Highlights

- Drill hole CS25-044 encountered three (3) spodumene pegmatite intervals, with the widest continuous interval of 457.4 metres , along with an additional 36.9 metre interval .

- Drill hole CS25-038 encountered 22 spodumene pegmatite intervals, including a 58.9 metre wide interval , along with a further 58.3 metre and 31.8 metre interval .

- Drill hole CS25-039 encountered 13 spodumene pegmatite intervals, including a 108.5 metre wide interval, along with a further 99.7 metre, 77.7 metre and 71.0 metre interval .

- Drill hole CS25-040 encountered 12 spodumene pegmatite intervals, including a 95.1 metre wide interval, along with a further 81.9 metre and 66.5 metre interval .

- A total of 46 holes for 20,138 metres have been drilled on the Cisco Project to date, with assays pending on the eight (8) holes drilled during the summer 2025 drill campaign.

- Three (3) drill rigs are currently operating on the Cisco Project, primarily focused on infill scale spacing of the main mineralized zone, as the Company works towards an initial inferred Mineral Resource estimate.

Q2 Metals Corp. (TSX.V: QTWO | OTCQB: QUEXF | FSE: 458) (" Q2 " or the " Company ") is pleased to announce an update from the summer 2025 infill drilling campaign (the "Summer Drill Program") at the Cisco Lithium Project (the "Project" or the "Cisco Project"), located within the greater Nemaska traditional territory of the Eeyou Istchee James Bay, Quebec, Canada.

Multiple wide intercepts of continuous spodumene pegmatite were encountered within the eight (8) holes drilled, for a total of 4,603 metres ("m"), during the Summer Drill Program that launched mid-June. All eight (8) holes intercepted pegmatite with visual indications of spodumene mineralization identified.

" Hole 44, with its 457-metre-long intercept, has far exceeded our expectations. The Mineralized Zone also remains open at depth and along strike and there remains potential for significant expansion. Our geology team has designed a robust drilling campaign for the fall & winter as we continue to define the Mineralized Zone and work towards an inferred Mineral Resource estimate," said Neil McCallum, Q2 Metals Vice President of Exploration.

"The visual results from our Summer Drill Program are giving us a clearer picture of the Mineralized Zone at Cisco, " said Alicia Milne, President and CEO of Q2 Metals. " The scale and consistency of the spodumene-bearing pegmatite intercepted to date reinforces the long-term potential of the Cisco Project. With a strong treasury in place, we are well positioned to continue our drill campaign and advance our strategy to unlock the full value of Cisco ."

Figure 1. Q2 Geologists with Core from Hole 39

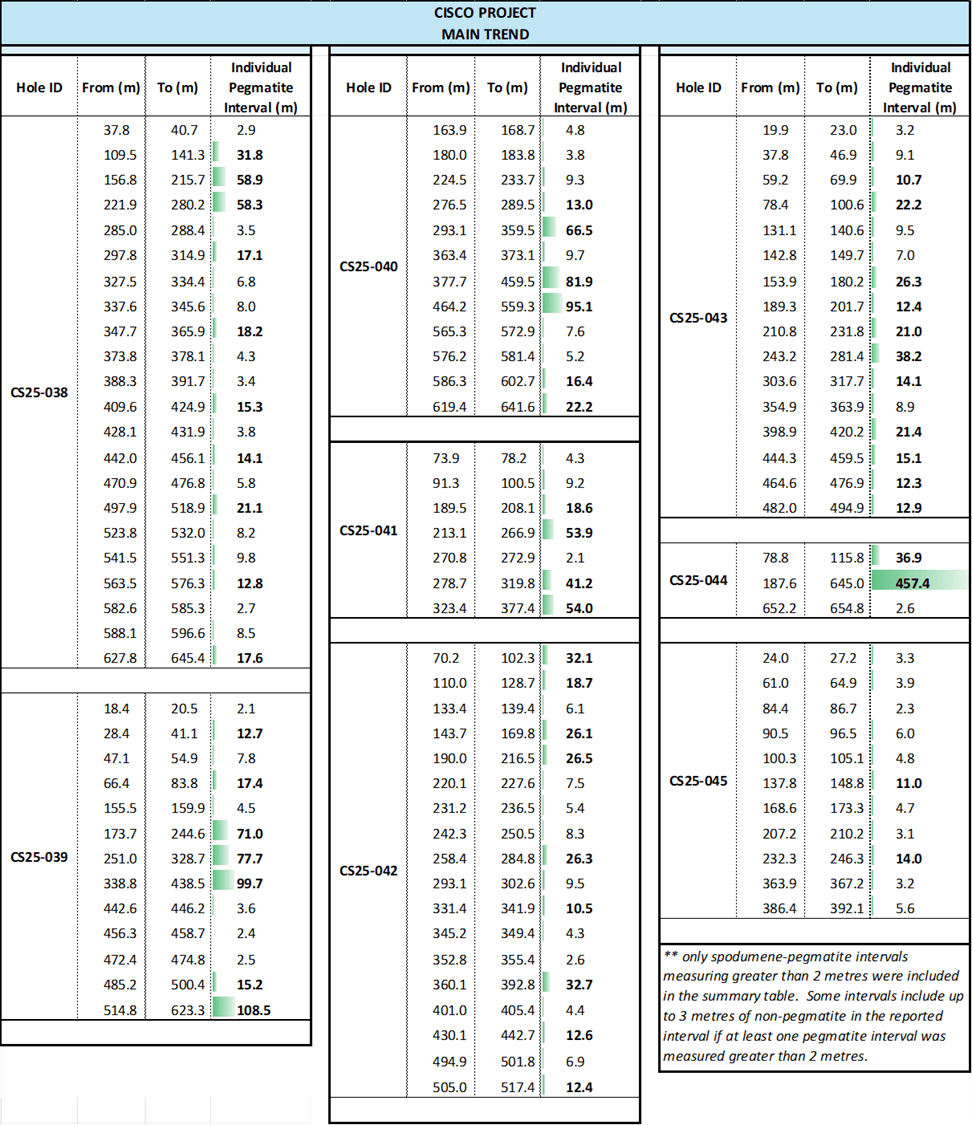

Summary of Spodumene-Bearing Pegmatite Intervals

The pegmatite intervals (greater than 2 m) of drill holes CS-25-038 to 045 are reported below in detail (Table 1):

Table 1. Summary of Spodumene-Pegmatite Intervals at the Main Zone, Cisco Project

The mineralized intervals in each of the holes are not necessarily representative of the true width and the modelled pegmatite zones are being refined with every additional hole.

Cautionary Statement: The presence of pegmatites does not confirm the presence of lithium (spodumene or other lithium minerals). Pegmatites are fractionated coarse grained igneous rocks commonly associated with lithium mineralization; however, many pegmatites do not contain mineralization. The presence of any mineralization can only be confirmed with assaying.

The geological team has completed the core cutting and logging of holes CS25-038 to CS25-045 and the samples have been dispatched to the SGS Canada preparation laboratory located in Val-d'Or, QC for mineral analysis to confirm the presence of lithium.

Discussion of Drilling Results

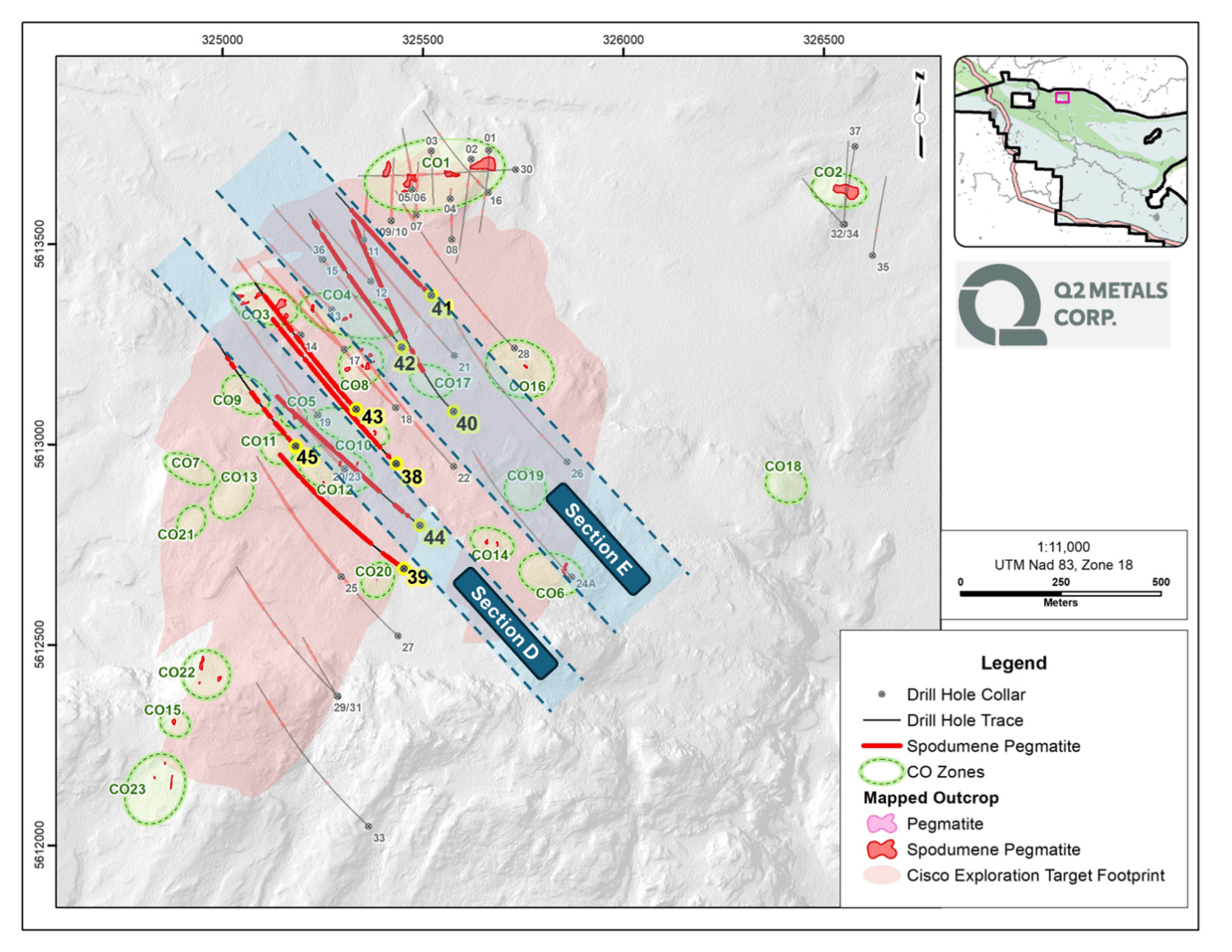

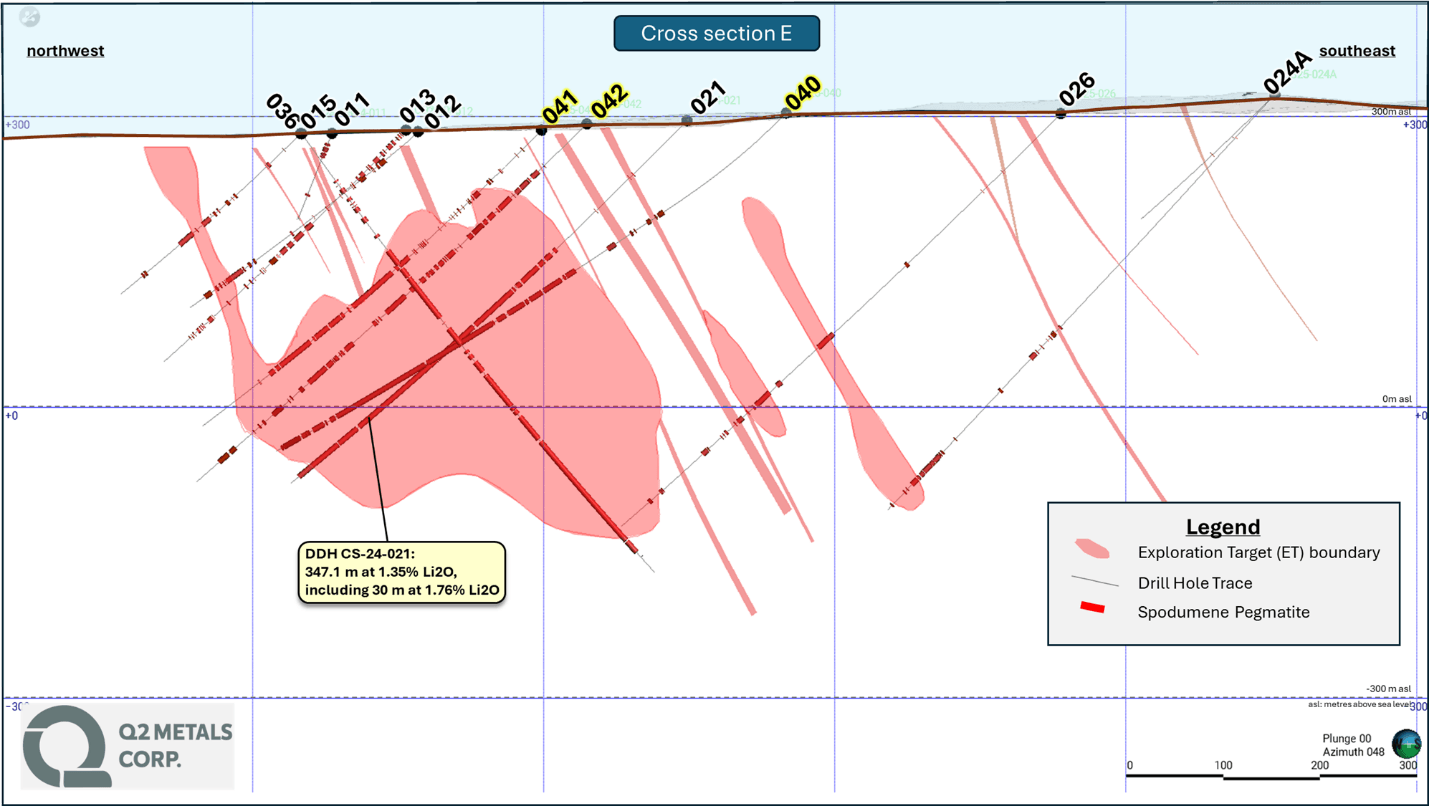

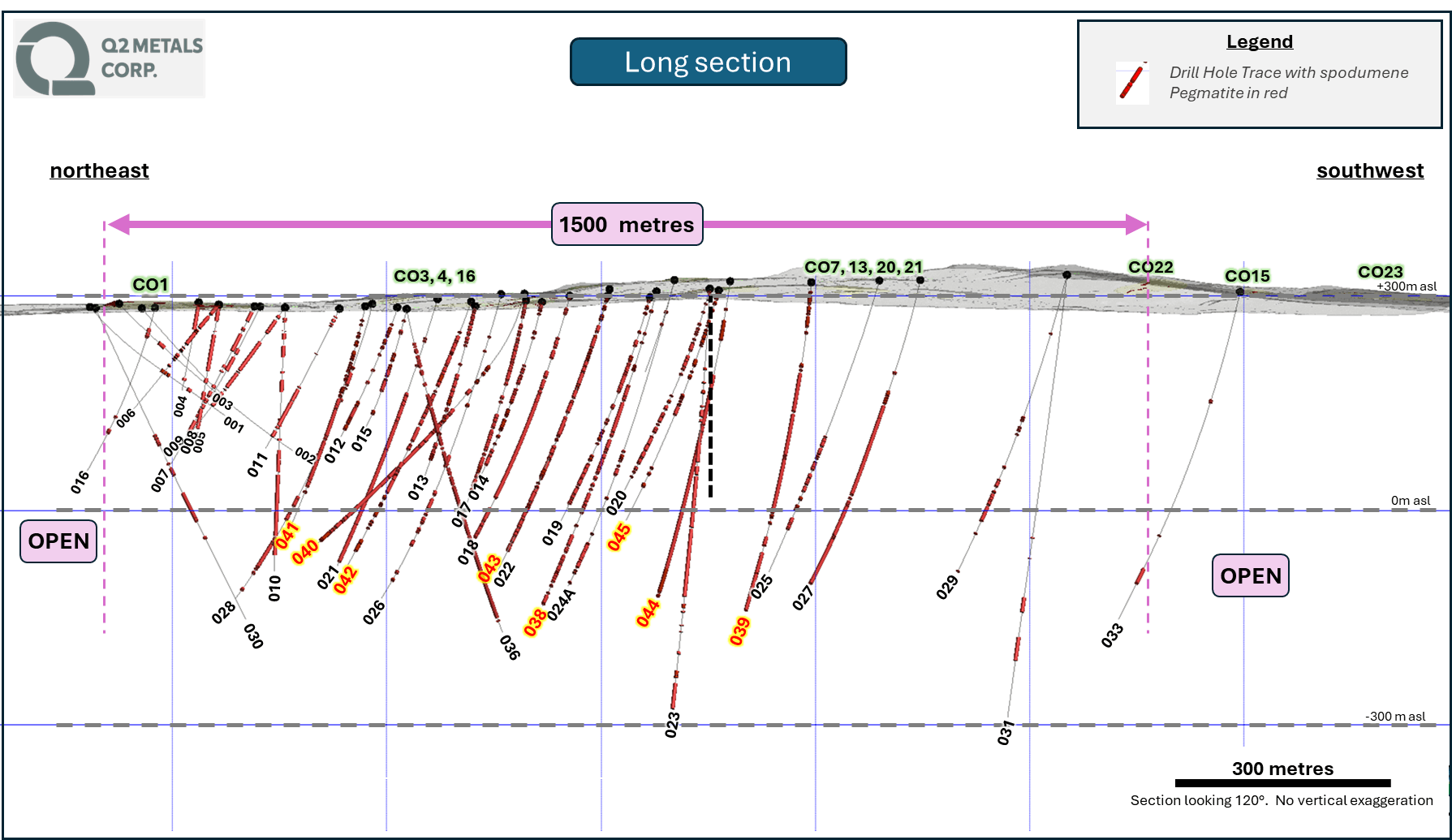

The summer drill program was designed to continue to drill within the main mineralized zone that spans approximately 1.5 kilometres ("km") northeast-southwest trending mineralized strike length identified at the Cisco Project (the "Mineralized Zone") (Figures 2, 3, 4 and 5).

An Exploration Target, prepared for the Company by independent consultant BBA Inc., encompassed the Mineralized Zone and included 40 holes completed for 16,167.8 m as at July 21, 2025 1 . The estimated range of potential mineralization and grade at the Mineralized Zone is from 215 to 329 million tonnes ("Mt") at a grade ranging from 1.0 to 1.38 % Li 2 O (see press release of July 21, 2025).

An Exploration Target is used to provide a conceptual estimate of the potential quantity and grade of a mineral deposit, based on known and additional limited geological evidence. It is an early-stage assessment that will help to guide further exploration, but it is not a mineral resource or mineral reserve and should not be treated as such.

The potential quantity and grade of the Exploration Target on the Cisco Project are conceptual in nature. There has been insufficient exploration to estimate and define a Mineral Resource, as defined by National Instrument 43-101 Standards of Disclosure for Mineral Project ("NI 43- 101"), and it is uncertain if further exploration will result in the target being delineated as a Mineral Resource.

Figure 2. Map of Drilling Area, Cisco Project

Figure 2. Map of Drilling Area, Cisco Project

Holes 38 and 43 were infill spaced holes located mid-way and 100 metres between two previously reported holes 21 and 23 which contained wide intervals of spodumene pegmatite . The pegmatite intervals of holes 38 and 43 are numerous with the most significant ones located close to surface (shallower than 200 metres from surface).

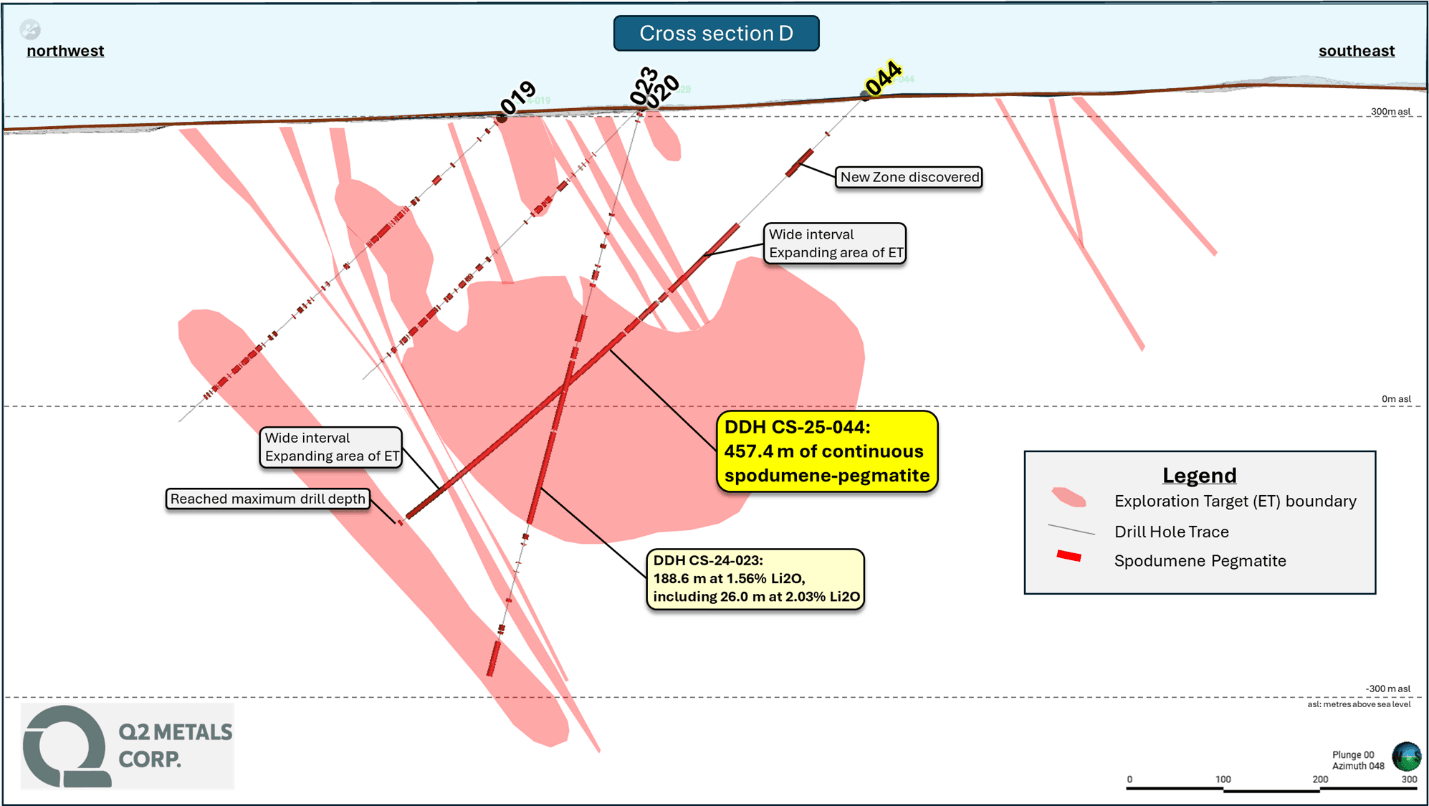

- Hole 21 reported a 347.1 m wide interval at 1.35% Li 2 O, including seven (7) higher-grade sub-intervals, including 30 m at 1.76% Li 2 O; and hole 23 reported 188.6 m at 1.56% Li 2 O, including 26.0 m at 2.03% Li 2 O.

Holes 39 and 45 were infill spaced holes located mid-way between previously reported holes 23 and 27 .

- Hole 27 reported a 179.6 m wide interval at 1.66% Li 2 O, 58.0 Metres at 1.75% Li 2 O, and 91.8 Metres at 1.81% Li 2 O.

Holes 40 and 42 were infill spaced holes located mid-way between previously reported holes 18 and 21 and on the same grid-line as partially reported hole 36 .

Hole 41 is an infill spaced hole, located between previously reported holes 21 and 10.

Hole 44 is an infill spaced hole, located on the same grid-line as previously reported hole 23 and significantly widens the known mineralization in that area of the zone.

Figure 3. Cross Section D (Looking Northeast)

Figure 4. Cross Section E (Looking Northeast)

Figure 5. Long Section of all drill holes of the main zone at Cisco.

The expanded drill program for the fall and winter will continue to tighten the drill spacing within the Mineralized Zone as the Company works towards an initial inferred Mineral Resource estimate at the Cisco Project. A portion of the expanded drill program will also test additional outcrop zones with the aid of geophysical targeting.

Sampling, Analytical Methods and QA/QC Protocols

All drilling is conducted using a diamond drill rig with NQ sized core and all drill core samples are shipped to SGS Canada's preparation facility in Val D'Or, Quebec, for standard sample preparation (code PRP92) which includes drying at 105°C, crushing to 90% passing 2 mm, riffle split 500 g, and pulverize 85% passing 75 microns. The pulps are then shipped by air to SGS Canada's laboratory in Burnaby, BC, where the samples are homogenized and subsequently analyzed for multi-element (including Li and Ta) using sodium peroxide fusion with ICP-AES/MS finish (code GE_ICM91A50). The reported Li grade will be multiplied by the standard conversion factor of 2.153 which results in an equivalent Li 2 O grade. Drill core was saw-cut with half-core sent for geochemical analysis and half-core remaining in the box for reference. The same side of the core was sampled to maintain representativeness.

A Quality Assurance / Quality Control (QA/QC) protocol following industry best practices has been incorporated into the sampling program. Measures include the systematic insertion of quartz blanks and certified reference materials (CRMs) into sample batches at a rate of approximately 5% each. Additionally, analysis of pulp-split and reject-split duplicates was completed to assess analytical precision. The QP has verified the QA/QC results of the analytical work.

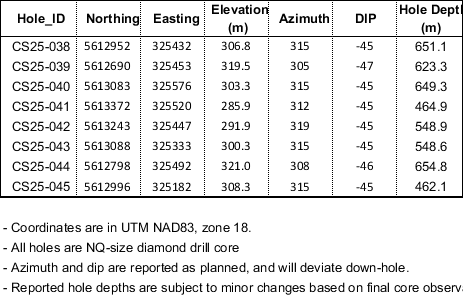

Drill Hole Collar Information

The summary of drill holes completed to date, including basic location and dip/azimuth is detailed below (Table 2):

Table 2. Summary of Drill Hole Collar Information, Cisco Project (CS25-038 to CS25-045)

Qualified Person

Neil McCallum, B.Sc., P.Geol, is a Qualified Person as defined by NI 43-101, and a registered permit holder with the Ordre des Géologues du Québec and member in good standing with the Professional Geoscientists of Ontario. Mr. McCallum has reviewed and approved the technical information in this news release. Mr. McCallum is a director and the Vice President Exploration for Q2.

Upcoming Events

Q2 Metals is hosting a site tour at the Cisco Project in mid-September and will be attending the following conferences and events:

| 121 Mining Investment | Hong Kong | September 24 - 25, 2025 |

| Investissement Quebec Critical and Strategic Minerals Trade Mission | South Korea & Japan | September 29 – October 3, 2025 |

| The Hidden Gems Conference | New York, NY | October 20 – 21, 2025 |

| IMARC | Sydney, Australia | October 21 – 23, 2025 |

| XPLOR | Montreal QC | October 27 – 30, 2025 |

ABOUT Q2 Metals Corp.

Q2 Metals is a Canadian mineral exploration company focused on the Cisco Lithium Project located within the greater Nemaska traditional territory of the Eeyou Istchee, James Bay, Quebec, Canada.

Cisco is comprised of 801 claims, totaling 41,253 hectares, with the main mineralized zone just 6.5 km from the Billy Diamond Highway, which transects the Project and leads to the Town of Matagami, rail head of the Canadian National Railway, approximately 150 km to the south.

The Cisco Project has district-scale potential with an initial Exploration Target estimating a range of potential lithium mineralization of 215 to 329 million tonnes at a grade ranging from 1.0 to 1.38% Li 2 O, based only on the first 40 holes drilled. It is noted that the potential quantity and grade of the Exploration Target are conceptual in nature. There has been insufficient exploration to estimate and define a Mineral Resource, as defined by NI 43-101, and it is uncertain if further exploration will result in the target being delineated as a Mineral Resource.

Drill testing continues with mineralization open at depth and along strike with potential for expansion at the Cisco Mineralized Zone. The 2025 Exploration Program is ongoing, with rolling assay results anticipated in the coming weeks and months as the Company works towards an initial mineral resource estimate.

FOR FURTHER INFORMATION, PLEASE CONTACT:

| Alicia Milne President & CEO Alicia@Q2metals.com | Jason McBride Investor Relations Manager Jason@Q2metals.com | Chris Ackerman Corporate Development Chris@Q2metals.com |

| Telephone: 1 (800) 482-7560 E-mail: info@Q2metals.com | ||

| www.Q2Metals.com | ||

Social Media:

Follow the Company: Twitter , LinkedIn , Facebook , and Instagram

Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian legislation. Forward-looking statements are typically identified by words such as: "believes", "expects", "anticipates", "intends", "estimates", "plans", "may", "should", "would", "will", "potential", "scheduled" or variations of such words and phrases and similar expressions, which, by their nature, refer to future events or results that may, could, would, might or will occur or be taken or achieved. Accordingly, all statements in this news release that are not purely historical are forward-looking statements and include statements regarding beliefs, plans, expectations and orientations regarding the future including, without limitation, any statements or plans regard the geological prospects of the Company's properties and the future exploration endeavors of the Company. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those anticipated in such forward-looking statements. The forward-looking statements in this news release speak only as of the date of this news release or as of the date specified in such statement. Forward looking statements in this news release include, but are not limited to, drilling results on the Cisco Project and inferences made therefrom, the conceptual nature of an exploration target on the Cisco Project, the potential scale of the Cisco Project, the focus of the Company's current and future exploration and drill programs, the scale, scope and location of future exploration and drilling activities, the Company's expectations in connection with the projects and exploration programs being met, the Company's objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, variations in ore grade or recovery rates, changes in project parameters as plans continue to be refined, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, reallocation of proposed use of funds, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same. Readers are cautioned that mineral exploration and development of mines is an inherently risky business and accordingly, the actual events may differ materially from those projected in the forward-looking statements. Additional risk factors are discussed in the section entitled "Risk Factors" in the Company's Management Discussion and Analysis for its recently completed fiscal period, which is available under Company's SEDAR profile at www.sedarplus.com .

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update this forward-looking information except as otherwise required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

1 Summary of Drill and Assay data

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/0bdd6397-66fa-49b9-a1d7-c4968bcb12e1

https://www.globenewswire.com/NewsRoom/AttachmentNg/f27706ce-a8e7-45ad-935a-2253668b9233

https://www.globenewswire.com/NewsRoom/AttachmentNg/4c732127-66a7-4b43-a29c-81cbf037b0eb

https://www.globenewswire.com/NewsRoom/AttachmentNg/e980860e-5d00-4711-a96c-f725040e1c20

https://www.globenewswire.com/NewsRoom/AttachmentNg/6ba520c7-0ea5-49bc-9d41-88659225529a

https://www.globenewswire.com/NewsRoom/AttachmentNg/eb650526-176c-4770-8f8f-08c2c40b6d30

https://www.globenewswire.com/NewsRoom/AttachmentNg/ba6cba05-35b3-4ba6-ba1a-aa5c770960fc