November 12, 2024

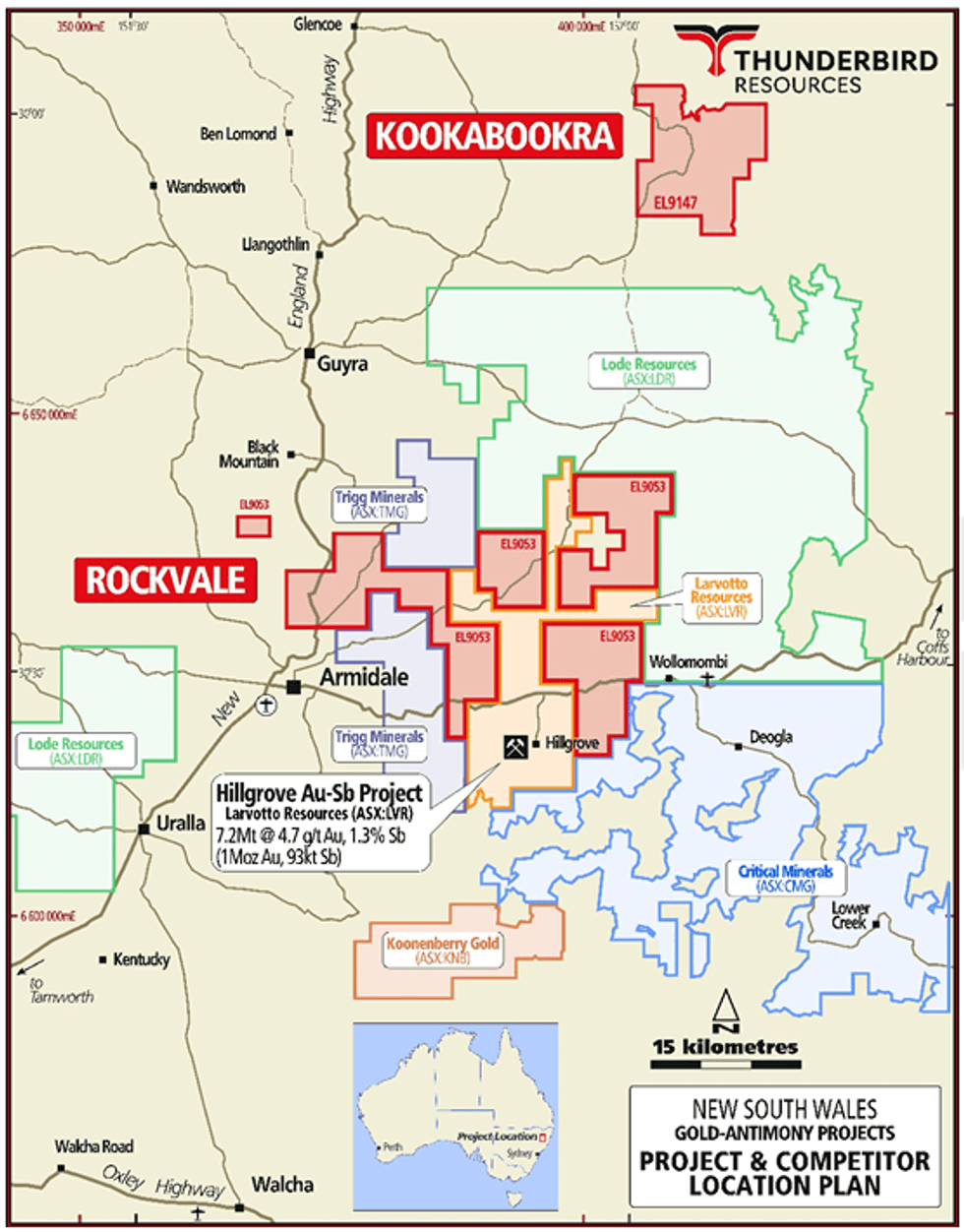

Thunderbird Resources Limited (Thunderbird or the Company) (ASX: THB) is pleased to advise that it has entered into an agreement to acquire a highly prospective antimony and gold exploration land package in the New England Orogen of New South Wales. The high-potential exploration portfolio is located immediately adjacent to Australia’s largest antimony deposit, the Hillgrove Gold & Antimony Project owned by Larvotto Resources (ASX: LRV) (LRV) (Figures 1 and 2).

Highlights

- Thunderbird enters into binding agreement to acquire a 100% interest in a highly prospective 488km2 exploration portfolio surrounding the Hillgrove Gold-Antimony project, a Top-10 global antimony deposit.

- The package, comprising EL9053 and EL9147, including sampling grades of up to 18.2%3 antimony and 76g/t gold4, sits in the heart of the New England Orogen of NSW, which is currently undergoing a major exploration renaissance.

- EL9053, known as the Rockvale Project, covers potential strike extensions of the gold-antimony mineralisation at Hillgrove and encompasses multiple known gold and antimony occurrences, including numerous high-grade historical workings.

- EL9053 adjoins Larvotto Resources’ (ASX: LRV) Hillgrove Gold & Antimony Project, the largest antimony deposit in Australia, with a Mineral Resource of 7.3Mt @ 4.4g/t Au and 1.3% Sb for 1.04Moz of contained gold and 93kt of contained antimony1,2.

- EL9147, known as the Kookabookra Gold Project, covers multiple gold reefs in the historical high-grade Kookabookra gold field.

- Both Projects are considered highly prospective for the discovery of high-grade orogenic gold +/- antimony mineralisation and intrusion-related gold mineralisation.

- The proposed acquisition provides a low-cost opportunity to explore high-quality assets that offer exposure to very favourable commodities, with the ability to explore and generate newsflow during the northern hemisphere winter when Thunderbird’s Canadian assets are less accessible.

- Antimony is a critical metal used for producing high-tech and defence products, including flame retardant materials, semiconductors and superhard materials. Antimony prices have been rising strongly since China, which dominates global supply, imposed export restrictions earlier this year.

Figure 1: Map showing location of EL9053 (Rockvale) and EL9147(Kookabookra) (shown in red outline).

Thunderbird has entered into a binding share purchase agreement with the shareholders of Kooky Resources Pty Ltd (Kooky Resources) to acquire all the issued share capital of Kooky Resources (Proposed Acquisition).

Kooky Resources holds a 100% interest in exploration licences EL9053 and EL9147, which offer strong prospectivity for high-grade antimony and gold mineralisation.

EL9053 lies directly adjacent to the Hillgrove Gold & Antimony Project held by LRV, which represents the largest antimony deposit in Australia with a Mineral Resource of 7.3Mt @ 4.4g/t Au and 1.3% Sb for 1.04Moz of contained gold and 93kt of contained antimony.

The Hillgrove Gold & Antimony Project is currently being redeveloped by LRV and already has most of the surface infrastructure in place, including the process plant, power, roads, decline and substantial underground development. Leveraging this existing infrastructure, LRV recently announced a positive pre-feasibility study, targeting first ore production by early 20261.

EL9053 covers potential strike extensions of the geology and structures that host the antimony-gold mineralisation at Hillgrove.

Numerous historical prospects and occurrences are reported within EL9053 with sampling grades of up to 18.2%3 antimony and 76g/t4 gold reported. Despite the number of historical gold and antimony occurrences the area has had minimal modern exploration or drilling since the 1980s.

EL9047 covers the historical Kookabookra gold field, which has seen virtually no modern exploration, with multiple gold occurrences and potential for both orogenic gold +/-antimony mineralisation and intrusion related gold mineralisation.

This article includes content from Thunderbird Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

THB:AU

The Conversation (0)

8h

Mark Moss: Trust is Gold's Key Driver as Price Hits Record Levels

Gold and silver's historic price rises are raising questions about the broader state of the world. For Mark Moss, the surges reflect a deeper breakdown of trust in sovereign currencies. “The real driver is not inflation,” the investor and commentator emphasized during a fireside chat at the... Keep Reading...

8h

What Was the Highest Price for Gold?

Gold has long been considered a store of wealth, and the price of gold often makes its biggest gains during turbulent times as investors look for cover in this safe-haven asset.The 21st century has so far been heavily marked by episodes of economic and sociopolitical upheaval. Uncertainty has... Keep Reading...

10h

Quarterly Activities/Appendix 5B Cash Flow Report

Aurum Resources (AUE:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

11h

Pinnacle Silver and Gold Targets Fast-track Production at Mexico Silver-Gold Project

Pinnacle Silver and Gold (TSXV:PINN,OTCID:PSGCF,FWB:P9J) is advancing its high-grade El Potrero silver-gold project in Durango, Mexico, with the goal of returning the past-producing asset to production as quickly as possible.Speaking with the Investing News Network at the Vancouver Resource... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00