August 30, 2023

Bryah Resources Limited (ASX: BYH, “the Company” or “Bryah”) is pleased to announce promising rock chip results from its wholly owned Lake Johnston Project, prospective for lithium and nickel. These results are a product of reconnaissance sampling and mapping completed in July 2023.

HIGHLIGHTS

- Rock chip results highly anomalous in suite of elements characteristic of Lithium- caesium-tantalum (LCT) pegmatites, alongside indicator mineralogy and mineral texture.

- Roundbottom prospect pegmatites in area of generally poor bedrock exposure:

- LJRK002 – 403 ppm Li2O, 774 ppm Rb, 228 ppm Nb, 18.2 ppm Ta, 62.7 ppm Sn, and 9.6 ppm W.

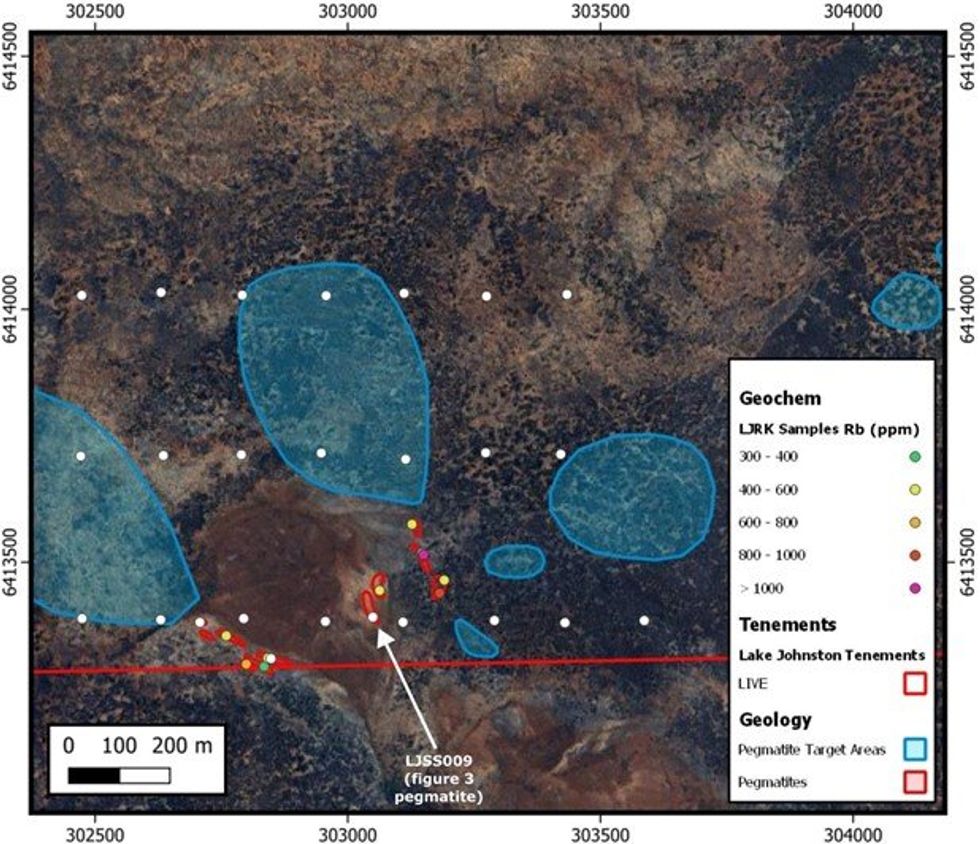

- Several sub-linear, parallel pegmatites identified at the Pegasus prospect dipping under recent alluvial cover with anomalous pathfinder elements.

- LJRK009 – 0.13% Rb, 25.2 ppm Nb, 30.8 ppm Cs, 11.8 ppm Be

- These prospects have historically been overlooked, with no previously reported or mapped pegmatites in these areas.

- New tenement under application

Lake Johnston Exploration – What’s Coming Up?

- Detailed geological mapping over prospect area

- Sample preparation and analysis of soil samples collected during this excursion

- Planning underway for regional auger soil sampling programme

- Delineation of drilling targets

Commenting on the results, Bryah CEO Ashley Jones said: “These initial results from pegmatites outcropping at the Lake Johnston Project are promising and confirm the LCT pegmatite prospectivity of our tenure. These rock chip samples are anomalous in lithium, as well as several other key elements distinctive of LCT pegmatites.

These areas have been historically overlooked, with no previously reported pegmatite outcrops. With additional geological mapping, rock chip sampling, and soil sampling, we have the potential to identify some exciting drill targets.

Our neighbours have so far been very successful, particularly at Charger Metal’s Lake Medcalf Prospect and TG Metals Burmeister Project. This is in addition to the nearby, world-class Mt Holland lithium mine. We are in the right postcode, and these rock chip samples confirm that we are searching in the correct areas.”

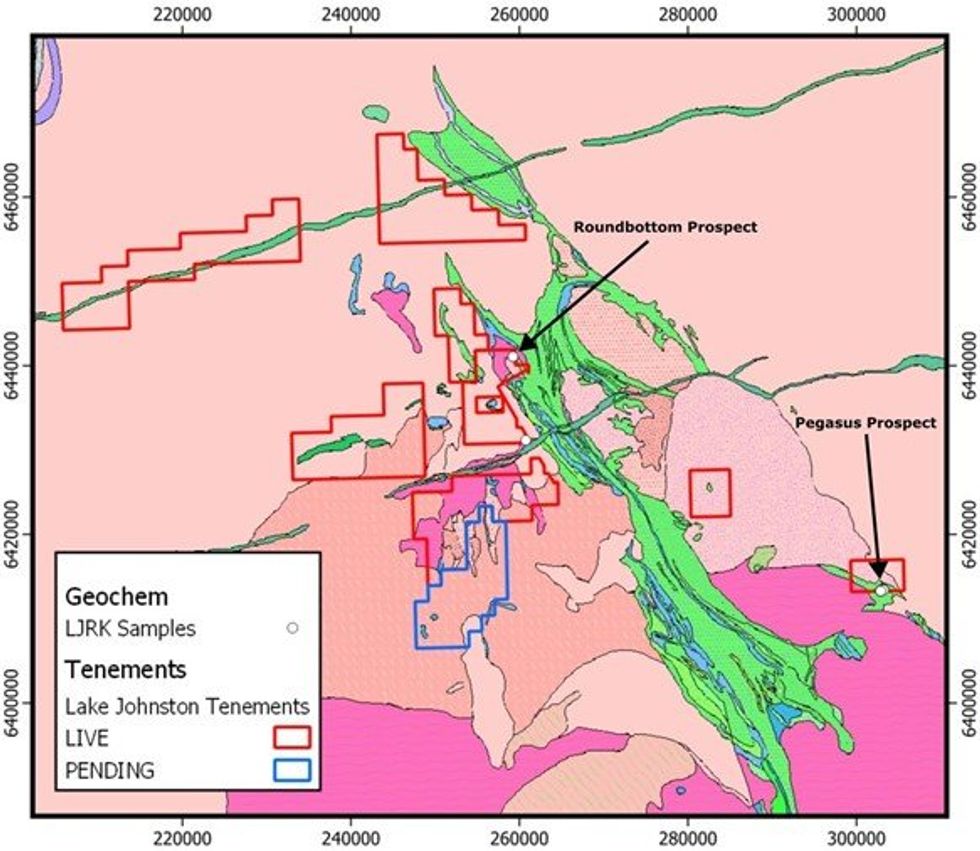

The Lake Johnston Project consists of eight granted exploration licenses and one licence under application. Six of these licences, covering 569 km2, are held Bryah Resources, whilst a further three licences are held by West Coast Minerals Pty Ltd. West Coast Minerals’ three exploration licences cover approximately 225km2.

The exploration ground extends to within 10 kilometres east of the world class Mount Holland Lithium mine and concentrator being developed under the Wesfarmers Limited/SQM Australia Pty Ltd joint venture. The Mount Holland Lithium project includes the Earl Grey Lithium deposit with a reported Mineral Resource1 of 189 million tonnes grading 1.5% Li2O, making it a globally significant high-grade hard rock lithium deposit.

Pegasus Prospect

The Pegasus prospect (Figure 2) is an area of mixed colluvium and aeolian sands with very poor outcrop. Bedrock geology is interpreted to consist of amphibolite, Banded Iron Formation (BIF) and olivine komatiite within a sliver of the Younami Terrane greenstone unit east of Lake Johnston. The area has previously been evaluated for komatiite-hosted nickel, analogous to the nearby Maggie- Hays and Emily-Anne deposits.

At the Pegasus prospect, several outcropping pegmatites were observed at the southern end of the tenement striking ~north-west before dipping under cover, hosted in a sheared amphibolite. These coarse to very coarse pegmatites contain key indicator minerals (garnet and tourmaline) as well as mineral growth textures (graphic quartz-feldspar texture) characteristic of LCT pegmatite deposits.

Despite no direct detection of anomalous lithium, the exceptionally anomalous Rb and subsequent low K/Rb ratio, as well as anomalism in Nb, Cs and Be, is encouraging. These anomalous pegmatites are not widely exposed in the area and no clear pegmatite zoning is therefore observed. Further work is required to resolve the true thickness of pegmatites and define lithium-rich zones.

Roundbottom Prospect

The Roundbottom Prospect (Figure 4), located ~3km north of Roundtop Hill, is characterised by expansive sheetwash material with very rare outcropping amphibolite. The bedrock geology is inferred to consist of Youanmi Greenstone Terrane amphibolites and komatiites folded around an Archaean granite contact.

Among the limited outcrop, two localities included some pegmatoidal rocks with a quartz- muscovite-feldspar-garnet mineralogy. Some trace tourmaline was also observed in the LJRK002 pegmatite.

Click here for the full ASX Release

This article includes content from Bryah Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BYH:AU

The Conversation (0)

11 October 2022

Bryah Resources

Battery Metal Exploration and Development Opportunities in Western Australia

Battery Metal Exploration and Development Opportunities in Western Australia Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00