January 24, 2023

Renforth Resources Inc. (CSE:RFR) (OTC:RFHRF) (FSE:9RR) (“ Renforth” or the “Company”) would like to offer shareholders an update on the status of exploration at Surimeau for pegmatites, lithium and rare-earth elements.

Due to our focus on the more advanced, by both Renforth and historically, ~20km Victoria mineralized battery metals horizon and the ~9km of the longer Lalonde horizon we have looked at to date, we have allocated only a small amount of our resources to the lithium/rare earths effort.

"Renforth has hardly looked at lithium at Surimeau, mainly because our battery metals systems, mineralized starting at surface, are the obvious, and the easiest, thing to "explore" and create value for shareholders. However, we do have pegmatites and they deserve to be properly considered, separately from Victoria and Lalonde, for not only lithium potential but also rare earth elements potential. So, we have begun that process in advance of the summer fieldwork season" states Nicole Brewster, President and CEO of Renforth.

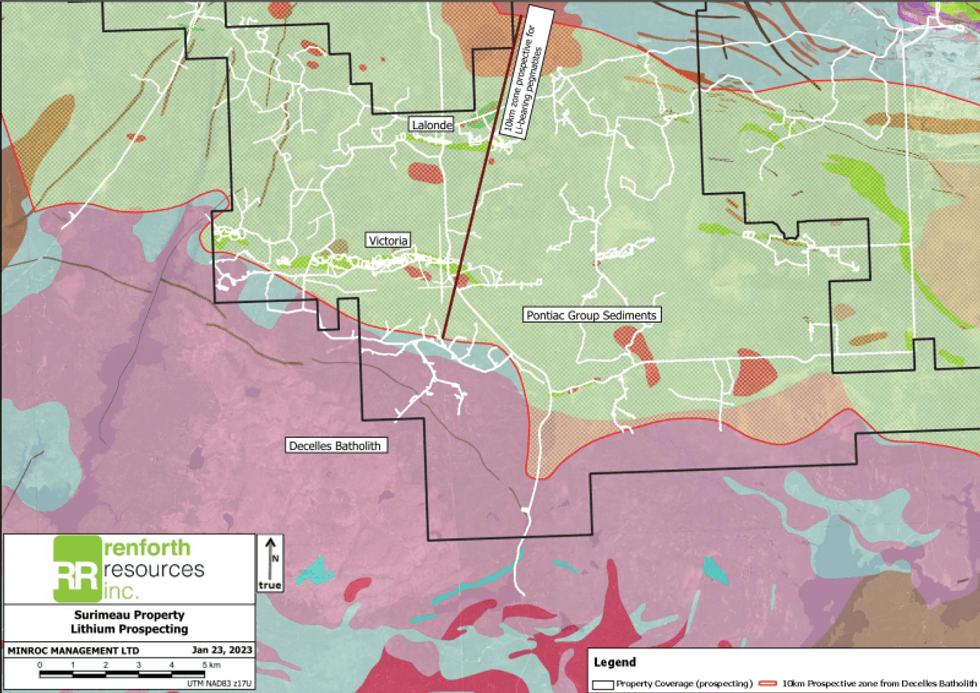

In 2022 Renforth only devoted a handful of field days to prospecting for lithium in a limited area, this work was focused only on the pegmatites mapped by Metals Tech Lithium and noted in the SIGEOM database in the SW portion of the property. In addition to sampling pegmatites Renforth has concluded, through sampling, that the Decelles Batholith, which forms the southern portion of Surimeau, is a fertile batholith, which can have an area of influence of up to 10km, a good portion of Surimeau to the north of the batholith. As a result, Renforth considers most of the property prospective for pegmatites, pegmatites have been noted as far north as Victoria and Lalonde.

Only the area west of the Rapid 7 road and south of the Victoria mineralization was prospected, with accessible pegmatites and granites (issues with snow, water, and lack of trails) visited and sampled. Sampling resulted in elevated lithium, caesium, rubidium, and tantalum at various locations, generally within the sediments near to or in contact with pegmatites. This could be interpreted as either a "halo" effect due to the mobility of various elements, or indicative of the presence of an unseen lithium bearing pegmatite. All of the documented pegmatites were visited and sampled, though this work covers only a small percentage of the prospective ground, "new" pegmatites were also found and sampled. All samples taken were grab samples, there was limited assaying for rare earth elements performed, Renforth has since concluded that any future work with respect to lithium should include this. Assay values returned range for each element as follows, for lithium background up to 800ppm (a re-assay of a sample which originally assayed 410 ppm), for caesium from background up to 169ppm, rubidium from background up to 1170ppm and tantalum from background up to 149.5ppm. Not only are grab samples, by their nature, not reflective of the whole, Renforth is confident that the exploration work we did do is not comprehensive, it was only designed as initial prospecting. Summer 2022 ended up being focused on the surface battery metals (Ni, Co, Cu, Zn and Mo) mineralization found, then channeled, stripped, and channeled again at Lalonde, finally drilled in December 2022, with no follow up on the early-stage lithium prospecting.

Pegmatites will be the focus of prospecting for Summer 2023, this will include searching for more "new" pegmatites, along with mapping and sampling of known pegmatites and the sediments in proximity. Currently, Renforth has commissioned a lithium targeting report to be generated by spectral analysis of available satellite data, this can be done during winter conditions. In addition, we are consulting with experts in exploration techniques for lithium and rare earth pegmatites in order to develop a comprehensive exploration plan for Surimeau using best practices and the latest knowledge available.

The map above shows the Decelles Batholith, which forms the southern portion of the map, with the Pontiac sediments to the north, as well as a 10km prospective zone north of the batholith where there is potential for Li-bearing pegmatite dykes, this zone covers most of the property. Prospecting tracks to date (both battery metals and lithium) are shown as white lines, showing property coverage.

Lalonde and Victoria Update

Renforth is now receiving, in no particular order, assay results from the December 2022 drill program at Lalonde and Victoria. Results will be publicly released once complete. Renforth has submitted permit applications for Surimeau, specifically for the very western end of the Victoria horizon. Upon receipt of permits drilling will be announced.

Technical disclosure in this press release has been reviewed and approved by Francis R. Newton OGQ a “qualified person” pursuant to NI 43-101.

For further information please contact:

Renforth Resources Inc.

Nicole Brewster

President and Chief Executive Officer

C:416-818-1393

E: nicole@renforthresources.com

#Unit 1B – 955 Brock Road, Pickering ON L1W 2X9

Follow Renforth on Facebook, LinkedIn and Instagram!

About Renforth

Renforth is focused on Quebec's newest battery metals district, our wholly owned ~330 km 2 Surimeau District Property, which hosts several known areas of polymetallic "battery metals" mineralization, each with various levels of exploration, as well as a significant amount of unexplored ground. Victoria West has been drilled over a strike length of 2.2km, within a 5km long mineralized structure, proving nickel, copper, zinc and cobalt mineralization, in the western end of a 20km magnetic anomaly. The Huston target, during initial reconnaissance, resulted in a grab sample grading 1.9% Ni, 1.38% Cu, 1170 ppm Co and 4 g/t Ag. Additionally, the Lalonde, Surimeau and Colonie Targets are all polymetallic mineralized occurrences which, along with various gold showings, comprise the areas of potential of this NSR free property.

In addition to the Surimeau District battery metals property Renforth wholly owns the Parbec Gold deposit, a surface gold deposit contiguous to the Canadian Malartic Mine property in Malartic, Quebec. In 2020/21 Renforth completed 15,569m of drilling which successfully twinned certain historic holes, filled in gaps in the resource model with newly discovered gold mineralization and extended mineralization deeper. Based upon the success of this significant drill program the Company considers the spring 2020 MRE, with a resource estimate of 104,000 indicated ounces of gold at a grade of 1.78 g/t Au and 177,000 inferred ounces of gold at a grade of 1.78 g/t Au to be out of date. With the new data gained Renforth will undertake to complete the first ever structural study of the mineralization at Parbec, as well as additional total metallic assay work in order to better contextualize the nugget effect on the gold mineralization.

Renforth also holds the Nixon-Bartleman property, west of Timmins Ontario, with gold present on surface over a strike length of ~500m.

No securities regulatory authority has approved or disapproved of the contents of this news release.

Forward Looking Statements

This news release contains forward-looking statements and information under applicable securities laws. All statements, other than statements of historical fact, are forward looking. Forward-looking statements are frequently identified by such words as ‘may’, ‘will’, ‘plan’, ‘expect’, ‘believe’, ‘anticipate’, ‘estimate’, ‘intend’ and similar words referring to future events and results. Such statements and information are based on the current opinions and expectations of management. All forward-looking information is inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including the speculative nature of mineral exploration and development, fluctuating commodity prices, the risks of obtaining necessary approvals, licenses and permits and the availability of financing, as described in more detail in the Company’s securities filings available at www.sedar.com. Actual events or results may differ materially from those projected in the forward-looking statements and the reader is cautioned against placing undue reliance thereon. Forward-looking information speaks only as of the date on which it is provided and the Company assumes no obligation to revise or update these forward-looking statements except as required by applicable law.

RFR:CNX

The Conversation (0)

07 March 2022

Renforth Resources

District Scale Battery Metals Discovery in Quebec Backed by the Parbec Gold Deposit

District Scale Battery Metals Discovery in Quebec Backed by the Parbec Gold Deposit Keep Reading...

3h

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

10h

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

21h

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00