August 05, 2024

Acquisition propels St George onto global niobium stage

St George Mining Limited (ASX: SGQ) (“St George” or “the Company”) is pleased to announce that it has entered into a binding conditional agreement to acquire all the issued capital of Itafos Araxá Mineracao E Fertilizantes S.A (“Itafos Araxá”) which owns 100% of the advanced niobium-REE Araxá Project in Minas Gerais, Brazil (“Araxá” or “the Project”). The closing of the transaction is subject to the completion (or waiver) of certain conditions by November 3, 2024.

Highlights

- Binding Agreement: St George has entered into a binding conditional agreement to acquire 100% of the Araxá niobium-REE Project in Minas Gerais, Brazil (the “Project”)

- World class location: The Project is immediately adjacent to, and within the same carbonatite complex as, the niobium mine of CBMM that produces approximately 80% of the world’s niobium

- High-grade mineralisation: Historical drilling at the Project has defined extensive high- grade niobium, REE and phosphate mineralisation with:

- More than 500 intercepts of high-grade niobium, >1% Nb2O5

- Ultra-high grades up to 8% Nb2O5, 33% TREO and 32% P2O5

- Mineralisation commencing from surface and open in all directions

- Strong foundation to deliver resource: Outstanding opportunity for St George to define a globally significant niobium-REE resource

- Enviable development potential: Located in an established mining district with existing infrastructure (roads and power), proven route to market and access to workforce

- Capital raising locked-in: St George has received firm commitments from investors to raise new funds of $21.25 million for application towards acquisition costs, exploration expenses and working capital

Drilling by previous explorers at the Project has confirmed significant niobium and rare earths element (REE) mineralisation – see Tables 1, 2 and 3.

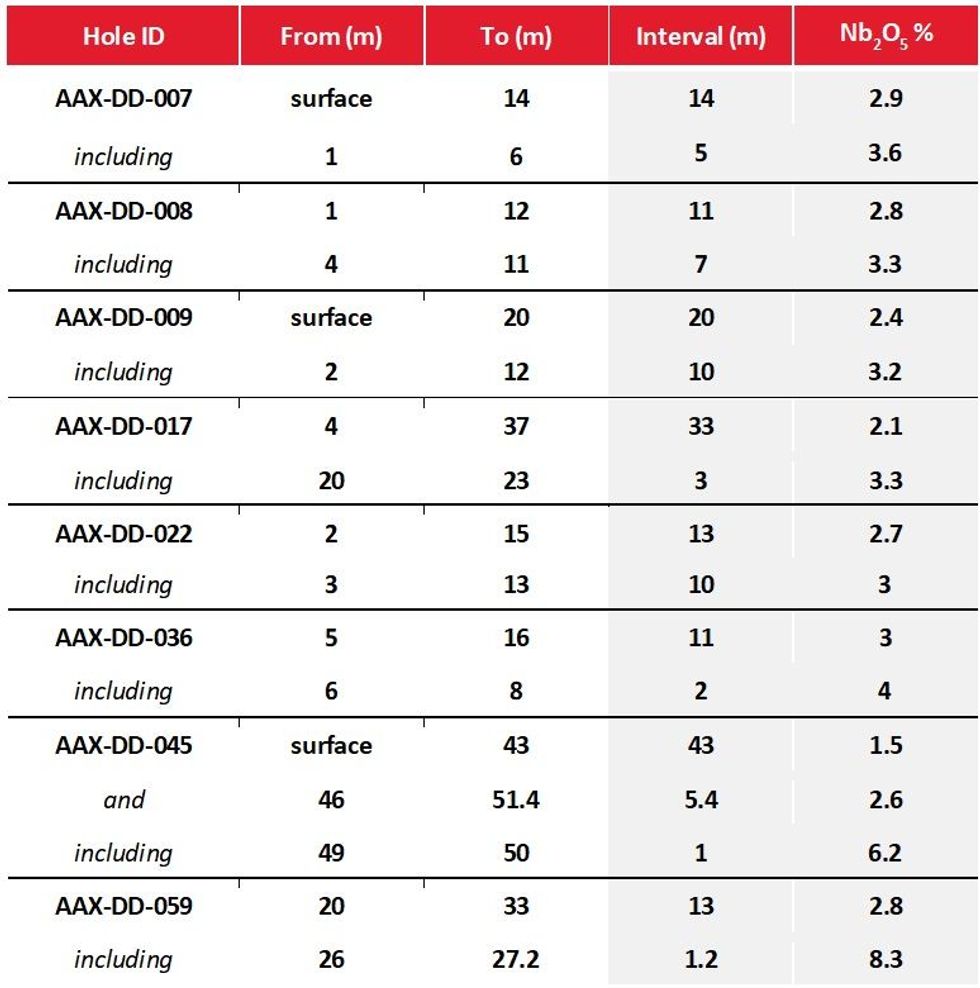

Table 1: Historical high-grade niobium drill intercepts at Araxá include (cut-off grade of 1% Nb2O5)1:

The intercepts in Tables 1 and 2 have been selected to demonstrate, respectively, the outstanding prospectivity for near-surface high-grade niobium and TREO mineralisation at the Project. For a full list of significant historical drill results, see Table 3 at the end of this ASX Release.

The historical drill results use categories of mineralisation consistent with those defined in the 2012 JORC Code. These results confirm the presence of high-grade niobium and REE mineralisation, providing St George with a strong platform to expand the mineralised footprint at the Project with further drilling.

Click here for the full ASX Release

This article includes content from St George Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00