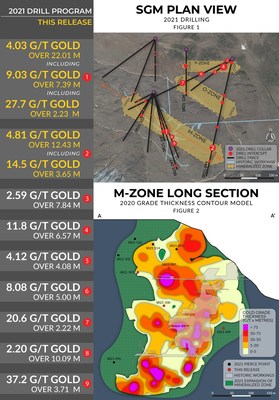

Scottie Resources Corp. (" Scottie " or the " Company ") (TSXV: SCOT) (OTCQB: SCTSF) (FSE: SR8), is pleased to report drill assays from its Scottie Gold Mine (SGM) target where multiple holes intersected high-grade gold mineralization on its targeting of additional ore shoots around the past-producing mine. Strong intercepts, including 9.0 gt over 7.39 metres illustrate the expansion potential of near mine mineralization. The high-grade mine operated in the early 1980's with a cut-off grade of 10 gt gold, leaving substantial upside for additional expansion. The Scottie Gold Mine is located on the Granduc Road, 20 kilometres north of the Ascot Resources Premier Mill, and 35 north of the town of Stewart, BC .

"Strong intercepts continue to underpin our belief that the near mine exploration of the Scottie Gold Mine has the potential to develop a substantial high-grade resource adjacent to existing mine underground workings." comments President and CEO, Brad Rourke . "Drilling around this underexplored deposit and the ability to leverage the existing historic data, offers us tremendous value on our path towards defining a road accessible 1M+ ounce resource."

Table 1: Selected results from new drill assay (uncut) from the Scottie Gold Mine Project.

| Drill Hole | | From (m) | To (m) | Width* (m) | Gold (g/t) | Silver (g/t) |

| SR21-097 | | 201.76 | 223.77 | 22.01 | 4.03 | 1.68 |

| including | 201.76 | 204.70 | 2.94 | 5.36 | 2.72 | |

| and | 216.38 | 223.77 | 7.39 | 9.03 | 3.08 | |

| including | 216.38 | 218.61 | 2.23 | 27.7 | 17.9 | |

| and | 234.24 | 235.25 | 1.01 | 2.40 | 7.00 | |

| SR21-099 | | 9.37 | 20.00 | 10.63 | 2.54 | 4.68 |

| and | 207.45 | 210.96 | 3.51 | 2.16 | 5.33 | |

| and | 294.80 | 296.80 | 2.00 | 4.24 | 2.00 | |

| and | 414.37 | 426.80 | 12.43 | 4.81 | 5.28 | |

| including | 414.37 | 418.02 | 3.65 | 14.5 | 15.1 | |

| SR21-100 | | 274.04 | 275.04 | 1.00 | 6.68 | 10.0 |

| and | 281.09 | 282.09 | 1.00 | 5.00 | 7.00 | |

| and | 348.50 | 351.00 | 2.50 | 5.56 | 10.8 | |

| SR21-103 | | 182.63 | 183.60 | 0.97 | 8.89 | 0.00 |

| SR21-124 | | 67.70 | 68.54 | 0.84 | 7.53 | 8.00 |

| * True thicknesses of mineralized intercepts are undetermined |

About the Scottie Gold Mine

The Scottie Gold Mine, which operated between 1981 to 1985, produced 95,426 gold ounces from 183,147 tonnes at an average recovered grade of 16.2 g/t gold. The mine ultimately shut down due to a drop in gold price combined with high-interest rates. Mineralization consists of east-west to northwest trending, steeply dipping, shear veins, that are comprised of pyrrhotite > pyrite ± quartz ± calcite. The veins are hosted in a package of andesitic volcanic rocks from the Hazelton Unuk River Formation that are situated adjacent to the contact with the Summit Lake stock, part of the Texas Creek Plutonic Suite. While 13 distinct gold-bearing vein zones have been identified on the Scottie Gold Mine Project, mine production was primarily from one vein (the M-zone).

Historical drilling of the Scottie Gold Mine was largely focused on mine production, with little work done on proving up substantial resources. The majority of historical drilling was done from underground, and therefore consisted of short holes with single targets – with very restricted drill pad locations. Recent exploration by Scottie has used the benefits of drilling from surface to target areas that were inaccessible with underground drill locations, and where possible to test multiple targets with individual holes. The Scottie Gold Mine is located on the Granduc Road, 20 km north of the Ascot Resources' Premier Project, which is in the process of refurbishing their mill in anticipation of production in Q1 2023 ( December 7, 2021 ). It is also located 25 km south of the Brucejack Mine that was the main asset acquired by Newcrest Mining Limited for $3.5 billion in its acquisition of Pretium Resources.

Quality Assurance and Control

Results from samples during the 2021 field season were analyzed at either ALS Laboratory in Vancouver, BC or at SGS Minerals in Burnaby, BC . The sampling program was undertaken under the direction of Dr. Thomas Mumford . A secure chain of custody is maintained in transporting and storing of all samples. Gold was assayed using a fire assay with atomic absorption spectrometry and gravimetric finish when required (+9 g/t Au). Analysis by four acid digestion with multi-element ICP-AES analysis was conducted on all samples with silver and base metal over-limits being re-analyzed by emission spectrometry.

Thomas Mumford , Ph.D., P.Geo and VP Exploration of Scottie, a qualified person under National Instrument 43-101, has reviewed the technical information contained in this news release on behalf of the Company.

ABOUT Scottie Resources Corp.

Scottie owns a 100% interest in the high-grade, past-producing Scottie Gold Mine and Bow properties and has the option to purchase a 100% interest in Summit Lake claims which are contiguous with the Scottie Gold Mine property. Scottie also owns 100% interest in the Georgia Project which contains the high-grade past-producing Georgia River Mine , as well as the Cambria Project properties and the Sulu property. Altogether Scottie Resources holds more than 52,000 ha of mineral claims in the Stewart Mining Camp in the Golden Triangle.

The Company's focus is on expanding the known mineralization around the past-producing mines while advancing near mine high-grade gold targets, with the purpose of delivering a potential resource. The Company's focus is on expanding the known mineralization around the past-producing mine while advancing near mine high-grade gold targets, with the purpose of delivering a potential resource.

All of the Company's properties are located in the area known as the Golden Triangle of British Columbia which is among the world's most prolific mineralized districts.

Forward Looking Statements

This news release may contain forward–looking statements. Forward looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Although the Company believes the expectations expressed in such forward–looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in forward looking statements. Forward–looking statements are based on the beliefs, estimates and opinions of the Company's management on the date such statements were made. The Company expressly disclaims any intention or obligation to update or revise any forward–looking statements whether as a result of new information, future events or otherwise.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of TSX Venture Exchange) accepts responsibility for the adequacy of accuracy of this release.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/scottie-resources-intercepts-9-0-gt-gold-over-7-39-metres-and-14-5-gt-gold-over-3-65-metres-at-scottie-gold-mine-project-301487275.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/scottie-resources-intercepts-9-0-gt-gold-over-7-39-metres-and-14-5-gt-gold-over-3-65-metres-at-scottie-gold-mine-project-301487275.html

SOURCE Scottie Resources Corp.