Power Metals Corp. (" Power Metals " or the " Company ") (TSXV: PWM) (FRANKFURT: OAA1) (OTC: PWRMF) is pleased to announce that it has received an exploration permit (PR-22-000035) for drilling on its 100% owned Case Lake Property in northeastern Ontario from Ministry of Northern Development, Mines, Natural Resources and Forestry. The exploration permit is valid for three years. Power Metals has started planning a first phase of a 5,000 meter drill program and a geological mapping program at Case Lake for the late spring of 2022.

Power Metals has drilled approximately 13,000 meters to date at Case Lake. Previous drilling on the Main Dyke intersected exceptionally high Lithium (Li) and Tantalum (Ta) intervals. Highlights from our 2017 drill program includes:

- 1.94 % Li 2 O, 323.75 ppm Ta over 26.0 m , PWM-17-08

- 1.23 % Li 2 O,148.0 ppm Ta over 16.0 m , PWM-17-09

- 1.74 % Li 2 O, 245.96 ppm Ta over 15.06 m , PWM-17-10

- 2.07 % Li 2 O, 213.96 ppm Ta over 18.0 m , PWM-17-40

- 2.81 % Li 2 O, 143.33 ppm Ta over 7.0 m , PWM-17-40

- 1.31 % Li 2 O, 106.62 ppm Ta over 6.0 m , PWM-17-50

- 1.48 % Li 2 O, 179.35 ppm Ta over 11.0, PWM-17-50

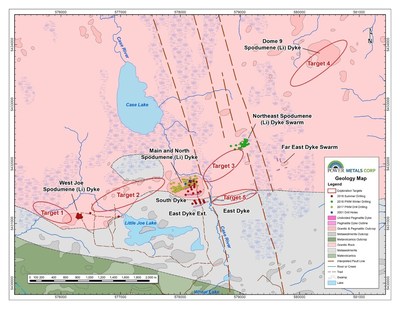

The upcoming 5,000 m drill program will be approximately 50 shallow drill holes at Case Lake focusing on Power Metals Li-Cs-Ta West Joe Dyke (Figure 1). The objective of the drill program will be to expand the lithium-cesium-tantalum (Li-Cs-Ta) mineralization previously discovered at West Joe during their 2018 drill program. The West Joe Dyke will be tested along strike and down dip, as it is currently open in all directions. Spodumene (Li ore) and Ta-oxide minerals occur in outcrop on the surface of the West Joe Dyke and pollucite (Cs ore) was intersected in drill core. Li-Cs-Ta are all on Canada's and Ontario's Critical Minerals list.

Previous drilling on the West Joe Dyke intersected exceptionally high-grade Li and Ta intervals:

- 3.88 % Li 2 O, 925 ppm Ta over 1.0 m , PWM-18-111

- 3.43 % Li 2 O, 264 ppm Ta over 1.05 m , PWM-18- 111B

- 3.07 % Li 2 O, 611 ppm Ta over 1.0 m , PWM-18-116

- 3.88 % Li 2 O, 232.0 ppm Ta over 0.82 m , PWM-18-124

- 3.20 % Li 2 O, 468.93 ppm Ta over 2.10 m , PWM-18-123

Cesium (Cs) mineralization was intersected in 6 drill holes on West Joe Dyke: PWM-18-111, 112, 116, 123, 124 and 126. Cesium (Cs) mineralization was also intersected in exceptionally high-grade Cs intervals:

- 14.70 % Cs 2 O over 1.0 m , PWM-18-126

- 12.40 % Cs 2 O over 1.0 m , PWM-18-112

- 6.74 % Cs 2 O over 5.0 m , PWM-18-126.

Johnathan More , Chairman of Power Metals stated, "We are thrilled to be getting back into the field and drilling where we left off from the pre-covid days. Our mineralization is open in all directions and is at surface. While we enjoy high-grade lithium and tantalum zones, we are a standout company because of our cesium results to date. This upcoming drill program will be led by world renowned Dr. Julie Selway , our VP of Exploration, alongside our partner Sinomine Resource Group who will also be providing top notch advisement from their plethora of expert geologists."

In addition to drilling, Power Metals will also complete geological mapping along the 10 km mineralization trend from West Joe Dyke to Main Dyke to NE Dyke to Dome 9 and to Abbotsford Dome (Figure 1). Dome 9 was discovered 2.7 km northeast of the Main Dyke by mapping in the summer of 2018 and has not yet been drilled. Dome 9 has three lithium pegmatite dykes: two of which contain spodumene and one contains lepidolite (Li ore minerals). Drilling on the North and Main Dykes indicated that the spodumene pegmatites are hosted by dome-shaped laccoliths. Power Metals is eager to explore their Abbotsford , Joe Creek , Kenning and Circle Lake domes acquired in May 2020 in search of additional spodumene pegmatites.

Quality Control

The drill core was sampled so that 1 m of the Case Batholith tonalite host rock was sampled followed by 1 m long samples of the pegmatite dyke and 1 m of the Case Batholith. The sampling followed lithology boundaries so that only one lithology unit is within a sample, except for the Cochrane by Power Metals' geologists. The core was then shipped to SGS analytical lab in Lakefield, Ontario which has ISO 17025 certification. Every 20 samples included one external quartz blank, one external lithium standard and one core duplicate. The ore grade Li 2 O% was prepared by sodium peroxide fusion with analysis by ICP-OES with a detection limit of 0.002 % Li 2 O. A QA/QC review of the standards and blanks for this drill program indicate that they passed and the drill core assays are accurate and not contaminated.

Case Lake Property

Case Lake Property is located 80 km east of Cochrane , northeastern Ontario close to the Ontario - Quebec border. Case Lake Property consists of 579 cell claims in Steele, Case, Scapa, Pliny, Abbotsford and Challies townships, Larder Lake Mining Division. The Property is 10 km x 9.5 km in size with 14 identified tonalite domes. The Case Lake pegmatite swarm consists of six spodumene dykes: North, Main, South, East and Northeast Dykes on the Henry Dome and the West Joe Dyke on a new tonalite dome. The Case Lake Property is owned 100% by Power Metals Corp. A National Instrument 43-101 Technical Report has been prepared on Case Lake Property and filed on July 18, 2017 .

Qualified Person

Julie Selway , Ph.D., P.Geo. supervised the preparation of the scientific and technical disclosure in this news release. Dr. Selway is the VP of Exploration for Power Metals and the Qualified Person ("QP") as defined by National Instrument 43-101. Dr. Selway is supervising the exploration program at Case Lake. Dr. Selway completed a Ph.D. on granitic pegmatites in 1999 and worked for 3 years as a pegmatite geoscientist for the Ontario Geological Survey. Dr. Selway also has twenty-three scientific journal articles on pegmatites.

About Power Metals Corp.

Power Metals Corp. is a diversified Canadian mining company with a mandate to explore, develop and acquire high quality mining projects. We are committed to building an arsenal of projects in both lithium and high-growth specialty metals and minerals. We see an unprecedented opportunity to supply the tremendous growth of the lithium battery and clean-technology industries. Learn more at www.powermetalscorp.com

ON BEHALF OF THE BOARD,

Johnathan More , Chairman & Director

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of the content of this news release.

No securities regulatory authority has either approved or disapproved of the contents of this news release. The securities being offered have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any state securities laws, and may not be offered or sold in the United States , or to, or for the account or benefit of, a "U.S. person" (as defined in Regulation S of the U.S. Securities Act) unless pursuant to an exemption therefrom. This press release is for information purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities of the Company in any jurisdiction.

Cautionary Note Regarding Forward-Looking Information

This press release contains forward-looking information based on current expectations, including the use of funds raised under the Offering. These statements should not be read as guarantees of future performance or results. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from those implied by such statements. Although such statements are based on management's reasonable assumptions, Power Metals assumes no responsibility to update or revise forward-looking information to reflect new events or circumstances unless required by law.

Although the Company believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. These statements speak only as of the date of this press release. Actual results could differ materially from those currently anticipated due to several factors and risks including various risk factors discussed in the Company's disclosure documents which can be found under the Company's profile on www.sedar.com .

This press release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E the Securities Exchange Act of 1934, as amended and such forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. The TSXV has neither reviewed nor approved the contents of this press release.

SOURCE POWER METALS CORP

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/April2022/13/c6227.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/April2022/13/c6227.html