The Project Would Further Strengthen Canadian and Asia Pacific Energy Connectivity, Improve Global Energy Security, and Deliver Positive Outcomes for All Stakeholders

26 April 2023 - 07:05 Central European Summer Time 25 April 2023 - 11:05pm Mountain Standard Time

Royal Vopak ("Vopak") (XAMS: VPK) and AltaGas Ltd. ("AltaGas") (TSX: ALA) are pleased to announce the execution of definitive agreements for a new 50/50 joint venture to further evaluate development of the Ridley Island Energy Export Facility (REEF), a large-scale liquefied petroleum gas (LPG) and bulk liquids terminal with marine infrastructure on Ridley Island , British Columbia, Canada .

REEF, as part of the previously submitted regulatory filings (under the name of Vopak Pacific Canada), will have the capability to facilitate the export of LPGs, methanol, and other bulk liquids that are vital for everyday life. REEF has been granted the key Federal and Provincial permits to construct storage tanks, a new dedicated jetty, and rail and other ancillary infrastructure required to operate a state-of-the-art and highly efficient facility. REEF would be developed on a 190-acre (77 hectare) site on lands administered by the Prince Rupert Port Authority for which the joint venture has executed a long-term lease that sits adjacent to AltaGas and Vopak's existing Ridley Island Propane Export Terminal (RIPET), which has been in operation since April 2019 .

Should REEF reach a positive final investment decision (FID), it is planned to be developed and brought online in phases. This approach will provide the most capital efficient build out of the project, match energy export supply with throughput capacity, mitigate the challenges that large development projects can have on local communities, and provide local construction and employment opportunities that would extend over longer time horizons. AltaGas has executed a long-term commercial agreement with the joint venture for 100% of the capacity for the first phase of LPG volumes, subject to a positive FID. AltaGas will also be responsible for the construction and operational stewardship of the facility. Future phases of the project will be developed as additional long-term commercial agreements and critical milestones are achieved to deliver the maximum value for all stakeholders.

Vopak, AltaGas, and the Prince Rupert Port Authority have been working closely with First Nations rights holders and key stakeholders, including the local communities in Northwestern British Columbia and the Federal and Provincial regulators, to deliver a project that will operate with industry-leading environmental stewardship and bring the strongest benefits to all parties involved. Key determinations and permits have been received from the Federal Government and an Environmental Assessment Certificate has been received from the British Columbia Provincial Government.

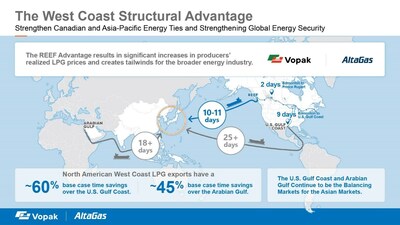

REEF Benefits from Structural West Coast Advantage to Asian Markets

With only ten shipping days to the fastest growing demand markets in Northeast Asia , REEF will be able to efficiently connect Canada's vital energy products to the world. This includes having an approximate 60 percent base time savings over the U.S. Gulf Coast, which requires a minimum 25-day shipping time to Northeast Asia , and approximately 45 percent base case time savings over the Arabian Gulf, which requires a minimum 18-day shipping time. This geographic advantage expands when there is significant congestion in the Panama Canal or when other global shipping pinch points experience disruptions. Furthermore, the Port of Prince Rupert provides REEF year-round ice-free operations and has the deepest natural harbour in North America , leaving it able to accommodate the world's largest vessels, which ensures safe and reliable market access and allows AltaGas and Vopak to efficiently connect upstream and downstream markets.

Joint Venture is Targeting Advancement of Critical Workstreams Over 2023

REEF is currently working through front end engineering design (FEED) activities, where deliverables will include a refined capital cost estimate, a project execution plan, a construction schedule, and a projected in-service date, among numerous other items. FEED and other development activities are expected to be completed by late 2023, followed by an FID by the joint venture. Solidifying long-term economic rail agreements in partnership with the rail operator will also be key for the joint venture to be able to reach a positive FID and ensure the project advances, and, in turn, delivers the strong benefits to the joint venture partners, First Nations rights holders, the Prince Rupert Port Authority, local communities, upstream and downstream customers, and other key stakeholders.

Vopak and AltaGas are excited to further evaluate the development of REEF and build on the strong partnership between the two companies, under this new joint venture agreement. Vopak and AltaGas thank all stakeholders for the continued embracement and ongoing partnerships as part of this project. Working with stakeholders and seeking strong partnerships is part of both organization's individual and collective DNA and is engrained in how Vopak and AltaGas approach their businesses every day.

"We are excited to build on our success with AltaGas in Prince Rupert ", said Dick Richelle , Chairman of the Executive Board and CEO of Royal Vopak. "Our goal is to create together with partners high quality critical infrastructure for vital products. The strategic location of Prince Rupert , with the shortest shipping distances between North America and Asia , has the potential to increase the trade between Canada and the Asia Pacific region. REEF fits very well within Vopak's strategic pillar to grow in gas and industrial infrastructure. We look forward to further collaboration with First Nations rights holders and key stakeholders to make this project a reality."

"We are excited to execute this agreement and continue to advance our relationship with Vopak, the Prince Rupert Port Authority, First Nations rights holders, and the local communities surrounding Prince Rupert " said Randy Crawford , President and CEO of AltaGas. " Canada has a structural advantage in delivering LPGs into Asia from its world class resources and through the shortest shipping time and lowest maritime emissions footprint. AltaGas delivers more than 12% of Japan's propane and 12% of South Korea's LPG imports through connecting our valued upstream customers with key downstream markets in Asia . REEF fits our corporate strategy of operating long-life infrastructure assets that connect customers and markets and provide resilient and durable value for our stakeholders. We look forward to working with all our partners to achieving the remaining milestones required to reach a positive FID on the project."

"We congratulate Royal Vopak and AltaGas on this significant milestone towards advancing development of the terminal project at the Port of Prince Rupert " said Shaun Stevenson , President and CEO, Prince Rupert Port Authority. "Once operational, the new facility will substantially increase and diversify the Port of Prince Rupert's liquid bulk cargo capabilities and capacity, while providing a much-needed export solution for Canadian producers during a critical time in the global energy transition."

"We commend Vopak and AltaGas on their efforts to-date on building long-term relationships with our community," said Chief Harold Leighton , Metlakatla First Nation. "We are excited with the potential this joint venture project provides to our area and the Metlakatla First Nation."

About Royal Vopak

Royal Vopak is the world's leading independent tank storage company. We store vital products with care. Products for everyday life. The energy that allows people to cook, heat or cool their homes and for transportation. The chemicals that enable companies to manufacture millions of useful products. The edible oils to prepare food. We take pride in improving access to cleaner energy and feedstocks for a growing world population, ensuring safe, clean and efficient storage and handling of bulk liquid products and gases at strategic locations around the world. We are excited to help shape a sustainable future by developing infrastructure solutions for new vital products, focusing on zero- and low-carbon hydrogen, ammonia, CO2, long duration energy storage and sustainable feedstocks. We have a track record of over 400 years in navigating change and are continuously investing in innovation. On sustainability, we are ambitious and performance driven, with a balanced roadmap that reflects key topics that matter most to our stakeholders and where we can have a positive impact for people, planet and profit and the United Nations Sustainable Development Goals. Vopak is listed on the Euronext Amsterdam and is headquartered in Rotterdam, the Netherlands . For more information, please visit www.vopak.com

About AltaGas

AltaGas is a leading North American infrastructure company that connects customers and markets to affordable and reliable sources of energy. The Company operates a diversified, lower-risk, high-growth Utilities and Midstream business that is focused on delivering resilient and durable value for its stakeholders. The company's mission is to improve quality of life by safely and reliably connecting customers to affordable sources of energy for today and tomorrow.

From wellhead to tidewater, AltaGas' Midstream business is focused on providing its customers with safe and reliable service and connectivity that facilitates the best outcomes for their businesses. This includes global market access for North American LPGs, which provides North American producers and aggregators with the best netbacks for LPGs while delivering diversity of supply and stronger energy security to its downstream customers in Asia .

Throughout AltaGas' operations, the company is playing a vital role within the larger energy ecosystem that keeps the global economy moving forward and is powering the possible within our society, and in a safe, reliable, and affordable manner.

For more information please contact:

Vopak:

- Analysts and Investors: Fatjona Topciu - Head of Investor Relations ( investor.relations@vopak.com )

- Press: Liesbeth Lans - Manager External Communication ( global.communication@vopak.com )

- Analysts and Investors: Jon Morrison , Senior Vice President, Corporate Development and Investor Relations ( Jon.Morrison@altagas.ca ) or Adam McKnight , Director, Investor Relations ( Adam.McKnight@altagas.ca )

- Media Inquiries : media.relations@altagas.ca

FORWARD-LOOKING INFORMATION

This news release contains forward-looking information (forward-looking statements). Words such as "may", "can", "would", "could", "should", "will", "intend", "plan", "anticipate", "believe", "aim", "seek", "propose", "contemplate", "estimate", "focus", "strive", "forecast", "expect", "project", "target", "potential", "objective", "continue", "outlook", "vision", "opportunity" and similar expressions suggesting future events or future performance, as they relate to the Corporation or any affiliate of the Corporation, are intended to identify forward-looking statements. In particular, this news release contains forward-looking statements with respect to, among other things, business objectives, expected growth, results of operations, performance, business projects and opportunities and financial results. Specifically, such forward-looking statements included in this document include, but are not limited to, statements with respect to the following: AltaGas' belief that REEF will strengthen Canadian and Asia Pacific energy connectivity, improve global energy security and deliver positive outcomes for all stakeholders; the potential development of REEF and expected project activities, deliverables and timing thereof; expectation that AltaGas' development approach will provide the most capital efficient build, match energy export supply with throughput capacity, mitigate challenges and provide longer-term local employment opportunities; anticipation of successful collaboration with First Nations and other key stakeholders; the expected impact of REEF's structural advantage and outcomes therefrom, including significant increases in producers' LPG prices and time savings of North American West Coast LPG exports; the expectation that the US Gulf Coast and Arabian Gulf will continue to be the balancing markets for Asian markets; AltaGas' Midstream business focus, strategy and expected outcomes therefrom; and the importance of AltaGas' role in the larger energy ecosystem and global economy.

These statements involve known and unknown risks, uncertainties and other factors that may cause actual results, events, and achievements to differ materially from those expressed or implied by such statements. Such statements reflect AltaGas' current expectations, estimates, and projections based on certain material factors and assumptions at the time the statement was made. Material assumptions include: anticipated timing of asset sale closings, effective tax rates, financing initiatives, degree day variance from normal, pension discount rate, the performance of the businesses underlying each sector, impacts of the hedging program, expected commodity supply, demand and pricing, volumes and rates, exchange rates, inflation, interest rates, credit ratings, regulatory approvals and policies, future operating and capital costs, capacity expectations, weather, frac spread, access to capital, planned and unplanned plant outages, timing of in-service dates of new projects and acquisition and divestiture activities, returns on investments, and dividend levels.

AltaGas' forward-looking statements are subject to certain risks and uncertainties which could cause results or events to differ from current expectations, including, without limitation: risks related to conflict in Eastern Europe ; health and safety risks; operating risks; infrastructure; natural gas supply risks; volume throughput; service interruptions; transportation of petroleum products; market risk; inflation; general economic conditions; cyber security, information, and control systems; climate-related risks; environmental regulation risks; regulatory risks; litigation; changes in law; Indigenous and treaty rights; dependence on certain partners; political uncertainty and civil unrest; decommissioning, abandonment and reclamation costs; reputation risk; weather data; capital market and liquidity risks; interest rates; internal credit risk; foreign exchange risk; debt financing, refinancing, and debt service risk; counterparty and supplier risk; technical systems and processes incidents; growth strategy risk; construction and development; underinsured and uninsured losses; impact of competition in AltaGas' businesses; counterparty credit risk; composition risk; collateral; rep agreements; market value of common shares and other securities; variability of dividends; potential sales of additional shares; labor relations; key personnel; risk management costs and limitations; commitments associated with regulatory approvals for the acquisition of WGL; cost of providing retirement plan benefits; failure of service providers; risks related to pandemics, epidemics or disease outbreaks, including COVID-19; and the other factors discussed under the heading "Risk Factors" in the Corporation's Annual Information Form for the year ended December 31, 2022 and set out in AltaGas' other continuous disclosure documents.

Many factors could cause AltaGas' or any particular business segment's actual results, performance or achievements to vary from those described in this press release, including, without limitation, those listed above and the assumptions upon which they are based proving incorrect. These factors should not be construed as exhaustive. Should one or more of these risks or uncertainties materialize, or should assumptions underlying forward-looking statements prove incorrect, actual results may vary materially from those described in this news release as intended, planned, anticipated, believed, sought, proposed, estimated, forecasted, expected, projected or targeted and such forward-looking statements included in this news release, should not be unduly relied upon. The impact of any one assumption, risk, uncertainty, or other factor on a particular forward-looking statement cannot be determined with certainty because they are interdependent and AltaGas' future decisions and actions will depend on management's assessment of all information at the relevant time. Such statements speak only as of the date of this news release. AltaGas does not intend, and does not assume any obligation, to update these forward-looking statements except as required by law. The forward-looking statements contained in this news release are expressly qualified by these cautionary statements.

Financial outlook information contained in this news release about prospective financial performance, financial position, or cash flows is based on assumptions about future events, including economic conditions and proposed courses of action, based on AltaGas management's (Management) assessment of the relevant information currently available. Readers are cautioned that such financial outlook information contained in this news release should not be used for purposes other than for which it is disclosed herein.

Additional information relating to AltaGas, including its quarterly and annual MD&A and Consolidated Financial Statements, AIF, and press releases are available through AltaGas' website at www.altagas.ca or through SEDAR at www.sedar.com

SOURCE AltaGas Ltd.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/April2023/26/c1272.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/April2023/26/c1272.html