July 14, 2024

Siren Gold Limited (ASX: SNG) (Siren or the Company) is pleased to announce that it has entered into a definitive agreement regarding a A$20m transaction for a sale of the Reefton Project.

Highlights

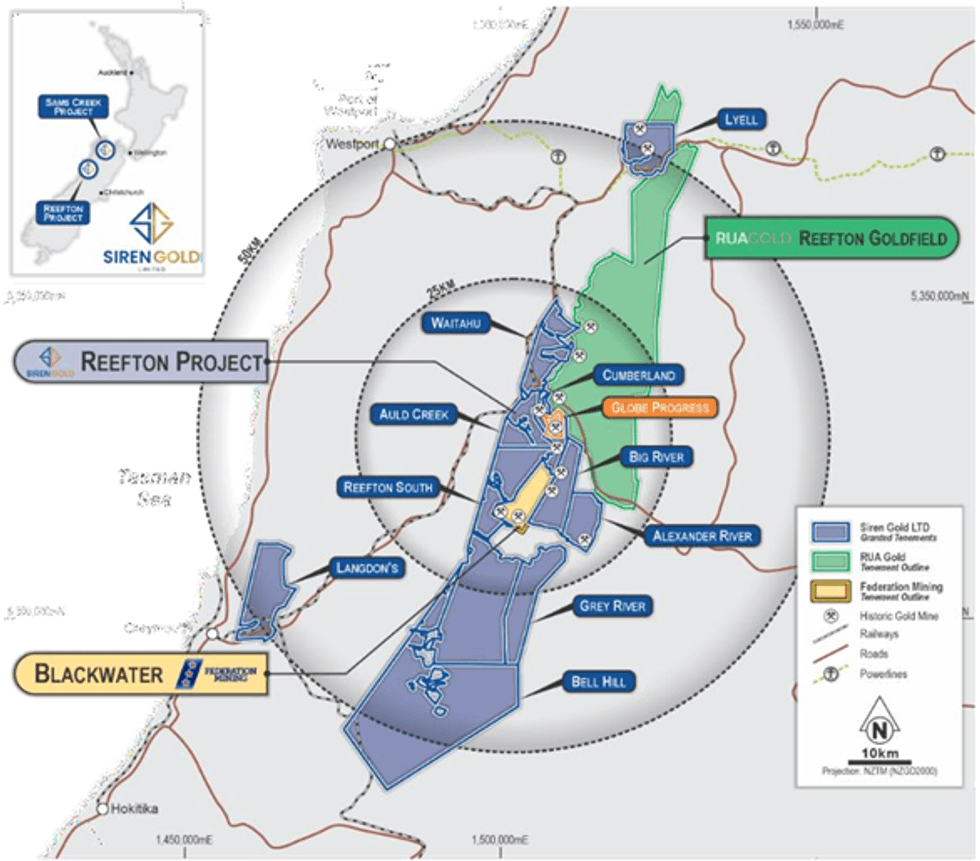

- Siren has entered into a definitive agreement with Canadian listed RUA Gold Inc. (CSE:RUA) for the sale of the Reefton Project to consolidate the Reefton Goldfield.

- This transaction will create the largest gold explorer on the Reefton Goldfield on the West Coast mining district of New Zealand’s South Island.

- The transaction will create the largest tenement package of 1,242km2, on the high-grade Reefton Goldfield that has produced +2Moz at 15.8 g/t Au.

- The proposed transaction is for RUA to acquire Siren’s 100% owned subsidiary, Reefton Resources Pty Ltd (NZ), with the key outcomes being:

- RUA to acquire the Reefton Project for A$20m, comprising A$2m in cash and A$18m in RUA shares.

- Siren Chairman Mr Brian Rodan will join the RUA Board on completion of the transaction.

- Acquisition price of A$45/oz, based on Reefton’s current 444,000 oz inferred Mineral Resource Estimate (MRE)2.

- Post transaction, Siren will hold approximately 30.2% of RUA’s common shares outstanding, maintaining a significant interest in the Reefton project as well as acquiring an interest in the high-grade Glamorgan Project in the North Island of New Zealand.

- Siren will retain the Sam’s Creek Project with a current MRE of 824koz @ 2.8g/t Au and remain listed on the ASX (Refer Table 1).

- The total consideration equates to approximately A$0.10 per issued share of Siren, which represents a 28.4% premium over Siren’s closing share price on 12 July 20241.

- Post transaction Siren will have cash and investments of over $20m, representing 10cps per SNG share, and it will focus on the Sam’s Creek Project, which currently has a MRE of 824koz of gold and a pending mining permit application, whilst shareholders will remain invested in Reefton through the RUA shareholding.

- The transaction is subject to customary conditions and approvals such as shareholder and regulatory approvals and is expected to close in Q4 2024.

Consolidation of the Reefton Goldfield

Siren Gold Limited (ASX: SNG) (“Siren” or the “Company”) is pleased to announce that it has entered into a definitive agreement dated 14 July 2024 (the “Definitive Agreement”) with Reefton Acquisition Corp., a wholly owned subsidiary of Canadian Securities Exchange listed RUA Gold Inc. (“RUA”), whereby RUA will acquire 100% of the capital of Reefton Resources Pty Ltd. (“Reefton Resources”), a wholly owned subsidiary of the Company, for A$20 million in cash and shares of RUA (the “Transaction”). Reefton Resources owns 100% of the tenements that comprise Siren’s Reefton Project.

The Transaction, expected to be completed in November 2024, provides Siren with a cash payment of $2 million and $18 million in common shares of RUA (the “RUA Shares”). Following completion of the Transaction, Siren would own approximately 30.2% of the current estimated issued and outstanding RUA Shares. The Transaction eliminates the need for a potentially dilutive near-term equity raising to continue exploration at Reefton, while retaining continued ownership and upside in the expansion and future development of the Reefton Project.

The Transaction will establish RUA as the dominant landholder in the region, with approximately 1,242km2 of tenements in the historical Reefton Goldfield. Following completion of the Transaction, RUA will be well positioned as the pre-eminent gold explorer on the Reefton Goldfield in New Zealand, with a pro forma market capitalisation of approximately C$60 million (A$64.9 million)2. Combining properties and exploration activities in the Reefton Goldfield provides a number of strategic benefits, including:

i. Consolidation of the tenement package, creating the dominant Reefton Goldfield explorer

ii. Significant project synergies for mine development and a central processing hub

iii. Larger exploration programs with more consistent news flow

iv. Combines mine permitting and expedites eventual project construction

v. Combined company best positioned to further consolidate the Reefton Goldfield

vi. Siren retains upside in exploration and development of a consolidated Reefton

vii. Siren will be able to focus on exploration and development at Sams Creek

viii. RUA will be focused on exploration and development of the combined Reefton belt

Siren Managing Director and CEO, Victor Rajasooriar commented:

“Siren’s vision for the Reefton region has been to create a significant high grade gold producer with a central processing facility fed by numerous underground mines. This transaction is a significant step in realising this vision and a great outcome for Siren shareholders. Siren can focus on the multi-million-ounce potential at Sams Creek while RUA can continue to explore the consolidated Reefton Project. This transaction is at a ~3.8x premium EV/ Resource multiple compared to Siren’s current share price and will enable Siren to fast-track Resource growth at Sams Creek, while RUA can fast-track gold and antimony Resource growth at Reefton. New Zealand is open for business and this partnership with RUA allows Siren to fast-track exploration and development of its asset base.”

RUA CEO, Robert Eckford commented:

“The transaction between RUA and Siren Gold is a significant step in RUA becoming the largest tenement holder of the highly prospective Reefton Goldfield district, home to host rocks with high-grade gold and antimony. This transaction is a natural fit for our portfolio and creates the opportunity for real synergies, which, in combination with local knowledge, sets us for a rapid re-rating from further exploration success and resource delineation across the combined land package.”

Click here for the full ASX Release

This article includes content from Siren Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SNG:AU

The Conversation (0)

18 March 2024

Siren Gold

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District Keep Reading...

6h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

6h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

04 March

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00