September 03, 2023

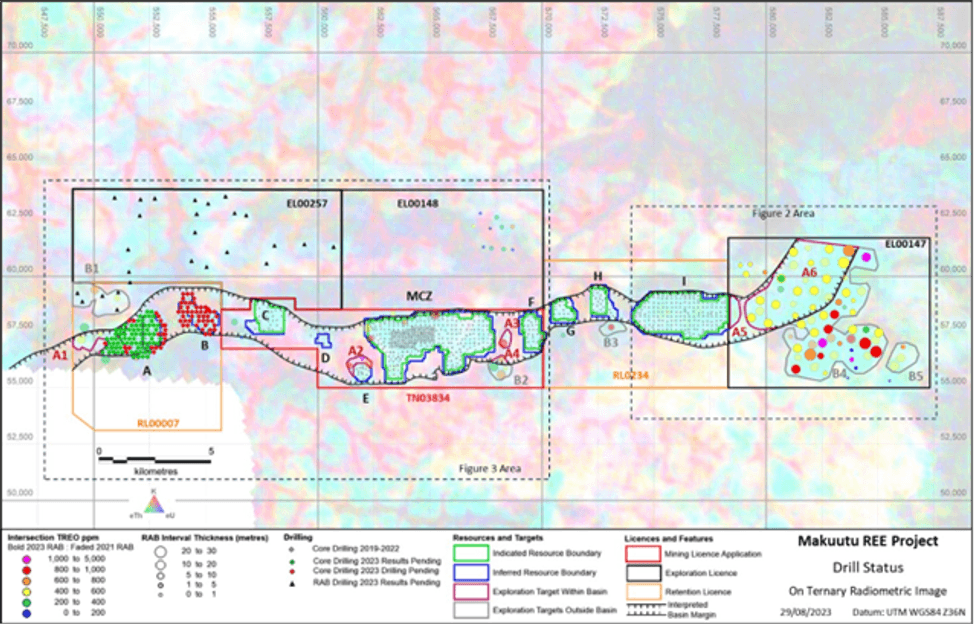

The Board of Ionic Rare Earths Limited (“IonicRE” or “The Company”) (ASX: IXR) advises on progress at its 60 per cent owned Makuutu Heavy Rare Earths Project (“Makuutu” or “the Project”) in Uganda.

- Phase 5 Rotary Air Blast (RAB) Tranche 1 assays on Exploration Licence (EL) 00147 reporting clay-hosted rare earth intersections achieved in 43 of 45 drill holes received including;

- 3 metres at 1,337 ppm TREO from 13 metres in RRMRB083;

- 10 metres at 1,029 ppm TREO from 5 metres in RRMRB079;

- 11 metres at 1,013 ppm TREO from 6 metres in RRMRB105;

- 7 metres at 974 ppm TREO from 6 metres in RRMRB078;

- 24 metres at 967ppm TREO from 4 metres in RRMRB086;

- Results support historic kilometre-spaced drilling program indicating large areas of rare earth mineralisation outside current Mineral Resource Estimate (MRE);

- Results from a further 31 RAB holes from unexplored Exploration Licence (EL) 00257 are currently being analysed; and

- Diamond drilling is continuing infill drilling at Retention Licence (RL) 00007, aiming to increase resource classification to Indicated Resource, with 78 holes completed (1,580 metres) to date.

A total of 45 holes were drilled with 43 recording intervals of regolith hosted rare earth mineralisation above the 2022 Mineral Resource Estimate (MRE) cut-off grade of 200 ppm TREO-CeO2. (ASX: 3 May 2022). Table 1 lists the intersection compilations and Figure 2 shows the location of the drill results.

IonicRE’s Managing Director Mr Tim Harrison said the Phase 5 RAB Tranche 1 assay results further validate the massive potential of EL00147 by having identified some of the highest-grade intervals drilled at this exploration target.

“EL00147 has now confirmed clay-hosted REE in 66 of 70 RAB holes drilled across programs in 2021 and 2023, on a broad 500 metre spacing, which highlights the massive potential of this exploration target. These results confirm the significance of Makuutu as a strategic asset with an expanding IAC deposit. This potential to expand the Makuutu resource further to the east means we expect the scale of the Project to substantially increase in the future, with these new assays inferring considerable upside at Makuutu.”

“Our focus on the delivery of the Makuutu Heavy Rare Earths Project in Uganda positions us to provide a secure, sustainable, and traceable supply of magnet rare earth oxides. Along with our Belfast recycling facility, Makuutu is key to us harnessing our technology to accelerate our mining, refining, and recycling of magnets and heavy rare earths which are critical for the energy transition, advanced manufacturing, and defence,” Mr Harrison said.

The Tranche 1 results are all from drilling located on Exploration Licence EL0147, located at the eastern end of the extensive licence holding at Makuutu.

This area was previously tested with 1-kilometre spaced RAB holes in 2021. The aim of the 2023 program was to decrease the hole spacing to approximately 500 metre spaced holes and determine broad trends and zonation of mineralisation.

The Company is progressing the development at the Makuutu Heavy Rare Earths Project through local Ugandan operating entity Rwenzori Rare Metals Limited (“RRM”).

A significant number of the drill intercepts including thick high-grade intercepts RRMRB07 (10 metres at 1,029ppm TREO), RRMRB105 (11 metres at 1,013ppm TREO), RRMRB086 (24 metres at 967ppm TREO) and RRMRB085 (22 metres at 879ppm TREO) are within Exploration Target area B4. The mineralisation in this area is hosted by a mixture of weathered rock types including granite, diorites and mafic rocks. These rocks are different from the primarily sedimentary rocks that form the protolith for the Makuutu MRE.

Results from Exploration Target area A6 are similar in TREO grade and thickness to the wide spaced 2021 drilling of the same area. This area is considered consistent to and along trend from MRE area I.

Further work planned on these areas includes metallurgical test work to determine potential rare earth extractions and core drilling to progress to a resource estimate.

Click here for the full ASX Release

This article includes content from Ionic Rare Earths, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IXR:AU

The Conversation (0)

14 September 2023

Ionic Rare Earths

Low Capital Operations With the Potential for High Margins

Low Capital Operations With the Potential for High Margins Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00