Surge Energy Inc. ("Surge" or the "Company") (TSX: SGY) is pleased to announce financial and operating results for the quarter ended September 30, 2025, as well as an update on the Company's latest operational achievements. Additionally, the Company has released its 2026 capital and operating budget as approved by Surge's Board of Directors (the "Board"). Furthermore, Surge is pleased to announce the appointment of Mr. Myles Bosman to the Board of Directors, effective November 5, 2025.

Select financial and operating information is outlined below and should be read in conjunction with the Company's unaudited condensed interim financial statements and management's discussion and analysis for the three and nine months ended September 30, 2025, available at www.sedarplus.ca and on Surge's website at www.surgeenergy.ca.

Q3/25 MESSAGE TO SHAREHOLDERS

During Q3/25 WTI crude oil prices averaged US$64.81 per barrel, and Surge generated adjusted funds flow ("AFF")1 of $70.1 million, with cash flow from operating activities of $66.4 million. In the third quarter of 2025, the Company spent $32.8 million on property, plant, and equipment, resulting in free cash flow ("FCF")1 of $37.2 million. On this basis, FCF represented 53 percent of AFF in Q3/25.

Continued strong drilling and waterflood results in the Company's Sparky and SE Saskatchewan core areas continue to drive production outperformance, as compared to Surge's revised 2025 budget guidance press released on July 28, 2025. In Q3/25, Surge's production averaged 23,622 boepd (88 percent liquids), more than 1,100 boepd above the Company's budgeted average 2H/25 production estimate of 22,500 boepd.

At Surge's 100 percent owned and operated Hope Valley play, the Company continues to experience better than anticipated well results from its open hole multi-lateral ("OHML") drilling program. Surge has drilled 12 gross (12.0 net) OHML wells at Hope Valley in 2025, with average IP90 production rates of 216 bopd. These results are 34 percent better than the Company's independent reserve auditor IP90 Total Proved type curve expectations of 162 bopd. Surge successfully drilled and brought on production 5 gross (5.0 net) wells in Hope Valley in Q3/25, and the Company anticipates drilling a further 6 gross (6.0 net) Sparky wells in Q4/25.

Additionally, over the last 12 months, the Company has drilled 20 single lateral multi-frac wells in the Sparky core area, where Surge has employed new high-density frac technology. This approach has doubled the number of frac stages per 1,400m lateral from 26 to 52 stages per well, representing an additional cost increase of approximately 15 percent ($0.3 million per well). This has resulted in a 50 percent increase in IP90 average production rates as compared to Surge's previous single lateral Sparky wells2.

In Q3/25, net operating expenses1 were $17.69 per boe, a decrease of $1.12 per boe (6 percent) as compared to $18.81 per boe in Q3/24. This decrease in operating expenses is primarily due to the Company's continued drilling and operational success in the Sparky and SE Saskatchewan core areas, which now represent over 92 percent of Surge's corporate production.

The combination of better than anticipated production levels, lower net operating expenses, and lower than budgeted exploration and development expenditures, have combined to allow Surge to generate over $104.9 million of FCF in the first three quarters of 2025.

Q3/25 FINANCIAL HIGHLIGHTS

In Q3/25, Surge's production averaged 23,622 boepd (88 percent liquids), well above the Company's budgeted average 2H/25 production estimate of 22,500 boepd. During the quarter, WTI crude oil prices averaged US$64.81 per barrel, and Surge generated AFF of $70.1 million, with cash flow from operating activities of $66.4 million.

During Q3/25, the Company spent $32.8 million on property, plant, and equipment, resulting in FCF of $37.2 million. On this basis, FCF represented 53 percent of the AFF generated in the quarter. Additionally, Surge closed the strategic acquisition of certain Mannville (Sparky) lands during the quarter for a cost of $5.7 million. The Company has internally identified more than 25 drilling locations on these acquired lands.

In Q3/25, Surge distributed $12.9 million in dividends to shareholders, representing only 18 percent of AFF generated during the period. In addition, Surge reduced net debt1 by $11.7 million in Q3/25, decreasing from $229.1 million as at June 30, 2025 to $217.4 million as at September 30, 2025.

Given the current lower crude oil price environment, Management elected to direct the majority of excess FCF1 to net debt reduction during the quarter. However, Surge also returned $0.7 million to shareholders in Q3/25 through its normal course issuer bid ("NCIB"), repurchasing 108,000 shares.

In total, Surge returned $25.3 million to shareholders during Q3/25 through its monthly base dividend, net debt reduction, and share buybacks. These shareholder returns represent 36 percent of Q3/25 AFF.

Highlights from the Company's Q3/25 financial and operating results include:

- Higher than budgeted average daily production of 23,622 boepd (88 percent liquids);

- Generating $70.1 million of AFF, with WTI crude oil prices averaging US$64.81 per barrel;

- Decreased net operating expenses by 6 percent over the past year, from $18.81 per boe in Q3/24 to $17.69 per boe in Q3/25;

- Drilled 13 gross (10.8 net) wells in the quarter;

- Distributed $12.9 million to Surge's shareholders by way of the Company's $0.52 per share per annum base dividend (paid monthly);

- Decreased net debt by $11.7 million, from $229.1 million in Q2/25, to $217.4 million in Q3/25;

- On an annualized basis, Q3/25 AFF represented 0.78 times Q3/25 net debt of $217.4 million; and

- The Company's $250 million first lien credit facility remained undrawn as at September 30, 2025, providing Surge with substantial available liquidity.

FINANCIAL AND OPERATING HIGHLIGHTS

| FINANCIAL AND OPERATING HIGHLIGHTS | Three Months Ended September 30, | Nine Months Ended September 30, | ||||

| ($000s except per share and per boe) | 2025 | 2024 | % Change | 2025 | 2024 | % Change |

| Financial highlights | ||||||

| Oil sales | 140,788 | 158,463 | (11) % | 435,139 | 477,213 | (9) % |

| NGL sales | 2,238 | 3,333 | (33) % | 5,549 | 10,840 | (49) % |

| Natural gas sales | 275 | 395 | (30) % | 4,550 | 5,478 | (17) % |

| Total oil, natural gas, and NGL revenue | 143,301 | 162,191 | (12) % | 445,238 | 493,531 | (10) % |

| Cash flow from operating activities | 66,392 | 73,420 | (10) % | 206,206 | 213,809 | (4) % |

| Per share - basic ($) | 0.67 | 0.73 | (8) % | 2.07 | 2.12 | (2) % |

| Per share diluted ($) | 0.66 | 0.72 | (8) % | 2.05 | 2.08 | (1) % |

| Adjusted funds flowa | 70,050 | 72,710 | (4) % | 222,913 | 218,002 | 2 % |

| Per share - basic ($)a | 0.71 | 0.72 | (1) % | 2.24 | 2.16 | 4 % |

| Per share diluted ($)a | 0.69 | 0.71 | (3) % | 2.21 | 2.13 | 4 % |

| Net income (loss)b | 7,199 | 17,263 | (58) % | 47,352 | (51,060) | nm |

| Per share basic ($) | 0.07 | 0.17 | (59) % | 0.48 | (0.51) | nm |

| Per share diluted ($)c | 0.07 | 0.17 | (59) % | 0.47 | (0.51) | nm |

| Expenditures on property, plant and equipment | 32,805 | 51,361 | (36) % | 118,034 | 136,826 | (14) % |

| Net acquisitions and dispositions | 5,677 | (20) | nmd | 5,661 | (33,521) | nm |

| Net capital expenditures | 38,482 | 51,341 | (25) % | 123,695 | 103,305 | 20 % |

| Net debta, end of period | 217,393 | 247,314 | (12) % | 217,393 | 247,314 | (12) % |

| Operating highlights | ||||||

| Production: | ||||||

| Oil (bbls per day) | 20,223 | 19,988 | 1 % | 20,408 | 20,078 | 2 % |

| NGLs (bbls per day) | 606 | 779 | (22) % | 471 | 832 | (43) % |

| Natural gas (mcf per day) | 16,759 | 18,168 | (8) % | 16,288 | 19,167 | (15) % |

| Total (boe per day) (6:1) | 23,622 | 23,795 | (1) % | 23,594 | 24,105 | (2) % |

| Average realized price (excluding hedges): | ||||||

| Oil ($ per bbl) | 75.67 | 86.17 | (12) % | 78.10 | 86.74 | (10) % |

| NGL ($ per bbl) | 40.15 | 46.50 | (14) % | 43.19 | 47.57 | (9) % |

| Natural gas ($ per mcf) | 0.18 | 0.24 | (25) % | 1.02 | 1.04 | (2) % |

| Netback ($ per boe) | ||||||

| Petroleum and natural gas revenue | 65.94 | 74.09 | (11) % | 69.13 | 74.72 | (7) % |

| Realized gain (loss) on commodity and FX contracts | 1.70 | (0.10) | nm | 1.74 | (0.49) | nm |

| Royalties | (11.60) | (14.88) | (22) % | (12.08) | (13.66) | (12) % |

| Net operating expensesa | (17.69) | (18.81) | (6) % | (17.85) | (20.33) | (12) % |

| Transportation expenses | (0.94) | (1.39) | (32) % | (1.03) | (1.26) | (18) % |

| Operating netbacka | 37.41 | 38.91 | (4) % | 39.91 | 38.98 | 2 % |

| G&A expense | (2.46) | (2.35) | 5 % | (2.57) | (2.34) | 10 % |

| Interest expense | (2.72) | (3.34) | (19) % | (2.73) | (3.64) | (25) % |

| Adjusted funds flowa | 32.23 | 33.22 | (3) % | 34.61 | 33.00 | 5 % |

| Common shares outstanding, end of period | 98,984 | 101,426 | (2) % | 98,984 | 101,426 | (2) % |

| Weighted average basic shares outstanding | 99,055 | 101,066 | (2) % | 99,448 | 100,728 | (1) % |

| Stock based compensation dilutionc | 2,105 | 1,471 | 43 % | 1,289 | 1,844 | (30) % |

| Weighted average diluted shares outstanding | 101,160 | 102,537 | (1) % | 100,737 | 102,572 | (2) % |

| a This is a non-GAAP and other financial measure which is defined under Non-GAAP and Other Financial Measures. | ||||||

| b The nine months ended September 30, 2024 includes a non-cash impairment charge of $96.5 million. | ||||||

| c Dilution is not reflected in the calculation of net loss for the nine months ended September 30, 2024. | ||||||

| d The Company views this change calculation as not meaningful, or "nm". | ||||||

OPERATIONS UPDATE: CONTINUED DRILLING SUCCESS IN SPARKY AND SE SASKATCHEWAN CORE AREAS DRIVES PRODUCTION OUTPERFORMANCE

Surge's Q3/25 production averaged 23,622 boepd (88 percent liquids), more than 1,100 boepd ahead of the Company's budgeted average 2H/2025 production estimate of 22,500 boepd. This continued production outperformance is primarily due to the ongoing, successful drilling and waterflood results in Surge's two core areas, highlighted by consistent OHML drilling success at the Company's Sparky discovery at Hope Valley.

Surge's Q3/25 drilling program was executed with one rig drilling in each of the Sparky and SE Saskatchewan core areas and consisted of a total of 13 gross (10.8 net) wells drilled in the quarter.

At Hope Valley in the Company's Sparky core area, Surge continues to experience better than anticipated well results from the Company's OHML drilling. Surge has drilled 12 gross (12.0 net) OHML wells at Hope Valley in 2025, with average IP90 production rates of 216 bopd. These results are 34 percent better than the Company's independent reserve auditor IP90 Total Proved type curve expectations of 162 bopd. Surge successfully drilled and brought on production 5 gross (5.0 net) wells in Hope Valley in Q3/25, and the Company anticipates drilling a further 6 gross (6.0 net) wells in Q4/25.

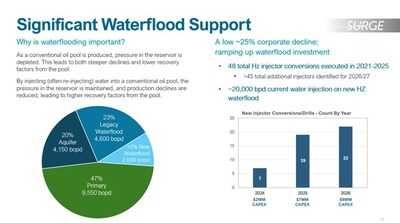

Surge has a low annual corporate production decline rate estimated to be 25 percent. Surge systematically budgets and spends significant waterflood capital each year to enhance pressure support in its crude oil reservoirs, lower production declines, and increase estimated ultimate recoveries from its conventional reservoirs.

As per the image below, 53 percent of the Company's current production is supported by legacy vertical waterfloods, horizontal waterfloods, and natural aquifer support, which help to maintain Surge's low corporate decline3. Surge has significantly increased the Company's horizontal waterflood program, from seven injector conversions in 2024, to 19 well conversions planned for 2025, based on the continued success of its Sparky, Lloyd, Radcliffe, Slave Point, and Midale waterfloods. In Q3/25, Surge drilled the Company's first waterflood injector to initiate secondary recovery at Surge's Hope Valley discovery, with the goal of increasing estimated ultimate recoveries from this large Sparky (Mannville) crude oil discovery. This injector is currently on production for a cleanup period and will be converted to injection in early Q1/26.

Additionally, over the past 12 months the Company has drilled 20 single lateral multi-frac wells in the Sparky core area where Surge has trialed high-density frac technology. This approach has doubled the go forward design with the number of frac stages per 1,400m lateral; increasing from 26 stages per well, to 52 stages per well.

To date in 2025, Surge has drilled a total of 42 gross (36.8 net) wells, while adding 80 gross (78.0 net2) drilling locations to its inventory in the Company's Sparky and SE Saskatchewan core areas through both organic crown land sales and strategic land acquisitions. This adds to Surge's lower risk development drilling inventory of more than 900 net internally identified locations (as of January 1, 2025), providing an inventory of more than 12 years2.

2026 CAPITAL AND OPERATING BUDGET: CONTINUING TO MAXIMIZE FREE CASH FLOW

Given the recent instability and volatility of world crude oil prices, Management has elected to utilize a US$65 WTI crude oil price assumption for the Company's 2026 capital and operating budget.

In 2026, Surge will continue to concentrate on the Company's disciplined capital allocation business strategy, with cash flow strategically allocated between focused capital projects and returns to shareholders. Surge is currently returning over $51 million annually to shareholders through the Company's existing $0.52 per share per annum base dividend (paid monthly). Management currently anticipates allocating the majority of the Company's remaining excess FCF in 2026 to continued reduction of net debt, as well as share repurchases under its existing NCIB program.

Surge's 2026 capital budget will see greater than 95 percent of the Company's development expenditures directed towards two of the top four crude oil plays in Canada4 in its Sparky (>13,500 boepd; 85 percent liquids) and SE Saskatchewan (~7,500 boepd; 90 percent liquids) core areas, which now comprise over 92 percent of the Company's current production.

Surge continues to experience better than anticipated drilling results, and an approximate 20 percent improvement in the Company's production efficiencies. As a result, Surge has reduced its capital spending budget by over $45 million since 2024, from $195.1 million in 2024 to a budgeted $150 million in 2026. This significant reduction in forecasted capital expenditures is largely due to the Company's successful application of modern, multilateral drilling technologies and the application of high-density fracking in both the Sparky and SE Saskatchewan core areas, which have provided improved capital efficiencies and increased FCF.

Surge's 2026 capital budget is focused on the sustainability of the Company's dividend and shareholder returns based business model, with the $45 million reduction in budgeted capital expenditures from 2024 to 2026 now representing over 87 percent of Surge's annual dividend payment of $51.5 million.

Based on Surge's 2026 capital budget, the Company anticipates delivering average production of 23,000 boepd (88 percent liquids), while concurrently generating an anticipated $95 million of FCF at US$65 WTI crude oil pricing5.

Management and the Board closely monitor market conditions for commodity prices, Canadian oil price differentials, and interest and foreign exchange rates. The pace of the Company's capital expenditures budget is strategically adjusted by Management based on market conditions.

2026 BUDGET HIGHLIGHTS

Surge's disciplined 2026 capital and operating budget is designed to maximize FCF as follows:

- A focused $150 million exploration and development capital expenditure program;

- Forecasted AFF of approximately $265 million ($2.68 per share) at US$65 WTI crude oil pricing5;

- Forecasted annual cash flow from operating activities of more than $245 million ($2.47 per share) at US$65 WTI crude oil pricing5;

- Forecasted FCF of $95 million ($0.96 per share) at US$65 WTI crude oil pricing5;

- Drilling of 54.5 of the Company's most capital efficient net drilling locations; focused predominately in the Sparky and SE Saskatchewan core areas; and

- Utilizing less than seven percent of the Company's internally estimated drilling location inventory (i.e. over 900 net total estimated locations currently in inventory)2.

Further details relating to the 2026 budget are set forth below:

| Guidance | @ US $65 WTI5 |

| Average 2026 production | 23,000 boepd (88% liquids) |

| 2026(e) Exploration and development expenditures | $150 million |

| 2026(e) Adjusted Funds Flow | $265 million |

| Per share | $2.68 per share |

| 2026(e) Cash flow from operating activities* | $245 million |

| Per share | $2.47 per share |

| 2026(e) Free cash flow | $95 million |

| Per share | $0.96 per share |

| 2026(e) Base dividend | $51.5 million |

| Per share | $0.52 per share |

| 2026(e) Royalties as a % of petroleum and natural gas revenue | 17.5% - 18.0% |

| 2026(e) Net operating expenses | $18.00 - $18.50 per boe |

| 2026(e) Transportation expenses | $1.15 - $1.35 per boe |

| 2026(e) General & administrative expenses | $2.50 - $2.70 per boe |

| 2026(e) Interest expenses | $2.50 - $2.75 per boe |

| $1.2 billion in tax pools (providing an estimated 6 year tax horizon) | |

| * Cash flow from operating activities assumes a nil change in non-cash working capital. |

2026 DRILLING PROGRAM: FOCUSED ON THE SPARKY (MANNVILLE) AND SE SASKATCHEWAN (FROBISHER)

Surge's 2026 capital program is focused in the Company's Sparky and SE Saskatchewan core areas, with over 95 percent of the 2025 drilling budget allocated to these two areas. A total of 54.5 net wells are planned across Surge's core areas, with 31.0 net wells planned in Sparky, and 23.5 net wells planned in SE Saskatchewan.

Sparky (Mannville)

Surge's 2026 capital program in the Sparky core area (>85 percent liquids; 23° API average crude oil gravity) is directed to development drilling, consisting of 10.0 net single-leg fracked Sparky horizontal wells, 16.0 net multi-leg Mannville stack wells, and five dedicated single leg injectors. In 2026, Management will be focused on the continued growth of Surge's multi-lateral well footprint in the Mannville stack of formations, with approximately two thirds of drilling capital directed to multi-lateral development.

Surge views the Nipisi Clearwater development as a strong technical analog for its Hope Valley Sparky development. With the success of the waterflood in the Clearwater development, Surge plans to accelerate the waterflood at Hope Valley with the drilling of five dedicated single-lateral injectors in 2026.

SE Saskatchewan

In the Company's SE Saskatchewan core area, Surge is currently budgeting the drilling of 23.5 net conventional Mississippian horizontal wells, with 19.5 of these wells targeting the Frobisher light oil formation, and 4.0 wells targeting the Midale and Lodgepole formations.

Over the past number of years, the Company has endeavored to optimize reservoir contact by drilling two and three leg vertically stacked multi-lateral wells within the Frobisher formation. In 2026, 15.0 net wells of Surge's planned 19.5 net Frobisher wells (77 percent) will be drilled as multi-lateral horizontal wells.

APPOINTMENT OF BOARD MEMBER

Surge is pleased to announce the appointment of Myles Bosman to the Board of Directors, effective November 5, 2025.

Mr. Bosman is a Professional Geologist and senior energy executive with over 34 years of exploration and operational experience in the Canadian oil and gas industry. Mr. Bosman is a founder of Birchcliff Energy and held the executive positions of Vice-President of Exploration and Chief Operating Officer of Birchcliff from 2004 to 2021. In 2021 he became the Executive Vice-President of Exploration until he retired from Birchcliff in January 2024.

Mr. Bosman received his Bachelor of Science Degree in Geology from the University of Calgary and his Resource Engineering Diploma from the Northern Alberta Institute of Technology. Mr. Bosman is a member of the Association of Professional Engineers and Geoscientists of Alberta. He is currently a board member of the Canadian Energy Executive Association and has served in several roles within the board since 2016.

Surge welcomes Mr. Bosman to our Board of Directors.

OUTLOOK: PREMIUM CRUDE OIL ASSET BASE DRIVES SUPERIOR RETURNS

Surge's premium, conventional crude oil asset base is now more than 92 percent focused in two of the top four crude oil plays in Canada4 based on per well payout economics in its Sparky (>13,500 boepd; 85 percent medium gravity oil and liquids) and SE Saskatchewan (~7,500 boepd; 90 percent light oil and liquids) core areas.

Surge expects to deliver attractive shareholder returns in 2026 and beyond based on the key corporate fundamentals set forth below:

- Increased average 2026 production guidance of 23,000 boepd (88 percent liquids);

- Estimated 2026 AFF of $265 million5;

- Estimated 2026 cash flow from operating activities of $245 million5;

- A $51.5 million annual base cash dividend ($0.52 per share annual dividend, paid monthly), which represents less than 20 percent of the Company's forecasted 2026 AFF of $265 million;

- An estimated 25 percent annual corporate decline3;

- An undrawn $250 million first lien credit facility;

- Approximately 900 (net) internally estimated drilling locations, providing a 12 year drilling inventory2; and

- $1.2 billion in tax pools (representing an estimated 6 year tax horizon)5.

| _______________________________ |

| 1 This is a non-GAAP and other financial measure which is defined under Non-GAAP and Other Financial Measures. |

FORWARD LOOKING STATEMENTS

This press release contains forward-looking statements. The use of any of the words "anticipate", "continue", "could", "estimate", "expect", "may", "will", "project", "should", "believe", "potential" and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements.

More particularly, this press release contains statements concerning: Surge's declared focus and primary goals; Management's 2026 operating and capital budget guidance, average and annual production guidance, capital expenditure budget guidance and FCF forecast; expectations with respect to the Company's spend on property, plant and equipment in 2026; projections with respect to the Company's capital efficiencies; crude oil fixed price hedges protecting the Company's 2026 free cash flow profile; share repurchases under the Company's NCIB; the repeatability and consistency of drilling results at Hope Valley and moving this asset to the full development phase; estimated Sparky drilling locations remaining on the Company's Hope Valley land and the future development of such land; Surge's planned 2026 drilling program and focus, including expectations regarding the number of wells to be drilled and the types thereof; goals with respect to recoveries from the Sparky crude oil reservoir; injector conversion expected to occur in Q1/26; Surge's 2026 capital program and focus; that Surge will continue to concentrate on the Company's disciplined capital allocation business strategy, with cash flow strategically allocated between focused capital projects and returns to shareholders; the expectation that the majority of the Company's remaining excess FCF in 2026 to reduction of net debt, as well as share repurchases under its existing NCIB program; expectations with respect to average production based on Surge's 2026 capital budget; expectations with respect to the Nipisi Clearwater development and waterflood at Hope Valley; drilling of new injectors and timing thereof; the resumption of drilling in SE Saskatchewan to mid-July; estimates with respect to its drilling inventory of more than 12 years; expectations with respect to Surge's shareholder returns in 2026 and beyond and the key corporate fundamentals underlining such expectations; and management's expectations regarding Surge's 2026 average production, AFF, cash flow from operating activities, dividends, drilling inventory and locations, annual corporate decline rates, tax pools and tax horizon.

The forward-looking statements are based on certain key expectations and assumptions made by Surge, including expectations and assumptions concerning the performance of existing wells and success obtained in drilling new wells; anticipated expenses; cash flow and capital expenditures; compliance with and application of regulatory and royalty regimes; prevailing commodity prices and economic conditions; the Company's expectations regarding well production rates, production decline of existing wells and performance and geographic location of new wells drilled; the ability of the Company to achieve its objectives and goals; the application of regulatory and royalty regimes; the financial assumptions used by Surge's reserve evaluators in assessing potential impairment of Surge assets; Surge's belief that the majority of cash flow's associated with its proved and probable reserves will be realized prior to the elimination of carbon based energy; the Company's belief in the uncertainty regarding the ultimate period in which global energy markets can transition from carbon based sources to alternative energy; management's expectations as to the cause of fluctuation in corporate royalty rates; management's beliefs regarding the estimates of the future values for certain assets and liabilities of the Company; underlying causes of the fluctuations in Surge's revenue and net income (loss) from quarter to quarter; the Company's estimates with respect to incremental borrowing rates and lease terms; development and completion activities and the costs relating thereto; that the Company has substantial available liquidity as a result of the undrawn amounts on its first lien credit facility; the performance of new wells and the ability of the Company to bring new wells on stream; the successful implementation of waterflood programs; the availability of and performance of facilities and pipelines; the geological characteristics of Surge's properties; and any acquired assets; the successful application of drilling, completion and seismic technology; the determination of decommissioning obligations; the ability to obtain approval from the syndicate to increase or maintain its credit facilities; the ability to continue borrowing under the Company's credit facilities and the syndicate's interpretation of the Company's obligations thereunder; ability of the Company to obtain alternative forms of debt and equity financing on terms acceptable to the Company to meet its capital requirements; ability to make shareholder returns and the timing thereof; prevailing weather conditions; exchange rates; licensing requirements; the impact of completed facilities on operating costs; that prevailing regulatory, tax and environmental laws and regulations apply or are introduced as expected, and the timing of such introduction; and the availability of costs of capital, labour and services; and the creditworthiness of industry partners.

Although Surge believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because Surge can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, risks associated with the condition of the global economy, including trade, public health and other geopolitical risks; risks associated with the oil and gas industry in general (e.g. operational risks in development, exploration and production; delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to production, costs and expenses, and health, safety and environmental risks); commodity price and exchange rate fluctuations and constraint in the availability of services, adverse weather or break-up conditions; the imposition or expansion of tariffs imposed by domestic and foreign governments or the imposition of other restrictive trade measures, retaliatory or countermeasures implemented by such governments, including the introduction of regulatory barriers to trade and the potential effect on the demand and/or market price for Surge's products and/or otherwise adversely affects Surge; uncertainties resulting from potential delays or changes in plans with respect to exploration or development projects or capital expenditures; and failure to obtain the continued support of the lenders under Surge's bank line. Certain of these risks are set out in more detail in Surge's AIF dated March 5, 2025 and in Surge's MD&A for the year ended December 31, 2024, both of which have been filed on SEDAR+ and can be accessed at www.sedarplus.ca.

The forward-looking statements contained in this press release are made as of the date hereof and Surge undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

Oil and Gas Advisories

Barrel of Oil Equivalency

The term "boe" means barrel of oil equivalent on the basis of 1 boe to 6,000 cubic feet of natural gas. Boe may be misleading, particularly if used in isolation. A boe conversion ratio of 1 boe for 6,000 cubic feet of natural gas is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. "Boe/d" and "boepd" mean barrel of oil equivalent per day. Bbl means barrel of oil and "bopd" means barrels of oil per day. NGLs means natural gas liquids.

Oil and Gas Metrics

This press release contains certain oil and gas metrics and defined terms which do not have standardized meanings or standard methods of calculation and therefore such measures may not be comparable to similar metrics/terms presented by other issuers and may differ by definition and application. All oil and gas metrics/terms used in this document are defined below:

"Capital payout" or "payout per well", is the time period for the operating netback of a well to equate to the individual cost of drilling, completing and equipping the well. Management uses capital payout and payout per well as a measure of capital efficiency of a well to make capital allocation decisions.

"Decline" is the amount existing production decreases year over year, without new drilling. Sproule's 2024 year end reserves have a Proved Developed Producing ("PDP") decline of 27 percent and a Proven Plus Probable Developed Producing ("P+PDP") decline of 25 percent.

Management uses these oil and gas metrics for its own performance measurements and to provide shareholders with measures to compare our operations over time. Readers are cautioned that the information provided by these metrics, or that can be derived from the metrics presented in this press release, should not be relied upon for investment or other purposes.

Drilling Inventory

This press release discloses drilling locations in two categories: (i) booked locations; and (ii) unbooked locations. Booked locations are proved locations and probable locations derived from an external evaluation using standard practices as prescribed in the Canadian Oil and Gas Evaluations Handbook and account for drilling locations that have associated proved and/or probable reserves, as applicable.

Unbooked locations are internal estimates based on prospective acreage and assumptions as to the number of wells that can be drilled per section based on industry practice and internal review. Unbooked locations do not have attributed reserves or resources. Unbooked locations have been identified by Surge's internal certified Engineers and Geologists (who are also Qualified Reserve Evaluators ("QRE")) as an estimation of our multi-year drilling activities based on evaluation of applicable geologic, seismic, engineering, production and reserves information. There is no certainty that the Company will drill all unbooked drilling locations and if drilled there is no certainty that such locations will result in additional oil and gas reserves, resources or production. The drilling locations on which the Company actually drills wells will ultimately depend upon the availability of capital, regulatory approvals, seasonal restrictions, oil and natural gas prices, costs, actual drilling results, additional reservoir information that is obtained and other factors. While certain of the unbooked drilling locations have been de-risked by drilling existing wells in relative close proximity to such unbooked drilling locations, the majority of other unbooked drilling locations are farther away from existing wells where Management has less information about the characteristics of the reservoir and therefore there is more uncertainty whether wells will be drilled in such locations and if drilled there is more uncertainty that such wells will result in additional oil and gas reserves, resources or production.

Assuming a January 1, 2025 reference date, the Company will have over >975 gross (>900 net) drilling locations identified herein; of these >575 gross (>525 net) are unbooked locations. Of the 367 net booked locations identified herein, 284 net are Proved locations and 83 net are Probable locations based on Sproule's 2024 year end reserves. Assuming an average number of net wells drilled per year of 75, Surge's >900 net locations provide 12 years of drilling.

Assuming a January 1, 2025 reference date, the Company will have over >500 gross (>475 net) Sparky Core area drilling locations identified herein; of these >300 gross (>300 net) are unbooked locations. Of the 196 net booked locations identified herein, 143 net are Proved locations and 53 net are Probable locations based on Sproule's 2024 year end reserves. Assuming an average number of wells drilled per year of 40, Surge's >475 net locations provide >12 years of drilling.

Surge's internally used type curves were constructed using a representative, factual and balanced analog data set, as of January 1, 2024. All locations were risked appropriately, and Estimated Ultimate Recovery ("EUR") was measured against Discovered Petroleum Initially In Place ("DPIIP") estimates to ensure a reasonable recovery factor was being achieved based on the respective spacing assumption. Other assumptions, such as capital, operating expenses, wellhead offsets, land encumbrances, working interests and NGL yields were all reviewed, updated and accounted for on a well-by-well basis by Surge's QRE's. All type curves fully comply with Part 5.8 of the Companion Policy 51 – 101CP.

Surge's internal Hope Valley type curve profile of 172 bopd (IP30), 168 bopd (IP90) and 175 mbbl (175 mboe) EUR reserves per well, with assumed $2.66 MM per well capital, has a payout of approximately 10 months at US$65/bbl WTI (C$83.33/bbl LSB) and an approximate 150 percent IRR.

Surge's internal Sparky single lateral high density 52 frac stage type curve profile of 173 bopd (monthly peak rate), 130 bopd (IP90) and 161 mboe EUR reserves per well, with assumed $2.0 MM per well capital, has a payout of approximately 12 months at US$65/bbl WTI (C$83.33/bbl LSB) and an approximate 110 percent IRR. This is in comparison to the Sparky single lateral 26 frac stage type curve profile of 114 bopd (monthly peak rate), 87 bopd (IP90) and 134 mboe EUR reserves per well, with assumed $1.7 MM per well capital, and a payout of approximately 14 months at US$65/bbl WTI (C$83.33/bbl LSB).

Non-GAAP and Other Financial Measures

This press release includes references to non-GAAP and other financial measures used by the Company to evaluate its financial performance, financial position or cash flow. These specified financial measures include non-GAAP financial measures and non-GAAP ratios and are not defined by IFRS Accounting Standards ("IFRS") as issued by the International Accounting Standards Board and therefore are referred to as non-GAAP and other financial measures.

These non-GAAP and other financial measures are included because Management uses the information to analyze business performance, cash flow generated from the business, leverage and liquidity, resulting from the Company's principal business activities and it may be useful to investors on the same basis. None of these measures are used to enhance the Company's reported financial performance or position. The non-GAAP and other financial measures do not have a standardized meaning prescribed by IFRS and therefore are unlikely to be comparable to similar measures presented by other issuers. They are common in the reports of other companies but may differ by definition and application. All non-GAAP and other financial measures used in this document are defined below, and as applicable, reconciliations to the most directly comparable GAAP measure for the period ended September 30, 2025, have been provided to demonstrate the calculation of these measures:

Adjusted Funds Flow & Adjusted Funds Flow Per Share

Adjusted funds flow is a non-GAAP financial measure. The Company adjusts cash flow from operating activities in calculating adjusted funds flow for changes in non-cash working capital, decommissioning expenditures, and cash settled transaction and other costs (income). Management believes the timing of collection, payment or incurrence of these items involves a high degree of discretion and as such, may not be useful for evaluating Surge's cash flows.

Changes in non-cash working capital are a result of the timing of cash flows related to accounts receivable and accounts payable, which Management believes reduces comparability between periods. Management views decommissioning expenditures predominately as a discretionary allocation of capital, with flexibility to determine the size and timing of decommissioning programs to achieve greater capital efficiencies and as such, costs may vary between periods. Transaction and other costs (income) represent expenditures associated with property acquisitions and dispositions, debt restructuring and employee severance costs as well as other income, which Management believes do not reflect the ongoing cash flows of the business, and as such, reduces comparability. Each of these expenditures, due to their nature, are not considered principal business activities and vary between periods, which Management believes reduces comparability.

Adjusted funds flow per share is a non-GAAP ratio, calculated using the same weighted average basic and diluted shares used in calculating income (loss) per share.

The following table reconciles cash flow from operating activities to adjusted funds flow and adjusted funds flow per share:

| Three Months Ended September 30, | Nine Months Ended September 30, | |||

| ($000s except per share) | 2025 | 2024 | 2025 | 2024 |

| Cash flow from operating activities | 66,392 | 73,420 | 206,206 | 213,809 |

| Change in non-cash working capital | (441) | (10,357) | 7,158 | (12,494) |

| Decommissioning expenditures | 4,025 | 4,016 | 9,636 | 9,640 |

| Cash settled transaction and other costs (income) | 74 | 5,631 | (87) | 7,047 |

| Adjusted funds flow | 70,050 | 72,710 | 222,913 | 218,002 |

| Per share - basic ($) | 0.71 | 0.72 | 2.24 | 2.16 |

| Per share - diluted ($) | 0.69 | 0.71 | 2.21 | 2.13 |

Free Cash Flow & Excess Free Cash Flow

Free cash flow and excess free cash flow are non-GAAP financial measures. Free cash flow is calculated as cash flow from operating activities, adjusted for changes in non-cash working capital, decommissioning expenditures, and cash settled transaction and other costs (income), less expenditures on property, plant and equipment. Excess free cash flow is calculated as cash flow from operating activities, adjusted for changes in non-cash working capital, decommissioning expenditures, and cash settled transaction and other costs, less expenditures on property, plant and equipment, and dividends paid. Management uses free cash flow and excess free cash flow to determine the amount of funds available to the Company for future capital allocation decisions.

Free cash flow per share is a non-GAAP ratio, calculated using the same weighted average basic and diluted shares used in calculating income (loss) per share.

| Three Months Ended September 30, | Nine Months Ended September 30, | |||

| ($000s) | 2025 | 2024 | 2025 | 2024 |

| Cash flow from operating activities | 66,392 | 73,420 | 206,206 | 213,809 |

| Change in non-cash working capital | (441) | (10,357) | 7,158 | (12,494) |

| Decommissioning expenditures | 4,025 | 4,016 | 9,636 | 9,640 |

| Cash settled transaction and other costs (income) | 74 | 5,631 | (87) | 7,047 |

| Adjusted funds flow | 70,050 | 72,710 | 222,913 | 218,002 |

| Less: expenditures on property, plant and equipment | (32,805) | (51,361) | (118,034) | (136,826) |

| Free cash flow | 37,245 | 21,349 | 104,879 | 81,176 |

| Less: dividends paid | (12,878) | (12,741) | (38,790) | (36,870) |

| Excess free cash flow | 24,367 | 8,608 | 66,089 | 44,306 |

Net Debt

Net debt is a non-GAAP financial measure, calculated as bank debt, senior unsecured notes, term debt, plus the liability component of the convertible debentures plus current assets, less current liabilities, however, excluding the fair value of financial contracts, decommissioning obligations, and lease and other obligations. There is no comparable measure in accordance with IFRS for net debt. This metric is used by Management to analyze the level of debt in the Company including the impact of working capital, which varies with the timing of settlement of these balances.

| ($000s) | As at September 30, 2025 | As at June 30, 2025 | As at September 30, 2024 |

| Cash | 20,494 | 8,434 | 11,500 |

| Accounts receivable | 52,305 | 49,569 | 53,193 |

| Prepaid expenses and deposits | 4,572 | 5,349 | 4,215 |

| Accounts payable and accrued liabilities | (72,373) | (70,883) | (93,094) |

| Dividends payable | (4,289) | (4,294) | (4,395) |

| Senior unsecured notes | (171,526) | (171,308) | (170,642) |

| Term debt | (5,872) | (5,753) | (9,094) |

| Convertible debentures | (40,704) | (40,253) | (38,997) |

| Net debt | (217,393) | (229,139) | (247,314) |

Net Operating Expenses & Net Operating Expenses per boe

Net operating expenses is a non-GAAP financial measure, determined by deducting processing income, primarily generated by processing third party volumes at processing facilities where the Company has an ownership interest. It is common in the industry to earn third party processing revenue on facilities where the entity has a working interest in the infrastructure asset. Under IFRS, this source of funds is required to be reported as revenue. However, the Company's principal business is not that of a midstream entity whose activities are dedicated to earning processing and other infrastructure payments. Where the Company has excess capacity at one of its facilities, it will look to process third party volumes as a means to reduce the cost of operating/owning the facility. As such, third party processing revenue is netted against operating costs when analyzed by Management.

Net operating expenses per boe is a non-GAAP ratio, calculated as net operating expenses divided by total barrels of oil equivalent produced during a specific period of time.

| Three Months Ended September 30, | Nine Months Ended September 30, | |||

| ($000s) | 2025 | 2024 | 2025 | 2024 |

| Operating expenses | 40,340 | 43,242 | 120,909 | 141,075 |

| Less: processing income | (1,905) | (2,054) | (5,967) | (6,812) |

| Net operating expenses | 38,435 | 41,188 | 114,942 | 134,263 |

| $ per boe | 17.69 | 18.81 | 17.85 | 20.33 |

Operating Netback, Operating Netback per boe & Adjusted Funds Flow per boe

Operating netback is a non-GAAP financial measure, calculated as petroleum and natural gas revenue and processing income, less royalties, realized gain (loss) on commodity and FX contracts, operating expenses, and transportation expenses. Operating netback per boe is a non-GAAP ratio, calculated as operating netback divided by total barrels of oil equivalent produced during a specific period of time. There is no comparable measure in accordance with IFRS. This metric is used by Management to evaluate the Company's ability to generate cash margin on a unit of production basis.

Adjusted funds flow per boe is a non-GAAP ratio, calculated as adjusted funds flow divided by total barrels of oil equivalent produced during a specific period of time.

Operating netback & adjusted funds flow are calculated on a per unit basis as follows:

| Three Months Ended September 30, | Nine Months Ended September 30, | |||

| ($000s) | 2025 | 2024 | 2025 | 2024 |

| Petroleum and natural gas revenue | 143,301 | 162,191 | 445,238 | 493,531 |

| Processing income | 1,905 | 2,054 | 5,967 | 6,812 |

| Royalties | (25,212) | (32,581) | (77,808) | (90,226) |

| Realized gain (loss) on commodity and FX contracts | 3,701 | (217) | 11,194 | (3,229) |

| Operating expenses | (40,340) | (43,242) | (120,909) | (141,075) |

| Transportation expenses | (2,045) | (3,035) | (6,658) | (8,328) |

| Operating netback | 81,310 | 85,170 | 257,024 | 257,485 |

| G&A expense | (5,344) | (5,154) | (16,539) | (15,437) |

| Interest expense | (5,916) | (7,306) | (17,572) | (24,046) |

| Adjusted funds flow | 70,050 | 72,710 | 222,913 | 218,002 |

| Barrels of oil equivalent (boe) | 2,173,225 | 2,189,137 | 6,440,909 | 6,604,665 |

| Operating netback ($ per boe) | 37.41 | 38.91 | 39.91 | 38.98 |

| Adjusted funds flow ($ per boe) | 32.23 | 33.22 | 34.61 | 33.00 |

For more information about Surge, please visit our website at www.surgeenergy.ca:

Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility of the accuracy of this release.

SOURCE Surge Energy Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2025/05/c5791.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2025/05/c5791.html