October 16, 2023

The Board of Ionic Rare Earths Limited (“IonicRE” or “The Company”) (ASX: IXR) advises on progress at its 60 per cent owned Makuutu Heavy Rare Earths Project (“Makuutu” or “the Project”) in Uganda.

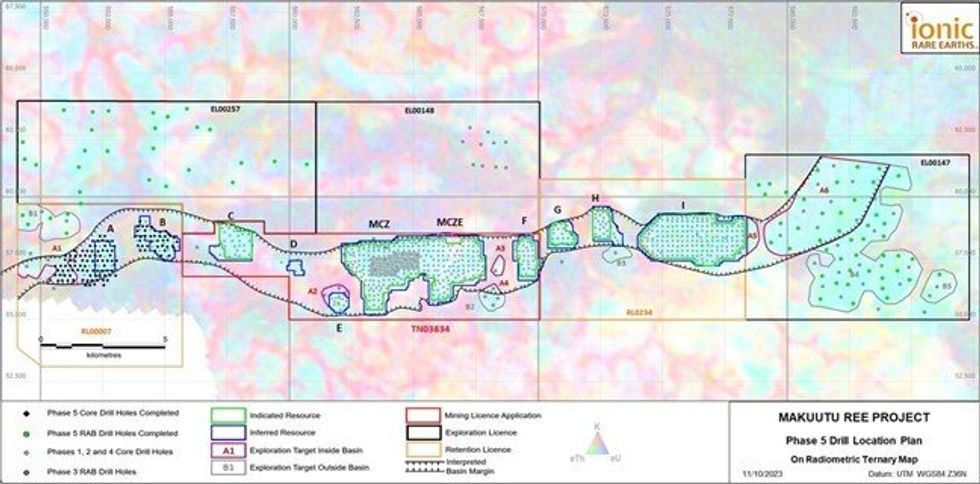

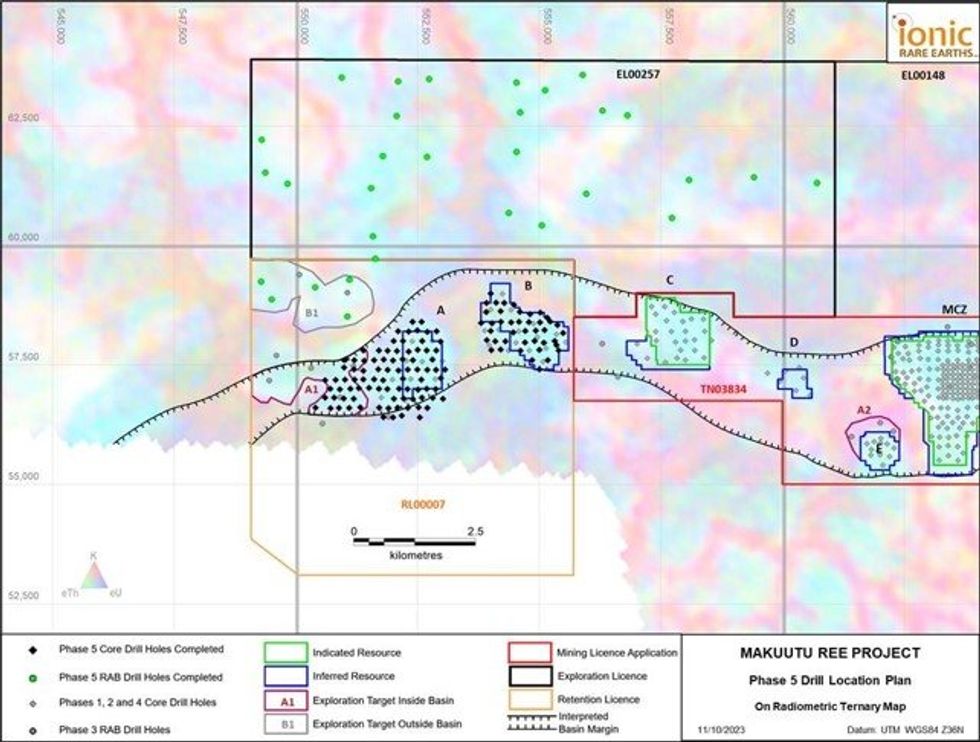

- Phase 5 infill drill program at Makuutu on Retention Licence (RL) 00007 completed with 128 holes drilled for 2,501 metres;

- Infill drilling expected to both increase confidence and scale of updated Mineral Resource Estimate (MRE) expected Q1 2024;

- Samples progressively being delivered to Perth for analysis, with first results expected this quarter; and

- Makuutu’s basket contains 71% magnet and heavy rare earths content, and is one of the most advanced heavy rare earth projects globally available as a source for new supply chains emerging across Europe, the US, and Asia;

The Company is pleased to advise completion of the Phase 5 drill program progressing the development at the Makuutu Heavy Rare Earths Project through local Ugandan operating entity Rwenzori Rare Metals Limited (“RRM”).

IonicRE’s Managing Director Mr Tim Harrison said the Phase 5 drill program, now completed, is an important activity in advancing the next stages of development at Makuutu for a much larger Project.

“The infill drilling has progressed to plan and we await assays, expected over the remainder of 2023, to feed into a significant increase in confidence on the MRE associated with RL00007 which will support our next Mining Licence Application at Makuutu.”

“We await the results of the metallurgical test work on samples selected from the recent RAB drilling as part of this Phase 5 drill program which will enable revision to the Exploration target aimed for late this quarter, and also assist the Company plan future drilling across both EL00147 and EL00257.”

“Our focus on the delivery of the Makuutu Heavy Rare Earths Project in Uganda positions us to provide a secure, sustainable, and traceable supply of magnet rare earth oxides. Along with our Ionic Technologies Belfast recycling facility, Makuutu is key to us harnessing our technology to accelerate mining, refining, and recycling of magnets and heavy rare earths that are critical for the energy transition, advanced manufacturing, and defence”.

Click here for the full ASX Release

This article includes content from Ionic Rare Earths, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IXR:AU

The Conversation (0)

14 September 2023

Ionic Rare Earths

Low Capital Operations With the Potential for High Margins

Low Capital Operations With the Potential for High Margins Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00