Investor Insight

Toro Energy’s significant uranium resource in a tier 1 jurisdiction places the company in a compelling position to leverage a bullish uranium market and the mineral’s strategic role in global decarbonization.

Overview

Australia is the world’s third-largest uranium producer (12 percent) next to Kazakhstan (43 percent) and Canada (13 percent). It is home to the Wiluna Uranium Project, the flagship asset of Toro Energy (ASX:TOE), a uranium exploration and development company also exploring value in other commodities.

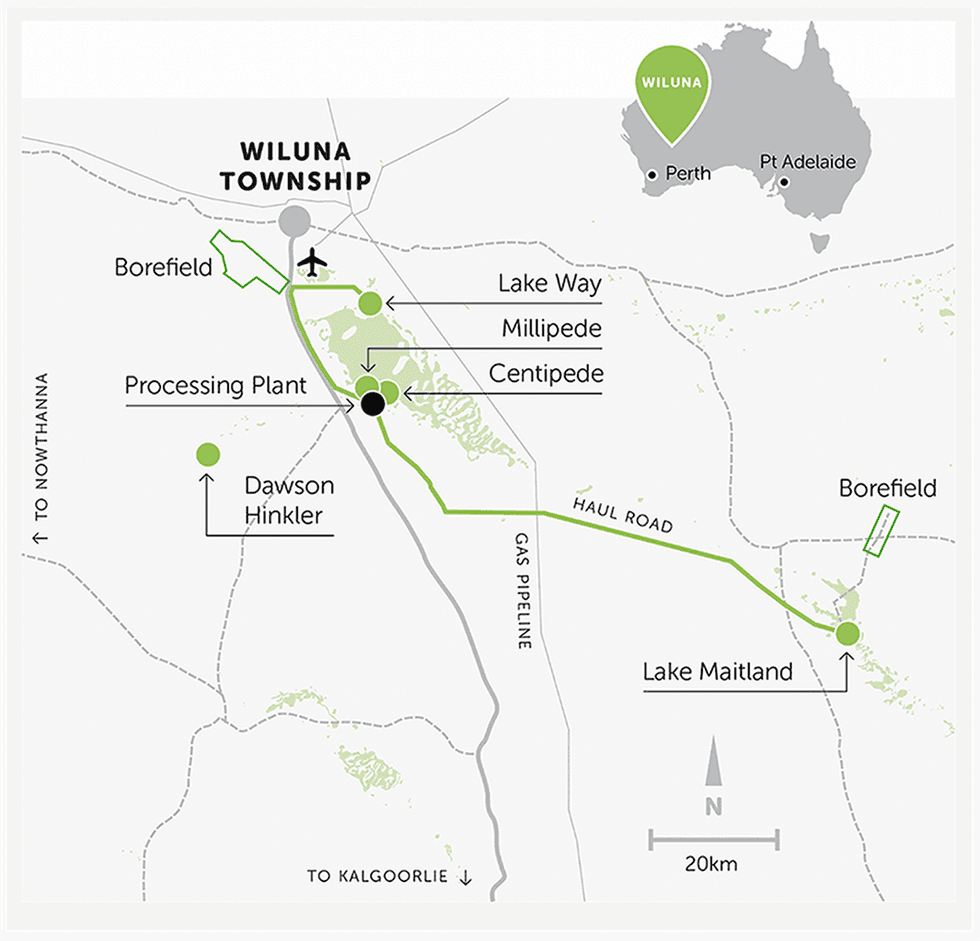

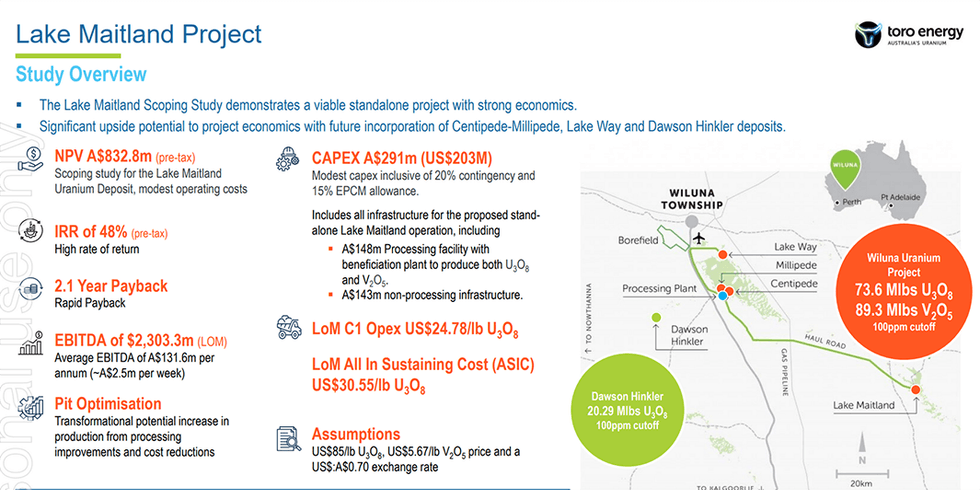

The 100-percent-owned Wiluna uranium project includes three key deposits – Lake Maitland, Centipede-Millipede and Lake Way – and offers significant uranium exposure of 87.8 million tons (Mt) at 381 ppm for 73.6 Mlbs U3O8 at 100 ppm cut-off (JORC 2012). It is located only 30 kilometers southeast of Wiluna in Central Western Australia.

The Wiluna uranium project has received state and federal approval (subject to required amendments) and has been granted mining leases.

Considerable research over recent years has identified processing redesign opportunities from unique geological attributes within the uranium deposits, but particularly at Lake Maitland, as well as the ability to extract the inherent vanadium held within the uranium ‘ore’ for a vanadium by-product.

Within the uranium mineralization envelope, the Wiluna project is estimated to contain 141.8 Mt vanadium oxide (V2O5) at 286 ppm for 89.3 Mlbs of V2O5 at 100 ppm V2O5 cut-off (JORC 2012), as of September 24, 2024.

The scoping study for the stand-alone Lake Maitland uranium-vanadium operation option shows potential for exceptional financial returns with a pre-tax NPV of AU$832.8 million, a short payback period of 2.5 years, 48 percent internal rate of return, and low capex of AU$291 million (US$203 million), based on price assumption of US$85/lb U3O8, US$5.67/lb V2O5 and a 70 cents US$:AU$ exchange rate.

In September 2024, the Lake Maitland deposit has been re-estimated using a resource envelope more in line with the other Wiluna uranium deposits; allowed the lowering of the cut-off grade to 100ppm U3O8, expanding Lake Maitland resources by 12 percent and that of the entire Wiluna project by 17 percent (when the expansions at Lake Way and Centipede-Millipede are also included).

The design phase of Toro Energy’s beneficiation and hydrometallurgical pilot plant is on track and in line with plans to finalise construction. The pilot plant will test the improved beneficiation and hydrometallurgical circuit developed by Toro from bench scale research at a closer-to-production scale and as single streams. It will also test potential ore from the three uranium-vanadium deposits that Toro believes will make up an extended Lake Maitland operation – these include Lake Maitland, Lake Way and Centipede-Millipede.

The Lake Maitland deposit is part of a joint venture partnership with two reputable Japanese corporations, Japan Australia Uranium Resource Development. (JAURD) and Itochu.

Toro has been actively evaluating the prospectivity of its Wiluna asset portfolio for minerals other than uranium, including nickel and gold.

The Lake Maitland mining pit re-optimization which incorporated the latest resource estimates and updated financial data has been completed. Mine scheduling is currently underway in preparation for the upcoming scoping study update.

Toro’s Dusty nickel project is located on the northern, eastern and southern shores of Lake Maitland and the Lake Maitland uranium deposit and is focused on two main target areas: Dusty and Yandal One. These properties will be the subject of a proposed demerger, following Toro’s recent strategic review of its non-core assets and future plans to solely focus on its uranium development opportunities and its flagship Wiluna project.

Toro Energy’s management team and board of directors have extensive experience in the mining industry, with combined expertise that includes working at major mining houses, exploration companies, uranium mining operations, corporate financing and government and community relations.

Get access to more exclusive Uranium Investing Stock profiles here