April 15, 2025

WIN Metals Ltd (ASX: WIN) (“WIN” or “the Company”) is pleased to provide shareholders with an updated Mineral Resource Estimate (“MRE”) for its flagship Butchers Creek Gold deposit, part of the Butchers Creek Gold Project (“BCGP”) located in the East Kimberley region of Western Australia.

Highlights

- Updated Mineral Resource Estimate: Butchers Creek Gold Mineral Resource revised to 5.23Mt @ 1.G1g/t Au for 321,000oz of Gold

- Significant Increase in Indicated Resource: Indicated category up by 86% to 3.58Mt @ 2.24g/t Au for 258,000oz of Gold

- Project De-Risked: Updated Mineral Resource significantly enhances confidence for future Economic Evaluation

- Growth Focused 2025 Drill Program: Planned drilling to target high-priority, high- grade resource growth targets, including Golden Crown (currently 0.4Mt @ 3.1g/t Au Inferred Mineral Resource1) with recent extensional drilling returned 6m @ 10.85g/t Au2

- Heritage survey scheduled: April survey ahead of the proposed July drill program

WIN Metals Managing Director and CEO, Mr Steve Norregaard, commented:

“Our first update of the Butchers Creek Mineral Resource following the successful maiden drill campaign completed late in 2024 has delivered an 8C% increase in the Indicated Resource. This paves the way for the Company to advance development studies while we continue to drill our other high-priority, high-grade targets.

With readily accessible mineralisation located immediately below the shallow open pit amenable to low-cost open pit mining methods, the opportunity to monetise this asset in the current high gold price environment is now an imperative.

To complement this great outcome, the Company will continue to enhance the resource base focussing on the Golden Crown area during the forthcoming dry season, building on the promising high-grade drill intersections reported last year.

The significant achievements by WIN during the short time we have held this project, and the opportunities we see in this underexplored goldfield in WA’s Kimberley region, provide a strong foundation for our future growth.”

This latest April 2025 MRE update increases the Mineral Resource to 321,000oz of gold at 1.G1g/t Au, with 258,000oz gold at 2.24g/t Au representing 80% of the MRE classified as Indicated available for economic studies for project development.

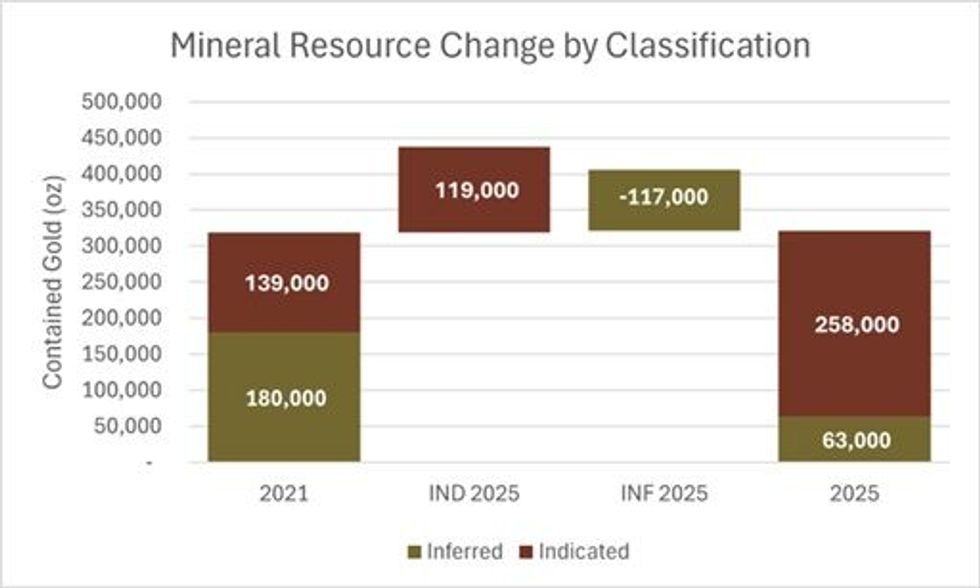

This update reflects the successful conversion of an additional 11G,000oz at 2.24g/t Au into the Indicated category representing an 86% increase in Indicated gold resource ounces compared to the 2021 MRE1 as demonstrated in the waterfall chart in Figure 1 below.

Click here for the full ASX Release

This article includes content from Win Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

21h

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00