Investor Insight

Sarama Resources offers a compelling investment opportunity driven by a US$242 million, plus interest, fully-funded arbitration claim and two belt-scale gold projects encompassing 1,000 sq km of the Cosmo-Newbery and Jutson Rocks Greenstone Belts in Western Australia’s highly prolific Laverton Gold District, which lies within the wider world-renowned Eastern Goldfields region.

Overview

Sarama Resources (TSXV:SWA, ASX:SRR) is an Australia-based gold exploration and development company with a dual value proposition: significant exploration upside in the world class Eastern Goldfields of Western Australia and a fully funded international arbitration claim against the Government of Burkina Faso.

Arbitration Claim

Sarama is pursuing an arbitration claim seeking no less than US$242 million in damages, plus interest, relating to the unlawful withdrawal of its Tankoro Deposit in Burkina Faso. The claim is fully financed through a non-recourse loan facility with Locke Capital and is being prosecuted by leading law firm Boies Schiller Flexner, which has secured major recent awards for peers including Indiana Resources (US$120 million), GreenX Metals (AU$490 million) and Lupaka Gold (US$67 million).

Exploration Opportunity

The company controls two belt-scale projects in the prolific Laverton Gold District, together covering ~1,000km² and more than 100km of strike in highly prospective but historically underexplored terrain. The flagship Cosmo gold project (580 sq km) dominates the Cosmo-Newbery Greenstone Belt, while the Mt Venn project (420 sq km) covers the Jutson Rocks Belt just 40 km away. Both lie near world-class deposits including Gruyere (+8 Moz) and Garden Well (2.5 Moz), benefit from excellent road access and nearby mills, and will see maiden drilling commence in Q4 CY25.

Sarama’s experienced board and management team have a proven discovery track record, including the +20 Moz Kibali Mine (DRC) and the +3 Moz Sanutura Project (Burkina Faso).

Company Highlights

Dual Value Drivers

- Arbitration Claim – Fully funded, US$242 million, plus interest, arbitration claim against the Government of Burkina Faso, potentially worth multiples of Sarama’s current market capitalisation.

- Exploration Upside – Two underexplored, belt-scale gold projects in Western Australia’s prolific Laverton Gold District, together spanning ~1,000 sq km with >100 km of prospective strike.

Arbitration Claim

- Large-scale Claim – Seeking damages of US$242 million, plus interest, relating to the illegal withdrawal of rights to the multi-million-ounce Tankoro Deposit.

- Fully Funded – Backed by a US$4.4 million four-year non-recourse funding facility covering all fees and expenses related to the claim.

- Top Legal Team – The company is represented by Boies Schiller Flexner (UK) LLP, a leading international law firm with significant experience in investor-state arbitration and a strong track record in the natural resources sector. The team is led by Timothy Foden who has won six out of six cases over the past two years including awards for Indiana Resources (ASX:IDA), GreenX Metals (ASX:GRX) and Lupaka Gold (TSX-V:LPK).

- Bilateral Treaty Protections - As a Canadian company, Sarama benefits from protections under the Canada-Burkina Faso Bilateral Investment Treaty and proceedings are underway at ICSID under the bilateral treaty protections.

- Proven Precedent – Comparable claims prosecuted by the same team have delivered major settlements, including US$120 million (Indiana Resources), AU$490 million (GreenX Metals) and US$67 million (Lupaka Gold).

Exploration Opportunity

- Cosmo & Mt Venn Projects – The flagship Cosmo project covers 580 sq km of the underexplored Cosmo-Newbery Greenstone Belt. Complementing this, Sarama holds an 80 percent interest in the Mt Venn project (420 sq km), located only 40 km from Cosmo and close to Gruyere (+8 Moz), Garden Well (2.5 Moz) and Golden Highway (1 Moz).

- Favourable Setting – Situated in highly prospective greenstone belts with excellent road access and several underutilised nearby mills, significantly lowering development hurdles.

- Untapped Potential – Historical land access restrictions meant limited prior exploration; current programs are designed to unlock this potential.

- Pipeline of Work – Drill-ready targets with first drilling and follow-up exploration programs planned and awaiting heritage clearance, tentatively scheduled for Q4 CY25.

Team Track Record

- Led by a seasoned group with over 30 years’ experience each, credited with major gold discoveries including the +20 Moz Kibali Mine (DRC) and the 3 Moz Tankoro Deposit (Burkina Faso).

Key Projects

Cosmo Gold Project

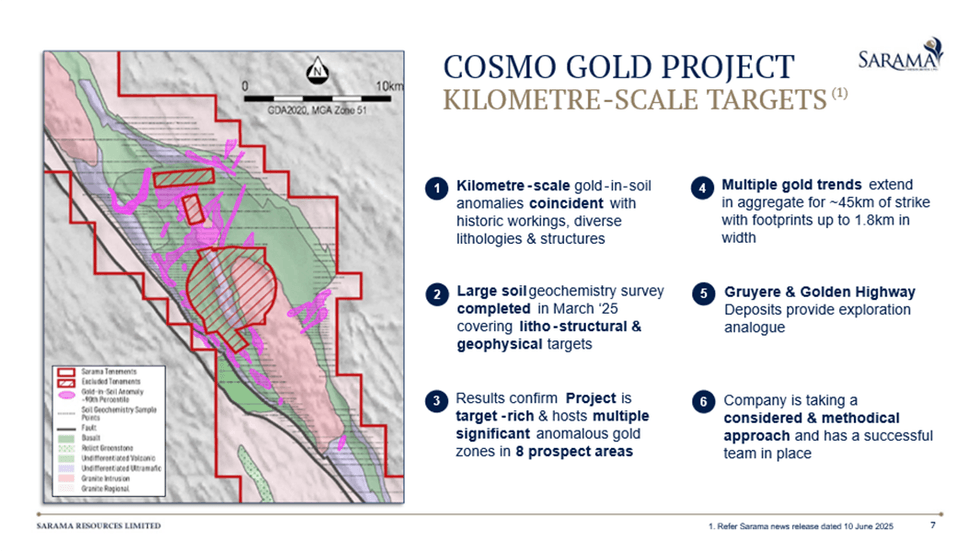

The Cosmo gold project is Sarama’s flagship exploration asset, covering 580 sq km of the Cosmo-Newbery Greenstone Belt in Western Australia’s Laverton Gold District. Located ~95 km from Laverton and accessible by predominantly paved roads, the project enjoys excellent infrastructure, with Kalgoorlie just four hours away. Cosmo is underlain by prospective Archaean volcanics with localised intrusions and shallow cover, yet has seen minimal modern exploration due to historic access restrictions. A major regional shear zone, interpreted to extend for more than 50km across the project, provides a strong structural framework for gold deposition.

Gold was first discovered at Cosmo in the early 1900s, with multiple shafts and workings mapped and high-grade ore historically mined and transported to a stamp mill in Laverton. Early miners selectively targeted narrow quartz veins, which are unlikely to represent the main system but instead may point to a much larger, concealed mineralised system.

Recent work by Sarama, including a soil geochemistry program completed in early 2025, has defined multiple kilometre-scale gold anomalies totalling 45 km in strike and up to 1.8 km in width. These anomalies confirm the presence of a large, coherent gold system and have outlined several high-priority drill targets. With historical evidence of mineralisation, favourable structural geology, and strong regional prospectivity, Cosmo presents a compelling opportunity for a major new discovery. Sarama plans to commence a maiden drilling program in late 2025.

Mt Venn Gold Project

The

Mt Venn project is a

recently acquired, belt-scale opportunity located in the Laverton Gold District of Western Australia. Operated under a joint venture where Sarama holds an 80 percent interest (Cazaly Resources 20 percent), Sarama acts as operator and manager. The project spans 420 sq km and captures the majority of the underexplored Jutson Rocks Greenstone Belt across ~50 km of strike length. A regionally extensive shear zone, 1–3 km wide, runs the full length of the belt with subordinate splays in the south, creating a favourable structural framework for gold deposition.

Gold mineralisation was first identified in the 1920s, and subsequent exploration has defined a 35 km x 4 km gold corridor hosting multiple occurrences and kilometre-scale soil anomalies. Historic drilling at the Three Bears prospect intersected broad zones of mineralisation that remain open along strike and at depth. Importantly, the project also demonstrates polymetallic potential with copper, nickel, zinc and platinum group elements, a trait often associated with larger, more significant systems.

Strategically located ~40 km from Sarama’s flagship Cosmo project, Mt Venn lies close to major deposits, including the +8 Moz Gruyere mine and the 1 Moz Golden Highway deposit. Together, Cosmo and Mt Venn provide Sarama with control over highly prospective and complementary ground, with Cosmo already hosting ~45 km of gold-anomalous trends and Mt Venn offering proven mineralisation, early drilling success and strong polymetallic prospectivity. With compelling targets identified across both projects, Sarama sees considerable exploration upside and intends to unlock this value through systematic, focused exploration programs.

Management Team

Andrew Dinning – Executive Chairman

Andrew Dinning is a founder and the executive chairman of Sarama Resources. Dinning has over 35 years of experience in the international mining arena and has worked in Australia, the Democratic Republic of Congo, West Africa, the UK and Russia. He has extensive mine management, operations and capital markets experience and has spent most of his career in the gold sector.

Dinning was a director and president of Moto Goldmines in the Democratic Republic of Congo from 2005 to 2009. He oversaw the development of the company's Moto gold project (Kibali Gold) from two million to more than 22 million ounces of gold. Dinning took the project from exploration to pre-development. The Moto gold project was later taken over by Randgold Resources and AngloGold Ashanti for $600 million in October 2009.

John (Jack) Hamilton - Vice-president of Exploration

Jack Hamilton is a founder and the vice-president of exploration at Sarama Resources. Hamilton has 35 years of experience as a professional geologist. Hamilton has worked around the world for international resource companies. Before Sarama, he was the exploration manager for Moto Goldmines. At Moto Goldmines, he led the team that discovered the main deposits and resource at the world-class Moto gold project (now Kibali Gold) which has a resource of more than 22 million ounces. Hamilton specializes in precious metal exploration in Birimian, Archean and Proterozoic greenstone belts. He has worked and consulted in West, Central and East Africa for the past 30 years with various companies, including Barrick Gold, Echo Bay Mines, Etruscan Resources, Anglo American, Geo Services International and Moto Goldmines. Whilst at Moto Goldmines, he led the exploration team that took the Moto gold deposit from discovery to bankable feasibility. The Moto gold deposit was later sold to Randgold Resources and AngloGold Ashanti in October 2009.

Paul Schmiede - Vice-president of Corporate Development

Paul Schmiede is a major shareholder and the vice-president of corporate development at Sarama Resources. He is a mining engineer with over 30 years of experience in mining and exploration. Before joining Sarama Resources in 2010, Schmiede was vice-president of operations and project development at Moto Goldmines. At Moto Goldmines, he managed the pre-feasibility, bankable and definitive feasibility study for the more than 22 million-ounce Moto gold project (now Kibali Gold). Whilst at Moto Goldmines, he also managed the in-country environment, community studies and pre-construction activities. Before joining Moto Goldmines, he held senior operational and management positions with Goldfields and WMC Resources.

Lui Evangelista - Chief Financial Officer

Lui Evangelista is Sarama's chief financial officer with 35 years of experience in accounting, finance and corporate governance with public companies. He has more than 20 years of experience in the mining industry - 10 years of which have been at the operational and corporate level with companies operating in Francophone Africa. Evangelista was a group financial controller and acting CFO at Anvil Mining which operated three mines in the DRC. He was an integral part of the senior management team that saw Anvil's market capitalization grow from C$100 million in 2005 to C$1.3 billion upon takeover by Minmetals in 2012.

Simon Jackson - Non-executive Director

Simon Jackson is a founder, shareholder and non-executive chairman of Sarama Resources. Jackson is a Chartered Accountant with over 30 years of experience in the mining sector. He is the Chairman of Predictive Discovery and non-executive director of African gold producer Resolute Mining. He has previously held senior management positions at Red Back Mining, Orca Gold and Beadell Resources.

Adrian Byass - Non-executive Director

Adrian Byass has more than 30 years of experience in the mining industry. He has focused his career on the economic development of mineral resources. He is skilled in economic and resource geology. Byass has experience ranging from production in gold and nickel mines to the evaluation and development of mining projects with listed and unlisted entities in multiple countries. He has also held executive and non-executive board roles on both ASX and AIM-listed companies. Byass has played key roles in a range of exploration and mining projects in Australia, Africa, North America and Europe, covering a suite of commodities including gold, base and specialty metals.

Michael Bohm - Non-executive Director

Michael Bohm is a seasoned director and mining engineer in the resources industry. His career spans roles as a mining engineer, mine manager, study manager, project manager, project director, and managing director. He has been directly involved in the development of multiple mines in the gold, nickel, and diamond industries, and made significant contributions to Ramelius Resources during its formative years. This experience is particularly important as Sarama is currently in the process of rebuilding its operations in the Eastern Goldfields region of Western Australia. He is a current director of ASX-listed Riedel Resources and has previously been a director of ASX-listed Perseus Mining, Ramelius Resources, Mincor Resources NL and Cygnus Metals.