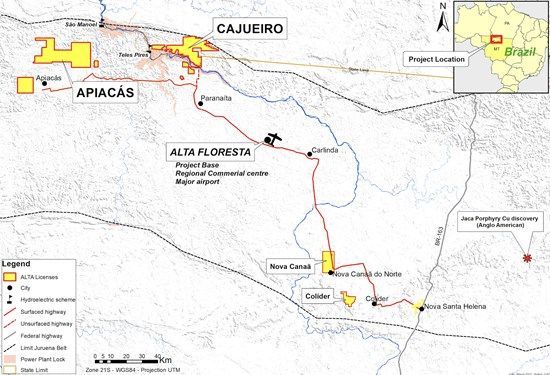

The Cajueiro project is located approximately 75km NW of the town of Alta Floresta in the state of Mato Grosso (Figure 1) in central western Brazil. The project is easily accessible by road, lies on open farmland and has grid power and a local water supply. Cajueiro is the most advanced of the key projects that Altamira controls in the region (Figure1).

Figure 1: Location of Altamira Gold's projects in the Alta Floresta Belt.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4500/267737_8613e78774c63a99_001full.jpg

The Cajueiro district consists of two independently estimated gold mineral resources at Cajueiro Central and Maria Bonita, plus a series of eight additional untested exploration targets within a radius of 8km of Cajueiro Central.

The Cajueiro Central area has a current open pit resource*1 of 5.66Mt @ 1.02 g/t gold for a total of 185,000 oz in the Indicated Resource category and 12.66Mt @ 1.26 g/t gold for a total of 515,000 oz in the Inferred Resource category (estimated using a cut-off grade of 0.25g/t Au and a gold price of US$1,500/oz).

The Maria Bonita open-pit resource consists of Indicated Resources of 24.19Mt @ 0.46g/t gold (for a total of 357,800oz) and Inferred Resources of 25.64Mt @ 0.44g/t gold (for a total of 362,400oz) *2. These resources were calculated using a 0.2 g/t gold cut-off grade and a gold price of US$2,780/oz. These resources include near-surface saprolite Indicated Resources of 2.02Mt @ 0.59g/t gold (38,000oz) and Inferred Resources of 0.68Mt @ 0.40g/t gold (8,700oz).

The mineralized zone at Maria Bonita is interpreted as dipping to the south and is open down dip. The best drillhole to date (MBA029) intersected 213m @ 0.8g/t gold from surface including 146 m @ 1g/t gold. A third phase of drilling is aimed at testing the area to the south and down-dip from the current resource model.

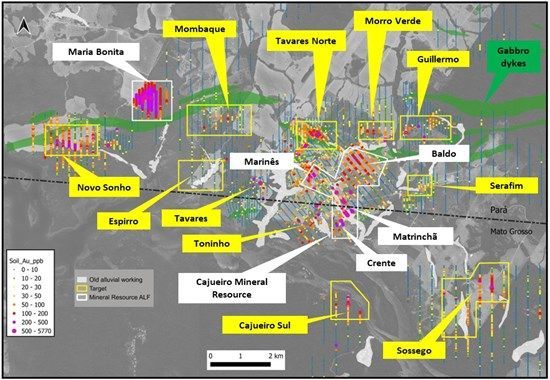

The Maria Bonita porphyry gold deposit is interpreted as part of a district-scale, porphyry-related mineralizing event. There are currently eight additional porphyry gold targets awaiting scout drill testing over an 8km radius from the Cajueiro Central resource (Figure 2).

Figure 2: Cajueiro district targets (yellow labels) and their position in relation to the defined Mineral Resources at Cajueiro Central and Maria Bonita (white labels for sub-sectors). An alignment of six of the targets occur in close spatial association to a pronounced east-west fault corridor marked by later gabbroic dykes.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4500/267737_8613e78774c63a99_002full.jpg

Granting of Environmental License in the Central Deposit

The license (LI No. 3651/2025) is valid until September 22, 2027, and authorizes the installation of activities related to trial mining at Cajueiro. The permit covers the Baldo and Matrincha targets (Figure 3), two contiguous mineral rights granted by the National Mining Agency (ANM), with a combined area of approximately 5,137 hectares. The license allows for up to 100,000 tonnes per year of trial mining (50,000 tonnes under each ANM authorization).

The Baldo target corresponds to the Guia de Utilização ("GU") under ANM process No. 850.224/2009 whilst the Matrincha target corresponds to the GU under ANM process No. 866.464/2017. Both targets are located within the state of Pará and lie within the currently defined mineral resource (reported under National Instrument 43-101*1) in the Central area of the Cajueiro Project.

Figure 3: Location of Baldo and Matrincha resource areas within the Cajueiro Central Mineral Resource.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4500/267737_8613e78774c63a99_003full.jpg

Qualified Person

Guillermo Hughes, FAIG and M Aus IMM., a consultant to the Company as well as a Qualified Person as defined by National Instrument 43-101, supervised the preparation of the technical information in this news release.

About Altamira Gold Corp.

The Company is focused on the exploration and development of gold and copper projects within western central Brazil, strategically advancing five projects spanning over 100,000 hectares within the prolific Juruena Gold Belt, an area that has historically yielded over 6 million ounces of placer gold**. The Company's advanced Cajueiro project contains two gold deposits. The central area comprises NI 43-101 resources of 5.66Mt @ 1.02 g/t gold for a total of 185,000 oz in the Indicated Resource category and 12.66Mt @ 1.26 g/t gold for a total of 515,000oz in the Inferred Resource category. In addition, the Maria Bonita gold deposit comprises additional open pit Indicated Resources of 24.19Mt @ 0.46g/t for a total of 357,800oz, and Inferred Resources of 25.64Mt @ 0.44g/t for a total of 362,400oz.

Ongoing exploration and fieldwork at Cajueiro indicate the presence of multiple porphyry gold systems, reinforcing its potential for district-scale development. These hard-rock gold sources align with historical alluvial gold production, highlighting the region's exceptional gold endowment and potential scalability. With two independently established mineral resources, a highly prospective geological setting and a track record of significant discoveries, the Company is well-positioned to unlock further value across its extensive land package.

*1NI 43-101 Technical Report, Cajueiro Project, Mineral Resource Estimate: Global Resource Engineering, Denver Colorado USA, 10thOctober 2019; Authors K. Gunesch, PE; H. Samari, QP-MMSA; T. Harvey, QP-MMSA

*2NI43-101 Technical Report, Mineral Resource for the Maria Bonita Prospect: VMG Consultoria, Belo Horizonte, Minas Gerais, Brazil. 12th June 2025; Author V. Myadzel

** Juliani, C. et al; Gold in Paleoproterozoic (2.1 to 1.77 Ga) Continental Magmatic Arcs at the Tapajós and Juruena Mineral Provinces (Amazonian Craton, Brazil): A New Frontier for the Exploration of Epithermal-Porphyry and Related Deposits. Minerals 2021, 11, 714. https://doi.org/10.3390/min11070714

On Behalf of the Board of Directors,

"Michael Bennett"

Michael Bennett

President & CEO

Tel: 604.676.5661

Toll-Free:1-833-606-6271

info@altamiragold.com

www.altamiragold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The securities described herein have not been registered under the U.S. Securities Act or any state securities laws, and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements under the U.S. Securities Act and any applicable state securities laws.

Forward-looking Statements

Certain information contained herein constitutes "forward-looking information" under Canadian securities legislation. Forward-looking information includes, but is not limited to, statements with respect to the extension of the Warrants. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "will", "intends" or variations of such words and phrases or statements that certain actions, events or results "will" occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results to be materially different from those expressed or implied by such forward-looking statements or forward-looking information, including the receipt of all necessary regulatory approvals. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. The Company will not update any forward-looking statements or forward-looking information that is incorporated by reference herein, except as required by applicable securities laws.

Notes

Gold analysis has been conducted by SGS method FAA505 (fire assay of 50g charge), with higher grade samples checked by FAA525. Analytical quality is monitored by certified references and blanks. Until dispatch, samples are stored under the supervision the Company's exploration office. The samples are couriered to the assay laboratory using a commercial contractor. Pulps are returned to the Company and archived. Drill holes results are quoted as down-hole length weighted intersections.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/267737