June 14, 2023

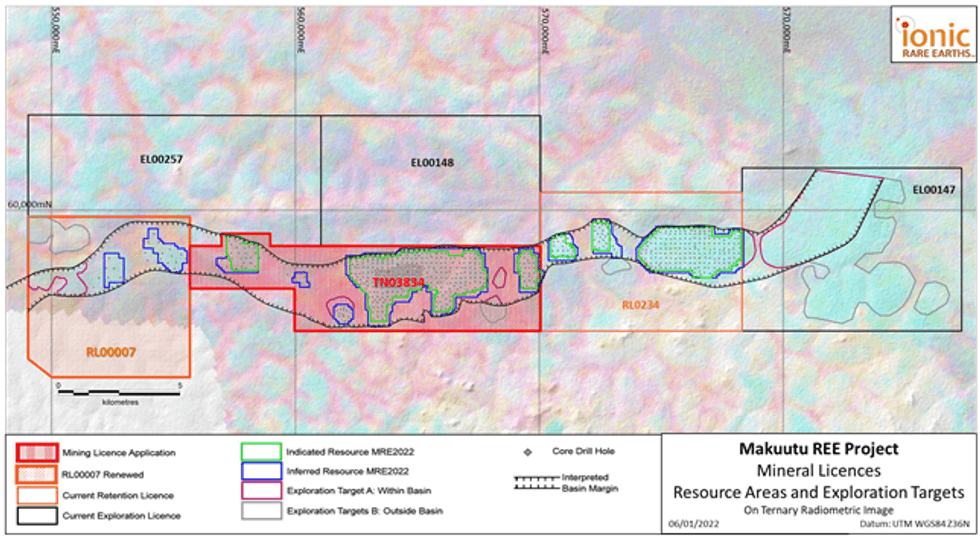

The Board of Ionic Rare Earths Limited (“IonicRE” or “The Company”) (ASX: IXR) is pleased to advise the Phase 5 drill program at its 60% owned Makuutu Rare Earths Project (“Makuutu” or “the Project”) is advancing to plan with the rotary air blast (RAB) drilling completed on Exploration Licence 00147 (EL00147), and now underway on EL00257. Additionally, the core drilling program, planned for Retention Licence RL00007, is expected to commence at the end of June.

- Makuutu Phase 5 drill program advances ahead of schedule with reconnaissance drilling (RAB) on EL00147 with 45 holes completed for 931 metres drilled to an average drill hole depth of 21 metres;

- RAB drilling on EL00257 commenced with 51 of 76 holes planned for 1,078 metres drilled to an average drill hole depth of 21 metres;

- The diamond drill rig is planned to be mobilised to site at the end of the month to commence infill drilling at RL00007, aiming to increase resource classification to Indicated Resource;

- All samples from EL00147 packaged, awaiting shipping to test lab in Perth, and expected to be reported by the end of Q3 2023;

- Strategic focus of Makuutu is to extend mine life to underpin the significant increase in demand to support new western supply chains of magnet and heavy rare earths; and

- New Mining Regulations expected to be approved in June 2023 to support the completion of the Makuutu’s Mining Licence Application.

Makuutu currently ranks amongst the world’s largest and most advanced ionic adsorption clay (IAC) rare earth element (REE) deposits, and as such, a globally strategic resource for near term, low capital development and long-term security of magnet and heavy rare earth oxide (HREO) supply.

With the addition of the other tenements at Makuutu, the larger consolidated Project has substantial scope for future growth, and increasing geopolitical importance, to underpin the establishment of western sources for new magnet and heavy rare earths supply chains.

The reconnaissance RAB drilling as part of the Phase 5 drilling program is part of a sequential program to define areas of further growth at Makuutu, supporting the potential growth targets to further extend the resource along the 37 km long mineralised corridor on the Company’s tenements.

The core drilling across RL00007 also is a requirement to increase the resource classification of existing resources to support the next planned Mining Licence Application at the larger Makuutu Project expected before the end of November 2024.

Commenting on the progress made to date with the Phase 5 drilling program at Makuutu, Ionic Rare Earths Managing Director Mr. Tim Harrison said:

“The drill program is progressing to and follows on from the encouraging results the Company identified when last drilling on this tenement. The second drill rig is due to be mobilised later this month, progressing core drilling of infill holes at RL00007 and we are confident this program will upgrade the Inferred Resource to Indicated Resource category.”

“The strategic focus of this Phase 5 exploration program is to further define potential for further growth at Makuutu plus also support increased confidence on the next MLA area on RL00007. Growing the resource and defining more growth potential is a key discussion point with several potential strategic partners looking at securing the potential product from Makuutu to underpin their heavy rare earth demands in the near term to support the new economy of electrification, advanced manufacturing, and defence.”

“We are also patiently awaiting approval of the new Mining Regulations in Uganda, and having been involved in several discussions with key Uganda stakeholders, we remain positive on near term approval of our MLA for the Stage 1 development at Makuutu on RL 1693 (now TN03834).”

Phase 5 Drill Program

Makuutu is made up of six tenements, with the Makuutu central tenement, RL 1693, the only tenement used to support the recently announced positive Makuutu Stage 1 Definitive Feasibility Study (DFS), which shows that Makuutu would have an initial 35-year mine life with EBITDA of A$2.29 billion and an IRR of 32.7% (ASX: 20 March 2023).

The Phase 5 drill program will include approximately 4,380 metres of core drilling used for resource upgrade on RL00007 plus 2,230 metres of RAB drilling used for evaluation of exploration targets on EL00147 and EL00257.

Click here for the full ASX Release

This article includes content from Ionic Rare Earths, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IXR:AU

The Conversation (0)

14 September 2023

Ionic Rare Earths

Low Capital Operations With the Potential for High Margins

Low Capital Operations With the Potential for High Margins Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00