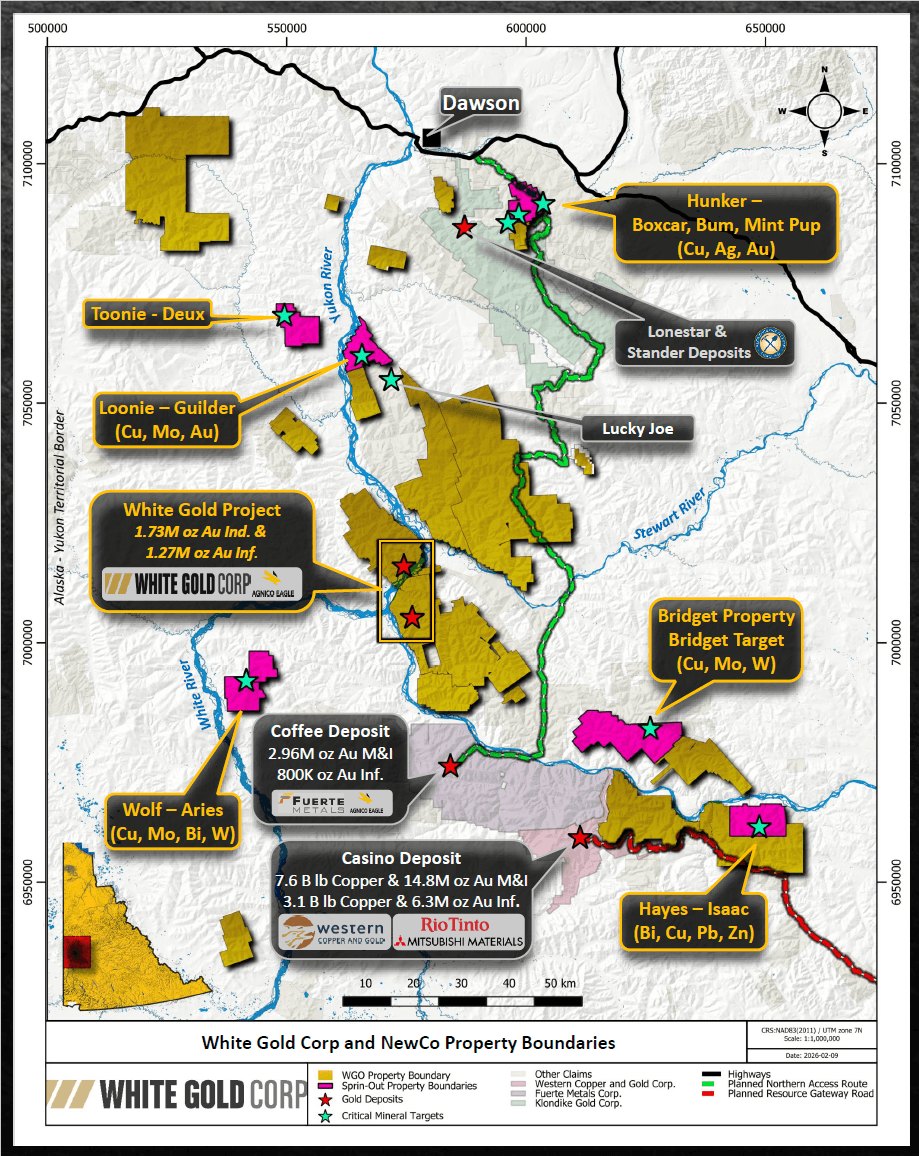

TORONTO, ON / ACCESS Newswire / February 11, 2026 / White Gold Corp. (TSXV:WGO,OTC:WHGOF)(OTCQX:WHGOF)(FRA:29W) ("White Gold" or the "Company") is pleased to announce that it has commenced procedures for a spin-out transaction (the "Spin-Out") to create a new, Yukon-focused critical minerals exploration company ("SpinCo"). The Spin-Out is designed to unlock the value of White Gold's non-gold project portfolio by transferring its portfolio of copper, molybdenum, tungsten and other critical mineral properties located in west-central Yukon into a dedicated, standalone vehicle with shares to be distributed to shareholders. Included below is an overview of the Spin-Out and properties to be transferred to SpinCo. Additional details will be provided as the procedure continues to advance.

The proposed transaction will enable the Company to focus on advancing its flagship White Gold Project which hosts four near-surface gold deposits, that collectively contain an estimated 1,732,300 ounces of gold in indicated resources (35.2 million tonnes grading 1.53 grams per tonne gold) and 1,265,900 ounces of gold in inferred resources (32.2 million tonnes grading 1.22 g/t Au) (see the Company's news release dated October 6, 2025), with significant expansion potential on the resource itself and in the immediately surrounding area, complimented by a substantial pipeline of gold targets across the Company's district scale property portfolio. The Spin-Out will provide shareholders with direct exposure to a significant portfolio of critical mineral exploration projects prospective for copper, molybdenum, tungsten, silver, and other strategic metals to be efficiently advanced by a dedicated team and resources.

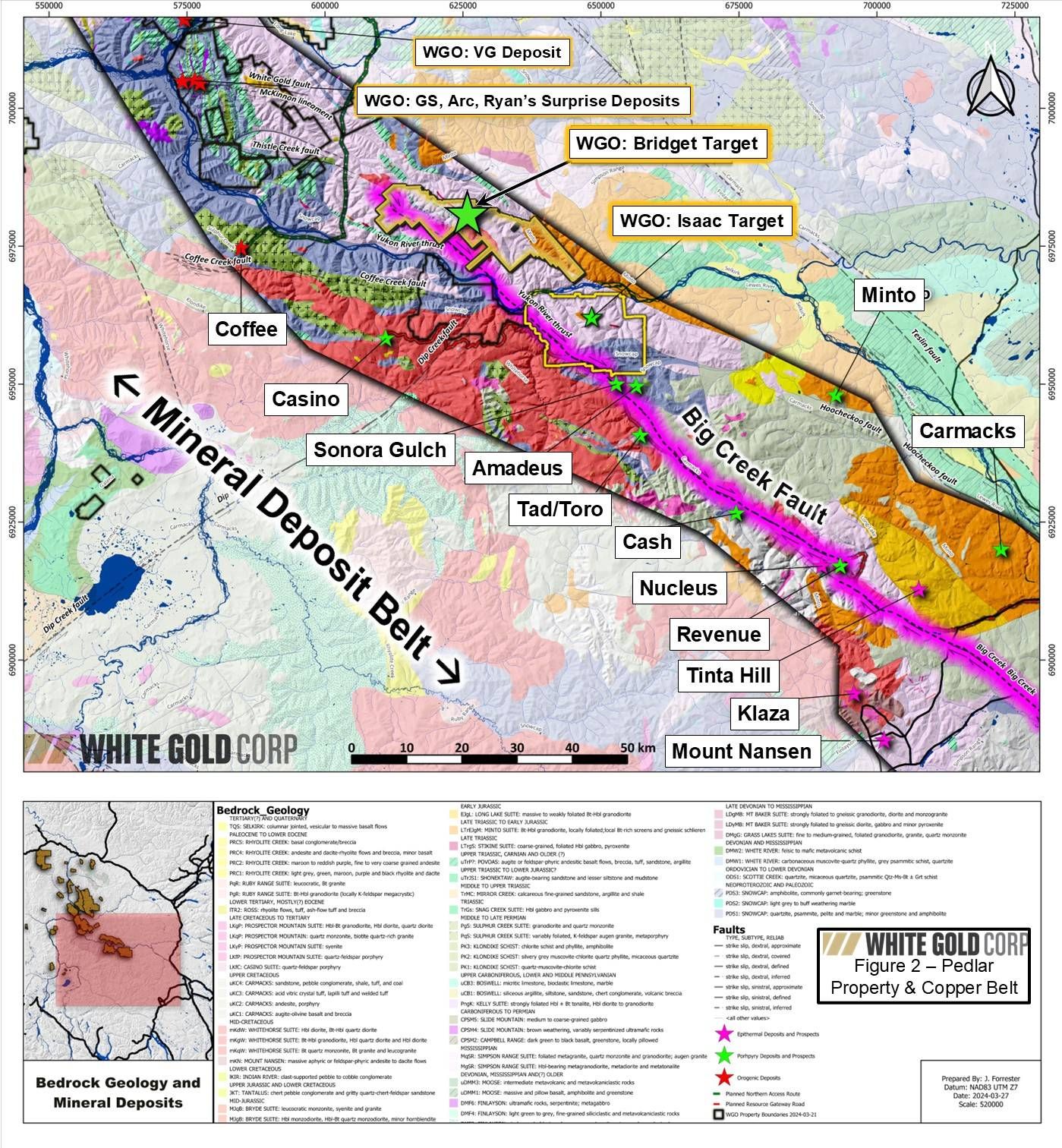

The Spin-Out portfolio includes several large-scale critical minerals targets prospective for Copper (Cu), Molybdenum (Mo), Tungsten (W), Antimony (Sb), Zinc (Zn) and Bismuth (Bi), underlain by highly prospective geology which were identified through White Gold's data driven exploration methodologies which have proven to be successful in the region. Key targets - including the Bridget, Isaac, and Mascot - are situated within the Dawson Range, a prolific east-southeast trending mineral belt that hosts several significant copper-gold porphyry deposits including the Casino deposit (one of the largest undeveloped copper-gold projects in Canada), the Minto Mine, and the Carmacks Project.

"Over the past several years, White Gold has systematically built one of the most comprehensive regional geochemical and geological datasets in the Yukon, which has clearly highlighted the scale and quality of several copper and critical mineral targets within our portfolio in addition to our highly prospective gold projects. Assets such as Bridget, Isaac, and Wolf exhibit the size, metal zonation, and geophysical signatures typically associated with large, fertile porphyry systems, yet remain largely untested by drilling. Spinning these assets into a dedicated vehicle allows them to be advanced more effectively with the technical focus and disciplined exploration strategy they warrant," commented Dylan Langille, Vice President of Exploration for White Gold Corp.

White Gold Corp's CEO, David D'Onofrio stated, "The timing of this proposed spin-out aligns exceptionally well with the strong and growing support we are seeing from both the Yukon and federal governments for the responsible development of critical minerals. Recent initiatives focused on advancing critical mineral exploration, improving infrastructure, streamlining permitting, and strengthening collaboration across Western and Northern Canada reinforce Yukon's position as a globally desirable jurisdiction for discovery and development. By creating a dedicated critical minerals company, we believe we are positioning these assets to directly benefit from this supportive policy environment, while providing shareholders with focused exposure to commodities that are increasingly central to Canada's long-term economic and supply chain strategies."

SpinCo Highlights:

Six properties representing approximately 15% of White Gold's current claims which includes numerous copper and strategic metals targets (Cu, Mo, W, Sb, Zn, Bi) remain largely unevaluated and undrilled, presenting significant discovery upside.

Highly prospective geology for copper, molybdenum, tungsten, antimony and bismuth across multiple deposit styles.

District-scale exploration database covering the Company's entire land package (Figure 1), including soil geochemical samples, and geophysical testing, have outlined multiple large, high-priority critical mineral anomalies.

Key targets - Bridget, Isaac and Mascot - situated within the Dawson Range, a proven mineral belt hosting major copper-gold systems such as the Casino deposit, Minto Mine, and the Carmacks Project.

The Bridget target, the most significant, untested porphyry system in the Company's critical mineral portfolio, is comprised of a Mo-Cu porphyry anomaly covering a 3 x 3.5 km area enriched with tungsten, bismuth and silver and is transected by two large northwest trending major crustal-scale dextral transpressional faults. An initial technical report on this property will be filed in connection with the Spin-Out.

Several of the Spin-Out targets include additional upside potential for antimony and bismuth as secondary metals across orogenic gold, intrusion-related, epithermal, and porphyry systems.

Further details on the Spin-Out transaction to be provided as the process continues to advance with a near term anticipated completion, subject to shareholder and regulatory approvals.

Spin-Out of Critical Mineral Portfolio

The Spin-Out will be completed by way of a plan of arrangement under the Business Corporations Act (Ontario) and subject to the terms and conditions of an arrangement agreement (the "Arrangement Agreement") to be entered into between the Company and SpinCo. Completion of the Spin-Out will also be conditional on the receipt of shareholder approval, and regulatory and court approvals, including, without limitation, the approval of the TSX Venture Exchange (the "TSXV"). It is intended that SpinCo will apply to list its shares on the TSXV and such listing will be subject to SpinCo fulfilling all of the requirements of the TSXV.

Additional details relating to the Spin-Out will be provided when the Company enters into the Arrangement Agreement. They will also be included in the management information circular in respect of the shareholders' meeting to be held to consider and approve, among other things, the Spin-Out. Copies of the management information circular and related meeting materials will also be filed with the applicable Canadian securities regulators and will be available on SEDAR+ (www.sedarplus.ca).

Regional Setting - The Dawson Range and Critical Mineral Belt

The Dawson Range is an east-southeast trending mountain belt that hosts numerous significant mineral deposits and prospects along the Minto-Carmacks Copper Belt, including the Casino copper-gold porphyry deposit in the west owned by Western Copper and Gold (Figure 2). In the southeast near the community of Carmacks, the Minto Mine owned by Selkirk Copper Mines Inc. contains Indicated Resources of 12.588 Mt grading 1.203% Cu, 0.461 g/t Au, 1.728 thousand ounces Ag for 333.8 M lbs copper, 186.6 k oz gold, and 1.728 M ounces silver and Inferred Resources of 23.658 Mt grading 1.048 % Cu, 0.387 g/t Au, 3.9 g/t Ag for 546.8 M lbs copper, 294.7 K ounces gold, and 2.9681 K ounces silver(5)(2). It also hosts the Carmacks Copper project, which contains Measured and Indicated Resources of 36.25 Mt grading 0.81 % Cu, 3.25 g/t Ag, 0.26 g/t Au for 651 M lbs of copper, 3.79 M ounces silver, and 302 K ounces of gold(6)(2), owned by Cascadia Minerals Ltd. Both deposits are interpreted as metamorphosed copper-gold-silver porphyry systems. Porphyry deposits in the Dawson Range occur in two principal age groups: Late Triassic (e.g., Minto, Carmacks) and Late Cretaceous (e.g., Casino, Cash, Revenue). In addition to porphyry-style mineralization, the Dawson Range also hosts epithermal, skarn, and polymetallic to gold-dominant veins, breccias, and fracture zones (7). Owing to this diverse and highly prospective mineral endowment, the region has attracted increasing attention and investment in recent years from both junior and major mining companies.

Critical Minerals Portfolio Overview

The assets proposed to be transferred to SpinCo include six core properties that collectively represent a pipeline of advanced to early-stage critical mineral exploration opportunities across multiple prolific metallogenic belts in Yukon. Highlights include:

Bridget Property - Bridget Target

The Bridget target is a standout Mo-Cu porphyry anomaly with one of the highest molybdenum-in-soil signatures in the White Gold District, spanning a 3 x 3.5 km area and enriched with additional critical elements like tungsten, bismuth, and silver. It is transected by two large northwest trending major crustal-scale dextral transpressional faults - the Sixtymile River Fault and Big Creek Fault. Both faults host several significant multi-element porphyry and epithermal deposits. The target was initially identified in 1972 when Silver Standard Mines conducted an extensive 14,000-plus regional silt survey looking for another Casino deposit.

Geologically, the target is underlain by hornblende gneiss, biotite schists, and calc-silicate altered marble (skarn), intruded by quartz eye granite and aplite dikes. The soil geochemical footprint of the anomaly is characterized by Mo-in-soil values as high as 321.9 ppm Mo, including 278.9 ppm Mo, 265.4 ppm Mo, 263.5 ppm Mo, 257.2 ppm Mo, and 253.3 ppm Mo with over 400 additional samples returning values greater than 20 ppm Mo. Across the target, anomalous Cu-in-soil values exceeding 100 ppm Cu are common with the most significant enrichment occurring at the core with values as high as 710.1 ppm Cu, including 662.6 ppm Cu, 594.7 ppm Cu, 492.9 ppm Cu, 406 ppm Cu observed over a roughly 900 m x 900 m area. Other notably enriched critical minerals include tungsten (W), with the highest concentrations observed in the northern half of the target area, where soil sampling has yielded values up to 101 ppm W, with values exceeding 30 ppm W common. Other anomalous metals including Pb, Bi, As, Zn, and Ag are typically observed over two large northwest-southeast oriented fault systems which cut the target in the north and in the south. Two rounds of IP Geophysics performed in 2023 and 2025 have identified favourable subsurface chargeability and resistivity anomalies beneath the strong surface Cu-Mo-Zn-W soil geochemistry signatures.

The 2025 Bridget IP survey delineated multiple high-priority anomalies, including five porphyry targets defined by chargeability, resistivity, metal factor, and 2D inversion models. These geophysical features are directly associated with the large multi-element soil anomalies measuring 3 x 4.3 km. Together, these results represent strong evidence of the potential for concealed porphyry style mineralization system at Bridget.

Its size, multi-element enrichment, proximity to key structures, and lack of drilling make it the company's most significant untested porphyry system and a critical priority for diamond drilling. An initial technical report on this property will be filed in connection with the Spin-Out.

Loonie Property - Guilder Target

Located adjacent to a known Cu-Au prospect (Lucky Joe), the Guilder target on the Loonie property hosts a 3 km long, northwest-southeast trending Cu-Mo-Au-Zn-Pb soil anomaly, which appears to be a northwestern extension of the Lucky Joe target. Prospecting on the Guilder target has uncovered malachite and chalcocite, hosted by quartz-feldspar-biotite schist, near an outcrop of augen gneiss. Samples from this showing returned 1114.8 ppm Cu and 6.1 g/t. Its proximity to historic mineralization and copper association makes it an attractive early-stage critical mineral target for follow-up work.

Wolf Property - Aries and Taurus Targets

The Aries target on Wolf property is an interpreted porphyry system that is characterized by a central zone of copper and molybdenum anomalies, surrounded by a large peripheral zone enriched in bismuth, arsenic, lead, and zinc. This forms a footprint measuring approximately 4 km in length (NE-SW) and 3 km in width (NW-SE). To the northeast, the Aries target transitions from a gold-dominant system into a potential porphyry system. This area's molybdenum-in-soil values reach as high as 51.4 ppm, with the bulk of the anomaly showing values above 5 ppm. Copper-in-soil values peak at 923.9 ppm, with notable results such as 637.8 ppm, 630.8 ppm, and 600.6 ppm Cu, located near areas enriched in arsenic and bismuth. Previous drilling on the property has been gold-focused and the property remains largely untested and highly prospective for several critical minerals including Mo and Cu.

The Wolf property is located east of the White River, approximately 120 km south-southwest of Dawson City and 35 km west of the White Gold Project. Two main target areas have been identified on the property, the Aries and Taurus targets. The area is predominantly underlain by hornblende-biotite diorite intruded by medium-grained and megacrystic K-feldspar granites. These intrusions are associated with widespread biotite and potassic alteration, which are key indicators of potential porphyry mineralization.

To the north and northeast, the property is underlain by Late Cretaceous Carmacks volcanic units, including andesite and basalt flows, and siliciclastic basal conglomerates. Cu-Mo enrichment appears to be localized along the contact between these volcanic units and the adjacent granites while gold mineralization is concentrated in the southwestern part of the property (Taurus target) in shreddy biotite and k-spar altered hornblende-biotite diorites. The Taurus target features a gold-in-soil anomaly that spans approximately 2 km long by 0.5 km wide, with maximum gold values reaching 358 ppb Au. The anomaly has an arcuate shape, trending east-west in the southwest and curving northeast-southwest to the east. GT Probe bedrock sampling returned gold values up to 1.22 g/t Au, with several samples exceeding 0.5 g/t Au. In 2023 RAB drilling of the target returned gold values of up to 0.81 g/t Au over 15.24m from 19.81m (hole WLFTRS23RAB002) including 6.55 g/t Au over 1.52m, along with 0.32 g/t Au over 30.47m) from 13.72m in hole WLFTRS23RAB002.

Hunker Property - Bum, Mint, and Boxcar Targets

The Hunker Property includes historical high-grade Cu-Ag showings and a large Cu-Au soil anomaly at Mint Pup (2.5 km by 2.7km), with recent rock and soil samples showing strong copper values and porphyry-related alteration. It's location in the Klondike goldfields and multiple Cu-Au showings make it a prime candidate for deeper exploration and geophysical targeting

Hayes Property - Isaac Target

The Isaac target measures approximately 2 km E-W by 1.5 km N-S with a central bismuth-arsenic enriched core measuring from 750 m to 1,000 m which is surrounded by a > 400 m wide halo of anomalous silver, lead and zinc. Anomalous copper occurs in the southern portion of the core, and a relatively small area of anomalous molybdenum occurs near the core's northern margin. The target is located in the central part of the Hayes property 38 km east of the Casino deposit and is a geochemically zoned multi-element soil anomaly associated with a mapped unit of Late Cretaceous Prospector Mountain suite intrusive rocks. Anomalous copper-in-soils occurs in the southern portion of the core, and a relatively small area of anomalous molybdenum occurs near the core's northern margin. Within the peripheral halo, silver-in-soil values range from 1 ppm Ag to as high as 16.9 ppm Ag, including 12.3 ppm Ag, 12.2 ppm Ag, 11 ppm Ag, 10.2 ppm Ag, 9.8 ppm Ag, while values > 3 ppm Ag are very common. Also, within this halo, lead-in-soil values occur as high as 3310.4 ppb Pb including 957.5 ppm Pb, 832.8 ppb Pb, 748 ppm Pb, 689.1 ppb Pb, with associated zinc-in-soil values as high as 1747 ppb Zn including 1360 ppm Zn, 1137 ppm Zn, 941 ppm Zn, 763 ppm Zn, 729 ppm Zn, and 713 ppm Zn. A limited 2022 prospecting and mapping program included the collection of 19 rock grab samples returning values as high as 1269.2 ppm Cu, 106.02 ppm Mo, 27.265 ppm Ag, 3100.1 ppm Zn, 2624.78 ppm Pb, 378.52 ppm Bi, and two samples returning over-limit values for Li (> 2000 ppm Li). The geochemical zonation seen in soils and supporting hyperspectral analysis of rock samples indicate that the anomaly may represent the surface expression of a copper molybdenum porphyry core surrounded by distal or epithermal style silver-lead-zinc mineralization.

In 2023 two deep-penetrating Induced Polarization - Resistivity survey lines were completed over the Isaac target with a total of eight chargeability anomalies identified. The bismuth soil anomaly appears to be controlled by faults interpreted from the IP resistivity data. The bismuth and copper core of the soil anomaly is underlain by multiple chargeability anomalies which sit above a resistivity low that is interpreted as a fault structure. Lead, zinc, and silver, which form a halo around the core, are coincident with fault structures on the south side and north side of the survey area which trend NE (065°) and NW (290°) respectively. Isaac is a recently recognized (2021) target and has never been drilled tested.

Toonie Property

Soil sampling has defined a zoned anomaly that may be related to a buried intrusion. The distribution of values with an Au-Mo-Cu domain and more distal Zn-Pb and Ag may indicate a porphyry system.

Hyperspectral Analysis & Results

During 2023, crushed coarse rejects from 2022 prospecting rock samples from the Pedlar and Hayes properties were analyzed with an ASD TerraSpec® 4 Hi-Res Mineral Spectrometer. Results were uploaded and processed using IMDEX's aiSIRIS™ cloud-based mineral interpretation AI software to produce semi-quantitative, standardized mineral interpretations and analytics.

The Hyperspectral analysis results for the prosecting rock samples show alteration mineralogy consistent with a porphyry deposit model.

A total of 17 prospecting rock samples were collected at the Bridget target and 19 samples at the Isaac target. Samples from both the Bridget and Isaac targets show anomalous trace element enrichments, including copper, molybdenum and silver, consistent with proximal porphyry copper-style mineralization. Hyperspectral data for the Isaac target samples provide evidence for phyllic alteration characterized by muscovite and potassic alteration, with evidence of propylitic alteration found only on the southern edge of the sampled area where significant chlorite is observed. The Bridget samples show no evidence of phyllic alteration, however most samples show both geochemical and hyperspectral evidence for widespread propylitic alteration involving epidote, chlorite and albite, as well as minor potassic alteration.

Qualified Person

Steven Walsh, P.Geo. and Senior Geologist for the Company is a "qualified person" as defined under National Instrument 43-101 - Standards of Disclosure of Mineral Projects and has reviewed and approved the content of this news release.

About White Gold Corp.

The Company owns a portfolio of 15,362 quartz claims across 21 properties covering 305,102 hectares (3,051 km2) representing approximately 40% of the Yukon's emerging White Gold District. The Company's flagship White Gold project hosts four near-surface gold deposits which collectively contain resource estimate of 1,732,300 ounces of gold in indicated resources (35.2 million tonnes grading 1.53 grams per tonne gold) and 1,265,900 ounces of gold in inferred resources (32.2 million tonnes grading 1.22 g/t Au) (see the Company's news release dated October 6, 2025)(3)(4). Regional exploration work has also produced several other new discoveries and prospective targets on the Company's claim packages which border sizable gold discoveries including the Coffee project owned by Fuerte Metals with Measured and Indicated Resources of 80.0.2 Mt grading 1.15 g/t Au for 2.96 million ounces of gold, and Inferred Resources of 21.2 Mt grading 1.17 g/t Au for 0.80 million ounces gold(8)(2)(4), and Western Copper and Gold Corporation's Casino project which has Measured and Indicated Resources of 2,490.7 Mt grading 0.18 g/t Au, 0.14% Cu for 14.8 million ounces of gold and 7.6 billion pounds of copper, and Inferred Resources of 1,412.5 Mt grading 0.14 g/t Au, 0.10% Cu for 6.3 million ounces of gold and 3.1 billion pounds of copper(1)(2)(4). For more information visit www.whitegoldcorp.ca.

(1) See Western Copper and Gold Corporation technical report titled "Casino project, Form 43-101F1 Technical ReportFeasibility Study, Yukon Canada", Effective Date June 13, 2022, Issue Date August 8, 2022, NI 43-101 Compliant Technical Report prepared by Daniel Roth, PE, P.Eng., Mike Hester, F Aus IMM, John M. Marek, P.E., Laurie M. Tahija, MMSA-QP, Carl Schulze, P.Geo., Daniel Friedman, P.Eng., Scott Weston, P.Geo., available on SEDAR+.

(2) The QP has been unable to verify the information. The information is not necessarily indicative to the mineralization on the properties that are subject of the disclosure.

(3) White Gold Corp. "White Gold Corp. Files Technical Report Demonstrating Significant 44% Increase in Indicated Resources to 1,732,300 oz Gold (35.2 million tonnes grading 1.53 g/t) and 13.4% Increase in Inferred Resources to 1,265,900 oz Gold (32.2 million tonnes grading 1.22 g/t) at its Flagship White Gold Project, Yukon, Canada" Press Release 6 Oct, 2025. https://www.whitegoldcorp.ca/news/white-gold-corp-files-technical-report-demonstrating-significant-44-increase-in-indicated-resources-to-1732300-oz-gold-352-million-tonnes-grading-153-gt-and-134-increase-in-inferred-resources-to-1265900-oz-gold-322-million-ton.

(4) All numbers are rounded. Overall numbers may not be exact due to rounding.

(5) See December 1, 2025 News Release "Selkirk Copper Announces Initial Drill Results - Successfully Expands Minto North West Zone with a High-Grade Intercept of 5.21% Cu, 0.47 g/t Au, 26.68 g/t Ag over 8.7m within a broader zone of 2.39% Cu, 0.32 g/t Au and 11.61 g/t Ag over 23.4 m in drill hole 25SCM001.

(6) See Cascadia Minerals New Release dated June 9, 2025 "Cascadia Minerals and Granite Creek Copper Announce Merger to Create a Leading Yukon Copper-Gold Exploration and Development Company".

(7) Allan, M.M., Mortensen, J.K., Hart, C.J.R., Bailey, L.A., Sánchez, M.G., Ciolkiewicz, W., McKenzie, G.G. and Creaser, R.A., 2013, Magmatic and Metallogenic Framework of West-Central Yukon and Eastern Alaska: Society of Economic Geologists, Special Publication 17, pp. 111-168.

(8) See Fuerte Metals press release titled "Fuerte Announces Transformational Acquisition of the Coffee Project from Newmont Corporation" dated September 15, 2025.

Cautionary Note Regarding Forward Looking Information

This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to the terms, timing and outcome of the Spin-Out; receipt of the required shareholder, regulatory, court and stock exchange approvals in connection with the Spin-Out; listing of SpinCo shares; the anticipated benefits of the Spin-Out; the entering into of the Arrangement Agreement; the formation of SpinCo; the assets to be transferred to SpinCo in connection with the Spin-Out; and anticipated strategic and growth opportunities. Generally, but not always, forward- looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof. Such forward-looking information and statements are based on numerous assumptions, completion of the Spin-Out, including the ability of the parties to receive, in a timely manner and on satisfactory terms, the necessary regulatory, court and shareholder approvals; the ability of the parties to satisfy, in a timely manner, the other conditions to the completion of the Spin-Out; that the anticipated benefits of the Spin-Out will be realized; that general business and economic conditions will not change in a material adverse manner, that financing will be available if and when needed and on reasonable terms, and that third party contractors, equipment and supplies and governmental and other approvals required to conduct the Company's planned exploration activities will be available on reasonable terms and in a timely manner. Although the assumptions made by the Company in providing forward-looking information or making forward-looking statements are considered reasonable by management at the time, there can be no assurance that such assumptions will prove to be accurate.

Forward-looking information and statements also involve known and unknown risks and uncertainties and other factors, which may cause actual events or results in future periods to differ materially from any projections of future events or results expressed or implied by such forward-looking information or statements, including, among others: the failure to obtain shareholder, regulatory, court or stock exchange approvals in connection with the Spin-Out; failure to realize the anticipated benefits of the Spin-Out or implement the business plan for SpinCo; the diversion of management time on transaction-related issues; expectations regarding negative operating cash flow and dependence on third party financing, uncertainty of additional financing, no known mineral reserves or resources, reliance on key management and other personnel, potential downturns in economic conditions, actual results of exploration activities being different than anticipated, changes in exploration programs based upon results, and risks generally associated with the mineral exploration industry, environmental risks, changes in laws and regulations, community relations and delays in obtaining governmental or other approval.

Although the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in the forward-looking information or implied by forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking statements or information. The Company undertakes no obligation to update or reissue forward-looking information as a result of new information or events except as required by applicable securities laws.

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this news release.

For Further Information, Please Contact:

Contact Information:

David D'Onofrio

Chief Executive Officer

White Gold Corp.

(647) 930-1880

ir@whitegoldcorp.ca

Request Meeting: https://calendly.com/meet-with-wgo/15min

SOURCE: White Gold Corp.

View the original press release on ACCESS Newswire