May 08, 2022

Perth-based lithium exploration and development company Winsome Resources (ASX:WR1; “Winsome” or “the Company”) is pleased to advise it has partnered with geology specialist Mr Glenn Griesbach and with local prospector Mr Marc de Keyser.

Highlights:

- Exclusive option agreement executed for Winsome to acquire and explore a further 259 claims, totalling 149 km2 in the highly sought after greater Decelles region of Quebec, Canada

- Option agreement expands Winsome’s lithium exploration footprint in Quebec, enlarging Company’s recently acquired Decelles claim area by nearly 40%

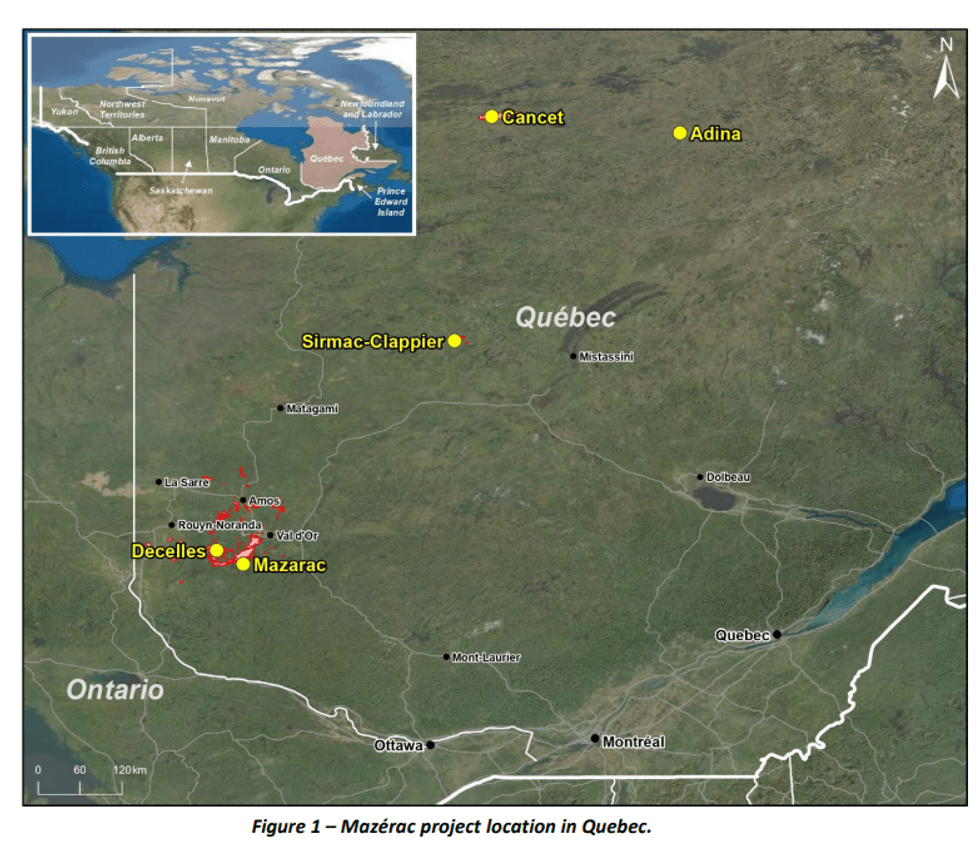

- This expanded area, known as Mazérac, is located around the Decelles Reservoir, about 50km southwest of Val-d’Or and easily accessible by a network of forestry roads

- The region has seen much recent staking and prospecting activity, including highgrade spodumene discoveries by Vision Lithium at their nearby Cadillac property1

- Enlarged property holding is highly complementary to Company’s 100% owned, existing projects in the James Bay region – Cancet, Adina and Sirmac-Clapier

The Company has entered into an exclusive option agreement to acquire 258 claims from Mr Glenn Griesbach and one claim from Mr de Keyser, totalling 149km2 in the prospective Mazérac region of Quebec, Canada. This is within the greater Decelles area, where the Company also acquired new property in January 20222 .

Mazérac is located close to the mining centres of Val-d’Or and Rouyn-Noranda, approximately 600km from Montreal. The Company has signed an exclusive option agreement to explore and subsequently acquire the claims over a 24-month period.

Mr Griesbach is a Canadian-certified geologist with more than 40 years of mineral exploration experience across Canada, Africa, China, and Southeast Asia. Mr de Keyser is a seasoned local prospector of First Nation heritage, with a strong understanding of the Mazérac region.

By entering into this agreement, the Company further expands its land holding in Quebec, exploring a new area of the province known for granitic and pegmatitic outcrops. The area is located close to infrastructure and the major mining centres immediately adjacent to recent lithium discoveries1 (see Figure 1 map)

Managing Director Chris Evans said:

“We are delighted to have entered into the option agreement for a further 259 claims at Mazérac in the Decelles region. There has been a considerable amount of recent lithium focused activity in the surrounding region, with several public and private companies making successful discoveries.

“By acquiring this project, we significantly increase the Company’s prospective lithium landholding in Quebec and continue towards achieving our vision of supplying high grade lithium products into the North American battery supply chain.”

Transaction details

Winsome has entered into an exclusive option agreement to acquire 259 claims from Mr Griesbach under the following broad terms:

- An upfront fee of AUD$75,000, paid in WR1 shares

- AUD $250,000 paid in three tranches of WR1 shares, based on the five-day VWAP from last week’s trading (AUS $0.47). This will equate to:

- 177,000 WR1 shares issued now

- 177,000 WR1 shares issued on 3 May 2023

- 177,000 WR1 shares issued on 3 May 2024

- A 2% Net Smelter Royalty (NSR) over the properties which can be reduced to 1% at any time for a consideration of AUD $1,000,000

Once the final payment of 175,000 WR1 shares is made on 3 May 2024, the 259 claims will transfer to Winsome’s Canadian subsidiary.

The Company also has the ability to accelerate the acquisition at any point within the next 24 months and have the claims transferred immediately by issuing all shares due to Mr Griesbach.

As a separate transaction, the Company paid Mr de Keyser CAD $20,000 to acquire outright the ‘Nippy Hill’ claim which is contiguous to the other Mazérac claims described above.

Click here for the full ASX Release

This article includes content from Winsome Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

WR1:AU

The Conversation (0)

14 November 2025

Nextech3D.ai Poised for Growth as Event-Tech and 3D/AR Revenue Accelerates

Nextech3D.AI (CSE:NTAR,OTCQX:NEXCF,FSE:EP2) is gaining investor attention following H.C. Wainwright’s November 2025 coverage, highlighting renewed optimism about the company’s growth prospects, driven largely by its expanding event‑technology business.The analyst firm maintained a Buy rating... Keep Reading...

31 May 2023

Restructure of the Renard Option

Highlights Reduction of initial payment upon exercise of the option from C$15 million to C$1 million . The balance of the Renard consideration payment delayed until 2026 and 2027. Renard Option restructure preserves shareholder value by deferring material payments by 12 months and extending the... Keep Reading...

27 April 2022

Quarterly Report for Period Ending 31 March 2022

Winsome Resources Limited (ASX: WR1) ("the Company" or "Winsome Resources ") is pleased to report on its Quarterly activities for the period ending 31 March 2022.Quarter Highlights Exploration Entered into exclusive option agreement to explore and acquire 669 claims in the highly prospective... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00