Uranium Trends 2021: Energy Metal Among Top Performers

What were the main uranium trends in 2021? Read on to learn what happened throughout the year.

Click here to read the previous uranium trends article.

Following 2020's breakout performance, which saw uranium rank among the year's top-performing commodities, 2021 has been another lucrative year for the important energy fuel.

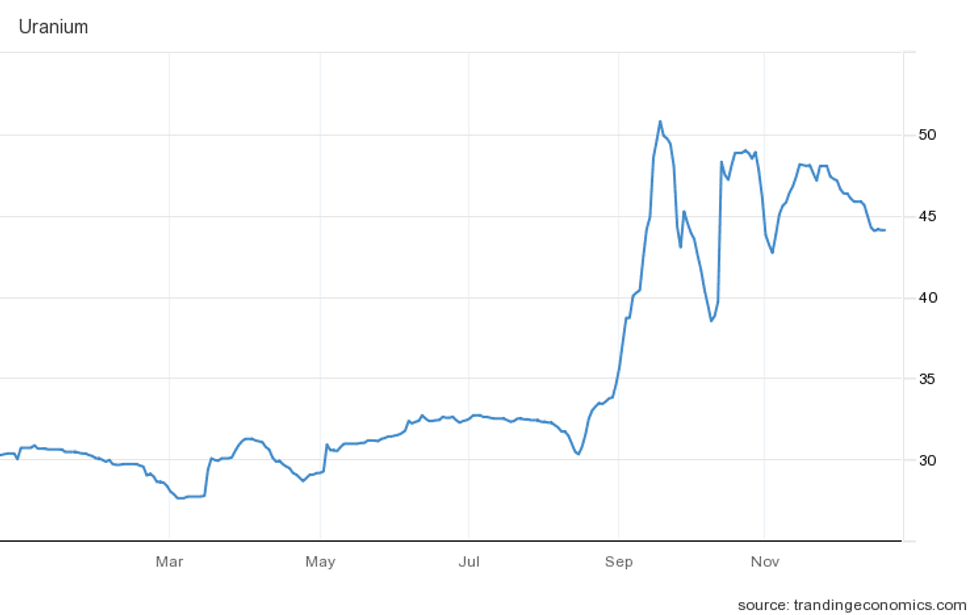

Propelled by that positivity, uranium prices were up 45 percent by December after starting the year around US$30 per pound. At its peak, the energy metal had added 83.83 percent to its value, outperforming both gold and silver.

Lingering supply and demand issues, the emergence of a physical uranium investment vehicle and forecasts for rising demand driven by green energy all worked in uranium’s favor in 2021. Read on to learn more.

Uranium trends 2021: Low supply still a persistent issue

Declining supply has become a significant price motivator in the uranium space, with annual output sinking in 2020 to 56,287 tonnes, or 74 percent of global demand. The production decline, which was largely caused by pandemic-related closures and disruptions, followed years of weak prices, which have also affected output.

“The currently depressed uranium market has caused not only a sharp decrease in uranium exploration activities (by 77 percent from US$2.12 billion in 2014 to nearly US$483 million in 2018), but also the curtailment of uranium production at existing mines, with more than 20,500 tonnes of annual production being idled,” notes the World Nuclear Association’s latest nuclear fuel report.

The organization's sector overview goes on to point out that 2020 supply was almost 30 percent lower than the amount required to run the world’s current fleet of nuclear reactors.

This discrepancy will be further exacerbated by rising demand coming predominantly from China, and will require an uptick in annual output from now well into the next decade.

“Irrespective of the uranium supply scenario, the capacity of all presently known mining projects will have to at least double by the end of the forecast period,” the document reads. “There is no doubt that sufficient uranium resources exist to meet future needs; however, the producers are waiting for the market to rebalance in order to start reinvesting in new capacity and bringing idled and shutdown projects back to production.”

For producers, the US$50 to US$60 threshold has long been touted as the level needed to restart shuttered projects and bring on new supply. Prices briefly reached the US$50 mark in September 2021 — a nine year high — but were unable to sustain that value, slipping back to the US$45 range a few days later.

Prior to the rally to US$50, prices were rangebound below US$35 for the first nine months of 2021.

Uranium trends 2021: Investment demand catalyzes growth

Looking beyond supply, another key factor that aided in uranium’s impressive year-to-date price rise is the emergence of the Sprott Physical Uranium Trust (TSX:U.UN). The investment vehicle, which launched this past July, quickly began amassing pounds of U3O8 on the spot market.

By mid-September, its holdings had ballooned to more than 27.7 million pounds worth US$1.46 billion.

“Sprott’s purchasing activity is bringing institutional capital back to the industry by demonstrating the uranium price fell below its real value, they say,” states a report from S&P Global. “Large financiers fled the space after the 2011 Fukushima Daiichi reactor disaster in Japan led to a political backlash against nuclear power, but rising commodity prices and positive tailwinds for ‘green’ businesses seem to be sparking a return to U3O8.”

Sprott’s flurry of buying activity facilitated uranium’s 83.83 percent climb from March’s low of US$27.58 to September’s high of US$50.70.

For Gerardo Del Real of Digest Publishing, Sprott's move to aggressively “stock up on uranium pounds” highlights that the market is in dire need of new supply. He pointed out that 52 nuclear reactors are now under construction, while 120 others already have their plants completed and more than 300 more are being contemplated.

“And then you consider that the utilities, which are the largest consumer of uranium, haven't even stepped off the sidelines, so when I look at all of that, I am extremely bullish on the uranium price and its ability to go higher in 2022," he told the Investing News Network (INN) toward the end of the year.

As the uranium price continues to hold above US$40, many analysts and market watchers anticipate that utilities companies, which use the energy fuel to generate 10 percent of all global electricity, will come to market. But the uranium space is known for being opaque, and knowing exactly when utilities will start buying remains uncertain.

“Utilities are always monitoring the market. The recent impact of new market entrants and associated price increases do not pose immediate concerns with access to uranium,” Nima Ashkeboussi, senior director of fuel and radiation safety at the Nuclear Energy Institute, told INN.

“Utilities are aware that new market entrants like Sprott will continue to buy as long as money is being poured into (the trust). They are continuing to assess these trends, and they may or may not make changes to their procurement strategies," Ashkeboussi continued. "These changes are based on several factors, including when they need uranium and the inventories on hand.”

Uranium trends 2021: Green energy demand on the rise globally

As supply challenges and Sprott purchases drove values higher in 2021, the expanding green energy sector also added tailwinds to the sector. Efforts to reduce global greenhouse gas emissions will require a broad range of solutions, from carbon-reduction technologies to clean energy generation capacity.

This bodes very well for the nuclear industry.

“Nuclear energy today is by far the largest source of carbon-free electricity in the United States. That's a fact. That's indisputable,” former US Energy Secretary Ernest Moniz said during a recent interview with NPR. He went on to point out two sections of the US$1 trillion infrastructure bill that are directed at the nuclear sector.

“One of them was US$6 billion to help keep running the existing nuclear plants. And that was in recognition of their contribution to addressing climate," he said. “And if nuclear is to be a significant contributor to continuing to address climate change, we will need to build on top of the existing fleet some of these new technologies.”

As much as 20 percent of the electricity in the US is produced by nuclear energy, 10 percent more than the global average. During an International Atomic Energy Agency side event at this year's Climate Change Conference in Glasgow, current Energy Secretary Jennifer Granholm said her country is “all in on nuclear” as the US makes a push to produce 100 percent of its electricity cleanly by 2035.

This sentiment was also echoed in a March United Nations Economic Commission for Europe (UNECE) report that examines entry pathways for nuclear fuel.

“Nuclear energy is an indispensable tool for achieving the global sustainable development agenda,” the 154 page report reads. “It has a crucial role in decarbonizing the energy sector, as well as eliminating poverty, achieving zero hunger, providing clean water, affordable energy, economic growth, and industry innovation. Improved government policy and public perception along with ongoing innovation will enable nuclear energy to overcome traditional barriers to deployment and expand into new markets.”

The UNECE nuclear overview calls for uranium — which it describes as “un-substitutable” to the sector — be dubbed a clean energy material rather than an industrial metal. These massive shifts in the nuclear narrative have led to more countries looking to build, grow and advance their own nuclear capacity.

“We are seeing an incredible amount of increased customer interest in new nuclear,” said John Kotek, senior vice president of policy development and public affairs at the Nuclear Energy Institute.

“That interest is being driven by commitments from utilities and policymakers who are counting on these technologies to provide the 24/7 clean electricity needed to meet carbon-reduction goals while maintaining reliability and affordability and creating well-paying, long-term jobs,” he added.

He went on to explain that in the US alone there are dozens of new nuclear reactor concepts actively in development, several of which have firm plans for commercial demonstration this decade.

“We expect to see the number of new US projects continue to grow, driven in large part by decarbonization commitments by states and major energy consumers," Kotek said. “There is also a growing demand for nuclear energy abroad as countries move away from fossil fuels and look to bring on more reliable, carbon-free power.”

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

- Uranium Outlook 2021: Positive Fundamentals Point to Growth | INN ›

- Uranium Outlook 2022: Positive Fundamentals Point to Growth | INN ›

- Uranium Outlook 2022: Prices Have Broken Out, How High Will They Go? ›