May 28, 2024

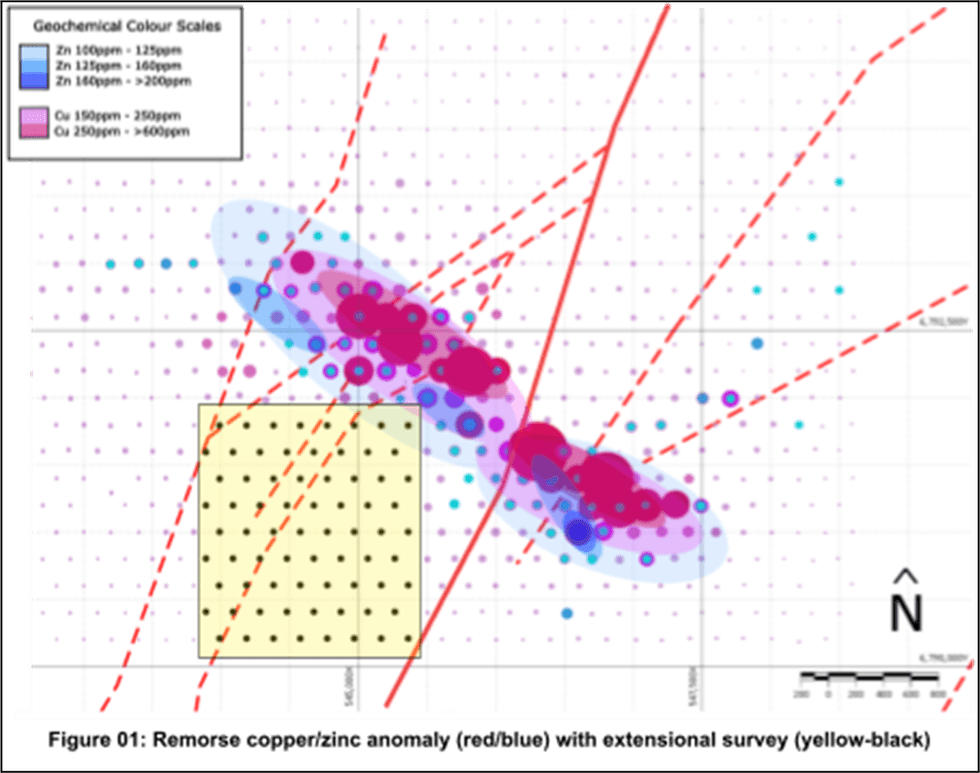

Tempest Minerals Ltd (TEM) is pleased to announce the completion of an extensional geochemistry sampling at the Remorse Target. An untested but previously tenement-constrained area to the south of the main copper anomaly has now been sampled. This area was identified as a high-priority task within ongoing fieldwork leading up to a major drill program at the Remorse Target.

Key Points

- >4km Remorse Copper Anomaly area open to the south now sampled

- Ultrafine assays and multi-sensor scanning results due in July 2024

- Ongoing fieldwork in the leadup to drilling

Yalgoo Project

Background

TEM holds more than 1,000km2 1 of highly prospective tenure in the Yalgoo Region of Western Australia 2. The Company previously announced the presence of large-scale copper zinc anomalies at the Remorse Target 3 that the Company is progressing towards drilling 4. The sampling area is one of a number of exploration targets and extensional geochem survey areas that previously became apparent 5 as a result of exploration works and were subsequently acquired in 2023 6.

Sampling

As part of ongoing fieldwork, approximately 80 soil samples were collected in an offset pattern to match existing surrounding sampling.

Samples will be Ultrafine assayed in conjunction with comprehensive scanning using Boxscan technology.

Assays are expected to be returned by July 2024 and integrated into the greater dataset in addition to drilling.

Next Steps

- Labwest Ultrafine assays of the collected samples

- Return of assays expected by July 2024

- Ongoing fieldwork in Yalgoo in preparation for drilling at Remorse

Click here for the full ASX Release

This article includes content from Tempest Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

03 February 2025

Tempest Minerals

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore.

A diverse portfolio of projects in Western Australia that are prospective for precious, base and energy metals in addition to iron ore. Keep Reading...

4h

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

7h

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

14h

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

16h

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

04 February

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

04 February

Precious Metals Price Update: Gold, Silver, PGMs Stage Recovery After Crash

It's been a wild week of ups and downs for precious metals prices.Gold, silver and platinum have already recorded new all-time highs in 2026. But this week, the rally reversed course — only briefly, but in a big way, as is the case with such highly volatile markets.Let’s take a look at what got... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00