5 Best-performing Copper Stocks on the TSX

Overview

As the old saying goes, to find a new mine you look in the shadow of an old or existing one.

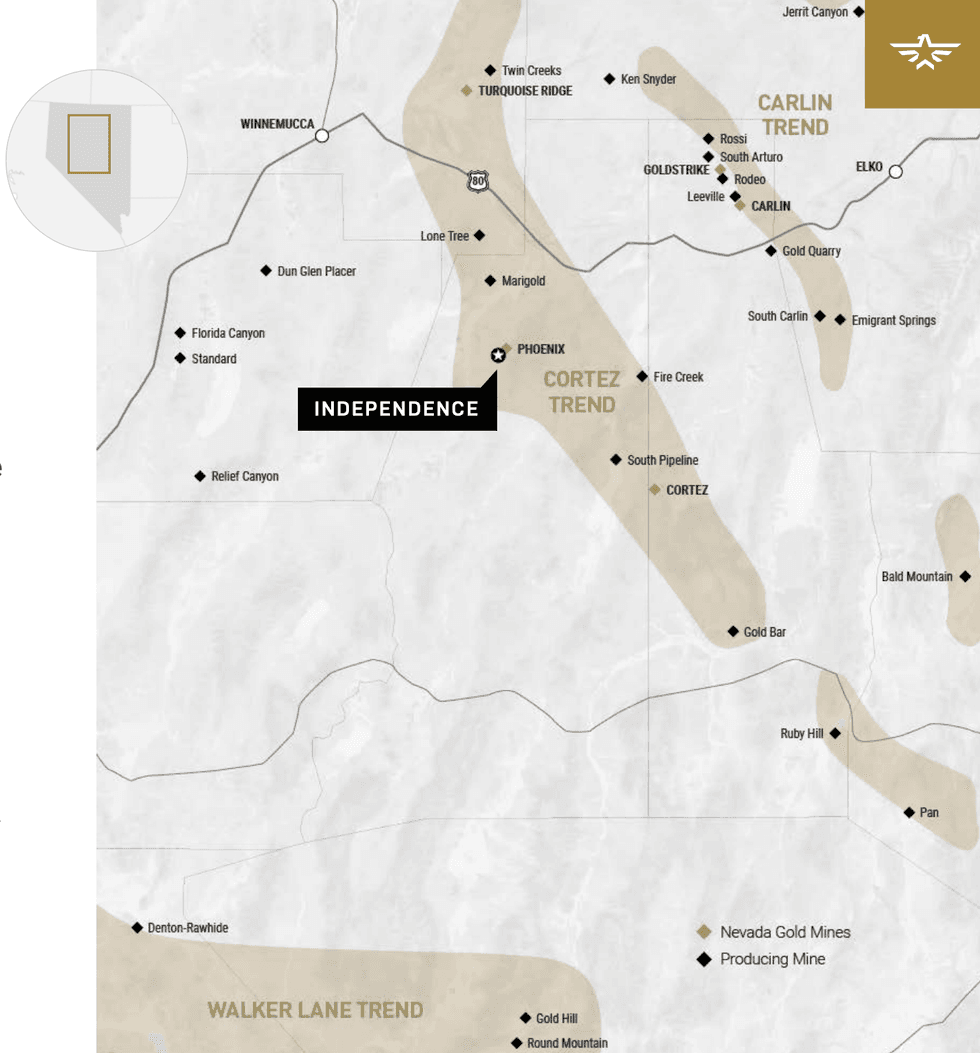

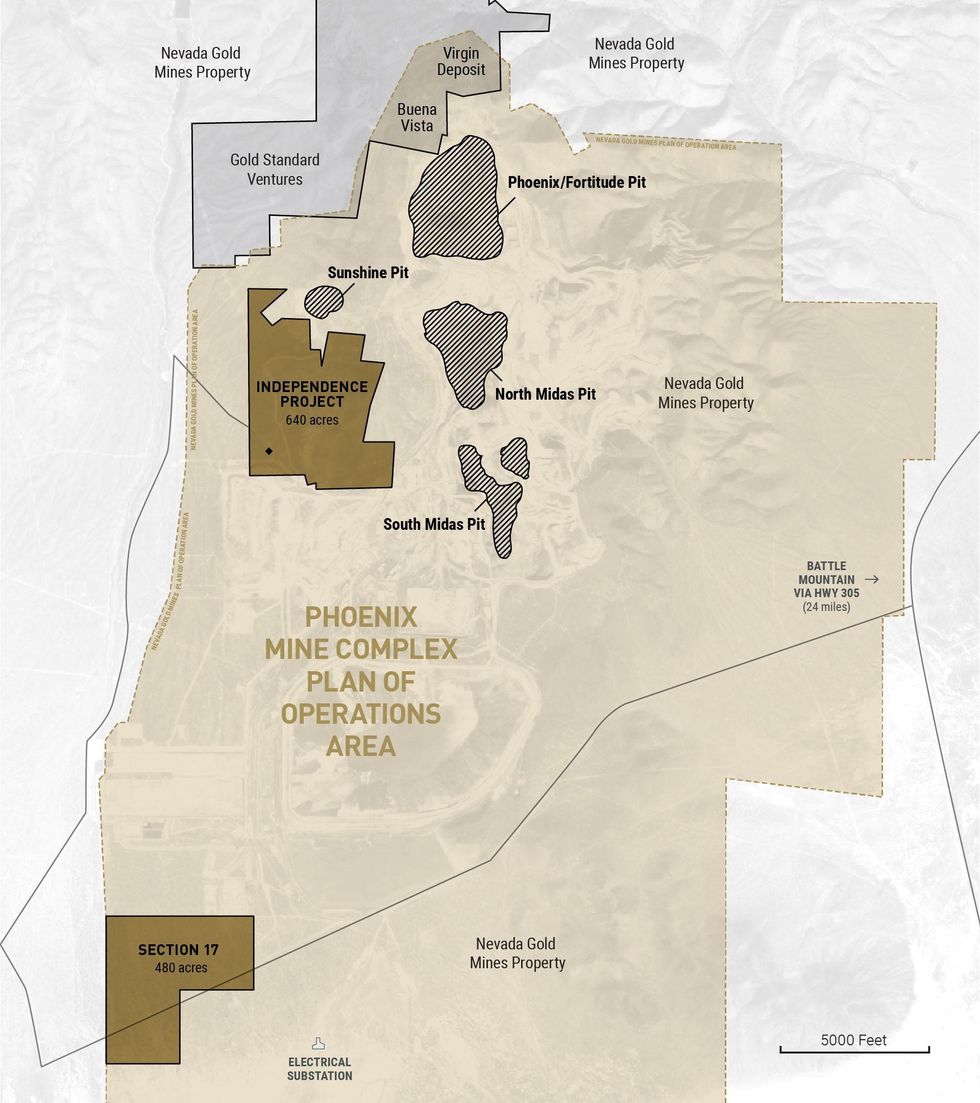

Golden Independence Mining’s (CSE:IGLD, OTC:GIDMF, FRA:6NN) flagship advanced-stage Independence project in the prolific mining state of Nevada hosts an impressive global historic resource estimate of 1,072,600 ounces of gold and is located entirely within the plan of operations of the Phoenix Mine operated by Nevada Gold Mines (NGM), a joint venture between two of the world’s largest gold producers, Newmont Mining (TSX:NGT) and Barrick Gold (TSX:ABX)

The project has seen over US$25 million in expenditures from previous operators, including the drilling of over 200 holes, numerous metallurgical bulk samples, as well as site permitting and development work, culminating in a 2010 historic resource of over a million ounces of gold. Since acquiring the project, Golden Independence has completed more than 25,000 feet of reverse circulation (RC) drilling in 36 holes. This, coupled with 56 RC holes not included in the 2010 resource, will form the basis of an expanded NI 43-101 compliant resource.

Updated in December 2021, the Mineral Resource Estimate (MRE) is part of the preliminary economic assessment (PEA). It outlines both a near surface and an underground resource, where the near surface portion of the MRE consists of Measured & Indicated Total Resource of 334,300 ounces of gold and 6.9 million ounces of silver. It also accounts for an additional Inferred Total Resource of 50,800 ounces of gold and 0.7 million ounces of silver. The underground portion of the MRE consists of an Inferred Resource of 796,200 ounces of gold.

Joint Venture formed December 2021, allowing for strategic discussions in 2022. Phase three RC drilling of the near surface resource, as well as core drilling to expand the high-grade skarn resource, are planned for mid-2022.

Nevada stands unmatched as the top mining jurisdiction globally for Investment Attractiveness and Policy Perception, according to the Fraser Institute Annual Survey of Mining Companies, in its 2021 study. The US alone currently sits as the fourth-largest gold producer globally, with Nevada accounting for over 70 percent of this production.

The company is currently focused on rapidly expanding the existing historic oxide resource and advancing it to heap leach production, which could be permitted in as little as 18 to 24 months. Comparable projects can typically see such production after extensive years of development and permitting. The larger, higher-grade sulfide resource at depth represents the future growth of the Company and is similar to the material currently being mined at NGM’s nearby Phoenix pit.

With a market cap of approximately C$17M — 60 million shares at C$0.28 per share — Golden Independence presents investors with an attractive valuation. Relative to its peer comparables, and with a private placement completed in April 2021, the company is well financed to continue developing the Independence property with working capital of around C$3 million.

Company Highlights

- Golden Independence is developing its Independence project in Nevada, located completely within the previously permitted plan of operations for the Phoenix Mine operated by NGM, a joint venture between Newmont Mining (TSX:NGT) and Barrick Gold (TSX:ABX).

- The 640-acre Independence property boasts excellent gold exploration potential, strategic positioning and a significant historic gold resource estimate.

- The project has a near surface historic oxide resource of 276,400 ounces of gold grading with approximately 0.5 g/t and an additional higher-grade sulfide resource of 796,200 ounces with gold grading of approximately 6.5 g/t.

- Golden Independence has an option to earn up to a 75 percent interest in the project.

- The company recently completed a 36-hole RC drill program at approximately 25,000 feet. These results will combine with 56 RC holes drilled by previous operators but not included in the 2010 historic resource, to generate an expanded NI 43-101 compliant resource.

- Joint venture formed December 2021, allowing for strategic discussions in 2022. Phase three RC drilling of the near surface resource, as well as core drilling to expand the high-grade skarn resource, are planned for mid-2022.

- As part of the recent drill program, the company had encouraging exploration success notably in hole AGEI-32 which returned 9.11 g/t of gold and 25.2 g/t of silver over 24.4 meters around 150 meters below surface in the oxides, likely captured in an open pit.

- Diversifying its portfolio, Golden Independence acquired the Fraser Lake Copper Porphyry Project, with 9,900 hectares located at the Quesnel Trough in British Columbia.

Get access to more exclusive Gold Investing Stock profiles here