November 03, 2024

Allup Silica Limited (ASX: APS) (“Allup” or “Company”) is pleased to announce recent exploration results from its Pink Bark Project in southern WA has demonstrated the project’s potential for rare earth elements (REE), uranium, graphite and kaolin mineralisation.

Key points

Further analysis carried out on samples from Allup’s 2023 drilling program has been returned with the following results:

- Significant uranium results up to 232ppm U3O8 and REE up to 980ppm for total TREE of 1,212ppm.

- Highest grade of 1,985ppm total rare earth oxide (TREO) in fresh bedrock from drill hole PB019, 21 to 22m

- Significant REE anomalism discovered in supergene and bedrock over a 7km x 7km area.

- Kaolin sampling confirms ISO Brightness, grainsize, and XRD mineralogy in four locations at Pink Bark Project.

- Raw insitu kaolin from Pink Bark is comparable to Australian kaolin deposits currently in production and demonstrates a marketable product with possible co-product silica.

- Graphite-rich bedrock intersected in the south of E63/2371, in particular in drill hole PBAC058.

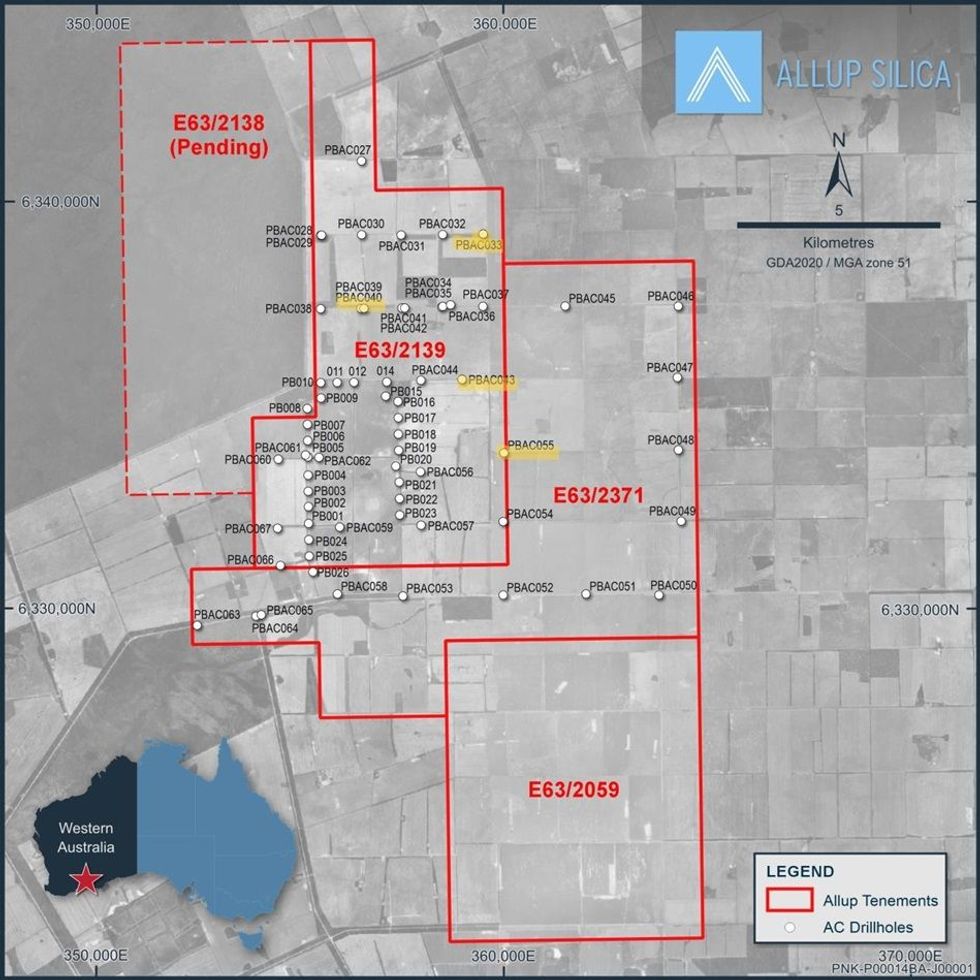

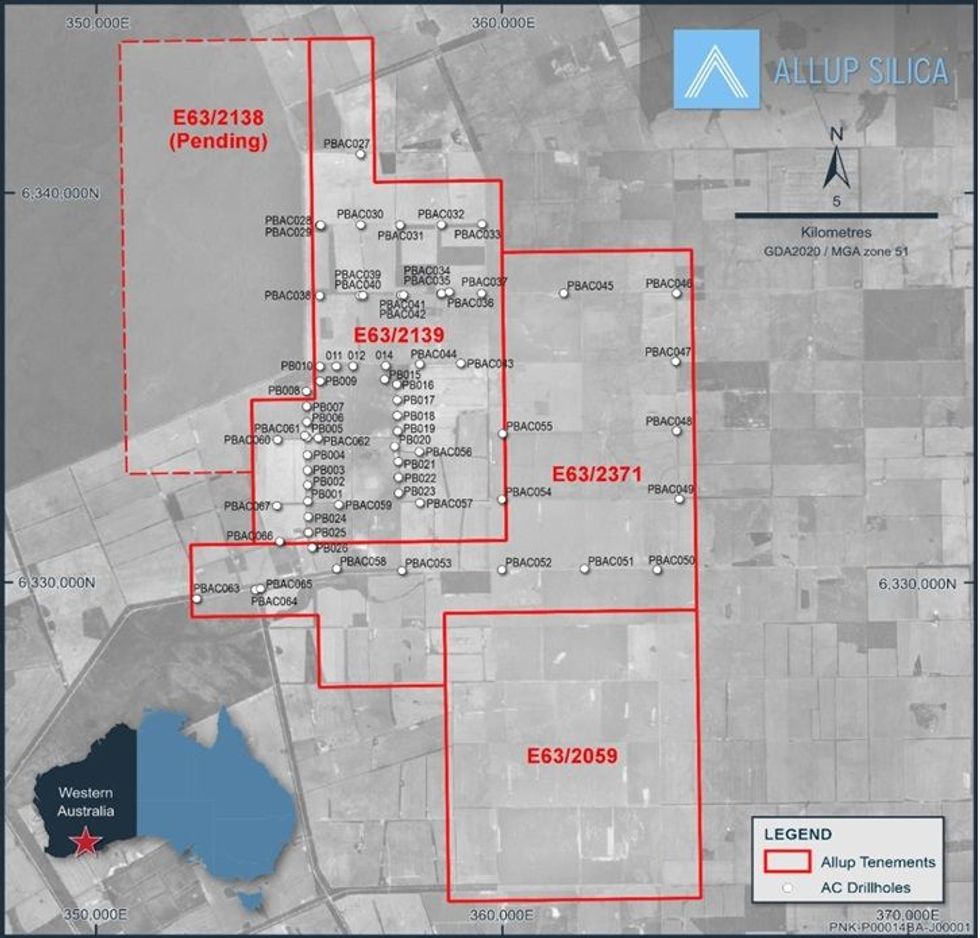

APS carried out additional analysis from samples taken during its November 2023 drilling program at Pink Bark to test the underlying clays of licence E63/2138 for REE potential, and for thick kaolin accumulations over large areas. The holes were drilled to fresh bedrock (blade refusal) where possible, and the bedrock samples were assayed for multi-element geochemistry.

The Albany Fraser Province has recorded several uranium occurrences. The combined rare earth and uranium mineralisation at Pink Bark is very significant. Further drilling is required to test the mineralisation for size and grade potential.

This release focuses on the Kaolin, Uranium and Rare Earth potential of the Pink Bark Project following the results of an air core drilling program that was completed in November 2023.

Introduction

The Pink Bark Project, comprises three granted Exploration Licences and one pending application area, and is located in the Albany Fraser Province's Biranup zone, north of Esperance. The tenement was acquired to explore and develop silica sand, but numerous recent nearby discoveries of REE clay- hosted deposits prompted Allup to consider the potential for such deposits on its tenement holdings.

The Biranup zone has been shown to be rich in valuable REE by the Geological Survey of Western Australia (GSWA) and modern explorers. A number of ASX-listed companies have reported wide areas of saprolitic clay enriched in rare earths overlying the Biranup late-stage granite intrusive rocks.

These deposits have been compared to China’s clay-hosted REE deposits, which have been a major source of REE for the country’s battery industry. In the Albany Fraser Province a number of carbonatites with rare earth potential have been reported and explored for rare earth mineralisation, and the Biranup granites are also rapidly emerging as a focus for exploration for clay and carbonatite-hosted rare earth deposits.

Kaolin

Allup’s previous work on kaolin at Pink Bark was reported in ASX Release dated 7 May 2024, where a significant Exploration Target was announced. Additional work to define other characteristics were recommended and these are discussed below.

Allup engaged Independent Metallurgical Operations Pty Ltd to complete further mineralology, brightness and yellowness testing on 10 samples from 10 different drill holes.

Based on the test work conducted on the 10 samples from the Pink Bark Project, IMO concludes that the percentage passing 45 µm ranged from 22.7% to 62.4%, averaging 36.7%.

Click here for the full ASX Release

This article includes content from Allup Silica Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00