July 19, 2023

Pivotal Metals Limited (ASX:PVT) (‘Pivotal’ or the ‘Company’) has agreed the sale of Tungsten San Finx S.L. (‘TSFx’), the 100% owner of the San Finx tin and tungsten mine The exit from San Finx will ensure that shareholder funds will be dedicated to the highly attractive Canadian portfolio of battery metal projects.

Highlights

- Sale has been executed with Metáis Estratéxicos, S.L. (“MESL”) with an effective date of 30 June 2023.

- Pivotal has to date made no consideration payments to Valoriza Mineria S.L.U. (‘Valoriza’ the previous owner) under the sale agreement dated 27 December 2021, incurring only working capital expenditure. MESL will assume the obligations payable to Valoriza (‘Valoriza Consideration’).

- MESL will pay Pivotal a 3% royalty on sales, capped at US$1m, commencing in the quarter following the satisfaction in full of the Valoriza Consideration. This consideration, in addition to €150,000 paid upfront, results in a total effective consideration payable of €1.15m to the Company, the majority of which is deferred until after production.

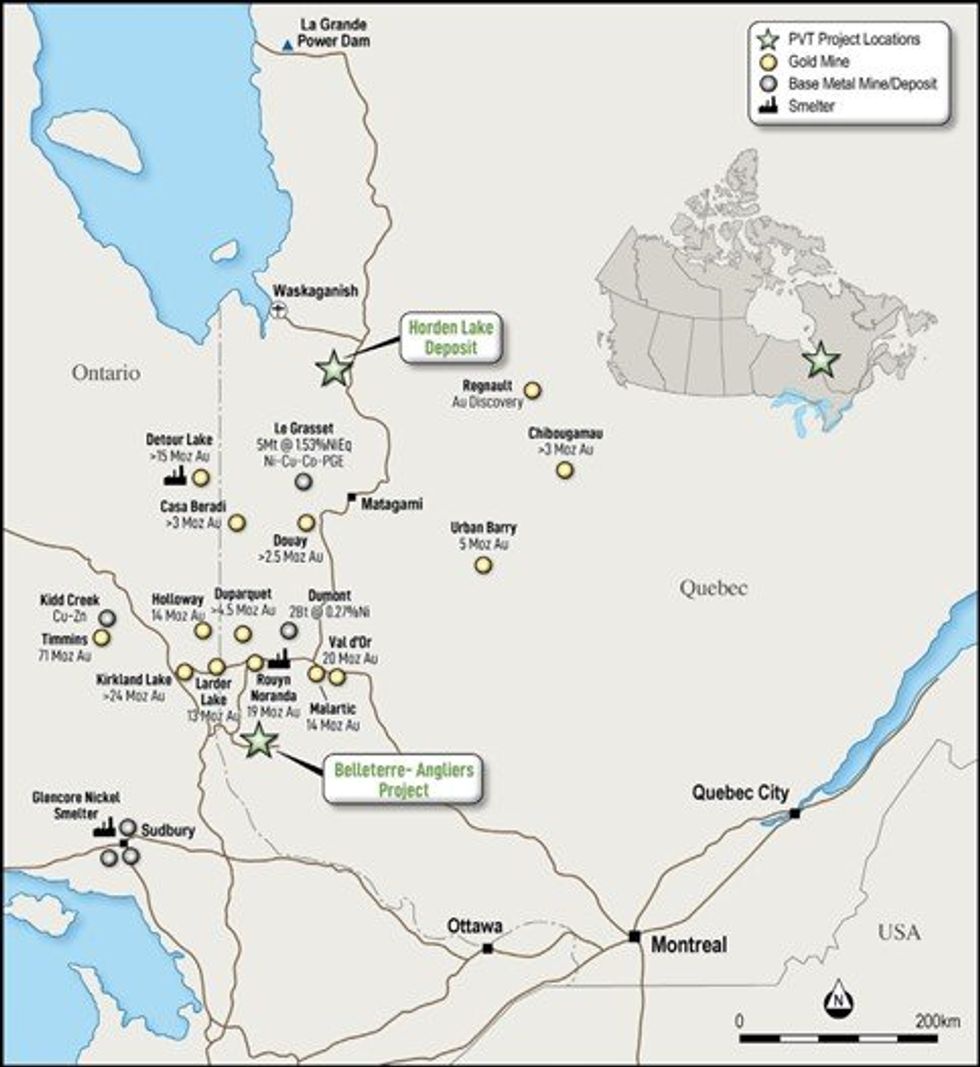

- The sale of TSFx is a significant milestone in completing the strategic shift to Canadian battery metals, initially announced on 22 May 2022. Since that date the Company has assembled a highly attractive Canadian portfolio comprising the Horden Lake Cu-Ni-PGM deposit with a JORC compliant resource totalling 27.8Mt at 1.49% CuEq1, and the 157 km2 high grade BAGB package of Ni-Cu- PGM exploration claims.

Managing Director Steven Turner said: “Pivotal believes that the Canadian portfolio offers exceptional upside to shareholders and has been keen to ensure that shareholder funds are focussed on the realisation of that value. The Board has agreed that a clean exit from San Finx is the best outcome for shareholders.”

Canadian Portfolio

Horden Lake is an advanced exploration project containing a JORC compliant pit constrained resource of 27.8Mt at a 1.49% CuEq. The resource estimate does not include all of the Au, nor any of the significant Co and Ag known to exist within the deposit. The planned drilling programme for 2023/24, once completed, will look to better define these various additional metals for inclusion in an updated mineral resource estimate.

Belleterre-Angliers Greenstone Belt (‘BAGB’) is a high impact exploration project that has demonstrated exceptional grades of nickel, copper and PGMs, potentially indicative of a large deeper system. A review of EM anomalies below 300m from recent VTEM surveys has identified 20 high priority targets never previously explored. These targets will be the focus of a survey programme scheduled for later in 2023.

Following the successful $4m flow through share capital raise announced 16 May 2023, the Company is well funded for the Canadian 2023/2024 drilling and survey programme across its two projects. The extensive Quebec forest fires have resulted in the Company rescheduling the order of its activities with an immediate focus on BAGB, noting that a winter drill programme at Horden Lake would avail the Company of significant costs savings given the use of a temporary land access track as opposed to the use of helicopters to complete the planned 8,000m programme.

Click here for the full ASX Release

This article includes content from Pivotal Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PVT:AU

The Conversation (0)

18 January 2024

Pivotal Metals

Investing in metals for a sustainable energy transition.

Investing in metals for a sustainable energy transition. Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00