- Snowline Gold doubles its Selwyn Basin, Yukon land holdings to roughly 254,000 ha through acquisition and staking

- Purchase of 10-property portfolio from StrikePoint Gold will add 7+ reduced intrusion related gold targets to Snowline's exploration pipeline

- Ongoing drilling continues to expand scale of high-density vein arrays on Rogue Project's Valley Zone, adding to the breadth, length and depth of zones known to host intense quartz vein mineralization.

Snowline Gold Corp. (CSE:SGD)(OTCQB:SNWGF) (the "Company" or "Snowline") is pleased to announce it has doubled its Selwyn Basin mineral tenure holdings to roughly 254,000 ha through targeted staking and an acquisition agreement for a large portfolio of Yukon Territory exploration assets from StrikePoint Gold Inc. (TSXV: SKP) ("StrikePoint"), an arm's length party. The acquired properties and certain blocks of the newly staked claims are considered by the Company to be prospective for reduced-intrusion related gold systems ("RIRGS") similar to its Valley Zone

"Our drill discoveries provide strong proof-of-concept for the gold potential of this part of the Selwyn Basin, particularly for reduced-intrusion related gold systems like Valley," said Scott Berdahl, CEO & Director of Snowline. "Our recent staking and the acquisition of the Yukon exploration property portfolio from StrikePoint Gold add significantly to our exploration pipeline. While our primary focus remains on our flagship Rogue and Einarson discoveries, these expansions add great depth to Snowline's exploration pipeline, giving shareholders the potential to participate in multiple future discoveries of this type."

STRIKEPOINT ACQUISITION

The Company has entered into an agreement with StrikePoint, whereby the Company will acquire 4,713 mineral claims from StrikePoint in exchange for (i) the payment of $500,000 in cash (the "Cash Consideration"), and (ii) the issuance of 500,000 common shares (the "Consideration Shares") of the Company (the "Acquisition").

The StrikePoint properties cover various geological targets prospective for gold. Most notably, the "Golden Oly" project covers a series of mid-Cretaceous aged felsic intrusions prospective for RIRGS mineralization. Limited historical work by previous operators encountered sheeted quartz vein arrays and surface grab samples of up to 19.2 g/t Au. These results have not yet been directly verified by the Company. Accompanying the mineral properties themselves is a historical exploration database including surface sampling (soil and rock) and extensive aerial magnetic data, providing the groundwork for planned initial exploration programs on these projects by Snowline.

The Consideration Shares issued in connection with the Acquisition are subject to a statutory hold period of four months and one day from the closing of the Acquisition, in accordance with applicable Canadian securities laws, and a contractual hold period of six months from the closing of the Acquisition.

There are no pressing claim maintenance costs for this property package. As carried over from a previous agreement, the mineral claims are subject to a 2% NSR and up to three milestone cash payments of $750,000 if total expenditures of $7,500,000, $15,000,000, and $25,000,000 are reached.

The Acquisition remains subject to acceptance by the Canadian Securities Exchange (the "CSE") and various closing conditions which are standard for such transactions.

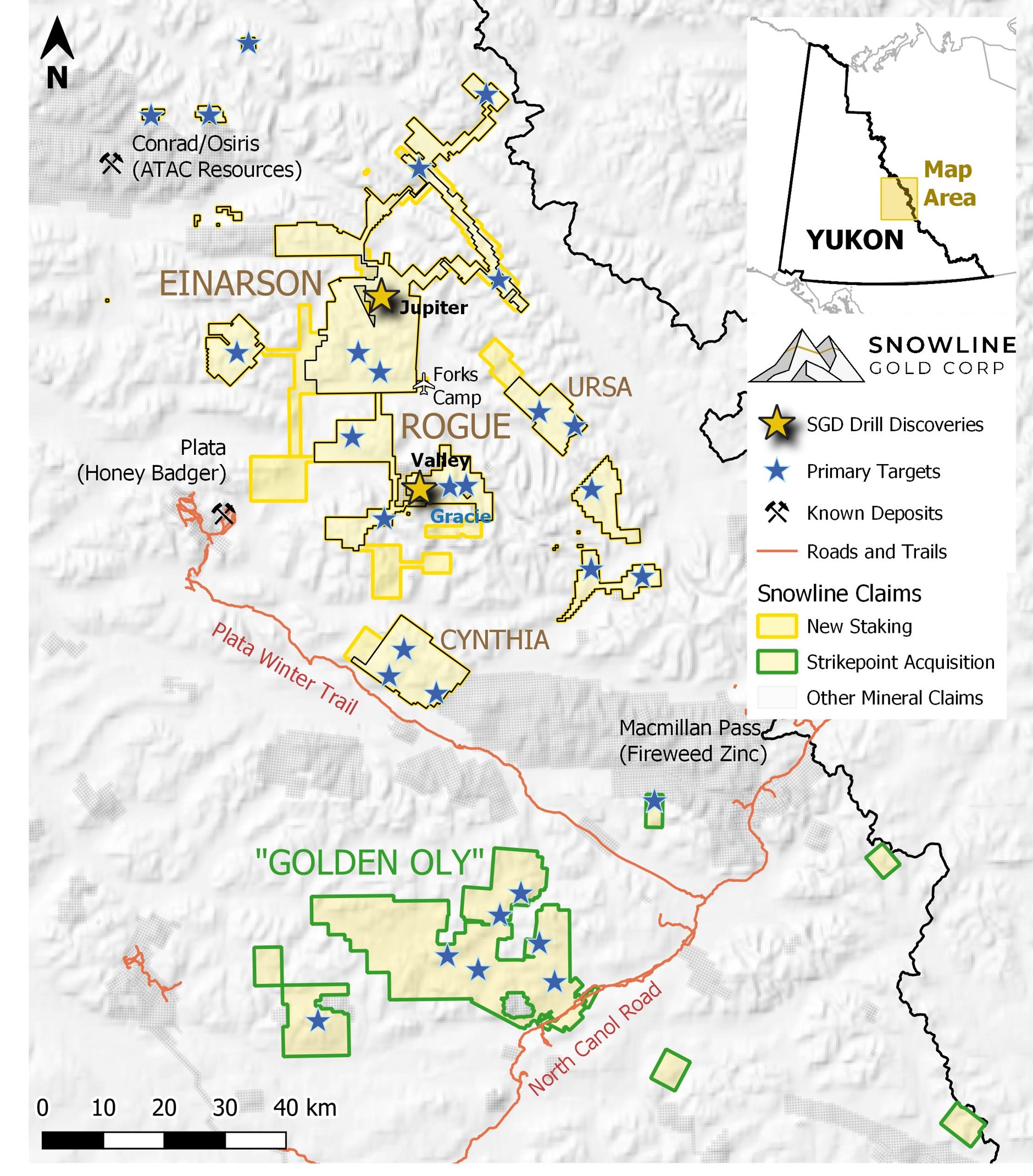

Figure 1 - Snowline Gold's expanded claim position following recent staking and Acquisition. Discoveries on Snowline's Rogue project led the Company to acquire a significant land package from StrikePoint Gold, believed to be prospective for a similar style of mineralization (reduced-intrusion related gold systems). The Company has also bolstered its existing land positions through extensive, targeted staking.

STAKING

In addition to the Acquisition, the Company has significantly expanded its Rogue, Einarson, Ursa, Rainbow and Cynthia projects through staking (Figure 1). Newly acquired areas were identified by the Snowline team as having elevated potential to host gold deposits based on geological, geochemical and geophysical information and based on the Company's evolving understanding of rocks and mineralization in this area through its surface and drill campaigns.

EXPLORATION UPDATE

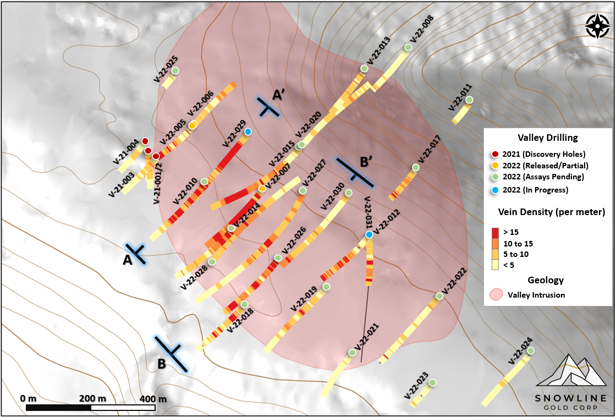

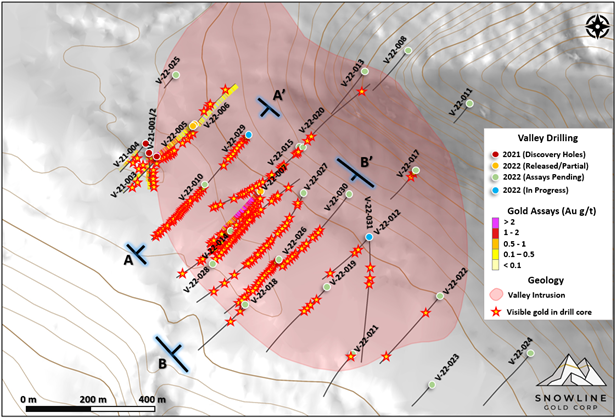

Ongoing drilling at Snowline's Valley Zone has encountered additional long intervals of high-density sheeted quartz veins, similar in character to that encountered in holes V-22-005 and V-22-007 (331.3 m @ 1.03 g/t Au including 192.0 m @ 1.52 g/t Au, and 282.9 m @ 2.30 g/t Au including 146.0 m @ 3.24 g/t Au, respectively; see Snowline news release dated August 24, 2022), and similar in character to other holes for which assays have yet to be received (Figure 2).

Drilling is ongoing at Valley, with 9,919 m drilled on the target so far this season for 10,718 m total drilled on the target to date. Assays for more than 22 holes drilled at Valley in 2022 remain pending, including assays for the bottom 31% of V-22-007. In total, this represents roughly 8,991 m of drilling (and counting), or 91% of the current season's results from the Valley Zone still to be reported.

At Gracie, trace instances of fine visible gold have been observed in bismuthinite bearing quartz veins in 4 of 5 holes. A total of 2,152 m has been drilled at Gracie, though drilling has yet to encounter the buried intrusion responsible for mineralization. Assays are pending for all holes at Gracie.

Figure 2 - Drilling progress at the Valley Zone, showing vein densities (top) and instances of visible gold alongside assays received to date (bottom). Roughly 91% of assays for the 2022 drill program have yet to be received, though observations of drill core demonstrate the presence of gold bearing vein system present at varying intensities across a 1,000 m by 800 m intrusion.

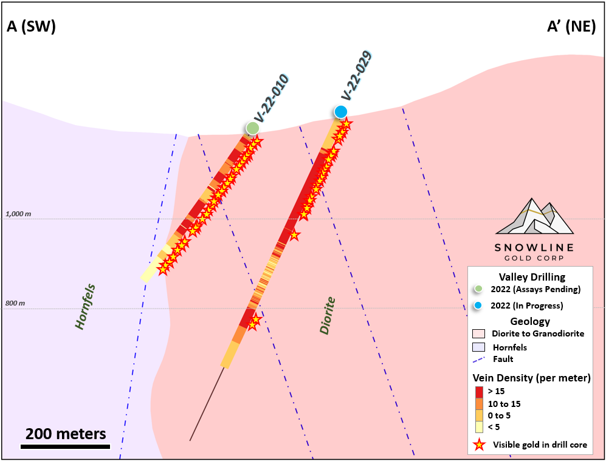

Figure 3 - Cross section showing vein densities and visible gold in V-22-010 and V-22-029. Hole V-22-029 encountered high quartz vein densities along with visible gold, expanding the known width and significantly expanding the known depth of mineralization. Note that the hole has not yet been surveyed, and thus true depth below surface is not yet known. View looks northwest along the strike of the system. The surface trace of the A to A' cross section shown can be seen in Figure 2.

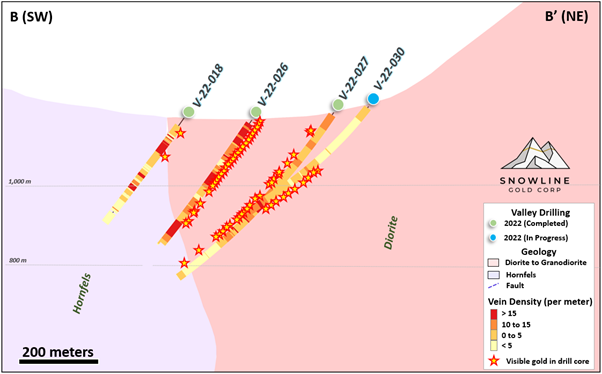

Figure 4 - Cross section showing vein densities and visible gold in V-22-018, 026, 027 and 028. View looks northwest along the strike of the system. Note that V-22-027 is projected onto the section from behind; the surface trace of the B to B' cross section shown can be seen in Figure 2.

Figure 5 - Quartz vein mineralization in V-22-026, from surface to 33.6 m downhole. Intense quartz vein mineralization begins at bedrock surface, accompanied by abundant trace instances of visible gold (marked by orange flags above core). Assays for this hole are pending.

Figure 6 - Quartz vein mineralization in V-22-029, from 127.7 m to 152.7 m downhole. The hole encountered high density quartz veining father to the northeast than expected, locally expending the width of the high-density central vein corridor. Moderate to high vein densities farther down hole appear to extend the known depth of the system well below previous depths of 430 m below surface (as encountered in V-22-015, assays pending). Instances of visible gold are marked by orange flags above core. Assays for this hole are pending.

ABOUT ROGUE

The geological setting and style of mineralization at Rogue's Valley Zone indicate the presence of a bulk tonnage gold target, with similarities to Kinross's Fort Knox Mine in Alaska and Victoria Gold's Eagle Mine in the Yukon. Gold is associated with bismuthinite and telluride minerals hosted in sheeted quartz vein arrays along the margins of a mid-Cretaceous aged Mayo-series intrusion. The Rogue Project hosts multiple intrusions of similar age and affinity to that at Valley along with widespread gold anomalism in stream sediment, soil and rock samples. The project is thus considered by the Company to have district-scale prospectivity for reduced-intrusion related gold systems.

Valley is an early-stage exploration project without a mineral resource estimate, and the presence or absence of an economically viable orebody cannot be determined until significant additional work is completed.

ABOUT Snowline Gold Corp.

Snowline Gold Corp. is a Yukon Territory focused gold exploration company with a seventeen-project portfolio covering >254,000 ha. The Company is exploring its flagship >111,000 ha Einarson and Rogue gold projects in the highly prospective yet underexplored Selwyn Basin. Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits including Kinross' Fort Knox mine, Newmont's Coffee deposit, and Victoria Gold's Eagle Mine. The Company's first-mover land position and extensive database provide a unique opportunity for investors to be part of multiple discoveries and the creation of a new gold district.

QUALIFIED PERSON

Information in this release has been prepared under supervision of and approved by J. Scott Berdahl, M.Sc., P. Geo., CEO and Director for Snowline and a Qualified Person for the purposes of National Instrument 43-101.

ON BEHALF OF THE BOARD

Scott Berdahl

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

info@snowlinegold.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements regarding the completion of the Acquisition, including CSE acceptance, payment of the Cash Consideration and the issuance of the Consideration Shares, newly staked targets being considered by the Company to be prospective for RIRGS and/or gold, the potential to participate in multiple future discoveries, newly acquired areas having elevated potential to host gold deposits, the Rogue project having district-scale prospectivity, the creation of a new gold district and the Company's future plans and intentions. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

SOURCE: Snowline Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/716688/Snowline-Gold-Doubles-Yukon-Mineral-Holdings-With-Acquisition-Of-Nearby-Project-Portfolio-And-Provides-Exploration-Update