/NOT FOR DISTRIBUTION TO UNITED STATES NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES /

Quimbaya Gold Inc. (CSE: QIM) (" Quimbaya ") is pleased to announce that, further to its press release dated May 15, 2023 it has entered into three (3) definitive agreements (the " Definitive Agreements ") with Remandes Corporation S.A. (" Remandes ") for the acquisition of all the issued and outstanding shares (the " Shares ") of Explogold Ingenieria y Consultoria S.A.S., Minera Buey Aures S.A.S . and Soluciones Ambientales Del Nordeste S.A.S. (collectively, the " Companies ") by way of share purchase agreements (the " Transaction ").

The Tahami and Maitamac Projects

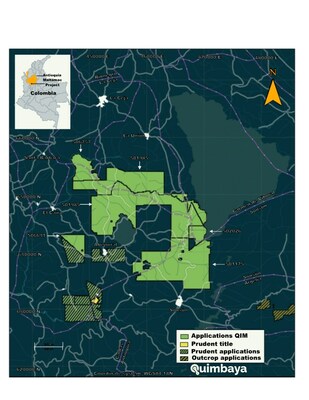

The Tahami Project is located 158 kilometers northeast of Medellin in the Segovia-Remedios mining district of Antioquia, in the most prolific gold region of Colombia which hosts several multi-million-ounce high-grade gold operations such as the Segovia mines that have been producing gold for more than 150 years. The Tahami Project consists of two titles covering approximately 622 Ha, located approximately 25 kilometers northeast of the producing Segovia gold mines (owned by Aris Mining). The property is easily accessible and hosts multiple gold occurrences defined by artisanal adits located near a regional scale structure known as the El Bagre fault. Gold and silver mineralization occurs in steeply dipping quartz-sulfide sheeted veins hosted by granodiorite of the Segovia Batholith. The property has never been drilled and shows excellent potential to uncover high grade gold and silver mineralization. Additionally, in accordance with the terms of the Definitive Agreement for the acquisition of Soluciones Ambientales Del Nordeste S.A.S., a portion of the purchase price will be held back by Quimbaya pending the successful transfer of certain mining applications covering a total aggregate area of approximately 2,494.4 Ha.

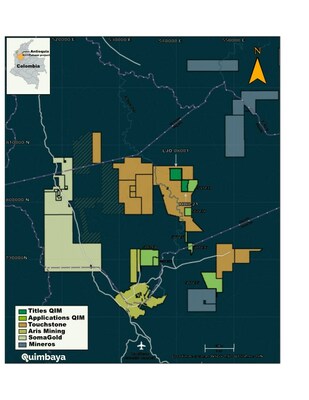

The Maitamac Project is located 45 km southwest of Medellín in the Abejorral and Sonson municipalities known for gold and silver artisanal mining towns. The property consists of 6 mining applications covering approximately 26,102 Ha and easily accessible. The property is mostly covered by the Cajamarca geological Complex hosting several gold occurrences and high-grade gold mines. Quartz-Sericite-Graphitic Schist as the preferred host rocks for gold were recently found on the property. Inside the project, many dredging artisanal mines were noted in several creeks. The source of the alluvial gold has never been found. Colombian Geological Services depicts Abejorral and Argelia-Sonsón region as a Gold Metallogenic District with several gold showings undiscovered yet. The property has been the subject of very little exploration work in the past and requires a systematic exploration program.

Alexandre P. Boivin , CEO commented: "This acquisition will significantly strengthen our gold and silver property portfolio. We are standing on solid ground and entering into the world class mining region of Segovia with promising titles, with significant upside exploration potential at Abejorral."

Francois Goulet , M.Sc., P.Geo, a "qualified person" as defined by National Instrument 43-101 - Standards for Disclosure of Mineral Projects , has reviewed the news release and assumes responsibility for scientific and technical disclosure contained herein.

The Transaction

The Transaction is be structured as three (3) separate share purchase agreements among Quimbaya, Remandes and each of the Companies. The purchase price payable by Quimbaya for all of the issued and outstanding Shares (the " Purchase Price ") shall be satisfied by: (i) the payment by Quimbaya to Remandes of a deposit in the amount of US$100,000 to be used by Remandes in accordance with an approved budget mutually agreed upon by the parties; and (ii) the issuance of 10,000,000 shares in the share capital of Quimbaya to Remandes (the " Consideration Shares "). 2,000,000 of the Consideration Shares will be retained by Quimbaya (the " Holdback Consideration Shares ") subject to the completion of the transfer of certain mining applications to Quimbaya. The Consideration Shares and the Holdback Consideration Shares will be subject to a 24 month contractual escrow arrangement, in addition to any escrow requirements required under applicable securities laws and stock exchange rules.

The completion of the Transaction is subject to the satisfaction of various conditions as are standard for a transaction of this nature, including but not limited to the receipt of all applicable regulatory, shareholder and third party approvals. In addition, the closing of each of the Definitive Agreements is conditional of the closing on each of the acquisitions closing.

The Transaction would constitute a "related party transaction" under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions (" MI 61-101 ") as Alexandre P. Boivin , President and CEO of Quimbaya, is a control person of Remandes. The completion of the Transaction will require simple majority approval of Quimbaya's minority shareholders.

Convertible Loan Agreement

Quimbaya also announces that, in accordance with the terms of the previously announced convertible loan agreement (the " Loan Agreement ") entered into between Quimbaya and Jean-Luc Peyrot (the " Lender "), the Lender has advanced an additional CA$145,000 (the " Second Advance ") to Quimbaya upon the execution of the Definitive Agreements. Pursuant to the terms of the Loan Agreement, Quimbaya will issue 45,000 bonus warrants (the " Bonus Warrants ") to the Lender within five (5) business days following the date of the Second Advance. The Bonus Warrants are exercisable into common shares of Quimbaya at a price of CA$0.60 for a period of 24 months from the date the issuance.

The Lender, Jean-Luc Peyrot , is a director of Quimabaya and the Loan Agreement is a "related party transaction" under MI 61-101. The directors (other than Jean-Luc Peyrot ) have determined that the transactions proposed by such Loan Agreement will be exempt from the formal valuation requirements of MI 61-101 as the Company is not listed on the markets specified in section 5.5(b) of MI 61-101, and the minority shareholder approval requirements of MI 61-101, as the fair market value of the Loan does not exceed CA$2,500,000.

Please refer to Quimbaya's press release dated May 15, 2023 for full details regarding the Loan Agreement.

About Quimbaya

Quimbaya aims to consolidate gold reserves through exploration and acquisition of mining properties in Antioquia, Colombia . Managed by an experienced team in mining sector, Quimbaya is focused on 3 projects in the regions of Segovia (the Tahami project), Puerto Berrio (the Berrio Project), and Abejorral (the Maitamac Project), all located in the Antioquia Province, Colombia.

Cautionary Statements

Certain statements contained in this press release constitute "forward-looking information" as that term is defined in applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein are forward-looking information. In particular, this news release contains forward-looking information in relation to: the definitive agreement, the Transaction and the potential completion of the Transaction, including Quimbaya's potential business upon the completion of the Transaction, the potential conditions and satisfaction of those conditions for the completion of the Transaction and the issuance of the Bonus Warrants. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" or "occur". Forward-looking information by its nature is based on assumptions and involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Quimbaya to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements or information. These assumptions include, but are not limited to: the satisfaction of any conditions to the Transaction set forth in the Definitive Agreements including, without limitation, the acceptance of the proposed Transaction by the CSE and typical closing conditions; the completion of satisfactory due diligence by Quimbaya in relation to the Transaction; and the receipt of all required approvals for the Transaction, including CSE acceptance, any board approvals, shareholder approvals or third party consents. Although Quimbaya's management believes that the assumptions made and the expectations represented by such information are reasonable, there can be no assurance that the forward-looking information will prove to be accurate. Furthermore, should one or more of the risks, uncertainties or other factors materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements or information. Readers are cautioned not to place undue reliance on forward-looking information as there can be no assurance that the plans, intentions or expectations upon which they are placed will occur. Forward-looking information contained in this news release is expressly qualified by this cautionary statement. The forward-looking information contained in this news release represents the expectations of Quimbaya as of the date of this news release and, accordingly, is subject to change after such date. Except as required by law, Quimbaya does not expect to update forward-looking statements and information continually as conditions change.

Neither the Canadian Securities Exchange nor its regulation services provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE Quimbaya Gold Inc.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/June2023/14/c8090.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/June2023/14/c8090.html