Alpha Exploration Ltd. (TSXV: ALEX) ("Alpha" or the "Company") is pleased to announce the appointment of John Wilton as full time Chief Executive Officer ("CEO") and provides results from recent shallow RAB drilling at Aburna Gold project.

Michael Hopley, Chairman of Alpha, stated: "We are very pleased to welcome John to the company in the role of CEO. His successful track record in discovery and management of high-quality gold and copper exploration teams in Africa, coupled with experience in leading a listed junior exploration and development company, make him the ideal fit with our existing strong management team and directors.

John's specific experience in running teams from cost effective grassroots discovery through resource building and into mine development scoping and feasibility studies will add significant further shareholder value to the Company's advancing gold and base metal exploration projects. We would also like to thank Tim Livesey for stepping in as interim CEO during the past few months and look forward to his ongoing inputs in his main role as a director of Alpha."

In addition, while the current gold exploration and evaluation drilling program progresses at the Aburna Gold project, the Company can report new positive results which indicate an expanding footprint to this prospect. These results are from a shallow rotary air blast ("RAB") drill program designed to test areas of potential gold mineralization underlying thick or transported soil cover. This gold prospect, the Anagulu gold-copper Prospect, the Tolegimja base metal Prospect and the Kosolda gold target are all located at Alpha's 100% owned, 514km2 Kerkasha concession in Eritrea.

John Wilton, CEO of Alpha, stated: "Having now visited the exploration team in Eritrea and after reviewing the Company's existing prospects for both gold and copper mineralization in the field it is very encouraging that the team, led by our in-country manager, has been able to deliver several new compelling gold targets at Aburna. These targets represent both potential extensions and satellite targets to the drilled Aburna project gold mineralization. The combination of the advanced exploration status of the generally shallow gold mineralization intercepted to date within the large 7km by 2km scale Aburna Gold project represents a substantial value unlocking opportunity for current and future stakeholders."

ABURNA GOLD PROJECT: RECENT SHALLOW RAB DRILLING RESULTS

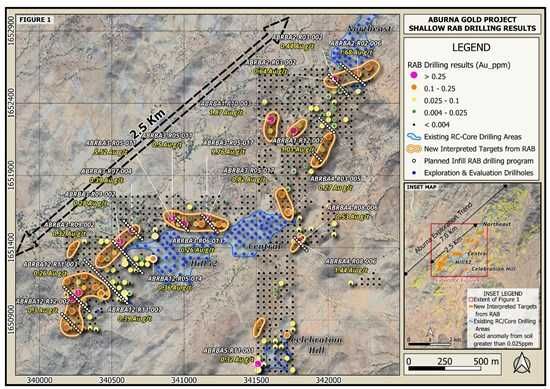

Figure 1 and Table 2 show the results of the RAB drilling program to date returning several gold-in-bedrock anomalies below areas of transported thin soil, and under areas of relatively thick soil cover. These targets are situated predominantly between the Central and Northeast prospects and to the northwest and West of the Hill 52 prospect. The general dip of the host units and structures of the existing mineralization means these new targets are largely untested.

Interpretation of the RAB results suggest materially increased target footprints to the known gold mineralization (see Figure 1). The scale of these individual targets range from 450 to 125 metres along trend. These individual target footprints potentially also represent the shallow expressions of larger plunging shoots/zones at depth as witnessed within the recognized drilled prospects. The tenor of the interpreted target anomalies RAB samples range from 9.76 grams per tonne ("g/t") gold to 0.26 g/t gold (see Figure 1 & Table 1) with the entire RAB drilling data sample results ranging from 9.76 g/t to less than 0.004 g/t gold. Figure 1 clearly illustrates the full results from the RAB program to date. The target anomalies are further supported by samples with more than 0.1 g/t and more than 0.025 g/t gold (see Figure 1).

The inset map on Figure 1 shows these new RAB targets, with the existing drilled gold prospects, and the along trend, geologically interpreted extent (approximately 7km) of the Aburna gold system. This demonstrates the considerable scale and upside exploration potential of the Aburna Gold project.

Figure 1: Location of Newly Identified Gold Targets (orange outlines), Full RAB Drilling Results to Date, and Position of Central, Hill 52, and Northeast Prospects. Inset Map: Showing Current RAB Drilling Area Targets & Existing Prospects Relative to the Largely Undrilled Aburna Gold Trend

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8361/271287_9bf5cc72840cc94a_002full.jpg

Importantly, when comparing these RAB results with previous surface soil sampling this indicates that certain areas of the soil cover are likely formed of immature and/or partially transported material. This opens the potential for these and further satellite targets and extensions to known gold mineralization in the other flat relief areas of property with little or no outcrop.

The results also demonstrate that such areas can be tested by cost and time effective shallow RAB with follow-up reverse circulation ("RC") or core drilling. Of the current phase of RAB drilling 796 holes have been completed and the last batch of results received at the end of September 2025. The company plans to complete the planned infill RAB drilling lines indicated on Figure 1 to define these targets for prioritization ahead of follow-up testing with RC or core drilling.

Table 1 below lists the selected RAB drill holes, depths and sample intervals and gold results with Table 2 showing the selected RAB hole details and collar coordinates.

Table 1: Selected RAB Drilling Results with Depth, Sample Interval and Gold Grade

| RAB Hole ID | Sample ID | Depth From (m) | Depth To (m) | Gold (Au) ppm (g/t) |

| Hill 52 Area | ||||

| ABRBA3-R05-017 | 800996 | 3 | 4 | 0.82 |

| ABRBA3-R05-017 | 800997 | 4 | 5 | 9.76 |

| ABRBA3-R05-011 | 800982 | 4 | 5 | 5.52 |

| ABRBA3-R05-011 | 800983 | 5 | 6 | 0.50 |

| ABRBA12-R05-014 | 801382 | 3 | 4 | 0.36 |

| ABRBA3-R06-013 | 801021 | 2 | 3 | 0.26 |

| ABRBA3-R07-004 | 801051 | 2 | 3 | 0.39 |

| ABRBA3-R09-002 | 801081 | 4 | 5 | 0.32 |

| ABRBA3-R09-002 | 801080 | 3 | 4 | 0.28 |

| ABRBA12-R11-007 | 801516 | 4 | 5 | 0.39 |

| ABRBA12-R11-003 | 801509 | 5 | 6 | 0.26 |

| ABRBA12-R12-002 | 801547 | 4 | 5 | 0.30 |

| Northeast Area | ||||

| ABRBA2-R02-006 | 800496 | 1 | 2 | 1.68 |

| ABRBA2-R03-002 | 800512 | 7 | 8 | 0.44 |

| ABRBA2-R03-002 | 800513 | 8 | 9 | 0.64 |

| ABRBA1-R10-003 | 800209 | 5 | 6 | 1.87 |

| ABRBA1-R12-007 | 800250 | 9 | 10 | 1.01 |

| Central Area | ||||

| ABRBA4-R03-005 | 800698 | 4 | 5 | 0.27 |

| ABRBA4-R08-006 | 800780 | 1 | 2 | 0.53 |

| ABRBA4-R08-006 | 800781 | 2 | 3 | 1.44 |

Note: The sample intervals above in Table 1 are drilled intercepts as the true thickness/widths of this mineralization are unknown at this stage.

QUALITY ASSURANCE AND QUALITY CONTROL

The results reported here for the RAB drilling were analysed by Intertek Minerals Ltd., an independent and accredited laboratory located in Tarkwa, Ghana. The RAB drilling was managed by Alpha Exploration's field team with the field operations conducted in-line with the standard operating procedures implemented at this project. Representative material of bedrock and weathered bedrock for the deepest two, one-metre, samples of each RAB drill hole, were screened to provide approximately 200 grams ("g") of minus 75-micron material. Approximately 60g of sub-sample is allocated for gold fire assay.

A 2-kilogram sample of the original sample is retained as a reference sample. The 60g samples with inserted QA/QC samples of blanks and certified reference material every 20th field sample were shipped directly to Intertek Minerals, Tarkwa, Ghana. These gold results at the laboratory were determined by using a 30g sub-sample for Fire Assay ("FA") and Atomic Absorption Spectroscopy ("AAS") finish (Intertek Code: FA30/AA). The RAB drilling was conducted by Colonnade Mining Group Eritrea Limited.

Table 2: Selected RAB Drill Hole ID, Azimuth, Dip, End of Hole Depth and Collar Coordinates

| RAB Hole ID | Azimuth | Dip | End of Hole (m) | X_UTM_37N | Y_UTM_37N | Elevation (Z) |

| Hill 52 Area | ||||||

| ABRBA3-R05-017 | 360 | -90 | 5 | 341158 | 1651595 | 933 |

| ABRBA3-R05-011 | 360 | -90 | 6 | 340918 | 1651594 | 930 |

| ABRBA3-R05-017 | 360 | -90 | 5 | 341158 | 1651595 | 933 |

| ABRBA3-R05-011 | 360 | -90 | 6 | 340918 | 1651594 | 930 |

| ABRBA12-R05-014 | 360 | -90 | 5 | 340787 | 1651313 | 937 |

| ABRBA3-R06-013 | 360 | -90 | 3 | 341001 | 1651556 | 931 |

| ABRBA3-R07-004 | 360 | -90 | 3 | 340641 | 1651510 | 923 |

| ABRBA3-R09-002 | 360 | -90 | 5 | 340559 | 1651432 | 928 |

| ABRBA3-R09-002 | 360 | -90 | 5 | 340559 | 1651432 | 928 |

| ABRBA12-R11-007 | 360 | -90 | 6 | 340426 | 1651074 | 934 |

| ABRBA12-R11-003 | 360 | -90 | 6 | 340269 | 1651078 | 936 |

| ABRBA12-R12-002 | 360 | -90 | 5 | 340226 | 1651034 | 932 |

| Northeast Area | ||||||

| ABRBA2-R02-006 | 360 | -90 | 3 | 342202 | 1652595 | 980 |

| ABRBA2-R03-002 | 360 | -90 | 9 | 342040 | 1652557 | 947 |

| ABRBA2-R03-002 | 360 | -90 | 9 | 342040 | 1652557 | 947 |

| ABRBA1-R10-003 | 360 | -90 | 6 | 341603 | 1652276 | 953 |

| ABRBA1-R12-007 | 360 | -90 | 11 | 341758 | 1652199 | 938 |

| Central Area | ||||||

| ABRBA4-R03-005 | 360 | -90 | 6 | 341721 | 1651636 | 930 |

| ABRBA4-R08-006 | 360 | -90 | 3 | 341800 | 1651436 | 936 |

| ABRBA4-R08-006 | 360 | -90 | 3 | 341800 | 1651436 | 936 |

QUALIFIED PERSON

All scientific and technical information in this press release, including the results of the Aburna drill program and how these results relate to the ongoing exploration at the Kerkasha Project has been reviewed, verified, and approved by Chris Bargmann CGeol FGS, consultant for Alpha and a "qualified person" for the purposes of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

ABOUT ALPHA

Alpha (TSXV: ALEX) is an exploration company that is rapidly advancing a number of important gold and base metal discoveries across its 100% owned, 514 km2 Kerkasha Project in Eritrea.

The Aburna Gold Prospect is an exciting new gold discovery where recent drilling has confirmed a high-grade mineralized system, with grades including 18m @ 15.33 g/t Au, 16 m @ 14.07 g/t Au, 9 m @ 10 g/t Au and 23 m @ 6.74 g/t Au.

The Anagulu Gold-Copper Prospect includes recent drilling intersections of 108 m @ 1.24 g/t Au and 0.60% Cu and 49 m @ 2.42 g/t Au and 1.10% Cu within a porphyry unit mapped over at a >2 km strike length.

The Company is managed by a group of highly experienced and successful mining and exploration professionals with long track records of establishing, building and returning value to stakeholders from a number of world class gold and base metal discoveries in Eritrea and across the wider Arabian Nubian Shield.

For further information go to the Alpha webpage at www.alpha-exploration.com or contact:

Michael Hopley

Chairman and Director

Alpha Exploration Ltd.

Cautionary Notes

This press release is intended for distribution in Canada only and is not intended for distribution to United States newswire services or dissemination in the United States. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward-Looking Statements

Certain statements and information herein, including all statements that are not historical facts, contain forward-looking statements and forward-looking information within the meaning of applicable securities laws. Such forward-looking statements or information include but are not limited to statements or information with respect to future dataset interpretations, sampling, plans for its projects (including the Anagulu prospect), surveys related to Alpha's assets, and the Company's drilling program. Often, but not always, forward-looking statements or information can be identified by the use of words such as "estimate", "project", "belief", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" and the negative of these words or such variations thereon or comparable terminology are intended to identify forward-looking statements and information. With respect to forward-looking statements and information contained herein, Alpha has made numerous assumptions including among other things, assumptions about general business and economic conditions and the price of gold and other minerals. The foregoing list of assumptions is not exhaustive.

Although management of Alpha believes that the assumptions made and the expectations represented by such statements or information are reasonable, there can be no assurance that forward-looking statements or information herein will prove to be accurate. Forward-looking statements and information by their nature are based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. These factors include, but are not limited to: risks relating to Alpha's financing efforts; risks associated with the business of Alpha given its limited operating history; business and economic conditions in the mining industry generally; the supply and demand for labour and other project inputs; changes in commodity prices; changes in interest and currency exchange rates; risks relating to inaccurate geological and engineering assumptions (including with respect to the tonnage, grade and recoverability of reserves and resources); risks relating to unanticipated operational difficulties (including failure of equipment or processes to operate in accordance with specifications or expectations, cost escalation, unavailability of materials and equipment, government action or delays in the receipt of government approvals, industrial disturbances or other job action, and unanticipated events related to health, safety and environmental matters); risks relating to adverse weather conditions; political risk and social unrest; changes in general economic conditions or conditions in the financial markets; changes in laws (including regulations respecting mining concessions); risks related to the direct and indirect impact of COVID-19 including, but not limited to, its impact on general economic conditions, the ability to obtain financing as required, and causing potential delays to exploration activities; those factors discussed under the heading "Risk Factors" in the Final Prospectus; and other risk factors as detailed from time to time. Alpha does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/271287