Soma Gold Corp. (TSXV: SOMA,OTC:SMAGF) (WKN: A2P4DU) (OTC: SMAGF) (the "Company" or "Soma") announces that production has recommenced at both the Cordero Mine and the El Bagre Gold Complex after 57 days of work stoppage as a result of the strike by unionized employees. Several systems at the mill require additional maintenance due to the prolonged stoppage, but this situation is being mitigated by additional leach capacity installed before the strike. Mine production will not be affected, but the processing plant will run at approximately 70% of full throughput until the end of November. The El Limon Mill is owned by a non-unionized subsidiary, but the production ramp-up depended on technical assistance and personnel from El Bagre, who were unavailable during the strike. The original ramp-up at El Limon was scheduled to be completed by the middle of December and has now been delayed until early January 2026.

Soma announces that, due to the disruption caused by the strike, 2025 gold production is expected to be reduced by approximately 5,000 ounces. This shortfall will impact both the third and fourth quarter revenue and profit. A further, though relatively minor, reduction in output may result from delays in the remediation of the El Bagre mill and the full commissioning of the El Limon Mill. However, these issues are anticipated to be resolved in the coming weeks, and the Company's 2026 production forecast remains unchanged.

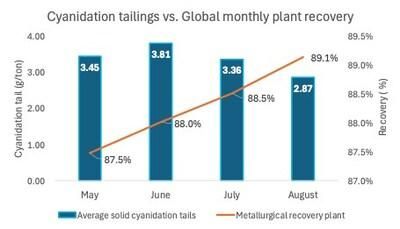

Soma also announces that commissioning of the new leach circuit and oxygen infusion system at the El Bagre processing plant was completed prior to the initiation of strike action by the union. The addition of this new tank increases gold recovery from 87.5% to 89.1%. This extra capacity is now helping to offset the impact of repairs to the damaged tank. The capital program took six months to complete at a cost of $475,000.

The new tank and agitator, combined with infused oxygen, ensure optimal dissolved oxygen levels, enhancing leaching kinetics and increasing residence time by approximately 30%. This upgrade provides improved leaching efficiency and greater metallurgical stability. Additionally, the added capacity enables the older leach tanks to be taken offline for routine preventative maintenance without impacting throughput.

Geoff Hampson, Soma CEO, states, "We are pleased to be back to work in Colombia and will address the various issues resulting from the processing plant shutdowns. We are confident that both mills will be operating at full capacity by early January 2026." Hampson further states, "Soma remains committed to enhancing operational efficiency and is investing in incremental improvements across all aspects of the operation. The payback on the investment in additional leach tank capacity is less than one year. For every 1% increase in recovery, based on current production levels and a gold price of US$3,800, approximately US$1 million in additional annual revenue is generated, which flows directly to the bottom line."

ABOUT SOMA GOLD

Soma Gold Corp. (TSXV: SOMA,OTC:SMAGF) is a profitable mining company focused on gold production and exploration. The Company owns over 43 sq. kilometers of mineral concessions following the prolific OTU fault in Antioquia, Colombia and two fully permitted mills located within 25 kilometers of each other, with a combined milling capacity of 675 tpd. The El Bagre Mill operates at 450 TPD, and the El Limon Mill is slated to restart operations in Q3 2025. Internally generated funds are being used to finance a regional exploration program.

With a solid commitment to sustainability and community engagement, Soma Gold Corp. is dedicated to achieving excellence in all aspects of its operations.

The Company also owns an exploration property near Tucuma, Para State, Brazil that is currently under option to Ero Copper Corp.

On behalf of the Board of Directors

"Geoff Hampson"

Chief Executive Officer and President

Forward-Looking Information and Cautionary Statements

This news release includes "forward-looking information" and "forward-looking statements" (collectively, "forward-looking information") within the meaning of applicable securities laws. Forward-looking information in this release may include, but is not limited to: statements regarding the anticipated restart of operations, the timing and sequencing of ramp-up activities, production expectations, workforce reintegration, and operational outcomes following the end of the strike.

Forward-looking information is based on a number of assumptions, including that labor relations will remain stable, restart preparations will proceed as planned, the Company will have access to necessary personnel, supplies, funding and infrastructure, and that external conditions (including regulatory, security, and market conditions) will remain supportive. There can be no assurance that these assumptions will prove to be correct.

Forward-looking information is subject to known and unknown risks, uncertainties, and other factors that may cause actual results to differ materially from those expressed or implied. These risks include, but are not limited to: risks related to labor relations and workforce availability, delays or difficulties in restarting production, operational and technical challenges, changes in permitting or regulatory conditions, fluctuations in commodity prices and exchange rates, political or community-related developments in Colombia, and general economic conditions.

Readers are cautioned not to place undue reliance on forward-looking information. The Company does not undertake to update or revise any forward-looking statements except as required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE Soma Gold Corp.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2025/14/c5375.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2025/14/c5375.html