July 11, 2024

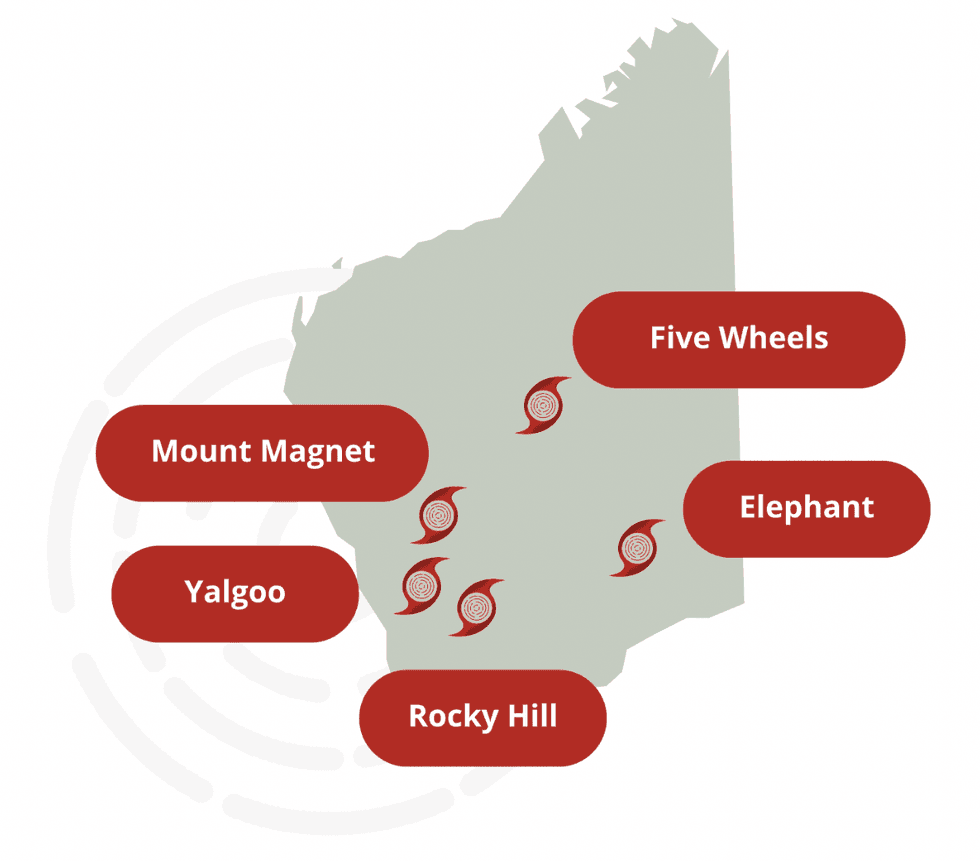

Tempest Minerals (ASX:TEM) is targeting gold, copper, rare earths (REE), lithium and base metals with a diversified portfolio of mineral assets in Australia. The company's five projects are located in prolific territories in Western Australia. The flagship Yalgoo project explores for gold, copper, zinc, silver, iron ore, tungsten, rare earths and more. The Mt Magnet project is focused on gold and REE while the Five Wheels project explores for gold and base metals. The Elephant project targets gold and Rocky Hill for lithium.

The Yalgoo property is a large land package comprising several targets, located in the prolific Yalgoo Region of Western Australia. Following extensive field exploration and a large geophysical survey, Tempest has defined two exceptional targets - Remorse (copper) and Sanity (gold) - which will be the focus of drill programs in the near term. A third drill target, Wrangler (gold), has also been identified in the Mt Magnet project.

Tempest Minerals is headquartered in Perth, Australia.

The Yalgoo property covers more than 1,000 square kilometres and is highly prospective for gold and base metals with world-class potential. It is located four hours from Perth, close to major infrastructure and adjacent to world-class gold and copper mines, including Golden Grove, Minjar, Rothsay, Mt Mulgine and Deflector.

Company Highlights

- Tempest Minerals’ exploration and development projects are primarily located in Western Australia and highlight a multi-commodity strategy in regions with a strong mining history.

- The company’s main strategy is to promote a project pipeline coupled with hands-on exploration methods aimed at identifying high-growth assets.

- Tempest is embarking on a 5,000 metre drilling campaign at the Remorse target at its Yalgoo project that should generate positive news flow and provide near-term support for the stock.

- This year’s work will focus on delineating additional mineralised systems to define larger targets.

This Tempest Minerals profile is part of a paid investor education campaign.*

Click here to connect with Tempest Minerals (ASX:TEM) to receive an Investor Presentation

TEM:AU

The Conversation (0)

03 February 2025

Tempest Minerals

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore.

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore. Keep Reading...

25 June 2025

Completion of Shortfall Offer

Tempest Minerals (TEM:AU) has announced Completion of Shortfall OfferDownload the PDF here. Keep Reading...

15 June 2025

Further Excellent Metallurgical Results From Remorse-Yalgoo

Tempest Minerals (TEM:AU) has announced Further Excellent Metallurgical Results From Remorse-YalgooDownload the PDF here. Keep Reading...

10 June 2025

Entitlement Offer Results

Tempest Minerals (TEM:AU) has announced Entitlement Offer ResultsDownload the PDF here. Keep Reading...

30 May 2025

Geochemical Sampling Extends Sanity Gold Anomalies - amended

Tempest Minerals (TEM:AU) has announced Geochemical Sampling Extends Sanity Gold Anomalies - amendedDownload the PDF here. Keep Reading...

20 May 2025

Yalgoo - Geochemical Sampling Extends Sanity Gold Anomalies

Tempest Minerals (TEM:AU) has announced Yalgoo - Geochemical Sampling Extends Sanity Gold AnomaliesDownload the PDF here. Keep Reading...

4h

Selta Project - Gold Exploration Update

First Development Resources plc (AIM: FDR), a UK-based, Australia-focused mineral exploration company with interests in Western Australia and the Northern Territory, is pleased to provide an update on its gold ("Au") focused exploration at the Selta Project ("Selta" or the "Project"), located in... Keep Reading...

8h

Flow Metals Provides Structural Interpretation Update from Sixtymile Gold Project

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to announce a technical update on its Sixtymile Gold Project, Yukon. Recent re-logging of historic drill core has resulted in a revised structural interpretation of gold mineralization.The revised interpretation supports a... Keep Reading...

8h

Tectonic Metals Drills 4.50 g/t Au over 48.77 metres with 7.79 g/t Au over 24.38 metres at New Target, Flat Gold Project, Alaska

First-Ever Drilling by Tectonic at Black Creek Intrusion Delivers High-Grade Gold Six Kilometres North of Chicken Mountain, Validating Multi-Intrusion Gold System Across 99,800-Acre Flat Property VANCOUVER, BC / ACCESS Newswire / January 29, 2026 / Tectonic Metals Inc. ("Tectonic" or the... Keep Reading...

9h

Peruvian Metals Provides Update on the Minas Visca Silver Project in Northern Peru and Announces Financing

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to provide an update on the Company's Minas Visca Silver property (the "Property") located in Northern Peru. Peruvian Metals acquired the Property in 2021 by submitting a superior offer... Keep Reading...

10h

Blackrock Silver Appoints Sean Thompson as Head of Investor Relations

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) (the "Company" or "Blackrock") is pleased to announce the appointment of Sean Thompson as Head of Investor Relations for the Company.Mr. Thompson is a seasoned capital markets professional with over 17 years of experience in... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00