Q2 Metals Corp. (TSX.V: QTWO | OTCQB: QUEXF | FSE: 458) (" Q2 " or the " Company ") announces that, as a result of a technical review by the British Columbia Securities Commission, the following news release is being issued to clarify the technical disclosure pertaining to the Company's news release issued on July 21, 2025 regarding the announcement of an inaugural Exploration Target on the Cisco Lithium Project (the " Project " or the " Cisco Project "), located within the greater Nemaska traditional territory of the Eeyou Istchee James Bay region of Quebec, Canada.

"We are restating our disclosure regarding the Exploration Target on the Mineralized Zone at the Cisco Project at the request of the BC Securities Commission," said Alicia Milne, President and CEO of Q2 . "In accordance with NI 43-101, the potential quantity and grade of the Exploration Target are conceptual in nature. There has been insufficient exploration to define a Mineral Resource, as defined by NI 43-101, and it is uncertain if further exploration will result in the Exploration Target being delineated as a Mineral Resource."

"To clarify, our continued drill campaign is being designed, in light of the Exploration Target, to define and prepare an inferred Mineral Resource estimate at the Cisco Project. The Exploration Target is a conceptual estimate of the potential quantity and grade of the Mineralized Zone at the Cisco Project and has been a valuable corporate milestone and tool for the Q2 team. The Mineralized Zone remains open at depth and along strike and there remains potential for significant expansion. We are excited to continue to advance the Cisco Project, executing on our strategy to create value for our shareholders."

The inaugural Exploration Target was prepared for the Company by BBA Inc., an independent geological and engineering consulting firm (" BBA "), and is based on the exploration and drilling conducted by the Company at the Cisco Property up to July 18, 2025 (the " Exploration Target ").

An Exploration Target is used to provide a conceptual estimate of the potential quantity and grade of a mineral deposit, based on known and additional limited geological evidence. It is an early-stage assessment that will help to guide further exploration, but it is not a mineral resource or mineral reserve and should not be treated as such.

The Exploration Target on the Cisco Project estimates a range of potential mineralization and grade from 215 to 329 million tonnes ("Mt") at a grade ranging from 1.0 to 1.38 % Li 2 O:

| Tonnes Range (Mt) | Li 2 O Range (%) | |||

| Minimum | Maximum | Minimum | Maximum | |

| Exploration Target | 215 | 329 | 1.00 | 1.38 |

Table 1: Exploration Target for Cisco Mineralized Zone

The potential quantity and grade of the Exploration Target on the Cisco Project are conceptual in nature. There has been insufficient exploration to estimate and define a Mineral Resource, as defined by National Instrument 43-101 Standards of Disclosure for Mineral Project ("NI 43- 101"), and it is uncertain if further exploration will result in the target being delineated as a Mineral Resource.

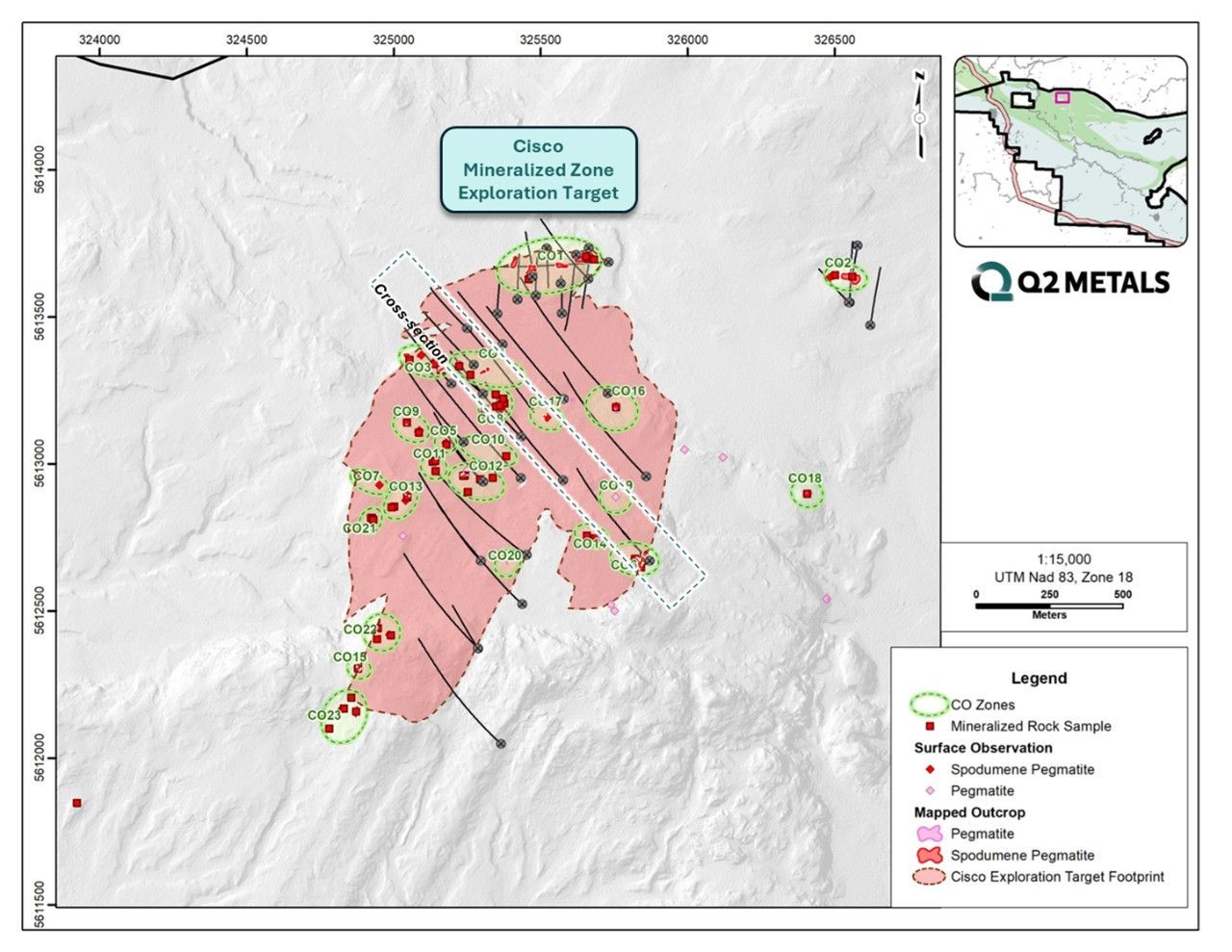

The data used by BBA to prepare the Exploration Target for the Cisco Project encompasses the main mineralized zone (the " Mineralized Zone ") (see Figure 1), which includes a total of 40 holes drilled for 16,167.8 metres ("m") 1 .

Figure 1. Cisco Project showing pegmatite outcrop zones in the Exploration Target area

The Exploration Target is constrained to the Mineralized Zone and does not include prospective geology and targets that the Company has identified outside of the Mineralized Zone.

The potential quantity and grade of the Exploration Target are conceptual in nature. There has been insufficient exploration to estimate and define a Mineral Resource, as defined by NI 43-101, and it is uncertain if further exploration will result in the target being delineated as a Mineral Resource.

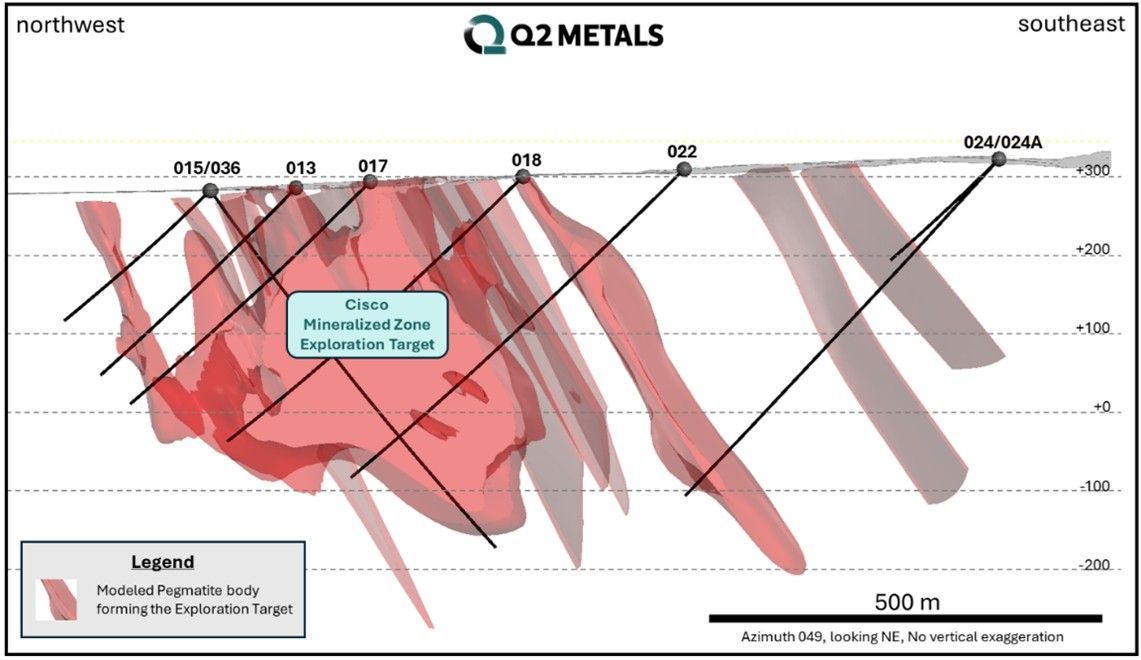

Figure 2. Cross section through the Mineralized Zone at Cisco Project

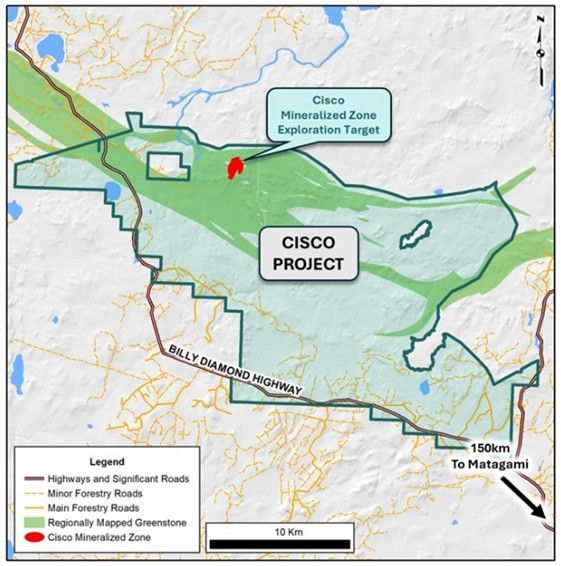

Figure 3. Cisco Project location

Methodology and Determination for the Exploration Target

The Company engaged BBA as an independent consultant to review all exploration and drilling conducted to date at the Cisco Project and to prepare the Exploration Target.

The Exploration Target is based on BBA's interpretation of the following geology and mineralization data that has been compiled to date:

- 40 diamond core drill holes completed for 16,167.8 m;

- 7,358 drill hole assay results;

- 156 surface rock chip samples;

- Surface geological mapping and diamond core geological logging;

- Detailed LiDAR surface topography; and

- The estimate includes geological information for the lower half of drill hole 36, and all of drill holes 38 and 39 (does not include pending assays).

BBA methodology included a complete review of the data and 3D modelling to create a conceptual volume of the pegmatite domains within the Mineralized Zone. The pegmatite domains were interpreted where geological information was available with sufficient quantity and quality. To estimate a tonnage, pegmatite specific gravity ("SG") was used for the pegmatite domains and based on 407 measurements. The average SG of each domain was then applied individually. An associated grade was then applied based on the assay results for each individual domain. The implied tonnage and grade of each volume was then reduced by a factor (confidence factor) to account for the likelihood of each domain being mineralized at a reasonable grade. The grade and tonnage were then further adjusted by an additional factor to be reported as ranges. The estimated tonnages are rounded to the nearest million tonnes and the grade rounded to the nearest 0.01% Li 2 O.

The 3D modelling of the pegmatite domains was restricted to the Mineralized Zone. The extent of the interpreted pegmatite domains was limited up to 250 m around the relevant geological information (drill hole, channel). The thickness of the interpreted pegmatite domains is representative of the pegmatite intercepts.

The potential quantity and grade of the Exploration Target are conceptual in nature. There has been insufficient exploration to estimate and define a Mineral Resource, as defined by NI 43-101, and it is uncertain if further exploration will result in the target being delineated as a Mineral Resource.

Qualified Person

Mr. Todd McCracken, P.Geo., is a Qualified Person as defined by NI 43-101, and member in good standing with the Ordre des Géologues du Québec and with the Professional Geoscientists of Ontario. Mr. McCracken has reviewed and approved the technical information in this news release. Mr. McCracken is Director – Mining & Geology – Central Canada, of BBA Inc. and is independent of the Company. Mr. McCracken does not hold any securities in the Company.

Neil McCallum, B.Sc., P.Geol, is a Qualified Person as defined by NI 43-101, and a registered permit holder with the Ordre des Géologues du Québec and member in good standing with the Professional Geoscientists of Ontario. Mr. McCallum has reviewed and approved the technical information in this news release. Mr. McCallum is a director and the Vice President Exploration for Q2.

ABOUT Q2 Metals Corp.

Q2 Metals is a Canadian mineral exploration company focused on the Cisco Lithium Project located within the greater Nemaska traditional territory of the Eeyou Istchee, James Bay, Quebec, Canada.

The Cisco Project is comprised of 801 claims, totaling 41,253 hectares, with the main mineralized zone just 6.5 km from the Billy Diamond Highway, which transects the Project. The Town of Matagami, rail head of the Canadian National Railway, is approximately 150 km to the south.

The Cisco Project has district-scale potential with an initial Exploration Target estimating a range of potential lithium mineralization of 215 to 329 million tonnes at a grade ranging from 1.0 to 1.38% Li 2 O, based only on the first 40 holes drilled. It is noted that the potential quantity and grade of the Exploration Target are conceptual in nature. There has been insufficient exploration to estimate and define a Mineral Resource, as defined by NI 43-101, and it is uncertain if further exploration will result in the target being delineated as a Mineral Resource.

Drill testing continues with mineralization open at depth and along strike with potential for expansion at the Cisco Mineralized Zone. The 2025 Exploration Program is ongoing, with rolling assay results anticipated in the coming weeks and months as the Company works towards an initial mineral resource estimate.

FOR FURTHER INFORMATION, PLEASE CONTACT:

| Alicia Milne | Jason McBride | Chris Ackerman |

| President & CEO | Investor Relations Manager | Corporate Development |

| Alicia@Q2metals.com | Jason@Q2metals.com | Chris@Q2metals.com |

Telephone: 1 (800) 482-7560

E-mail: info@Q2metals.com

Follow the Company: Twitter , LinkedIn , Facebook , and Instagram

Sampling, Analytical Methods and QA/QC Protocols

All drilling is conducted using a diamond drill rig with NQ sized core and all drill core samples are shipped to SGS Canada's preparation facility in Val D'Or, Quebec, for standard sample preparation (code PRP92) which includes drying at 105°C, crushing to 90% passing 2 mm, riffle split 500 g, and pulverize 85% passing 75 microns. The pulps are then shipped by air to SGS Canada's laboratory in Burnaby, BC, where the samples are homogenized and subsequently analyzed for multi-element (including Li and Ta) using sodium peroxide fusion with ICP-AES/MS finish (code GE_ICM91A50). The reported Li grade will be multiplied by the standard conversion factor of 2.153 which results in an equivalent Li 2 O grade. Drill core was saw-cut with half-core sent for geochemical analysis and half-core remaining in the box for reference. The same side of the core was sampled to maintain representativeness.

A Quality Assurance / Quality Control (QA/QC) protocol following industry best practices has been incorporated into the sampling program. Measures include the systematic insertion of quartz blanks and certified reference materials (CRMs) into sample batches at a rate of approximately 5% each. Additionally, analysis of pulp-split and reject-split duplicates was completed to assess analytical precision. The QP has verified the QA/QC results of the analytical work.

Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian legislation. Forward-looking statements are typically identified by words such as: "believes", "expects", "anticipates", "intends", "estimates", "plans", "may", "should", "would", "will", "potential", "scheduled" or variations of such words and phrases and similar expressions, which, by their nature, refer to future events or results that may, could, would, might or will occur or be taken or achieved. Accordingly, all statements in this news release that are not purely historical are forward-looking statements and include statements regarding beliefs, plans, expectations and orientations regarding the future including, without limitation, any statements or plans regard the geological prospects of the Company's properties and the future exploration endeavors of the Company. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. Forward-looking statements are based on a number of material factors and assumptions.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those anticipated in such forward-looking statements. The forward-looking statements in this news release speak only as of the date of this news release or as of the date specified in such statement. Forward looking statements in this news release include, but are not limited to, statements with respect to the definition of an Exploration Target at the Company's Cisco Project, drilling results on the Cisco Project and inferences made therefrom, the preparation of an exploration target on the Cisco Project, the potential scale of the Cisco Project, the focus of the Company's current and future exploration and drill programs, the scale, scope and location of future exploration and drilling activities, the Company's expectations in connection with the projects and exploration programs being met, the Company's objectives, goals or future plans, statements, exploration results, potential mineralization, the estimation of mineral resources, exploration and mine development plans, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from those in forward-looking statements include failure to obtain necessary approvals, variations in ore grade or recovery rates, changes in project parameters as plans continue to be refined, unsuccessful exploration results, changes in project parameters as plans continue to be refined, results of future resource estimates, future metal prices, availability of capital and financing on acceptable terms, reallocation of proposed use of funds, general economic, market or business conditions, risks associated with regulatory changes, defects in title, availability of personnel, materials and equipment on a timely basis, accidents or equipment breakdowns, uninsured risks, delays in receiving government approvals, unanticipated environmental impacts on operations and costs to remedy same. Readers are cautioned that mineral exploration and development of mines is an inherently risky business and accordingly, the actual events may differ materially from those projected in the forward-looking statements. Additional risk factors are discussed in the section entitled "Risk Factors" in the Company's Management Discussion and Analysis for its recently completed fiscal period, which is available under Company's SEDAR profile at www.sedarplus.com .

Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update this forward-looking information except as otherwise required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

1 Summary of Drill and Assay data .

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/e31b19ce-ac6b-4cd6-9050-9aa5c5b8210d

https://www.globenewswire.com/NewsRoom/AttachmentNg/733f5bb2-f3e1-47f0-babf-8cd2292f0c26

https://www.globenewswire.com/NewsRoom/AttachmentNg/121a3367-b67f-42d8-9e7a-59895010a974