November 22, 2023

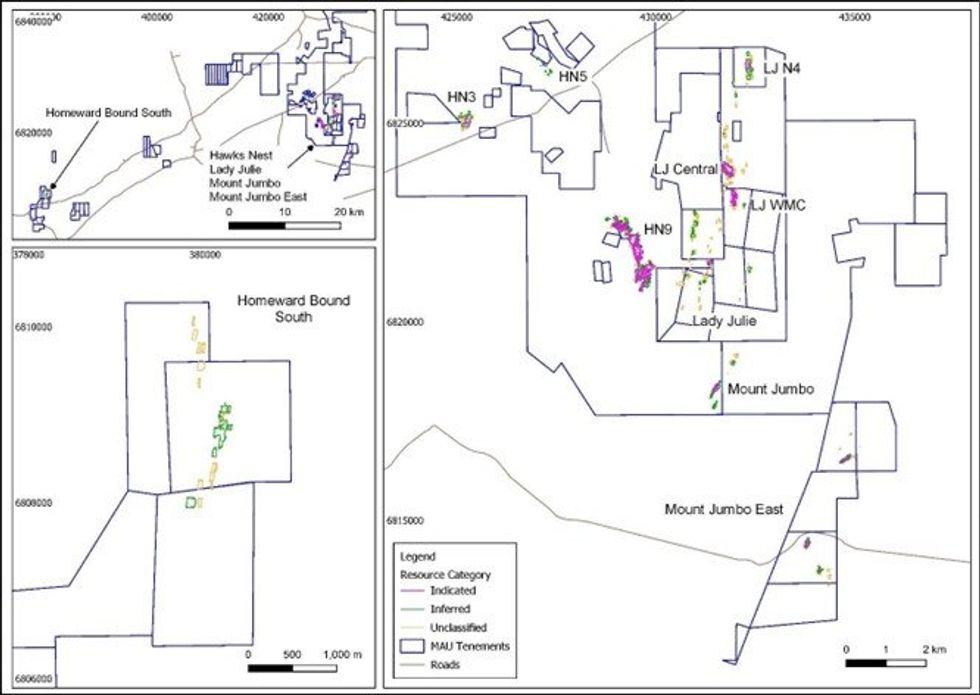

Magnetic Resources NL (Magnetic or the Company) is pleased to announce an Updated Mineral Resource Estimates from its deposits in the Laverton and Homeward Bound area. The main deposits include Hawks Nest 9 (HN9), Lady Julie Central (LJC), Lady Julie North 4 (LJN4), Mount Jumbo and Homeward Bound South, which are all located in an area with well-endowed regional infrastructure including three processing plants within 35kms.

HIGHLIGHTS

- This update incorporates recent drilling results at Lady Julie North 4 (LJN4) and Lady Julie Central (LJC) since the last resource report in February 2023 (“Expands Mineral Resources estimate ASX release 3 February 2023”).

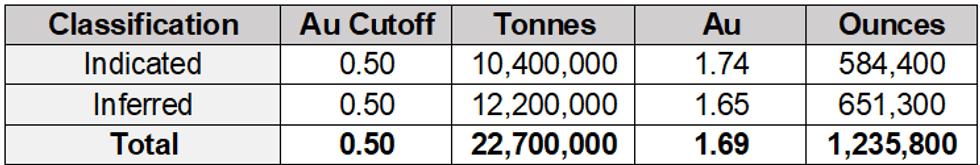

- Updated combined Mineral Resources estimate for the whole project area of:

- 22.7Mt @ 1.69g/t Au totaling 1.24Moz of gold at 0.5g/t cutoff.

- Increase of 107% of the total ounces over the 3 February 2023 ASX Release.

- Significantly, the contained gold in LJN4 has risen from 204,000oz to 852,000oz Au (a 317% increase).

- LJN4 is now by far the largest resource in the project area – and it remains open at depth; exploration continues for similar deposits along the extensive 12km Chatterbox shear.

- Key deposits are close to each other and form part of one mining field.

- Three processing plants are nearby, within 10km - 35km away providing scope for toll processing. Given the scale of the resource upgrade, consideration is now also being given to a dedicated processing plant.

- Ongoing extension drilling continues and is expected to result in further resource increases.

The update follows extensive infill and down-dip drilling mainly at LJN4 and some at LJC.

The verification and reporting of Mineral Resources on behalf of the Company was completed by its JORC Competent Person, Mr M Edwards of Blue Cap Mining. The Mineral Resources Estimate has been prepared and reported in accordance with the 2012 Edition of the JORC Code.

Total Mineral Resources reported for the Laverton and Homeward Bound South projects is now 22.7Mt @ 1.69g/t Au at 0.5g/t cut-off totaling 1,236,000oz of gold (See Table 1 below). The cutoff grade is considered appropriate for a large-scale open pit operation.

Managing Director George Sakalidis commented:

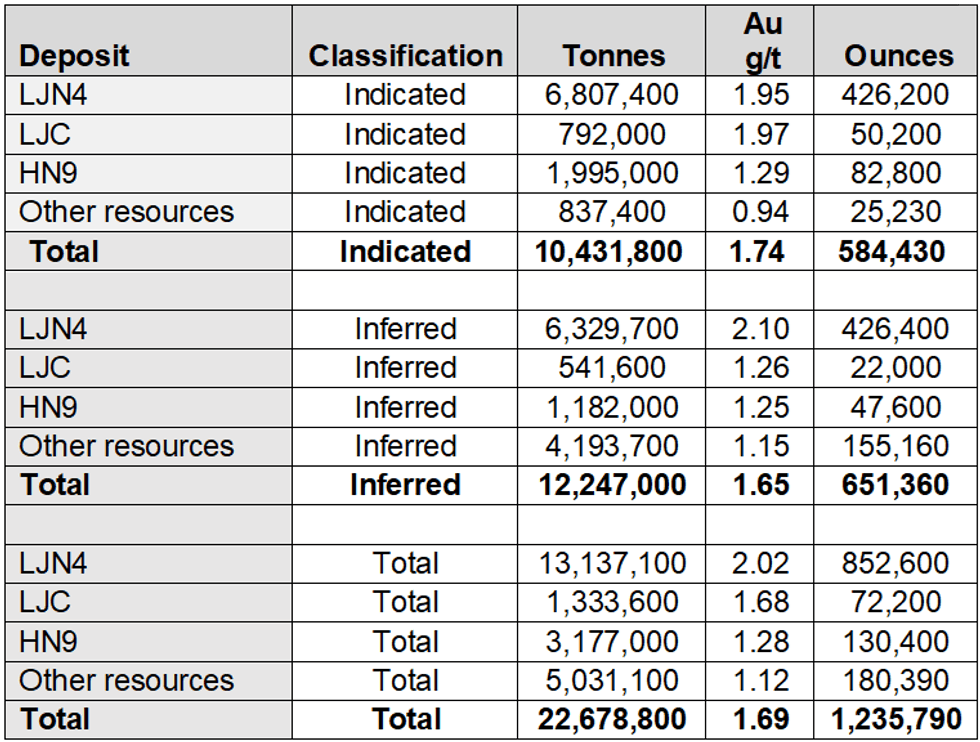

“The Lady Julie North 4 Resource has been the prime drilling focus as reported in periodic releases to the ASX. It has multiple stacked lodes with a number of thick intersections that have not been closed off at depth. The initial deeper drilling started on the 25 January 2023 and has expanded in subsequent months to a 95-hole RC program for 16,356m. Drilling is continuing, with holes in excess of 400m depth, which is expected to increase the current resource at LJN4 of 13.1Mt at 2.02g/t for 852,000oz at a 0.5g/t cut off (Table 2).

This LJN4 deposit sits within a regional structure called the Chatterbox Shear Zone that extends over a 12km length within the Magnetic tenements. This shear extends southwards of LJN4 and has had initial AC and RC drilling completed and some anomalous intersections that will be followed up with some shallow RC drilling for the purpose of finding further gold deposits.

Drilling in the last 6 months included diamond drill holes for geotechnical evaluation of proposed pits, and for hydrology analysis. Project environmental, heritage and technical background studies are close to completion – optimisation and pit design has commenced on LJC and the expanded LJN4 – the aim is to prepare and submit a Mining Proposal in early 2024. Other strategic opportunities are also being investigated”.

The Table below summarises the updated Total Mineral Resource at a 0.5g/t Au cutoff (Table 1), with Table 2 providing details of the major resources. Details for the smaller resources which have not changed can be found in the 3 February 2023 ASX release.

The key deposits that have been drilled in the last six months are LJC and LJN4, which are shown in Table 2 and are further summarised below:

LJC Resource

The LJC (Indicated and Inferred) Resource of 1.33Mt at 1.68g/t Au for 72,200oz is 350m by 200m in plan (Figure 2). 59% of the resource falls in the Indicated category. There are some thicker intersections including a number of intersections that start from surface (Figure 3 a, b and c). The long section (Figure 4) shows a thickened, near surface zone which gently plunges to the south-east forming two distinct zones.

Click here for the full ASX Release

This article includes content from Magnetic Resources NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MAU:AU

The Conversation (0)

13 December 2023

Magnetic Resources NL

An Exciting Gold Development Play in Western Australia

An Exciting Gold Development Play in Western Australia Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00