June 05, 2022

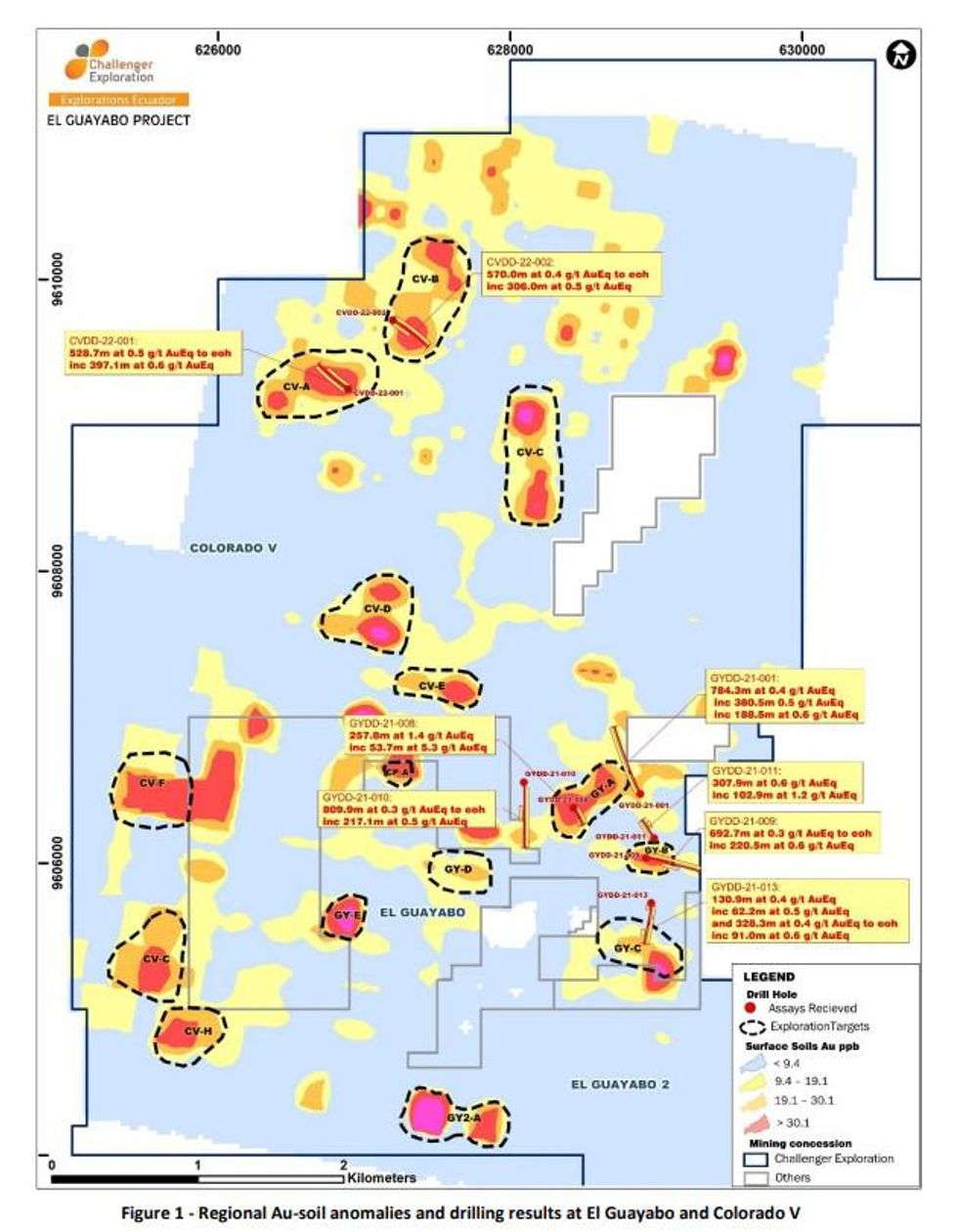

Challenger Exploration (ASX: CEL) (“CEL” the “Company”) is pleased to announce results from drill holes GYDD-22-014 to GYDD-22-016 in the El Guayabo concession and CVDD-22-001 and CVDD-22- 002, the first two drillholes on the Colorado V concession in El Oro Province, Ecuador.

Highlights

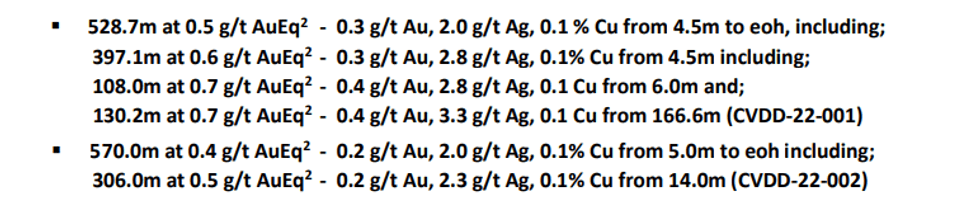

- First drill holes on the CV-A and CV-B Au-soil anomalies in Colorado V both intercepted 500 metres of mineralisation from surface to the end of the hole with results including (refer Table 1):

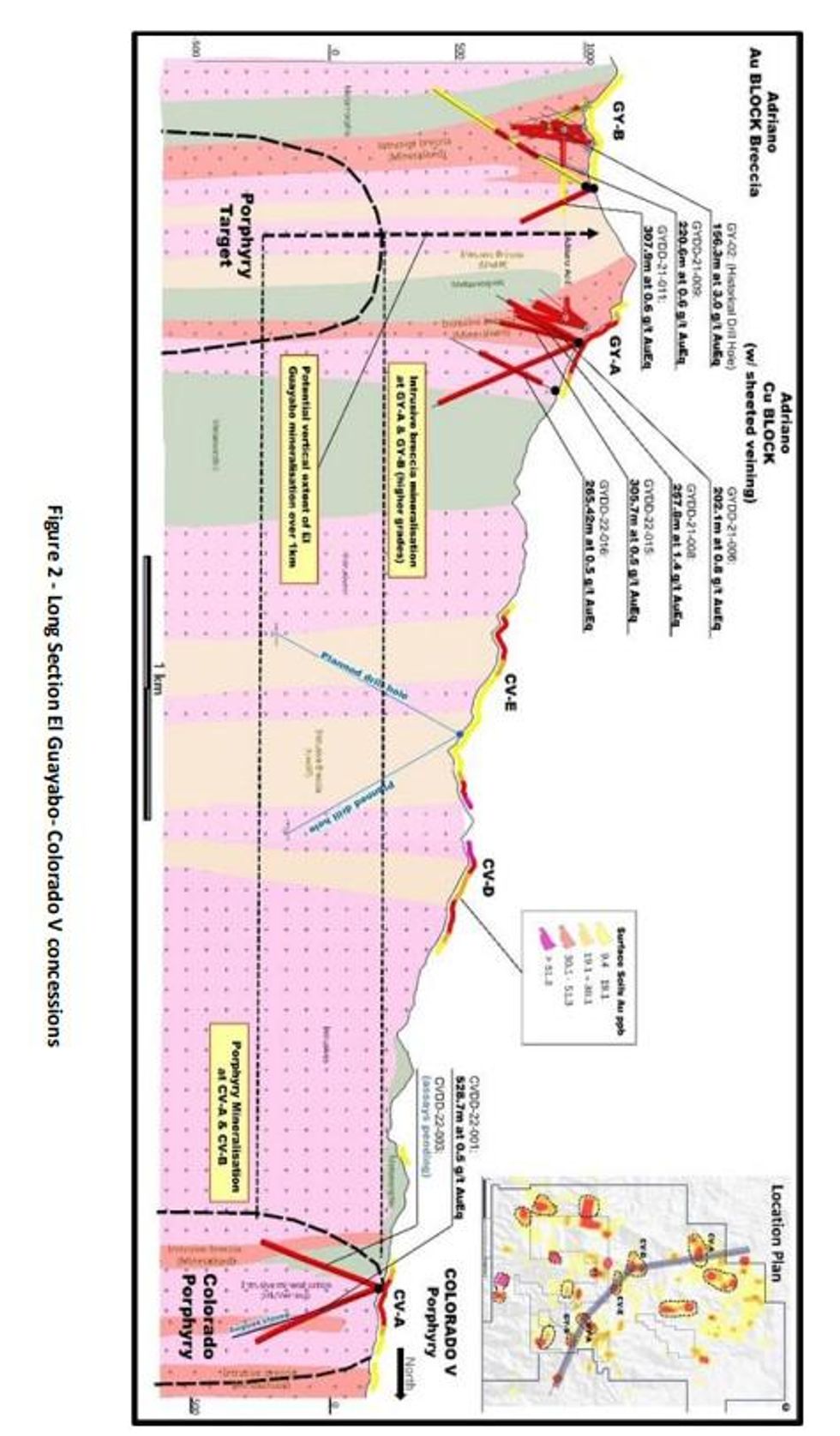

- Confirms two Au-Cu-Ag-Mo discoveries of significant scale. Both Au-soil anomalies are 1 kilometre long and 500 metres wide and lie within a structural corridor over a 3 kilometre strike distance.

- CEL has drilled five of fifteen regionally significant Au-soil anomalies with over 500 metres of mineralisation intersected at all anomalies, confirming the potential for a major bulk gold system.

- El Guayabo drilling continues to deliver with the next two drill holes on the main discovery zone confirming at least 1 kilometre of continuous mineralisation which remains open in all directions

Commenting on the results, CEL Managing Director, Mr Kris Knauer, said

“We have been eagerly awaiting the results from our first holes testing the CV-A and CV-B soil anomalies at Colorado V. These anomalies are just a few kilometres on strike from the 22 million ounce Cangrejos Gold Project1 . The anomalies have the same geology and surface footprint as Cangrejos and have now produced the same grades.

While Hualilan in Argentina remains our primary focus we are beginning to get excited about Ecuador. We have drilled five of fifteen regional gold-soil anomalies and all five have returned significant mineralisation. Our project lies just across the tenement boundary from one of the largest undeveloped gold projects in the world and we have something I believe has the potential to become a Tier 1 gold asset over time."

The first two drill holes at Colorado V, where the Company is farming in to earn an initial 50% interest, have confirmed significant Au-Cu-Ag-Mo discoveries in the first two regional gold in soil anomalies to be drilled by the Company. The Colorado V concession adjoins CEL's 100% owned El Guayabo concession to the south and the Cangrejos concession which hosts the 17 million ounce Cangrejos Gold Project1 , to the north. The new discoveries have significant scale with both Au-soil anomalies 1 kilometre long and 500 metres wide and lying within a structural corridor with over 3 kilometre strike distance.

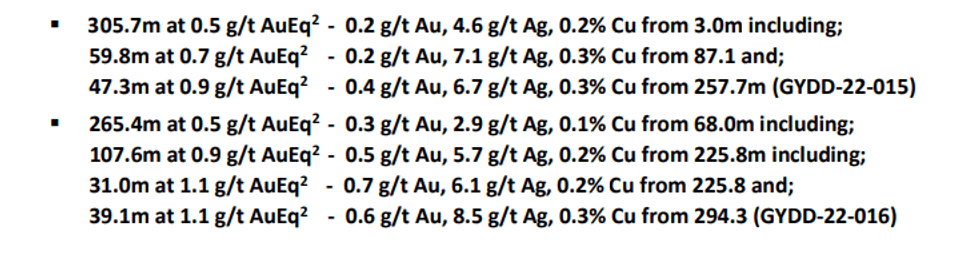

The next three drill holes in the 100% owned El Guayabo concession all recorded significant intercepts. Drill holes GYDD-22-015 (305.7m at 0.5 g/t AuEq) and GYDD-22-016 (265.4m at 0.5 g/t AuEq including 107.6 metres at 0.9 g/t AuEq) have confirmed that the mineralisation on the main discovery zone is continuous over 1 kilometre strike and remains open at depth and along strike.

Click here for the full ASX Release

This article includes content from Challenger Exploration, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

From Your Site Articles

CEL:AU

The Conversation (0)

14 February 2022

Challenger Exploration

Gold and Copper Exploration Across Known and Untapped Sources

Gold and Copper Exploration Across Known and Untapped Sources Keep Reading...

12h

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

04 February

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00