Power Nickel Inc. (the "Company" or "Power Nickel") (TSX-V:PNPN)(OTCBB:CMETF)(Frankfurt:IVVI) is pleased to announce it has completed its over-subscribed non-brokered private placement of 13,750,000 flow-through units (each, an "FT Unit") at a price of $0.20 per FT Unit and 14,425,000 non-flow-through units (each an "NFT Unit") at a price of $0.10 per NFT Unit, for aggregate gross proceeds of CAD$4,192,500. (the "Private Placement"). The Company has received conditional TSX Venture Exchange ("TSXV") approval for the Private Placement

Each FT Unit consists of one common share of the Company that qualifies as a "flow-through share" (each, an "FT Share"), for purposes of the Income Tax Act (Canada) (the "ITA"), and one non-flow-through common share purchase warrant (each, a "Warrant"). Each Warrant is exercisable into one non-flow-through common share (each, a "Common Share") at an exercise price of $0.20 per Warrant for a period of five years from the date of issuance. Each NFT Unit consists of one Common Share and one Warrant. All securities issued under the Private Placement will be subject to a four-month and one-day statutory hold period.

In connection with the closing of the Private Placement, the Company paid finder's fees of $109,375 and issued 708,750 non-transferable finder's Warrants to certain finders in accordance with applicable securities laws and the policies of the TSXV. Each finder's warrant has the same terms as the Warrants but are non-transferable.

The Warrants are subject to an acceleration clause that entitles the Company to provide notice (the "Acceleration Notice") to holders that the Warrants will expire 30 days from the date the Company provides the Acceleration Notice. The Company can only provide the Acceleration Notice if the closing price of the Company's Common Shares on the TSXV is equal to or greater than $0.40 for 10 consecutive trading days. The Acceleration Notice can be provided at any time after the statutory hold period and before the expiry date of the Warrants.

The Company intends to use the gross proceeds from the sale of the FT Shares to incur eligible "Canadian exploration expenses", within the meaning of the ITA, that will qualify for the federal 30% Critical Mineral Exploration Tax Credit pursuant to the draft legislation released on August 9, 2022. The Company intends to use approximately $800,000 of the proceeds from the sale of the NFT Units to settle an outstanding debenture. The Company intends to use the remainder of the proceeds from the sale of the NFT Units for general administrative and working capital purposes.

Two insiders of the Company invested aggregate funds of $540,000 into the Private Placement in NFT Units, which is considered a "related party transaction" within the meaning of Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Company intends to rely on the exemptions from the formal valuation and minority shareholder approval requirements of MI 61-101 as the Company is not listed on a specified market (as set out in Section 5.5(b) of MI 61-101) and the aggregate fair market value of the NFT Units being subscribed to by the insiders does not exceed CAD $2,500,000 (as set out in Section 5.7(1)(b) of MI 61-101).

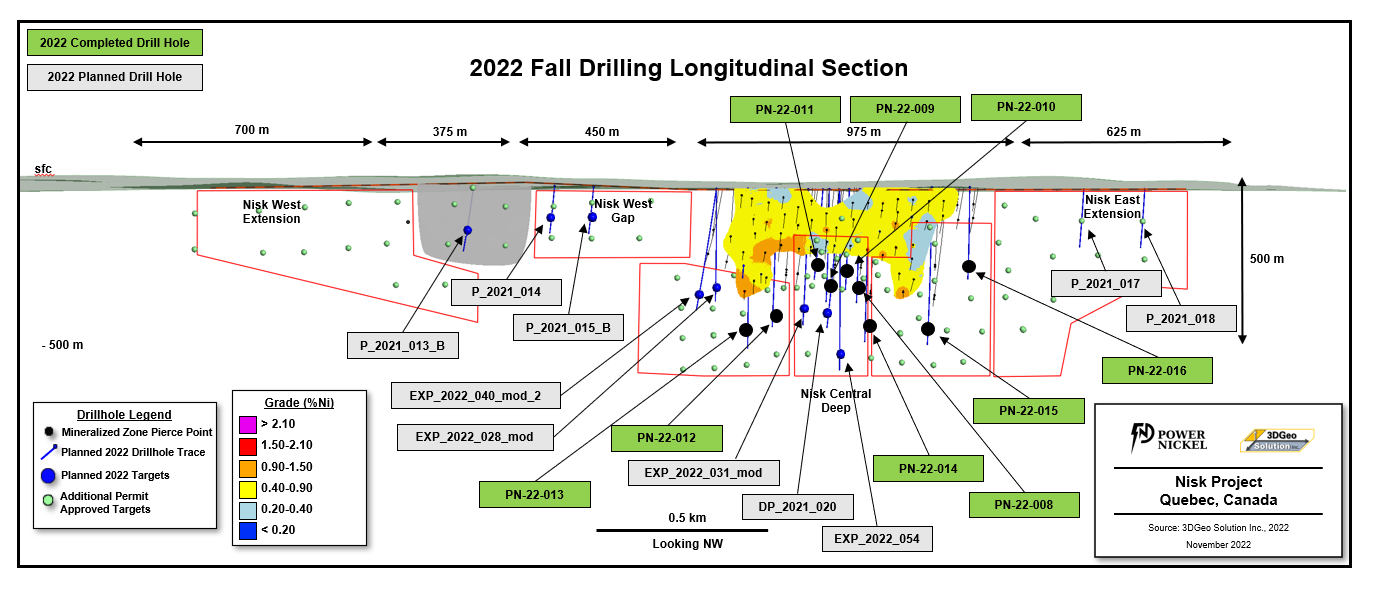

"With the new financing we have expanded our drill program and now plan to keep drilling through mid-December and start up again in Mid January. We had planned to drill 5000 meters and will now add an additional 7500 to 10,000 meters as we continue to like what we see with our drilling program." Commented Power Nickel CEO Terry Lynch. "Sections like these from hole PN 22-009 certainly were exciting to see.

We have made good progress drilling at Nisk. The Green holes have been completed and are in for assay. We would expect to get results out starting next week and every two weeks or so after that until the end of February". Lynch added.

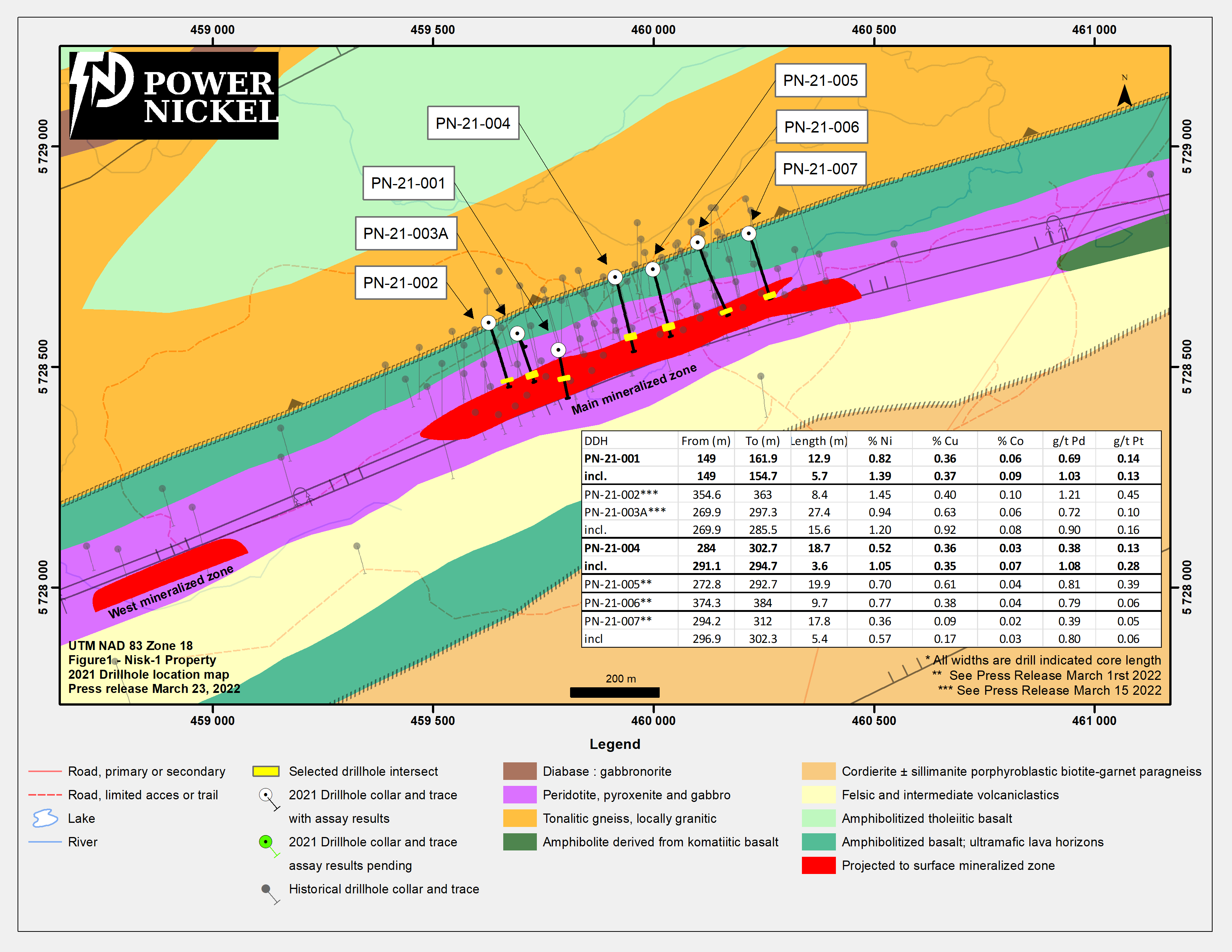

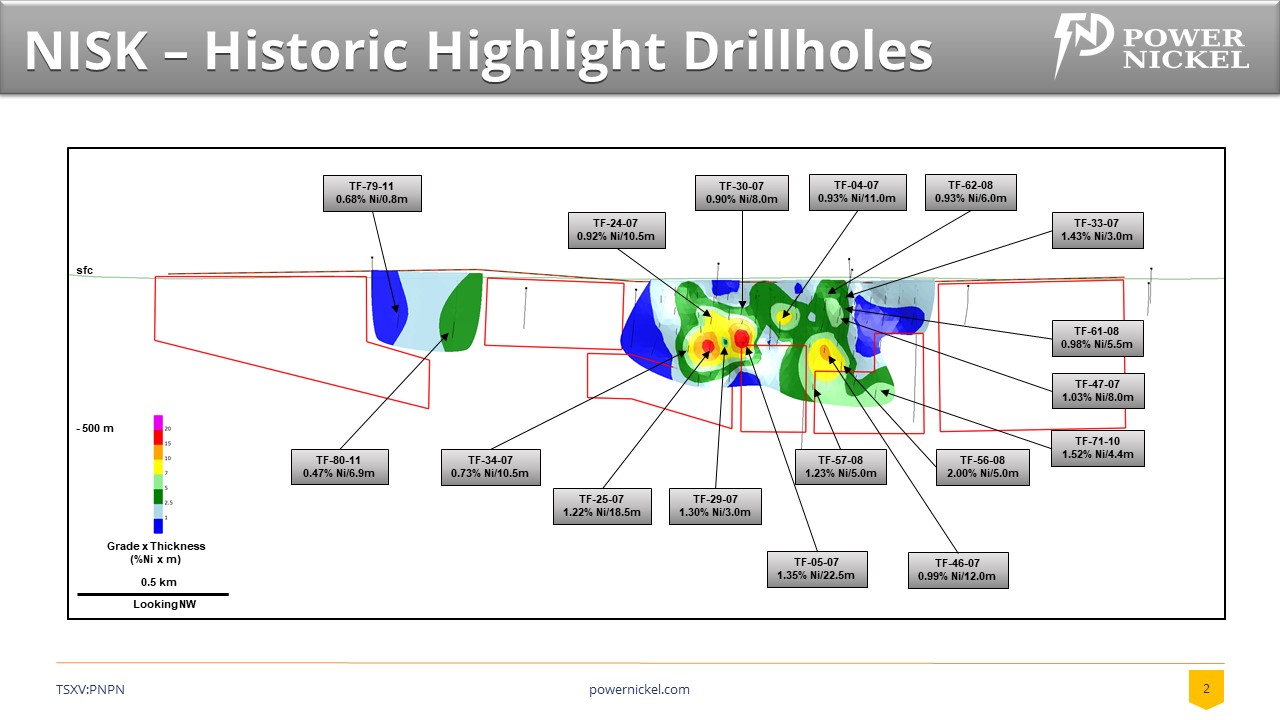

The illustration below details the previous drill holes we completed on our last campaign which was reported in March of this year.

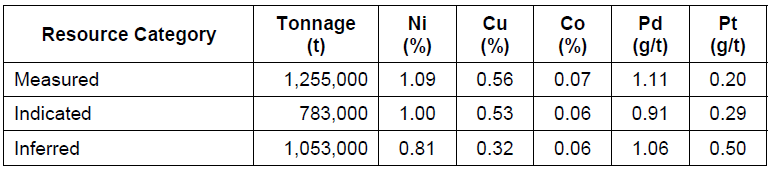

The existing resource estimates at the Nisk project are of historic nature and the Company's geology team has not completed sufficient work to confirm a NI 43-101 compliant mineral resource. Therefore, caution is appropriate since these historic estimates cannot, and should not be relied on. For merely informational purposes see Table 1.

Table ‑1: Historical Resource Estimate figures for respective confidence categories at the NISK-1 deposit, After RSW Inc 2009: Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Québec.

The information regarding the NISK-1 deposit was derived from the technical report titled "Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Québec" dated December 2009. The key assumptions, parameters and methods used to prepare the mineral resource estimates described above are set out in the technical report.

Power Nickel expects to take the results from the historic drilling programs, its initial program in late 2021, the current drill program, and a new metallurgical study and prepare a new 43-101 which we would expect to deliver in Q2 2023.

The 3D geological model developed by 3DGeo Solution Inc. ("3DGS") identified a prospective set of targets that the Company feels will give the best potential to expand the Nisk historical deposit. The image below is a view of the mineralization projected from the surface at the area we refer to as Nisk Main.

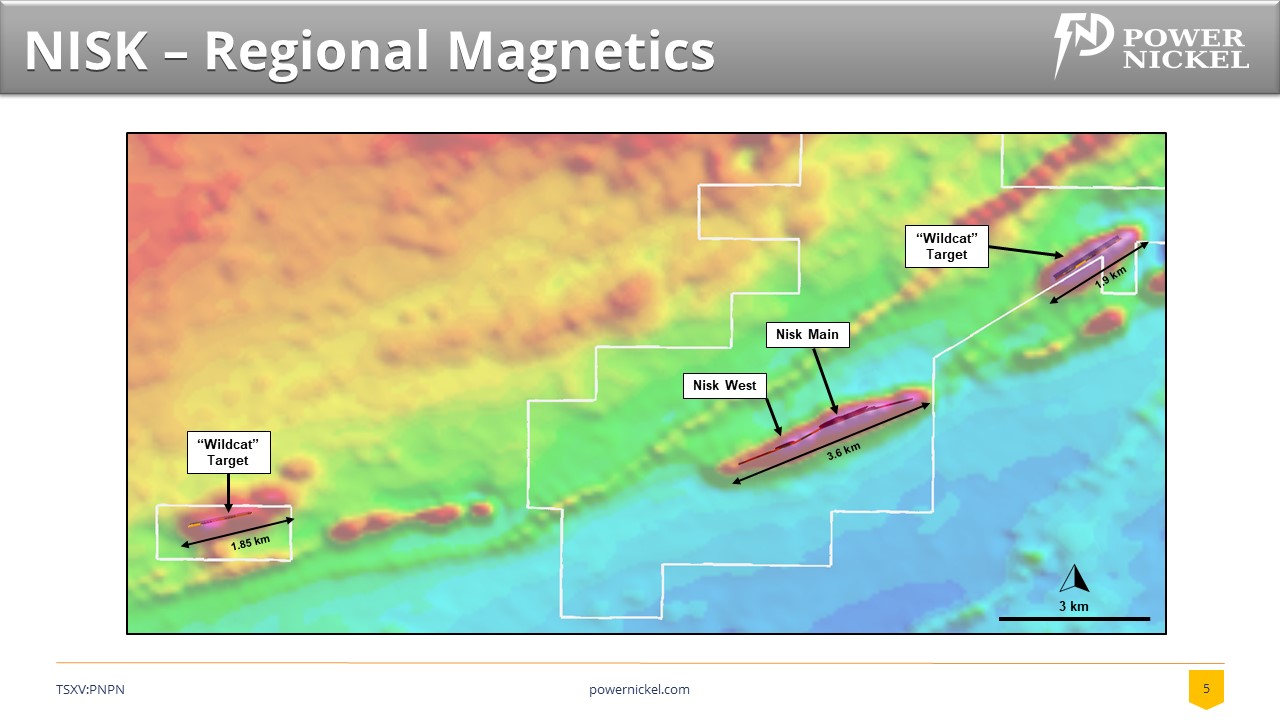

"Nisk has four distinct target areas covering over 7 Kilometres of strike length. Our focus in our 2022 drill program was on the Nisk Main target. Historically, we know globally these types of deposits typically have multiple pods. We are encouraged by what we see on Nisk Main and feel we can continue to build commercial tonnage there but we are also looking forward to exploring Nisk West and the two wildcat targets in subsequent drilling in Q1/Q2 2023", commented Power Nickel's CEO Terry Lynch.

ABOUT NISK

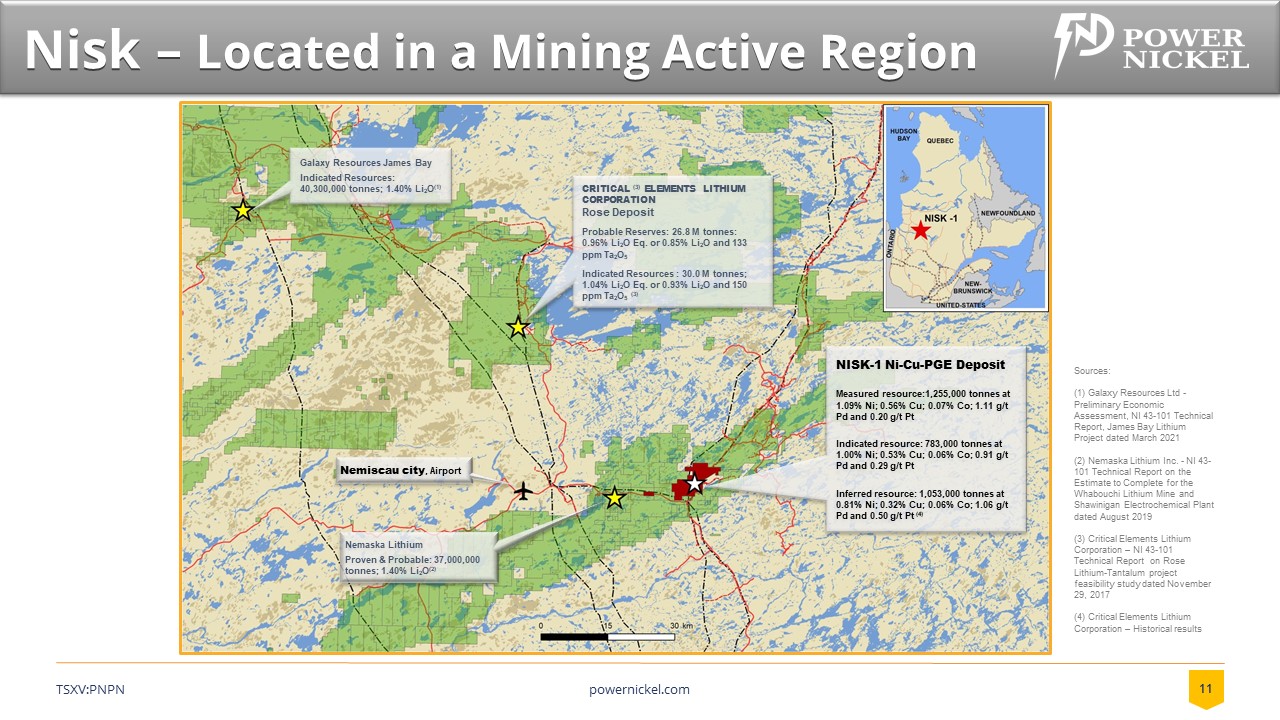

Nisk is located south of James Bay as illustrated in the area map below. This region is the site of a number of mining projects and improving infrastructure.

Nisk has historically had some very high-grade Nickel intercepts as shown below. The Grade-Thickness iso-contours are representative of the nickel distribution only.

Analysis and QAQC Procedures

All samples were submitted to and analyzed at ALS Global ("ALS"), an independent commercial laboratory located in Val-d'Or, Québec for both the sample preparation and assaying. ALS is a commercial laboratory independent of Power Nickel with no interest in the Project. ALS is an ISO 9001 and 17025 certified and accredited laboratory. Samples submitted through ALS are run through standard preparation methods and analyzed using ME-ICP61a (33 element Suite; 0.4g sample; Intermediate Level Four Acid Digestion) and PGM-ICP27 (Pt, Pd, and Au; 30g fire assay and ICP-AES Finish) methods. ALS also undertake its own internal coarse and pulp duplicate analysis to ensure proper sample preparation and equipment calibration.

Power Nickel's QA/QC program includes the regular insertion of CRM standards, duplicates, and blanks into the sample stream with a stringent review of all results. Historic holes were assayed by various accredited laboratories.

Qualified Person

Kenneth Williamson, Géo (OGQ #1490), M.Sc., Senior Consulting Geologist is the independent qualified person pursuant to the requirements of NI 43-101, and has reviewed and approved the technical content of this press release.

About Power Nickel Inc.

Power Nickel is a Canadian junior exploration company focusing on high-potential copper, gold, and battery metal prospects in Canada and Chile.

On February 1, 2021, Power Nickel (then called Chilean Metals) completed the acquisition of its option to acquire up to 80% of the Nisk project from Critical Elements Lithium Corp. (CRE:TSXV)

The NISK property comprises a large land position (20 kilometers of strike length) with numerous high-grade intercepts. Power Nickel, formerly Chilean Metals is focused on confirming and expanding its current high-grade nickel-copper PGE mineralization historical resource by preparing a new Mineral Resource Estimate in accordance with NI 43-101, identifying additional high-grade mineralization, and developing a process to potentially produce nickel sulfates responsibly for batteries to be used in the electric vehicles industry.

Power Nickel (then called Chilean Metals) announced on June 8th, 2021 that an agreement has been made to complete the 100% acquisition of its Golden Ivan project in the heart of the Golden Triangle. The Golden Triangle has reported mineral resources (past production and current resources) in a total of 67 million ounces of gold, 569 million ounces of silver, and 27 billion pounds of copper. This property hosts two known mineral showings (gold ore and magee), and a portion of the past-producing Silverado mine, which was reportedly exploited between 1921 and 1939. These mineral showings are described to be Polymetallic veins that contain quantities of silver, lead, zinc, plus/minus gold, and plus/minus copper.

Power Nickel is 100 percent owner of five properties comprising over 50,000 acres strategically located in the prolific iron-oxide-copper-gold belt of northern Chile. It also owns a 3-per-cent NSR royalty interest on any future production from the Copaquire copper-molybdenum deposit, recently sold to a subsidiary of Teck Resources Inc. Under the terms of the sale agreement, Teck has the right to acquire one-third of the 3-per-cent NSR for $ 3 million at any time. The Copaquire property borders Teck's producing Quebrada Blanca copper mine in Chile's first region.

For further information on Power Nickel Inc., please contact:

Mr. Terry Lynch, CEO

647-448-8044

terry@powernickel.com

For further information, readers are encouraged to contact:

Power Nickel Inc.

The Canadian Venture Building

82 Richmond St East, Suite 202

Toronto, ON

ON BEHALF OF THE BOARD OF DIRECTORS

Terry Lynch & CEO terry@powernickel.com

Cautionary Note Regarding Forward-Looking Statement

This news release may contain certain statements that may be deemed "forward-looking statements". All statements in this release, other than statements of historical fact, that address events or developments that PNPN expects to occur, including details related to the proposed spin out transactions, are forward looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Forward-looking statements in this document include statements regarding current and future exploration programs, activities and results. Although PNPN believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include market prices, exploitation and exploration success, continued availability of capital and financing, inability to obtain required regulatory or governmental approvals and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Power Nickel Inc.

View source version on accesswire.com:

https://www.accesswire.com/727829/Power-Nickel-Closes-Financing-Adding-Over-4-Million-Dollars-Looks-to-Expand-the-Drill-Program-at-Nisk-its-High-Grade-Nickel-Sulfide-Project-From-5000-Metres-to-12500-15000-Metres