April 26, 2022

Auroch Minerals Limited (ASX:AOU) (Auroch or the Company) is pleased to advise that preliminary metallurgical testwork has successfully been completed on the high-grade shallow nickel sulphide mineralisation directly south of the historic Nepean nickel mine at the Nepean Nickel Project (Nepean) in Western Australia (Auroch Minerals Ltd 80%; Lodestar Minerals Ltd 20%).

Highlights

- Preliminary metallurgical testwork has successfully been completed on the shallow high-grade nickel sulphide mineralisation identified directly south of the historic Nepean nickel mine

- Testwork confirms the nickel sulphide mineralisation responds well to conventional flotation beneficiation with nickel recoveries between 85% to 97%

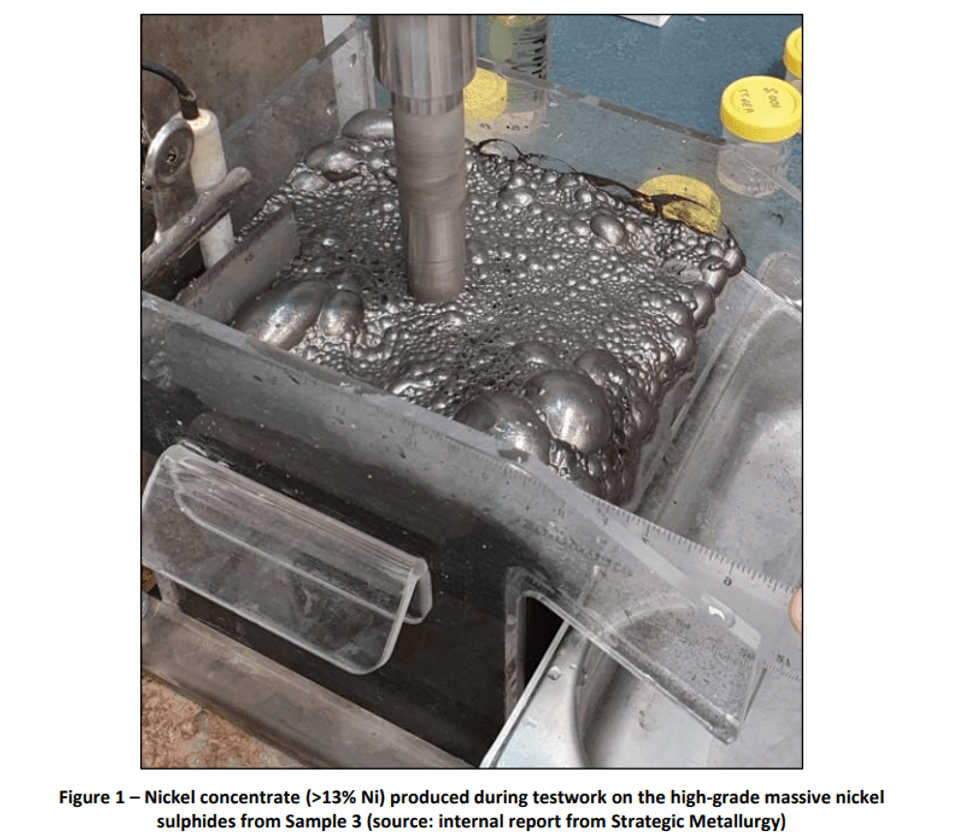

- Saleable nickel concentrate grades (>13% Ni) were achieved for all three composite samples

- The positive results from the testwork are an important milestone for the Nepean Scoping Study looking into the economic viability of a potential open-pit mining scenario of the shallow high-grade nickel sulphide mineralisation

Head assays were initially taken for the three composite drill-core samples (Table 1) with nickel grades up to 7.18% Ni for the massive sulphide sample (Sample 3). Results from the metallurgical testwork indicated all samples responded well to conventional froth flotation, with rougher recoveries for nickel between 85% and 97%. Saleable concentrate grades in excess of 13% Ni were achieved for all three composite samples (Table 2), albeit at a lower recovery (30%) for Sample 1, which is the subject of ongoing optimisation testwork.

All samples demonstrated minor non-sulphide nickel (NSNi) present. Sulphur speciation for the samples also indicated some degree of sulphide oxidation has occurred, consistent with the petrology which identified violarite as the dominant nickel sulphide species. No talc or deleterious elements were detected during the testwork.

The results achieved during the preliminary metallurgical testwork programme are encouraging and further work would be expected to improve upon current results, especially with respect to Fe:MgO ratios of the final nickel concentrates produced.

The positive results from the testwork are an important milestone for the Nepean Scoping Study looking into the economic viability of a potential open-pit mining scenario of the known shallow high-grade nickel sulphide mineralisation, which commences within 50m from surface (Figure 2). The Company will now look to complete a JORC(2012)-compliant Mineral Resource Estimate (MRE) for the shallow high-grade nickel sulphide mineralisation at Nepean.

Auroch Managing Director Aidan Platel commented: “We are very happy with the results from this first phase of metallurgical testwork at Nepean. We knew we have very shallow, high-grade nickel sulphide mineralisation at Nepean that may potentially be extracted in an open-pit mining scenario, but because of the oxidation of the mineralisation being so close to surface, we were unsure if we would be able to produce a saleable grade nickel sulphide concentrate.

The results are extremely encouraging and show that this shallow nickel sulphide mineralisation will indeed produce a saleable grade nickel concentrate, and furthermore that the nickel recoveries are more than acceptable.

As such, the results justify continuing work on the Nepean Scoping Study, and the Company will now commence work on updating the MRE for the shallow portion of the known nickel sulphide mineralisation at Nepean so that we can then begin work on mine designs and optimisation work on potential open-pit mining scenarios.”

Click here for the full ASX Release

This article includes content from Auroch Minerals Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AOU:AU

The Conversation (0)

23 September 2021

Auroch Minerals

Exploring High-Grade Nickel Sulfides in Western Australia

Exploring High-Grade Nickel Sulfides in Western Australia Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00