Fully-Funded 4,000 Meter Program with Planned Upsize to Boost High-Grade Silver and Critical Minerals

Silver47 Exploration Corp. (TSXV: AGA) (OTCQB: AAGAF) ("Silver47" or the "Company") is pleased to announce the commencement of a fully-funded drill program at Silver47's wholly-owned Red Mountain VMS Project in south-central Alaska.

Highlights

Drilling Commences at Red Mountain: A core drilling rig is now fully operational at the Red Mountain project in Alaska, actively advancing the first hole of Silver47's 2025 summer exploration program.

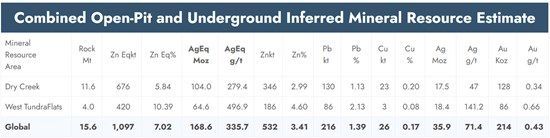

Targeting High-Impact Resource Growth: The program focuses on expanding the inferred 168.6 million silver equivalent ounce resource (336 g/t AgEq*) at Dry Creek and West Tundra Flats (see Table 1), where previous drilling by Silver47 and prior operators indicates significant expansion potential.

High-Grade Precious Metals Potential: The 2025 program targets untested areas near historical high-grade intercepts, prioritizing areas richer in silver and gold to enhance Red Mountain's resource base.

Strategic Critical Minerals Focus: Red Mountain hosts five critical minerals scarce in the U.S., including zinc, copper, tin, antimony and gallium, which will be evaluated during this program to support domestic supply chain security.

Upsized Program on the Horizon: Closing of Summa Silver's oversubscribed $6.9 million subscription receipt financing was completed on June 17th, paving the way for a substantial expansion of the current drilling campaign when the Silver47 and Summa Silver merger is complete.

Gary Thompson, CEO of Silver47, stated: "We are excited to kick off a significant drill program at our Red Mountain silver-gold-rich VMS project with a view to expanding the resource base and making new discoveries. The results from previous drill holes, including DC24-106, WT24-33 and DC18-77, demonstrate the robust nature of the Bonnifield district, where Red Mountain is located, and we are eager to build on these successes. This year is shaping up to be transformational for the Company with a full season of drilling and the pending merger with Summa Silver."

Highlights from Previous Drilling (see news releases dated November 21 and 26, 2024 and February 12, 2025):

- DC24-104: 15.24 m grading 546 g/t AgEq* plus 290 g/t antimony ("Sb") and 32 g/t gallium ("Ga") from 14.3 m depth

(AgEq: 106 g/t silver, 0.45 g/t gold, 6.4% zinc, 2.2% lead, and 0.19% copper)

- DC24-105: 22.32 m grading 601 g/t AgEq plus 503 g/t Sb and 54 g/t Ga from 18.9 m

(AgEq: 150.6 g/t silver, 0.82 g/t gold, 5.9% zinc, 2.6% lead, and 0.13% copper)

- WT24-33: 2.90 m grading 1,079 g/t AgEq plus 920 g/t Sb and 15 g/t Ga from 121.70 m depth

(AgEq: 418 g/t silver, 0.74 g/t gold, 9.1% zinc, 4.7% lead, 0.105% copper)

- DC18-77: 4.26 m grading 2,003 g/t AgEq plus 4,432 g/t Sb and 97 g/t Ga 168.8 m depth

(AgEq: 1,435 g/t silver, 2.2 g/t gold, 4.8% zinc, 2.3% lead, 0.5% copper)

*Notes: g/t=grams per tonne; AgEq=silver equivalent; ZnEq=zinc equivalent; m=metres; Ag=silver; Au=gold; Cu=copper; Zn=zinc; Pb=lead; 1ppm=1 g/t. Equivalencies are calculated using ratios with metal prices of US$2,750/tonne Zn, US$2,100/tonne Pb, US$8,880/tonne Cu, US$1,850/oz Au, and US$23/oz Ag and metal recoveries are based on metallurgical work returned of 90% Zn, 75% Pb, 70% Cu, 70% Ag, and 80% Au. Silver Equivalent (AgEq g/t) = [Zn (%) x 47.81] + [Pb (%) x 30.43] + [Cu (%) x 119] + [Ag (g/t) x 1] + [Au (g/t) x 91.93]

Figure 1. Dorado Drilling at the 2025 season's first drill hole at the Red Mountain Project.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10967/255876_16e7ead07418ca15_002full.jpg

Figure 2. Map of the Dry Creek and West Tundra Flats Deposits.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10967/255876_16e7ead07418ca15_003full.jpg

Table 1: Combined Open Pit and Underground Inferred Mineral Resource Estimate for the Red Mountain Project, Alaska

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10967/255876_16e7ead07418ca15_004full.jpg

- The 2024 Red Mountain MRE was estimated and classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum ("CIM") "Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines" dated November 29, 2019, and the CIM "Definition Standards for Mineral Resources and Mineral Reserves" dated May 10, 2014.

- Mr. Warren Black, M.Sc., P.Geo. of APEX Geoscience Ltd., a QP as defined by NI 43-101, is responsible for completing the 2024 Mineral Resource Estimate, effective January 12, 2024.

- Mineral resources that are not mineral reserves have not demonstrated economic viability. No mineral reserves have been calculated for Red Mountain. There is no guarantee that any part of the mineral resources discussed herein will be converted to a mineral reserve in the future.

- The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, market, or other relevant factors.

- The quantity and grade of reported Inferred Resources is uncertain, and there has not been sufficient work to define the Inferred Mineral Resource as an Indicated or Measured Mineral Resource. It is reasonably expected that most of the Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- All figures are rounded to reflect the relative accuracy of the estimates. Totals may not sum due to rounding. Reported grades are undiluted.

- A standard density of 2.94 g/cm³ is assumed for mineralized material and waste rock. Overburden density is set at 1.8 g/cm³. For mineralized material blocks with iron assays close enough to estimate an iron value for the block, density is calculated using the formula: density (g/cm³) = 0.0553 * Fe (%) + 2.5426.

- Metal prices are US$2,750/tonne Zn, US$2,100/tonne Pb, US$8,880/tonne Cu, US$1,850/oz Au, and US$23/oz Ag.

- Recoveries are 90% Zn, 75% Pb, 70% Cu, 70% Ag, and 80% Au.

- ZnEQ (%) = [Zn (%) x 1] + [Pb (%) x 0.6364] + [Cu (%) x 2.4889] + [Ag (ppm) x 0.0209] + [Au (ppm) x 0.1923]

- AgEQ (ppm) = [Zn (%) x 47.81] + [Pb (%) x 30.43] + [Cu (%) x 119] + [Ag (ppm) x 1] + [Au (ppm) x 91.93]

- Open-pit resource economic assumptions are US$3/tonne for mining mineralized and waste material, US$19/tonne for processing, and 48° pit slopes.

- Underground resource economic assumptions are US$50/tonne for mining mineralized and waste material and US$19/tonne for processing.

- Open-pit resources comprise blocks constrained by the pit shell resulting from the pseudoflow optimization using the open-pit economic assumptions.

- Underground resources comprise blocks below the open-pit shell that form minable shapes. They must be contained in domains of a minimum width of 1.5 m at Dry Creek or 3 m height at West Tundra Flats. Resources not meeting these size criteria are included if, once diluted to the required size, maintain a grade above the cutoff.

- Global AgEq calculated using component metal grades: 3.41% Zn, 1.39% Pb, 0.17% Cu, 71.4 g/t Ag, 0.43 g/t Au.

Red Mountain Project Overview

Red Mountain, situated in south-central Alaska, is a high-grade volcanogenic massive sulfide (VMS) deposit wholly owned by Silver47 Exploration Corp. Hosted within the Devonian to Mississippian-aged Totatlanika Schist, the deposit comprises submarine volcanic and volcaniclastic rocks, primarily felsic to intermediate tuffs and flows, ideal for VMS mineralization. The project hosts an inferred resource of 168.6 million silver equivalent ounces at 336 g/t AgEq across the Dry Creek and West Tundra Flats deposits, with high-grade silver, gold, zinc, lead, and copper as reported in the NI 43-101 Technical Report dated January 12, 2024. Of particular importance, both Dry Creek and West Tundra Flats remain open to expansion. Beyond precious and base metals, Red Mountain contains critical minerals-antimony, gallium, zinc, copper, and tin-scarce in the U.S., supporting national supply chain security goals.

The broader Red Mountain property, spanning over 630 square kilometers, remains substantially underexplored. Airborne magnetic and electromagnetic surveys have identified multiple untested targets within the Totatlanika Schist's favorable stratigraphy. These targets, coupled with coincident high-grade mineralized rock samples and anomalous soil geochemistry, suggest strong potential for discovering additional VMS and sedimentary exhalative deposits across the property, positioning Red Mountain as a district-scale opportunity.

Qualified Person

Mr. Alex S. Wallis, P.Geo., is Vice President of Exploration for Silver47 who is a "qualified person" as defined by National Instrument 43-101. Mr. Wallis has verified the data disclosed in this press release, including the sampling, analytical and test data underlying the technical information and has approved the technical information in this press release.

About Silver47 Exploration

Silver47 Exploration Corp., wholly-owns three silver and critical metals (polymetallic) exploration projects in Canada and the US. These projects include the flagship Red Mountain Project in southcentral Alaska, a silver-gold-zinc-copper-lead-antimony-gallium VMS-SEDEX project. The Red Mountain Project hosts an inferred mineral resource estimate of 15.6 million tonnes at 7% ZnEq or 335.7 g/t AgEq, totaling 168.6 million ounces of silver equivalent, as reported in the NI 43-101 Technical Report dated January 12, 2024. The Company also owns the Adams Plateau Project in southern British Columbia, a silver-zinc-copper-gold-lead SEDEX-VMS project, and the Michelle Project in the Yukon Territory, a silver-lead-zinc-gallium-antimony MVT-SEDEX project. For detailed information regarding the resource estimates, assumptions, and technical reports, please refer to the NI 43-101 Technical Report and other filings available on SEDAR+ at www.sedarplus.ca. The Company trades on the TSXV under the ticker symbol AGA and OTCQB under the ticker symbol AAGAF.

For more information about the Company, please visit www.silver47.ca and see the Technical Report filed on SEDAR+ (www.sedarplus.ca) and titled "Technical Report on the Red Mountain VMS Property Bonnifield Mining District, Alaska, USA with an effective date January 12, 2024, and prepared by APEX Geoscience Ltd."

Silver47 Contact Information

Mr. Gary R. Thompson

Director and CEO

gthompson@silver47.ca

For investor relations

Kristina Pillon

info@silver47.ca

604.908.1695

X: @Silver47co

LinkedIn: Silver47

No securities regulatory authority has either approved or disapproved of the contents of this release. Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENTS

This release contains certain "forward-looking statements" and certain "forward-looking information" as defined under applicable Canadian securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as "may", "will", "expect", "intend", "estimate", "upon" "anticipate", "believe", "continue", "plans" or similar terminology. Forward-looking statements and information include, but are not limited to: closing of the Offering, including the number of Units and FT Units issued in respect thereof; anticipated use of proceeds; expected closing date of the Offering; payment of finder's fees; ability to obtain all necessary regulatory approvals; insider participation in the Offering; the statements in regards to existing and future products of the Company; and the Company's plans and strategies. Forward-looking statements and information are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that, while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of the Company to control or predict, that may cause the Company's actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including but not limited to: the ability to close the Offering, including the time and sizing thereof, the insider participation in the Offering and receipt of required regulatory approvals; the use of proceeds not being as anticipated; the Company's ability to implement its business strategies; risks associated with general economic conditions; adverse industry events; stakeholder engagement; marketing and transportation costs; loss of markets; volatility of commodity prices; inability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favourable terms; industry and government regulation; changes in legislation, income tax and regulatory matters; competition; currency and interest rate fluctuations; and the additional risks identified in the Company's financial statements and the accompanying management's discussion and analysis and other public disclosures recently filed under its issuer profile on SEDAR+ and other reports and filings with the TSXV and applicable Canadian securities regulators. The forward-looking information are made based on management's beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws.

No forward-looking statement can be guaranteed, and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/255876