Rua Gold Inc. (TSXV: RUA) (OTCQB: NZAUF) (WKN: A40QYC) ("Rua Gold" or the "Company") is pleased to provide an update on its gold-antimony exploration at the Auld Creek project in the Reefton Goldfield on the South Island of New Zealand, reporting further high-grade gold-antimony intersections 120 meters below the current resource estimate.

Highlights:

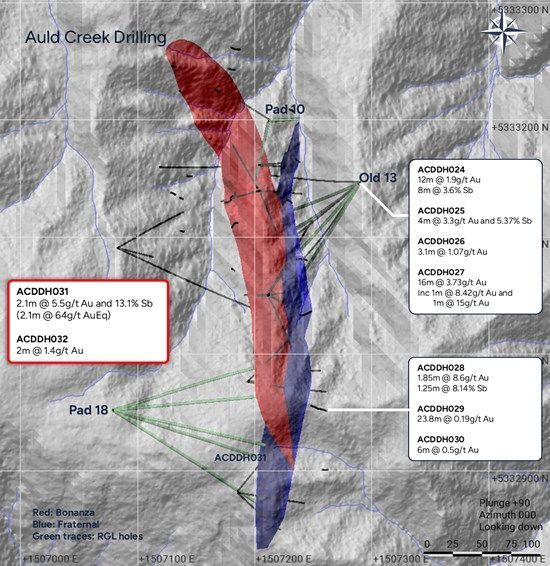

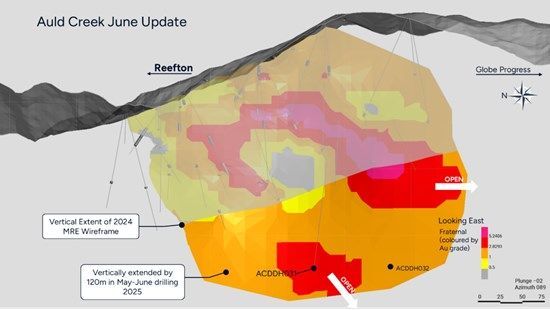

- Auld Creek has an inferred resource hosted by two ore shoots, Bonanza and Fraternal. This resource outcrops at surface. The latest drilling increases the vertical extent of the resource from 160m to 280m and remains open at depth.

- Following up on the encouraging high-grade gold-antimony results from drillholes ACDDH026-028; holes ACDDH030-33 intersected excellent high-grade mineralization with continuity of the strong gold-stibnite (antimony sulfide) mineralization previously reported.

- Assay results show:

- ACDDH031: 2.1m @ 64.0g/t AuEq1 (5.5g/t Au & 13.1% Sb) from 310m depth

- ACDDH032: 2m @ 1.4g/t Au from 296m depth

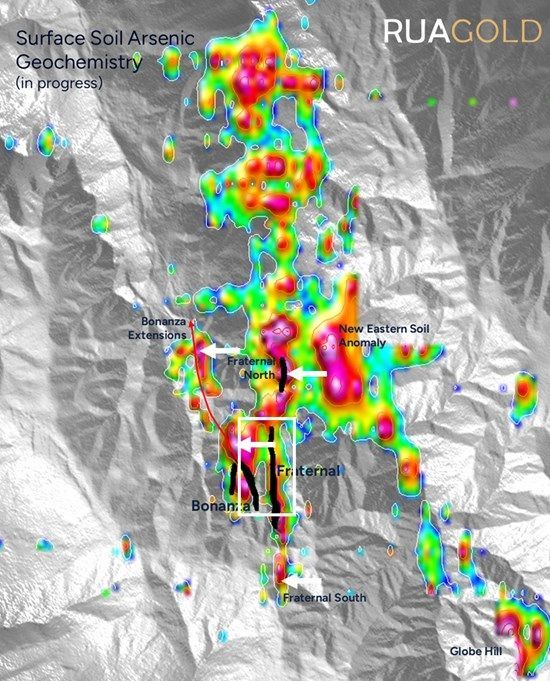

- Current drilling is testing the Fraternal north prospect and Bonanza northeast prospect, where surface soil geochemistry has confirmed the system is traceable over a 2.5km length.

- Drilling in the second quarter will then probe further at depth and test its extent southward with the goal of growing the current resource.

- Antimony is in rising demand due to its vital role in renewable energy, batteries, defense, and technology. Its supply is scarce and largely controlled by China, Russia, and Tajikistan, making it a strategic material, especially during geopolitical tensions, which has caused prices to surge from US$11,350 to over US$60,000 per tonne.

Robert Eckford, CEO of Rua Gold commented: "This is an exciting development to see high-grade gold-antimony mineralization at Auld Creek that is 120m deeper than the current resource. Proving out continuity at depth and growing this resource will be a key focus of drilling in the next quarter, while simultaneously drilling the Cumberland-Galant deposit 3km to the south.

We continue to be focused on expanding the Auld Creek resource both north, south and at depth, with intensified surface exploration showing early promise in identifying additional mineralization over its 2.5km length.

With Antimony being at the top of every nations' critical minerals lists, the importance of this resource growth to both Rua Gold and New Zealand is significant."

1. Using recent spot prices of gold and antimony, and applying a ~30% discount, the gold equivalent formula is based on AuEq = Au g/t + 4.3 x Sb% using a Au price of US$2065/oz, Sb price of US$34,300 per tonne and 85% recovery.

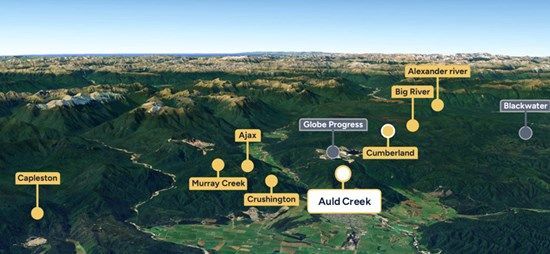

Figure 1: Overview of the Reefton Goldfield.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10755/255667_539f6d61941598e0_007full.jpg

Figure 2: Location of Auld Creek Drilling

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10755/255667_539f6d61941598e0_008full.jpg

GLOBAL SUPPLY AND VALUE OF ANTIMONY

Antimony is a critical metalloid primarily sourced from the mineral, stibnite. It is highly valuable and increasing in demand due to its versatility and has essential applications across renewable energy, liquid battery metals, defence and technological sectors.

Due to its limited supply, predominantly controlled by China, Russia & Tajikistan, antimony is considered a strategic material essential for supply chain security, particularly during periods of geopolitical instability. This was heightened in September 2024, when China announced export controls on processed antimony products. In response to these controls, nations have accelerated their efforts to secure alternative sources of antimony to mitigate the risk of significant supply chain vulnerabilities.

The US, EU, UK, Japan, Canada and Australia all designate antimony as a critical mineral. On January 31, 2025, New Zealand also announced their Critical Mineral List which included antimony.

Reflecting heightened demand, the price of antimony has reached new highs, currently trading over US$60,000 per tonne, a significant increase from US$11,350 per tonne at the start of 2024. This market shift has intensified interest in the strategic antimony potential held by Rua Gold.

EXPLORATION POTENTIAL

Rua Gold commenced drilling at Auld Creek in December 2024. It has a targeted program to drill four mineralised shoots identified from historical surface exploration work interpreted by the Rua Gold team over the past 3 months.

Auld Creek is situated between two past producing mines, Globe Progress mine, and the Crushington Group of mines which collectively produced 933,000oz at 14.0g/t Au (Barry 1993). Auld Creek has three historic adits but no commercial production from the reefs.

Rua Gold has an inferred resource indicating 700,000 tonnes at 3.1g/t Au and 1.1% Sb for 67,000oz of gold and 8,000 tonnes of antimony1 (AuEq 110,000oz2). The resource is restricted to two of the four known shoots. Soil geochemistry indicates the potential for discovery of additional mineralised shoots over a strike length of 2.5km.

Four of the eight holes completed to date intersected 4-5m of strong visible stibnite (antimony sulfide) mineralization in the Fraternal-Bonanza structure.

Results from ACDDH024, ACDDH025 confirm the approximate average gold grades, but report higher antimony grades than the current resource estimate. Results from ACDDH027, ACDDH028 highlight above average gold grades with narrow but high-grade antimony in ACDDH028.

Drilling of ACDDH030,31,32 and 33 (results pending, but structure intercepted) provide strong evidence of the continuity of the Fraternal gold-antimony structure at depth, and the narrow high-grade intersection of ACDDH031 has confirmed resource grade mineralization and continuity with the previously reported drilling of holes ACDDH027 and ACDDH028.

Intensified surface exploration is showing very encouraging strong trends both north and north-west confirming additional targets on the Fraternal North and Bonanza north-west extensions.

1. Please see the Company's technical report entitled, "Technical Report on Reefton Project, New Zealand", dated October 30, 2024.

2. Based on gold equivalent formula of AuEq = Au g/t + 1.9 x Sb% using a Au price of US$2025/oz, Sb price of US$15,000 per tonne and 85% recovery.

Figure 3: Fraternal ore shoots at Auld Creek.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10755/255667_539f6d61941598e0_009full.jpg

Figure 4: Arsenic soil geochemistry over Auld Creek area.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10755/255667_539f6d61941598e0_010full.jpg

ABOUT Rua Gold

Rua Gold is an exploration company, strategically focused on New Zealand. With decades of expertise, our team has successfully taken major discoveries into producing world-class mines across multiple continents. The team is now focused on maximizing the asset potential of Rua Gold's two highly prospective high-grade gold projects.

The Company controls the Reefton Gold District as the dominant landholder in the Reefton Goldfield on New Zealand's South Island with over 120,000 hectares of tenements, in a district that historically produced over 2Moz of gold grading between 9 and 50g/t.

The Company's Glamorgan Project solidifies Rua Gold's position as a leading high-grade gold explorer on New Zealand's North Island. This highly prospective project is located within the North Islands' Hauraki district, a region that has produced an impressive 15Moz of gold and 60Moz of silver. Glamorgan is adjacent to OceanaGold Corporation's biggest gold mining project, Wharekirauponga.

For further information, please refer to the Company's disclosure record on SEDAR+ at www.sedarplus.ca.

TECHNICAL INFORMATION

Simon Henderson CP, AUSIMM, a qualified person under National Instrument 43-101 Standards of Disclosure for Mineral Projects and Chief Operating Officer and a director of Rua Gold, has reviewed and approved the technical disclosure contained herein. Mr. Henderson has participated in the geochemical sampling, and mapping programs to verify that they have been conducted in accordance with standard operating procedures. Mr. Henderson has verified the data disclosed by running checks on the location, analytical, and test data underlying the information in the technical disclosure herein.

QA/QC Drill Core

Core samples were sent to SGS Laboratories, Westport for sample preparation. Samples were crushed and pulverized to 85% passing 75 µm. The pulverized rock-chips were split into two samples: a ~50 g sent for laboratory analysis, and the reject returned to RGL for pXRF analysis and storage. Pulverized rock-chip samples were analyzed for gold (Au) by 50-g fire assay with AAS finish at SGS Waihi (SGS Code FAA505); and for antimony (Sb) by Sodium Peroxide Fusion Analysis by ICP-MS at SGS Waihi.

Rua Gold Contact

Robert Eckford

Chief Executive Officer

Email: reckford@RUAGOLD.com

Website: www.RUAGOLD.com

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this new release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur and specifically include statements regarding: the Company's strategies, expectations, planned operations or future actions, including but not limited to exploration programs at its Reefton and Glamorgan projects and the results thereof. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements.

Investors are cautioned that any such forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. A variety of inherent risks, uncertainties and factors, many of which are beyond the Company's control, affect the operations, performance and results of the Company and its business, and could cause actual events or results to differ materially from estimated or anticipated events or results expressed or implied by forward looking statements. Some of these risks, uncertainties and factors include: general business, economic, competitive, political and social uncertainties; risks related to the effects of the Russia-Ukraine war; risks related to climate change; operational risks in exploration, delays or changes in plans with respect to exploration projects or capital expenditures; the actual results of current exploration activities; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; changes in labour costs and other costs and expenses or equipment or processes to operate as anticipated, accidents, labour disputes and other risks of the mining industry, including but not limited to environmental hazards, flooding or unfavorable operating conditions and losses, insurrection or war, delays in obtaining governmental approvals or financing, and commodity prices. This list is not exhaustive of the factors that may affect any of the Company's forward-looking statements and reference should also be made to the Company's short form base shelf prospectus dated July 11, 2024, and the documents incorporated by reference therein, filed under its SEDAR+ profile at www.sedarplus.ca for a description of additional risk factors.

Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

Table 1: Location of Auld Creek drill holes from RUA 2024-2025 program

| Hole ID | Easting | Northing | rL | Total Depth | Site _ID | Dip | Azimuth (true) | Year |

| ACDDH022 | 1507213 | 5333198 | 511.11 | 108.5 | Pad 10 | -54 | 193 | 2024 |

| ACDDH023 | 1507213 | 5333200 | 510.87 | 51.5 | Pad 10 | -60 | 85 | 2024 |

| ACDDH024 | 1507290 | 5333150 | 538.41 | 156.3 | Old Pad 13 | -37 | 220 | 2025 |

| ACDDH025 | 1507290 | 5333151 | 538.03 | 180.9 | Old Pad 13 | -54 | 248 | 2025 |

| ACDDH026 | 1507291 | 5333151 | 537.77 | 200 | Old Pad 13 | -59 | 231 | 2025 |

| ACDDH027 | 1507291 | 5333150 | 538.15 | 193.4 | Old Pad 13 | -45 | 212 | 2025 |

| ACDDH028 | 1507078 | 5332957 | 605.4 | 243.5 | Pad 18 | -50 | 104 | 2025 |

| ACDDH029 | 1507079 | 5332956 | 605.43 | 256 | Pad 18 | -50 | 120 | 2025 |

| ACDDH030 | 1507074 | 5332955 | 606.38 | 268.5 | Pad 18 | -53 | 85 | 2025 |

| ACDDH031 | 1507074 | 5332955 | 606.24 | 336 | Pad 18 | -65 | 74 | 2025 |

| ACDDH032 | 1507075 | 5332956 | 606.15 | 351.6 | Pad 18 | -70 | 108 | 2025 |

| ACDDH033* | 1507076 | 5332956 | 606.13 | 291.1 | Pad 18 | -64 | 92 | 2025 |

| ACDDH034* | 1507213 | 5333197 | 511.61 | 200 | Pad 10 | -72 | 267 | 2025 |

*Results pending from the assay lab for holes ACDDH033 and ACDDH034

Table 2: Significant drilling intercepts at Auld Creek, full mineralized zone composites (1.5g/t Au cut-off)

| Sample No | From | To | Interval | Au (g/t) | Sb (%) |

| ACDDH026 | 175 | 175.9 | 0.9 | 0.96 | |

| ACDDH026 | 175.9 | 177.1 | 1.2 | 1.55 | |

| ACDDH027 | 152 | 153 | 1 | 2.52 | |

| ACDDH027 | 153 | 154 | 1 | 1.88 | |

| ACDDH027 | 154 | 155 | 1 | 3.44 | |

| ACDDH027 | 155 | 156 | 1 | 2.25 | |

| ACDDH027 | 156 | 157 | 1 | 1.84 | |

| ACDDH027 | 157 | 158 | 1 | 0.37 | |

| ACDDH027 | 158 | 159 | 1 | 0.15 | |

| ACDDH027 | 159 | 160 | 1 | 2.38 | 0.013% |

| ACDDH027 | 160 | 161 | 1 | 2.39 | 0.802% |

| ACDDH027 | 161 | 162 | 1 | 4.75 | 0.008% |

| ACDDH027 | 162 | 163 | 1 | 2.84 | 0.016% |

| ACDDH027 | 163 | 164 | 1 | 8.42 | 0.010% |

| ACDDH027 | 164 | 165 | 1 | 4.7 | 0.010% |

| ACDDH027 | 165 | 166 | 1 | 3.77 | 0.009% |

| ACDDH027 | 166 | 167 | 1 | 15 | 0.178% |

| ACDDH027 | 167 | 168 | 1 | 3.11 | 0.428% |

| ACDDH028 | 209.5 | 210.15 | 0.65 | 0.92 | |

| ACDDH028 | 210.15 | 210.6 | 0.45 | 18.4 | 11.600% |

| ACDDH028 | 210.6 | 211.4 | 0.8 | 8.28 | 4.680% |

| ACDDH028 | 211.4 | 212 | 0.6 | 1.68 | |

| ACDDH031 | 310.4 | 312.5 | 2.1 | 5.4 | 13.06% |

| ACDDH032 | 296 | 305 | 9.0 | 0.6 |

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/255667