January 29, 2025

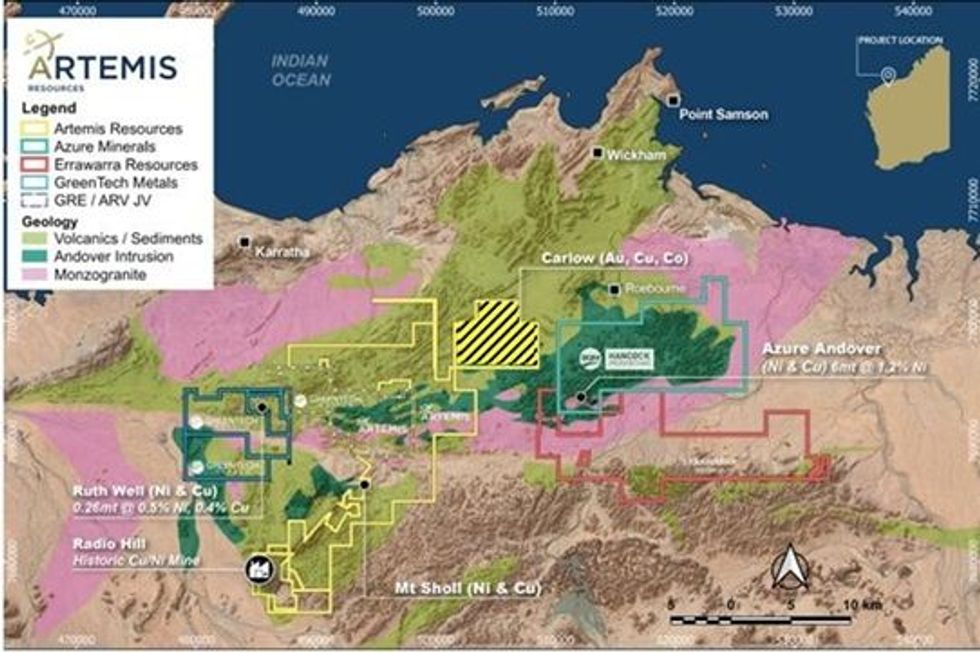

Artemis Resources Limited (‘Artemis’ or the ‘Company’) (ASX/AIM: ARV) is pleased to provide an outline of a substantial drilling program planned to test high priority gold exploration targets on the 100% owned Carlow Tenement within the Company’s extensive holdings in the North Pilbara gold province of Western Australia.

A diamond and Reverse Circulation (“RC”) drilling program is expected to commence in early February to test several compelling targets within a 4km long northwest trending zone centred around the Company’s 704Koz AuEq Carlow Mineral Resource1 which includes 374Koz gold, 64,000t copper and remains open. Despite proximity to Carlow, the targets planned to be drilled during the March Quarter are previously untested.

Summary of Planned Activities – March Quarter 2025

- The first hole will test the large Marillion Electro-magnetic (“EM”) conductor 500m east of the Carlow resource, near the base of the Andover Intrusion

- Diamond drilling will then test the potential for significant extensions to the Carlow resource, down plunge from previous high-grade gold intersections

- RC drilling is then planned across the Titan Prospect 2km northwest of Carlow, as an initial test of widespread high-grade gold occurrences at surface

- Recent assays from outcrops of chert and quartz/ironstone veins at Titan include 51.8g/t Au and 41.4g/t Au, in line with results announced during 2024

- Surface gold occurrences at Titan may be associated with a large gravity-low feature surrounded by chert outcrops, interpreted major faults and thrusts

- Conceptual mining study planned to review the 2022 Carlow Inferred Mineral Resource1 including 7.25Mt @ 1.3g/t gold for 296,000oz Au in an optimised pit

- Artemis is also evaluating other quality assets and recently applied for an EL to cover an interpreted intrusion with potential for IOCG Cu/Au mineralisation

- Following the recent $4M placement, the Company is now well funded to drill priority targets around Carlow and progress other promising gold targets

Recently appointed Managing Director Julian Hanna2 commented: ‘As a result of the excellent work completed by the Karratha exploration team during 2024 and following the announced capital raising in December, Artemis is now in a strong position to undertake drilling of some exciting targets at the Karratha Gold Project.

Exploration in the following months will be focussed on the Carlow Tenement which hosts a significant gold - copper resource at Carlow and covers a wide range of exploration targets within a wide, prospective corridor with minimal previous drilling.

I look forward to working closely with the very experienced and committed team at Artemis and updating shareholders with results from the drilling in due course.’

Priority Drill Targets and other Activities – March Quarter 2025

Marillion Electro-Magnetic Anomaly3

Marillion is a large, highly conductive electro-magnetic (FLTEM) anomaly modelled by the Company’s consulting geophysicist as a 500m long, c.11,000 siemens conductor with the top at approximately 350m vertical depth (refer to Figure 2). Marillion is undrilled, and the source of the conductive anomaly is unknown.

Drilling is planned to start in early February with the first drill hole designed to test the centre of the Marillion EM anomaly for possible sulphide hosted mineralisation.

Marillion may potentially represent an extension of the Carlow gold/copper deposit offset >500m by a fault or represent a possible sulphide accumulation at the interpreted base of the Andover Intrusion which is mapped in outcrop near Marillion.

Click here for the full ASX Release

This article includes content from Artemis Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

21h

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

21h

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00