Saga Metals Corp. (" TSXV: SAGA ") (" FSE: 20H" ) (" SAGA " or the " Company "), a North American exploration company focused on discovering critical minerals, is pleased to announce the completion of its maiden field program at the Double Mer Uranium Project in Labrador, Canada. This successful field season marks a significant step forward in SAGA's efforts to unlock the Double Mer Uranium project's potential for uranium mineralization.

Strategic Location with Historical Exploration Work

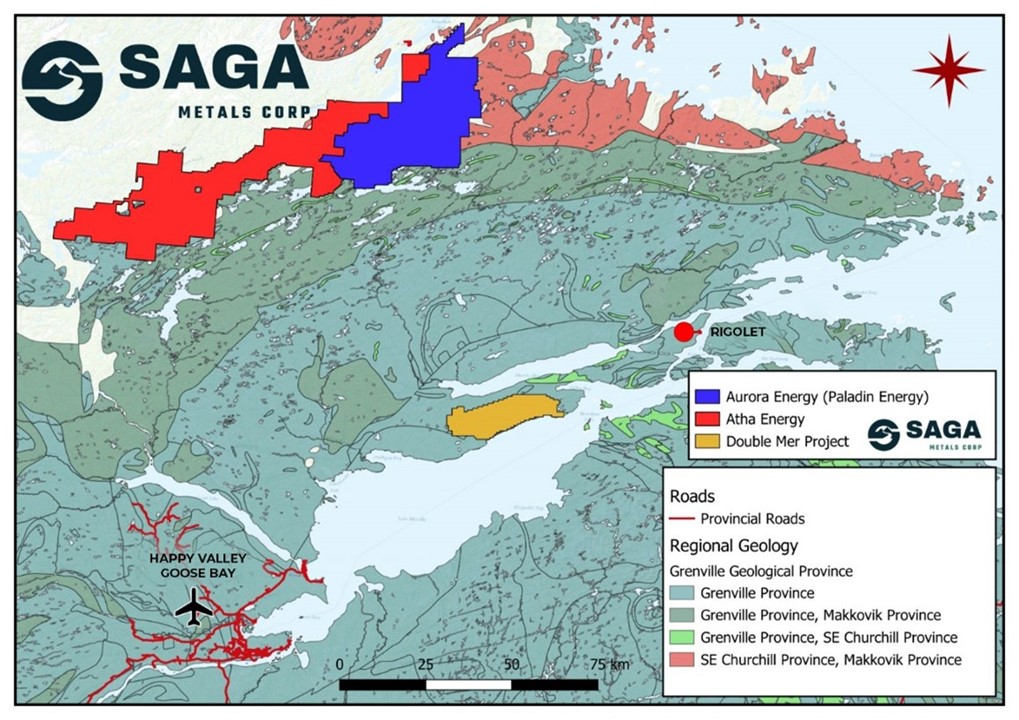

The Double Mer Uranium Property is SAGA's flagship project, comprising 1,024 claims over 25,600 hectares in the eastern-central region of Labrador, approximately 90 km northeast of Happy Valley-Goose Bay. With significant investment in historical exploration work, SAGA entered 2024's field program with a strong foundation, allowing for a targeted and efficient approach to expanding known uranium mineralization along the 18km trend.

Regional map of the Double Mer Uranium Project in Labrador, Canada

Field Results Show Increased Potential for Uranium Mineralization

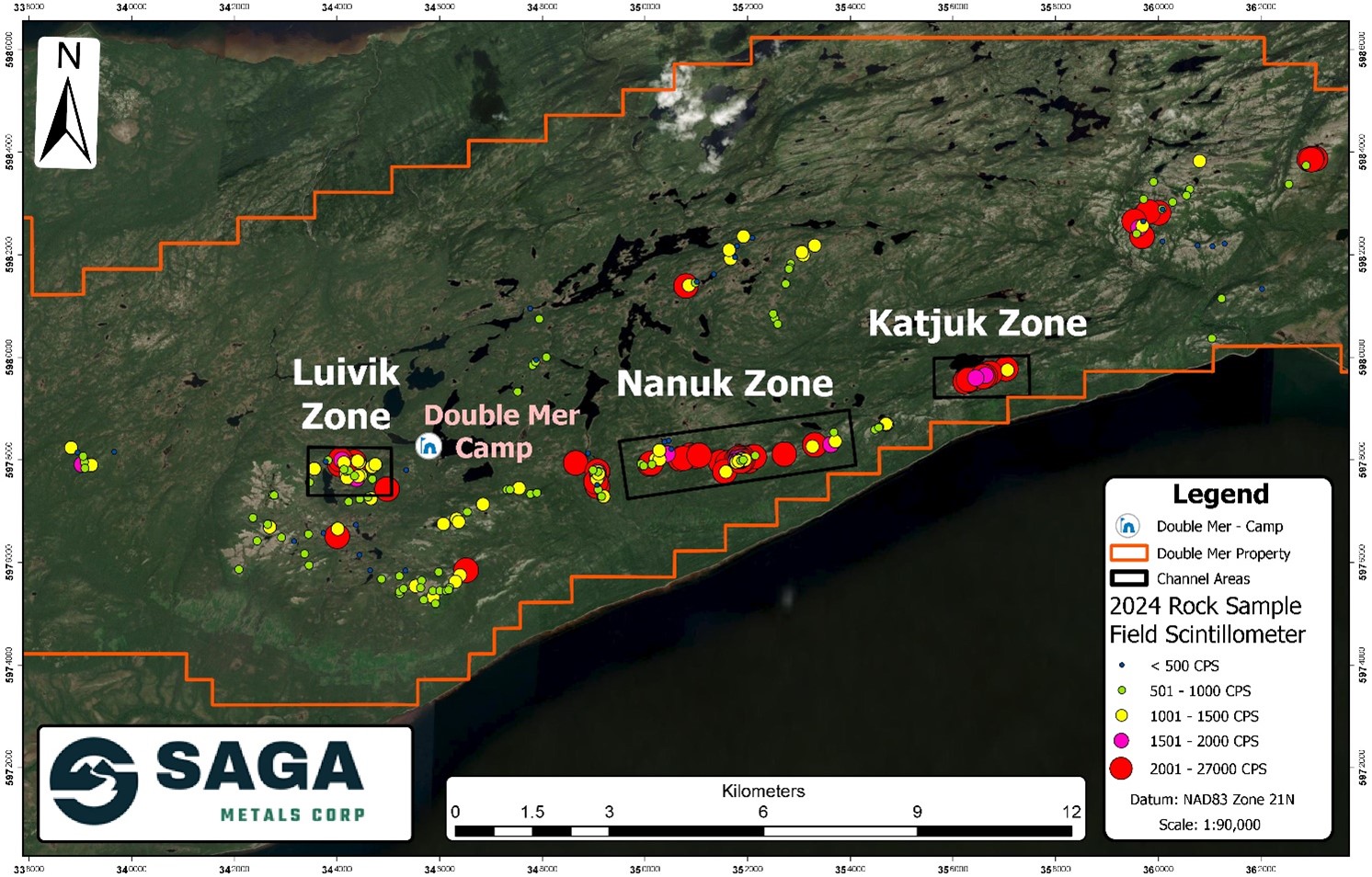

Throughout the summer and early fall, SAGA's exploration team focused on verifying the property's uranium radiometric trend, which produced multiple Counts per Second (CPS) readings above 5,000 CPS, with notable peaks of 22,000 CPS in an outcrop and 27,000 CPS in a sub-rounded boulder—surpassing the historical 21,000 CPS benchmark. These high CPS readings suggest that the uranium trend may be more extensive than originally anticipated.

The program involved collecting 309 grab samples and 253 channel samples over 200 meters across three identified zones. The sampling results provide valuable data for understanding the extent of mineralization and guiding the next phase of exploration. This sampling further confirms the presence of uranium mineralization and supports the view that the trend could extend beyond initial projections.

2024 Saga Metals Rock sample locations with field CPS (Counts per Second) readings taken on R-125 Scintillometer

Identification of High-Priority Zones

The exploration efforts have identified three key zones that represent the highest potential for further uranium exploration:

- Nanuk (Polar Bear) Zone : Central area with consistent mineralization.

- Luivik (Lion) Zone : Western section of the trend, showing high CPS readings.

- Katjuk (Arrow) Zone : Eastern zone, extending the known trend.

These zones were named in collaboration with local field workers, reflecting SAGA's commitment to community engagement and regional roots.

Diverse Mineralization Styles Offer Exploration Upside

The field program identified three styles of uranium mineralization across the property:

- Mineralized granitic pegmatites , rich in biotite and uranophane.

- Sheared pegmatites and gneissic rocks , showing high CPS readings and uranophane staining in biotite-rich areas.

- IOCG-style mineralization , characterized by iron carbonate staining and sheeted smokey quartz veins parallel to foliation.

Highly strained granitic pegmatite showing an East-West foliation and significant uranophane mineralization located in the Katjuk (Arrow) Zone. Photo showing biotite fabric in the pegmatite with localised stringers of garnet beads.

Significant Exploration Success Identifying Three High-Priority Zones

SAGA's exploration team identified three high-priority zones within the Double Mer Uranium Project, each showcasing potential for substantial uranium mineralization:

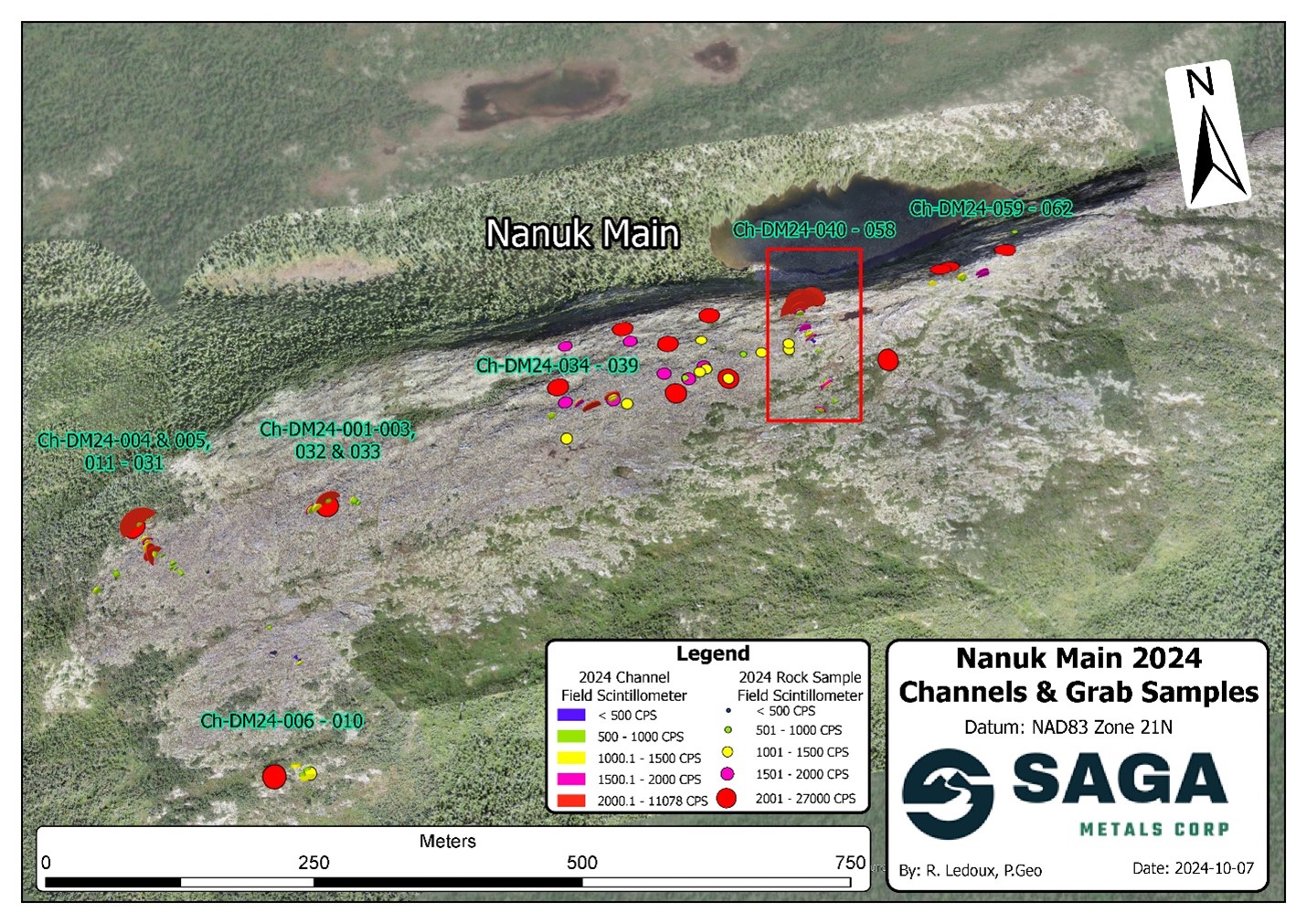

- Nanuk Zone : Centrally located within the project area, the Nanuk Zone is the largest and most extensive, with a 4.7 km strike length and an estimated width of 350 meters. It has been further divided into three sections: Nanuk Main, Nanuk West, and Nanuk East. The team's efforts at Nanuk Main included extensive channel sampling, revealing some of the highest CPS (Counts per Second) readings on the property. Early analysis indicates the presence of uranophane and potential uraninite, promising indicators of uranium mineralization. Historical assays in the Nanuk West section reached up to 4,281 ppm U3O8 , further highlighting this zone's potential.

Nanuk (Polar bear) zone. The main section with 2024 Saga Metals rock and channel sample locations expressing corresponding CPS (Counts per second) readings taken on R-125 scintillometer

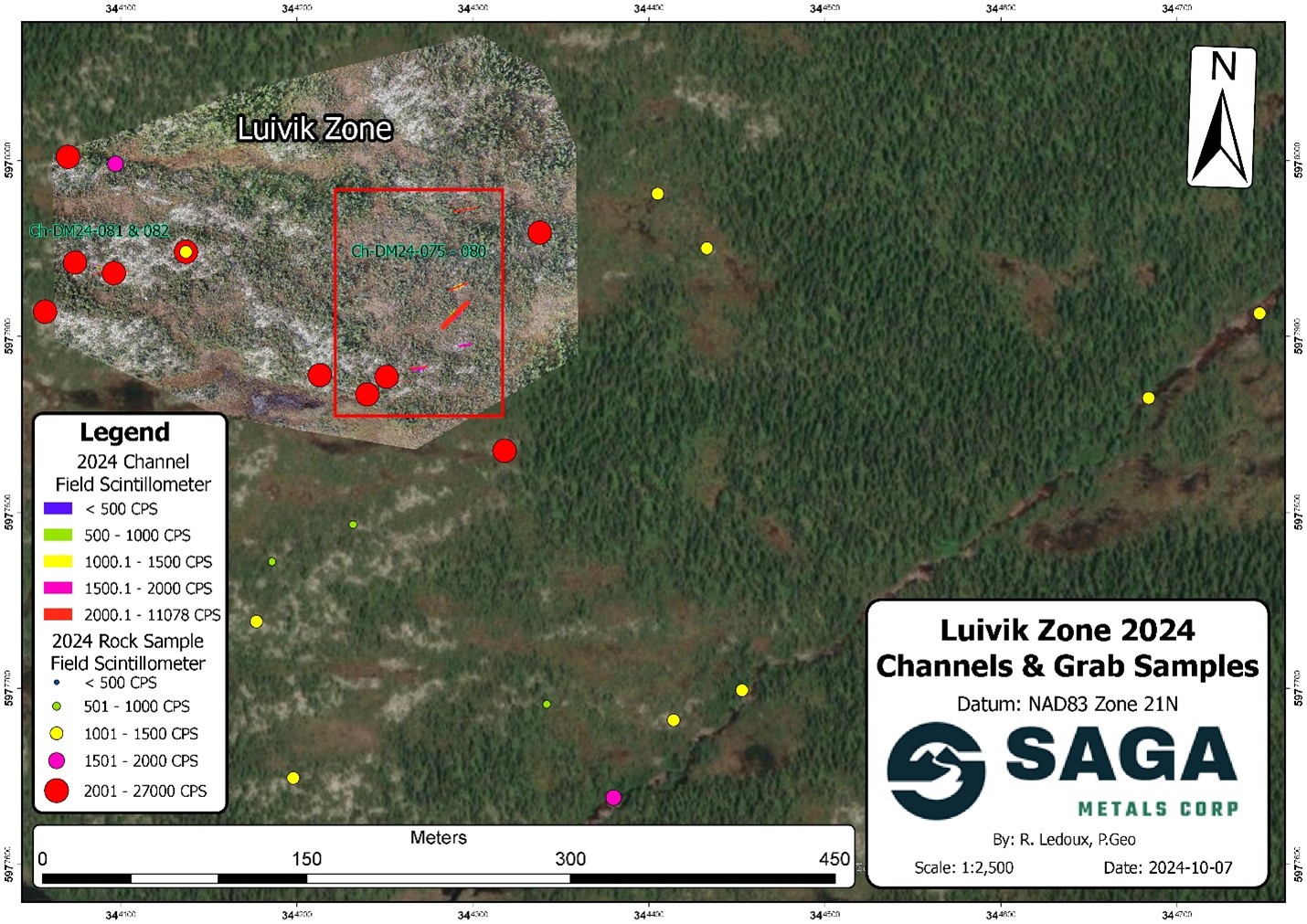

- Luivik Zone : Located just 1.5 km west of the base camp, the Luivik Zone has a 300-meter strike length and a width of 200 meters. It is notable for its IOCG (Iron Oxide Copper Gold) enrichment characteristics, featuring high concentrations of smoky quartz and iron carbonate staining. The continuous CPS readings here suggest significant uranium potential, making it an ideal target for further exploration. Its proximity to the base camp enhances the zone's economic viability for ongoing exploration and future drilling.

Luivik zone with detailed drone imagery inset of channel sample cross section perpendicular over zone expressing both rock and channel sample locations with CPS readings from R-125 Scintillometer

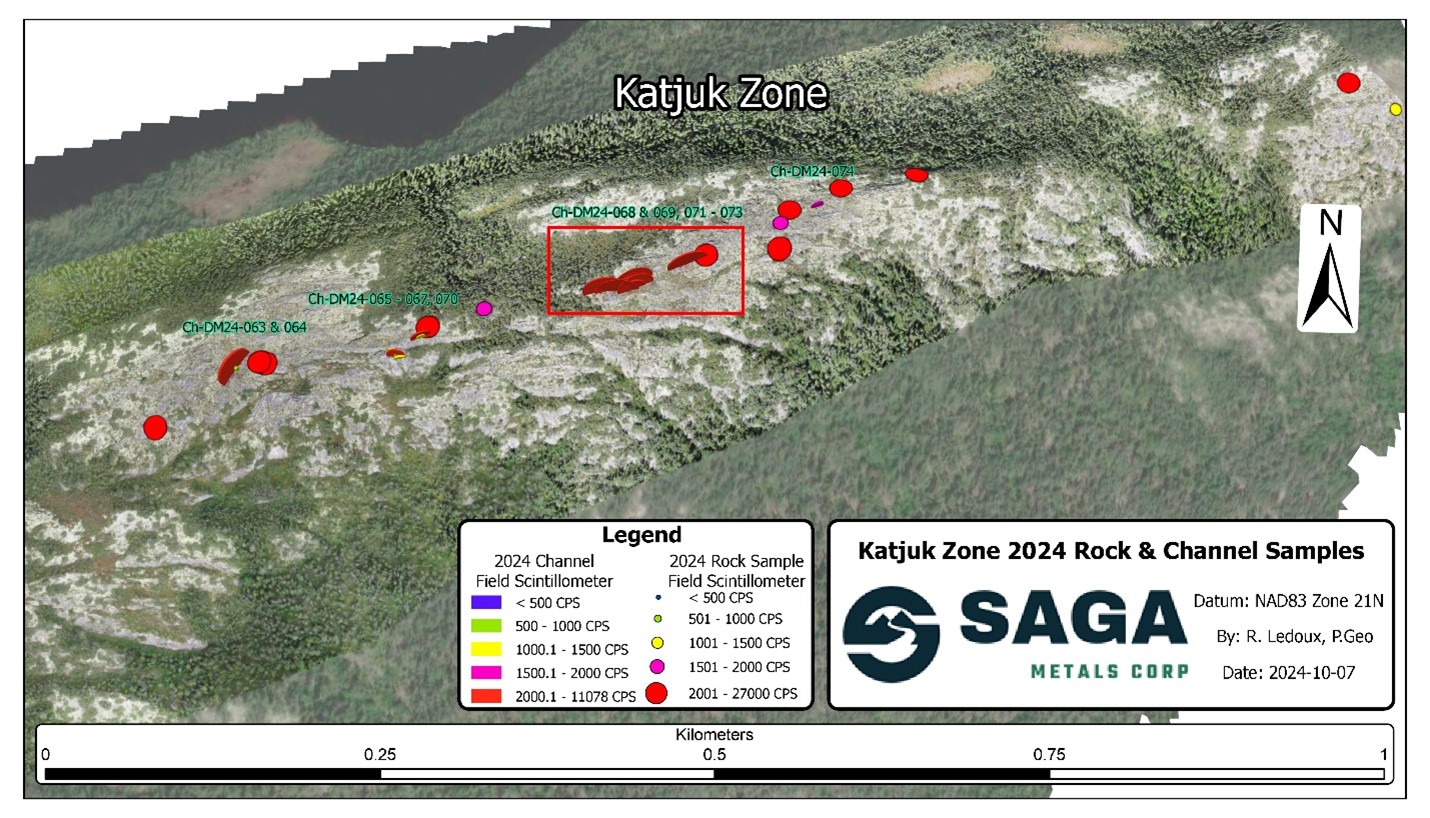

- Katjuk Zone : At the eastern edge of the radiometric trend, the Katjuk Zone spans 1 km in length and 100 meters in width, with high uranium content observed in strained and sheared pegmatites. The mineralization in this area is characterized by widespread uranophan e and biotite-rich structures, correlating to the higher CPS readings. The zone's geological features suggest that it could extend further with additional exploration, presenting a promising opportunity for expansion.

Katjuk zone with detailed drone imagery inset of channel sample cross section perpendicular over zone expressing both rock and channel sample locations with CPS readings from R-125 Scintillometer

Enhanced Infrastructure to Support Future Exploration

To support ongoing exploration, SAGA has upgraded its base camp, originally built in 2006 by Silver Spruce. With assistance from Geominex Consultants Inc., the Company has repaired infrastructure, including the dock, fuel cache, and helicopter pad, while upgrading buildings to support year-round operations. Located just 90 km northeast of Happy Valley-Goose Bay, the base camp is strategically positioned to ensure efficient, cost-effective exploration, allowing SAGA to continue its work into the winter months.

SAGA's Double Mer Uranium Project Base Camp

Preparing for Next Steps

The identification of these three high-priority zones at the Double Mer Uranium Project provides a significant opportunity for the company and its shareholders. The potential extension of the uranium trend and higher-than-expected CPS readings highlight the possibility of larger uranium mineralization at the project. Leveraging historical data allowed SAGA to conduct a targeted exploration program, reducing time and costs while accelerating results. As the Company prepares for the next phase of drilling the Double Mer Uranium Project stands as a promising asset.

Michael Garagan, CGO & Director of Saga Metals Corp., commented: "This maiden field program was a significant milestone for SAGA. We accomplished all the objectives we set out to achieve and, more importantly, gained a deeper understanding of the geological potential of the Double Mer Uranium Project. As we move forward, we are excited to share our assay results in the coming weeks and focus on the next phase—finalizing the drill program preparations and starting to drill this winter."

Investor Relations Agreement

The Company further announces that it has entered into a consulting agreement dated October 8, 2024 (the " IR Agreement ") with Fairfax Partners Inc. (" Fairfax "), pursuant to which Fairfax has agreed to provide certain investor relations services to the Company in exchange for cash consideration in the amount of CAD$50,000. The IR Agreement has an initial term of 31 days unless earlier terminated or renewed in accordance with its terms. The Company may renew the IR Agreement for successive 31-day periods upon providing notice to Fairfax.

Pursuant to the terms of the IR Agreement, Fairfax will provide certain services to the Company, including marketing services, such as social media and influencer marketing and such other services as mutually agreed to by the Company and Fairfax.

Fairfax is an investor relations consultancy firm headquartered in Vancouver. Fairfax is arm's length to Saga and, to the Company's knowledge, holds no securities, directly or indirectly, of the Company nor has any right or intent to acquire such an interest.

About Saga Metals Corp.

Saga Metals Corp. is a North American mining company focused on the exploration and discovery of critical minerals that support the global transition to green energy. The company's flagship asset, the Double Mer Uranium Project, is located in Labrador, Canada, covering 25,600 hectares. This project features uranium radiometrics that highlight an 18-kilometer east-west trend, with a confirmed 14-kilometer section producing samples as high as 4,281ppm U 3 O 8 and spectrometer readings of 22,000cps.

In addition to its uranium focus, SAGA owns the Legacy Lithium Property in Quebec's Eeyou Istchee James Bay region. This project, developed in partnership with Rio Tinto, has been expanded through the acquisition of the Amirault Lithium Project. Together, these properties cover 65,849 hectares and share significant geological continuity with other major players in the area, including Rio Tinto, Winsome Resources, Azimut Exploration, and Loyal Lithium.

SAGA also holds secondary exploration assets in Labrador, where the company is focused on the discovery of titanium, vanadium, and iron ore. With a portfolio that spans key minerals crucial to the green energy transition, SAGA is strategically positioned to play an essential role in the clean energy future.

For more information, contact:

Saga Metals Corp.

Investor Relations

Tel: +1 (778) 930-1321

Email: info@sagametals.com

www.sagametals.com

Qualified Persons

Peter Webster, P. Geo., of Mercator Geological Services Limited are each a "qualified person" as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (" NI 43-101 ") and have reviewed and approved the scientific and technical content of this news release regarding the Double Mer Property.

The TSX Venture Exchange has not reviewed and does not accept responsibility for the accuracy or adequacy of this release. Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Disclaimer

This news release contains forward-looking statements within the meaning of applicable securities laws that are not historical facts. Forward-looking statements are often identified by terms such as "will", "may", "should", "anticipates", "expects", "believes", and similar expressions or the negative of these words or other comparable terminology. All statements other than statements of historical fact, included in this release are forward-looking statements that involve risks and uncertainties. In particular, this news release contains forward-looking information pertaining to plans with respect to samples from its mineral exploration properties and services and payment to be provided under the IR Agreement. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include, but are not limited to, changes in the state of equity and debt markets, fluctuations in commodity prices, delays in obtaining required regulatory or governmental approvals, environmental risks, limitations on insurance coverage, failure to satisfy closing conditions in respect of the Offering, risks and uncertainties involved in the mineral exploration and development industry, and the risks detailed in the Prospectus and available under the Company's profile at www.sedarplus.ca, and in the continuous disclosure filings made by the Company with securities regulations from time to time. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company will update or revise publicly any of the included forward-looking statements only as expressly required by applicable law.

Images accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/2ba130bb-6a7f-4a81-b3c7-111a335551cb

https://www.globenewswire.com/NewsRoom/AttachmentNg/efa80632-ed86-47d8-8c88-1c9af22ce42a

https://www.globenewswire.com/NewsRoom/AttachmentNg/b748d207-3476-466a-ae6a-e832efb62f0d

https://www.globenewswire.com/NewsRoom/AttachmentNg/40d279d0-3051-4449-923a-5bc903d62e21

https://www.globenewswire.com/NewsRoom/AttachmentNg/47e58ac1-f947-48cc-b35c-d4c265786684

https://www.globenewswire.com/NewsRoom/AttachmentNg/1ed40bae-8d3e-42bb-9dd3-446d84b16e7f

https://www.globenewswire.com/NewsRoom/AttachmentNg/6d1ba7eb-17db-4748-ab17-0daeb2bdafb9