Overview

Mineral exploration is an expensive prospect, and as new deposits become deeper, fewer and farther between, it will only grow costlier. Yet mining companies cannot afford to slow down — demand for critical minerals such as copper and antimony is quickly ballooning beyond our global production capacity.

Leadership, therefore, has two options. They can play it safe and exclusively pursue known quantities and pre-existing mines in the hopes that it will be enough. Alternatively, they can direct their investments towards unexplored and underexplored regions in favorable orogenic settings.

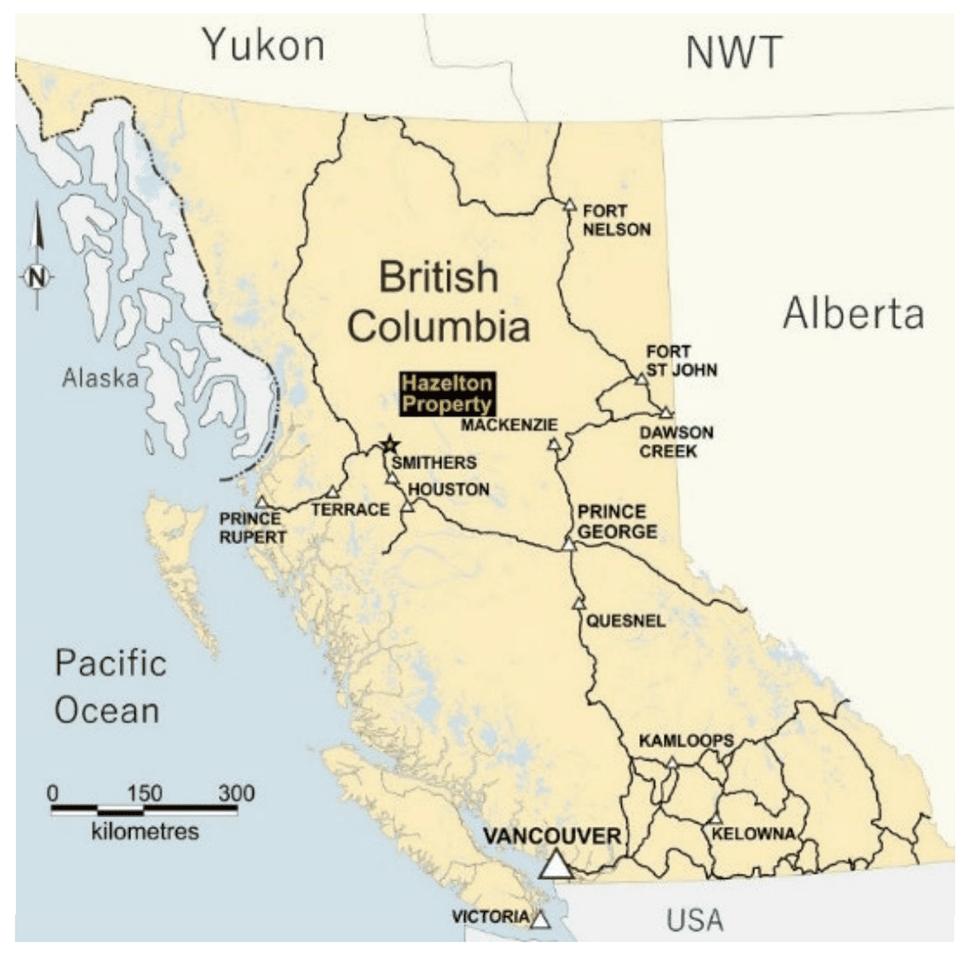

Jaxon Mining (TSXV:JAX, FSE:0U31, OTC:JXMNF) went with the second option when it purchased the Hazelton Property. Comprising 74 contiguous mineral claims across an area totaling 730 square kilometers, the property is situated 57 kilometers north of Smithers, in British Columbia's prospective yet underexplored Omenica Mining Division. Hazelton contains a total of seven porphyries, three of which constitute the company's main focus in 2023: Netalzul Mountain, Kispiox Mountain and Red Springs.

Netalzul is a polymetallic epithermal-porphyry system topped by one of the largest and strongest copper, molybdenum and zinc anomalies ever observed in British Columbia. Kispiox Mountain, meanwhile, is home to arguably North America’s and one of the world's highest-grade antimony deposits. Similarly, Red Springs contains one of the largest occurrences of mineralized quartz-tourmaline breccia zones and pipes ever discovered in North America.

The company's leadership team includes some of the world's leading experts in mineral exploration and development. Particularly noteworthy are John King Burns, CEO, and Dr. Tony Guo, the company's president and chief geologist.

Burns is a veteran in the mining finance sector, having managed risk and financed projects at every stage of development all around the world. Guo, meanwhile, combines extensive business expertise with a doctorate in geology and is a master explorationist. Between them, they've more than five decades of experience working with both major producers and junior exploration companies.

Jaxon has leveraged the technical discipline and experience of these individuals and the rest of the company’s management team very effectively, while also keeping operations relatively lean. In addition to comprehensive structural and surface mapping and modeling, the company has applied geophysics, geochemistry and extensive sampling to its exploration and discovery efforts. This model- and data-driven approach has more than borne fruit, allowing the company to uncover multiple promising deposits with minimal drilling required.

In addition to highly promising geology, Jaxon’s project locations allow the company to take full advantage of the Canadian government's critical minerals exploration incentives, including the British Columbia Mineral Exploration Tax Credit (BCMETC) and the Federal Critical Mineral Exploration Tax Credit (CMETC).

The BCMETC provides credit equal to 20 percent of qualified mining exploration expenses, with an enhanced rate of 30 percent for operations undertaken in mountain-pine-beetle-affected areas. The CMETC, meanwhile, is a recently introduced 30 percent investment tax credit applicable to eligible flow-through share agreements. It applies to 15 critical minerals, including copper and zinc — making Jaxon eligible to raise funds under the new requirements.Company Highlights

- Jaxon Mining is a junior mining company operating primarily in northwest British Columbia and helmed by industry veterans with decades of expertise.

- Jaxon is currently pursuing discoveries in its 100-percent-owned Hazelton land package, which has the potential to provide the company with a major district-scale play.

- Divided into seven owned and connected target areas, Hazelton exists in a comprehensive mining service center with proximity to a major highway and railroad, energy infrastructure and an airport.

- Copper, antimony, molybdenum, silver and zinc represent the Hazelton Property's primary mineral resources. There is also the potential for significant gold, lead and tungsten reserves.

- Jaxon expects a copper equivalent grade of 0.7 percent from its projects, significantly higher than the province's average.

- Porphyries in Hazelton are primarily situated above sea level and should be amenable to advanced underground mining techniques.

- In February 2023, the company received $741,890.96 in mineral exploration tax credit from the BC Provincial Government.

Get access to more exclusive Gold Investing Stock profiles here