August 06, 2024

37-hole drilling campaign has expanded resource outline northwest of the Deep Leads high-grade rare earth element resource zone. Thicker mineralisation encountered and grades continue to be enriched in Dy+Tb

ABx Group (ASX: ABX) (“ABx” or “the Company”) has received 316 assays from 37 holes that were the first drilled into the untested NW Block of its Deep Leads rare earth elements (REE) project, located 45 km west of Launceston, Tasmania. Several intercepts were considerably thicker than usual and extend ABx’s REE mineralisation across the plateau.

High Dy+Tb enrichment: ABx’s rare earth strategy is to produce a mixed rare earth carbonate (MREC) that is enriched in dysprosium (Dy) and terbium (Tb), the two heavy rare earths with the highest supply risk. The Dy+Tb exceeds 4.3% of Deep Leads’ total rare earth oxides (TREO), which is the highest proportion of Dy and Tb of any clay-hosted rare earth resource in Australia and high by world standards. Thick zones of high-grade ionic adsorption clay rare earths with such a high proportion of Dy+Tb are extremely rare.

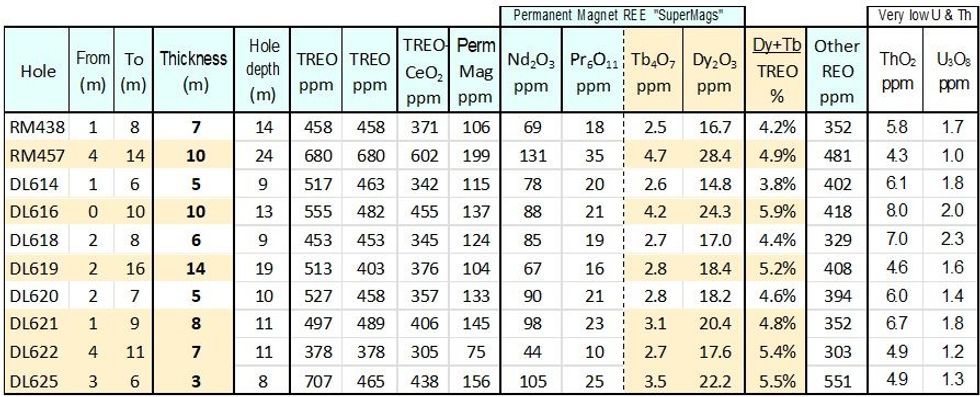

Favourable ore geometry: ABx’s rare earths layer is typically 4 to 7 metres thick beneath 2 to 5 metres of clay and soil, which is ideal for restoring any mined areas to productive, fertile land (see Table 1 and Figure 2).

ABx Group Managing Director and CEO, Mark Cooksey said: “Drill results in the NW Block expand the resource outline for the Deep Leads high-grade rare earth zone and also enhance the areal extent from hole DL520. DL520 is one of the nearest existing drill holes and is also where rare earth extractions of over 50% were measured using low-acid (pH 4) conditions – confirmed in desorption tests by the Australian Nuclear Science and Technology Organisation (ANSTO) and in- house tests.”

TREO is total rare earth oxides & Y2O3 (15 oxides in total). TREO-CeO2 = TREO minus ppm CeO2. High Dy+Tb intercepts.

Click here for the full ASX Release

This article includes content from ABX Group Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Trading Halt

1h

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00